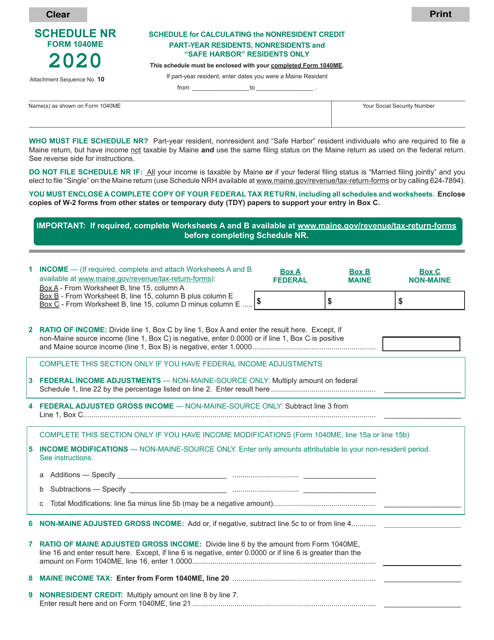

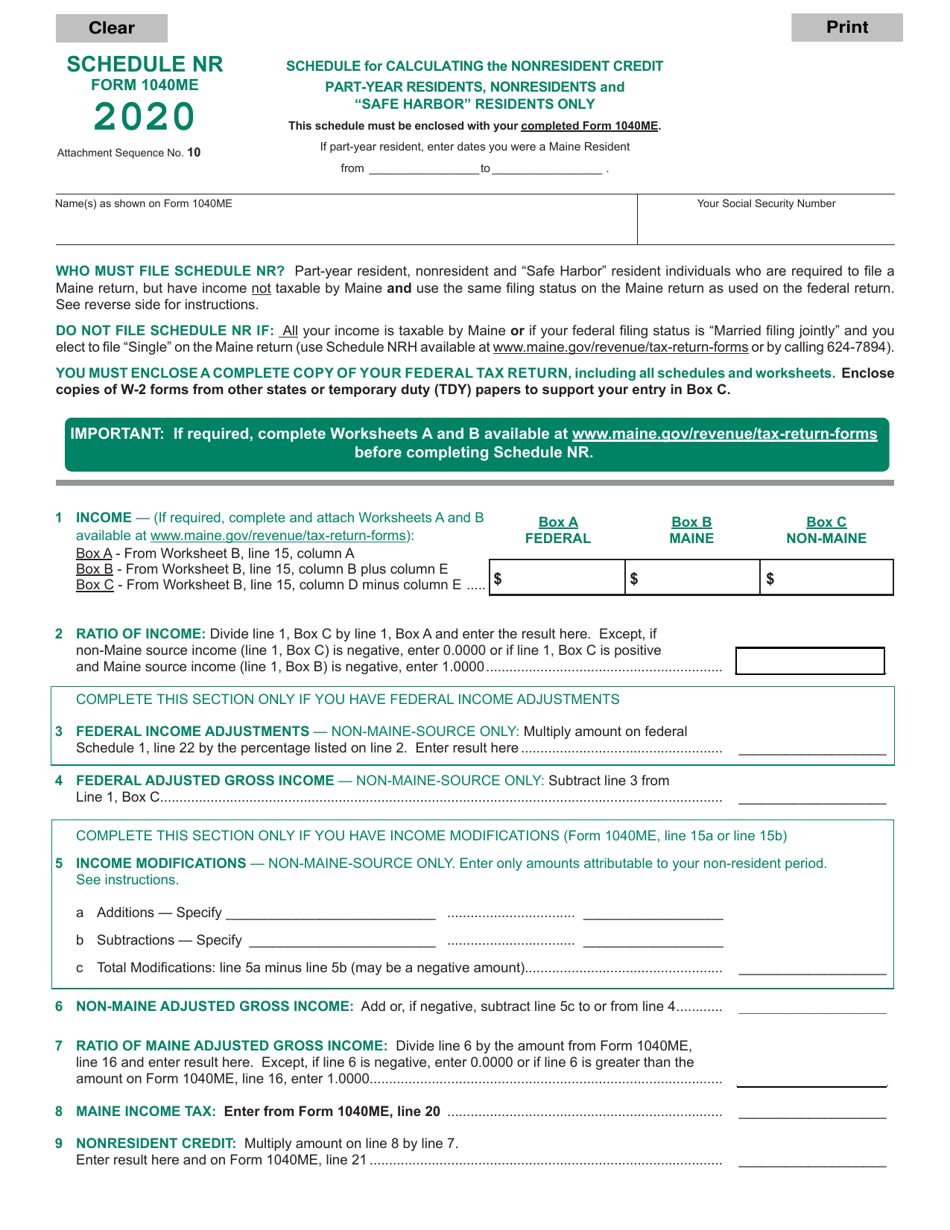

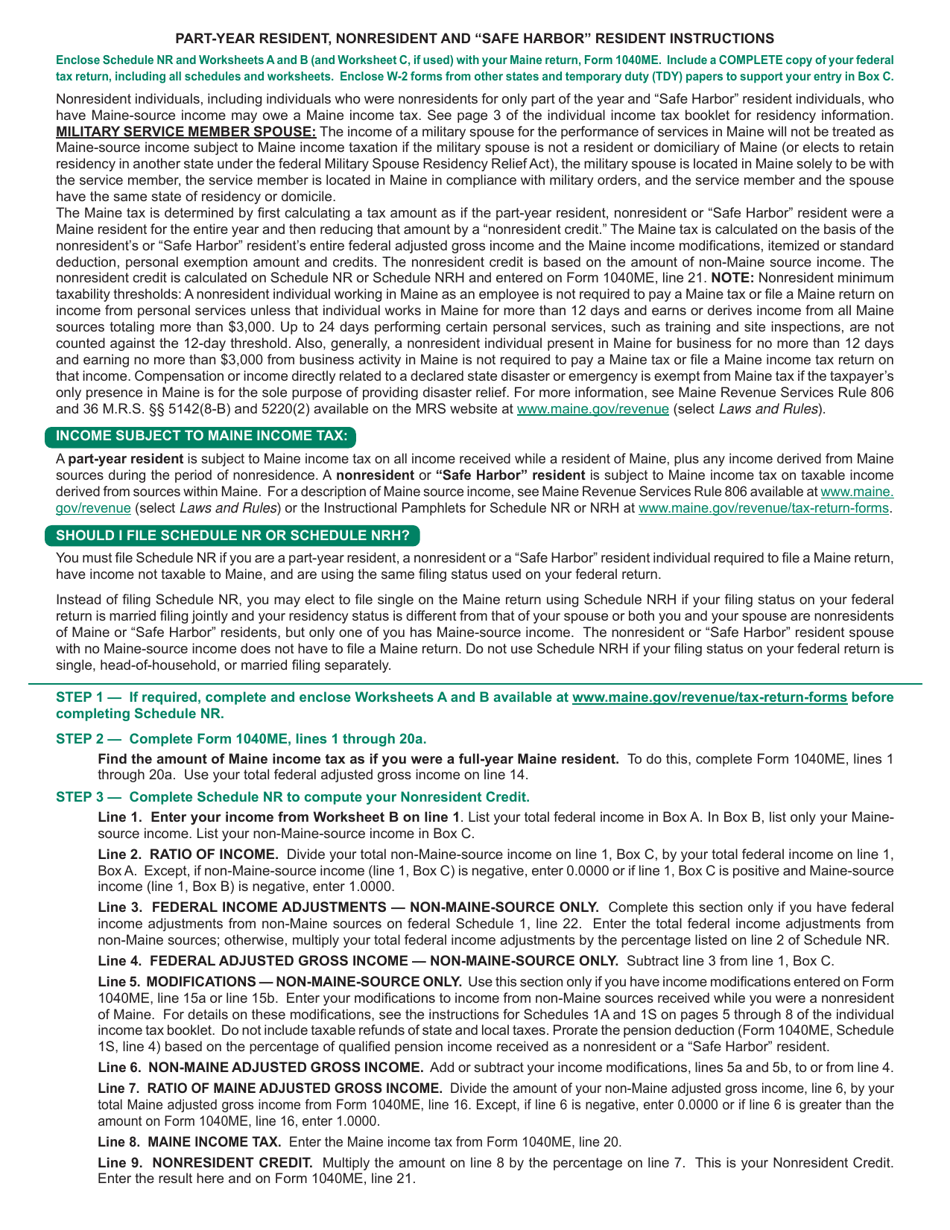

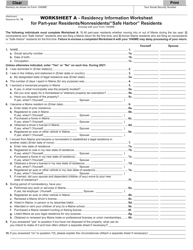

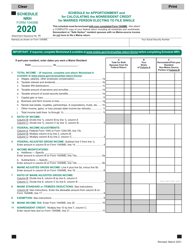

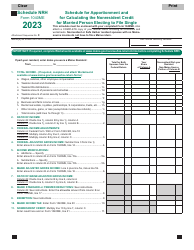

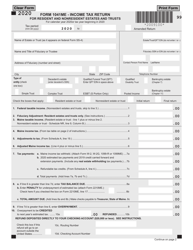

Form 1040ME Schedule NR Schedule for Calculating the Nonresident Credit Part-Year Residents, Nonresidents and "safe Harbor" Residents Only - Maine

What Is Form 1040ME Schedule NR?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule NR?

A: Form 1040ME Schedule NR is a schedule for calculating the Nonresident Credit in Maine.

Q: Who needs to file Form 1040ME Schedule NR?

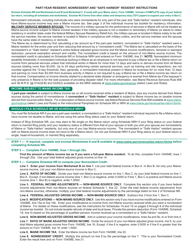

A: Part-Year Residents, Nonresidents, and 'Safe Harbor' Residents in Maine need to file Form 1040ME Schedule NR.

Q: What is the purpose of Form 1040ME Schedule NR?

A: The purpose of Form 1040ME Schedule NR is to calculate the Nonresident Credit in Maine.

Q: What does 'safe harbor' residents mean in Maine?

A: 'Safe harbor' residents in Maine refer to individuals who spend less than 30 days in Maine during the tax year.

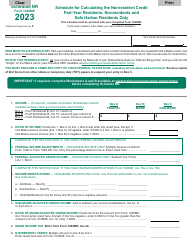

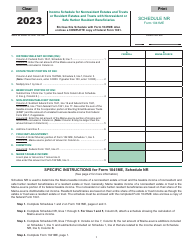

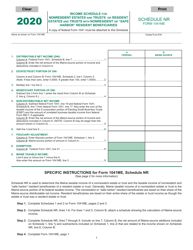

Q: What information is required to complete Form 1040ME Schedule NR?

A: To complete Form 1040ME Schedule NR, you will need information about your income, deductions, and credits for Maine.

Q: Does filing Form 1040ME Schedule NR impact federal taxes?

A: Filing Form 1040ME Schedule NR is specific to Maine state taxes and does not directly impact federal taxes.

Q: When is the deadline to file Form 1040ME Schedule NR?

A: The deadline to file Form 1040ME Schedule NR is usually the same as the deadline to file your Maine state tax return, which is April 15th.

Q: Can I e-file Form 1040ME Schedule NR?

A: Yes, you can e-file Form 1040ME Schedule NR if you are filing your Maine state tax return electronically.

Q: Is there a fee to file Form 1040ME Schedule NR?

A: There may be a fee to file Form 1040ME Schedule NR, depending on the method you choose to file your Maine state tax return.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule NR by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.