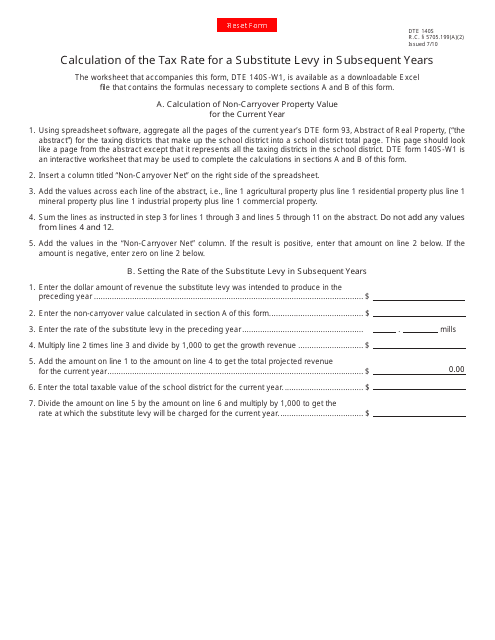

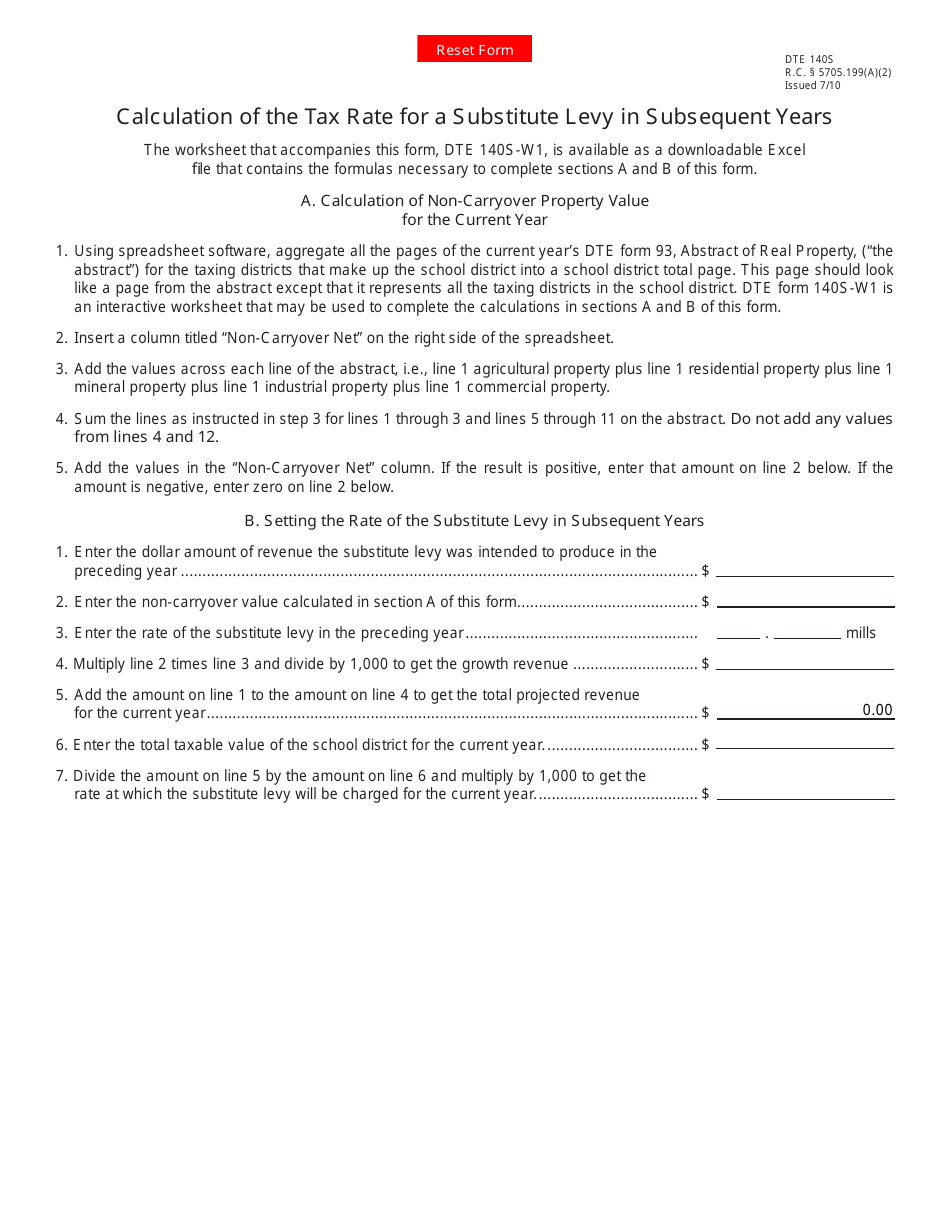

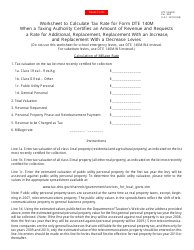

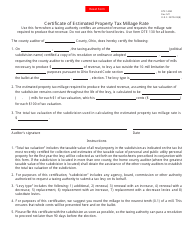

Form DTE140S Calculation of the Tax Rate for a Substitute Levy in Subsequent Years - Ohio

What Is Form DTE140S?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140S?

A: Form DTE140S is used for calculating the tax rate for a substitute levy in subsequent years in Ohio.

Q: What is a substitute levy?

A: A substitute levy is a tax levy that is used by a taxing authority to generate revenue that replaces lost revenue from another source.

Q: How is the tax rate calculated for a substitute levy?

A: The tax rate for a substitute levy is calculated using the formula provided in Form DTE140S.

Q: Who uses Form DTE140S?

A: Form DTE140S is used by taxing authorities in Ohio to calculate the tax rate for a substitute levy.

Q: Why is it important to calculate the tax rate for a substitute levy?

A: Calculating the tax rate for a substitute levy is important for ensuring that the taxing authority generates enough revenue to replace the lost revenue from another source.

Form Details:

- Released on July 1, 2010;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140S by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.