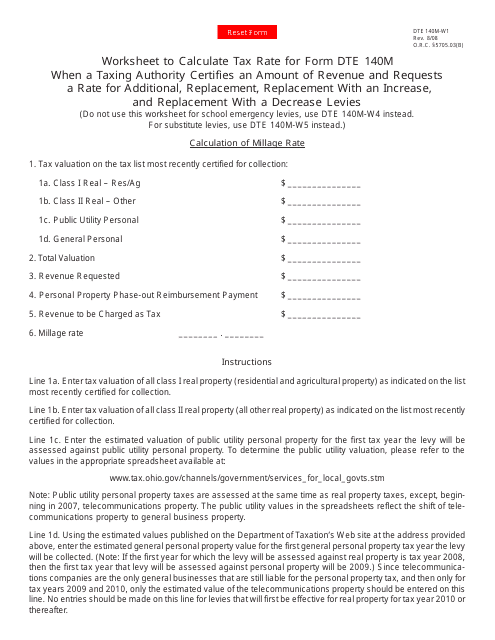

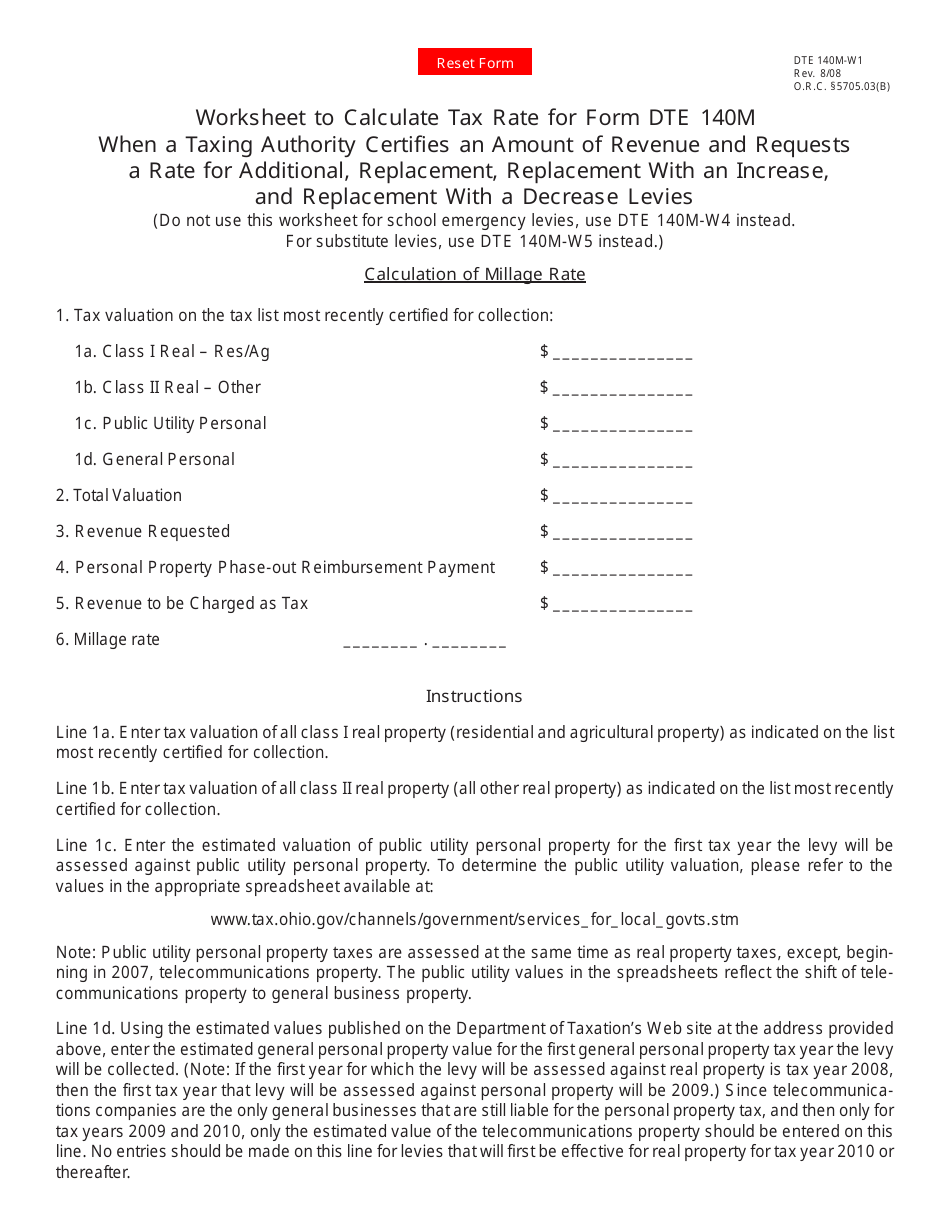

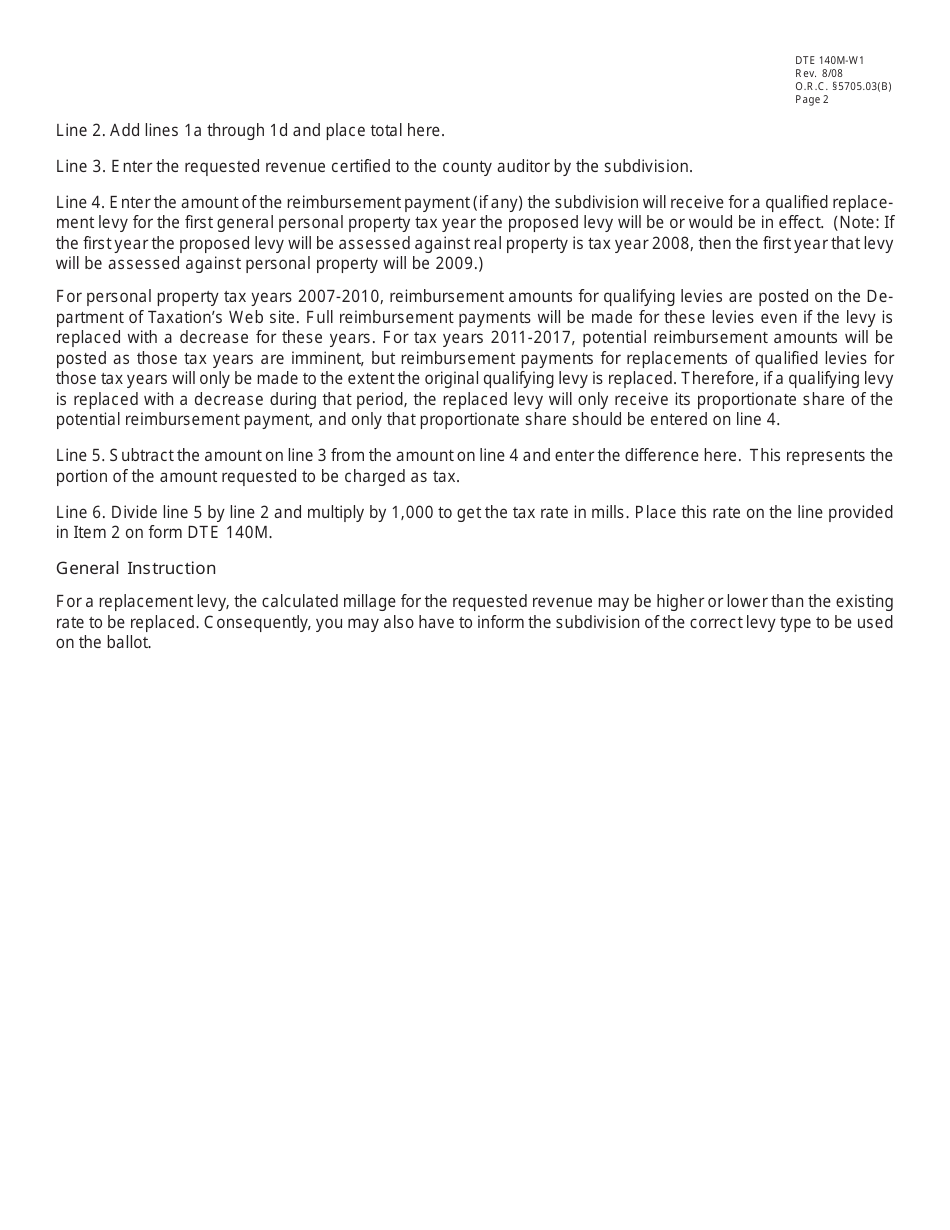

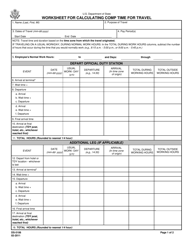

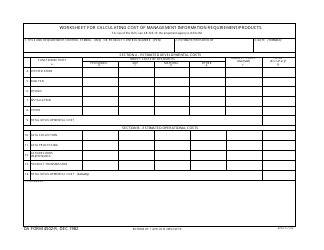

Form DTE140M-W1 Worksheet to Calculate Tax Rate for Form Dte 140m When a Taxing Authority Certifies an Amount of Revenue and Requests a Rate for Additional, Replacement, Replacement With an Increase, and Replacement With a Decrease Levies - Ohio

What Is Form DTE140M-W1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140M-W1?

A: Form DTE140M-W1 is a worksheet used to calculate the tax rate for Form DTE 140M in Ohio.

Q: When is Form DTE140M-W1 used?

A: Form DTE140M-W1 is used when a taxing authority certifies an amount of revenue and requests a tax rate for additional, replacement, replacement with an increase, and replacement with a decrease levies.

Q: What is Form DTE 140M?

A: Form DTE 140M is a form used to report property tax rates in Ohio.

Q: What is a taxing authority?

A: A taxing authority is an entity that has the power to levy and collect taxes.

Q: What is an additional levy?

A: An additional levy is a tax levy imposed on top of existing tax rates to generate additional revenue.

Q: What is a replacement levy?

A: A replacement levy is a tax levy that replaces an expiring levy and maintains the same tax rate.

Q: What is a replacement levy with an increase?

A: A replacement levy with an increase is a tax levy that replaces an expiring levy and increases the tax rate.

Q: What is a replacement levy with a decrease?

A: A replacement levy with a decrease is a tax levy that replaces an expiring levy and decreases the tax rate.

Q: Why is the tax rate calculated for these levies?

A: The tax rate is calculated for these levies to determine the amount of tax that needs to be collected to meet the revenue requirements set by the taxing authority.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140M-W1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.