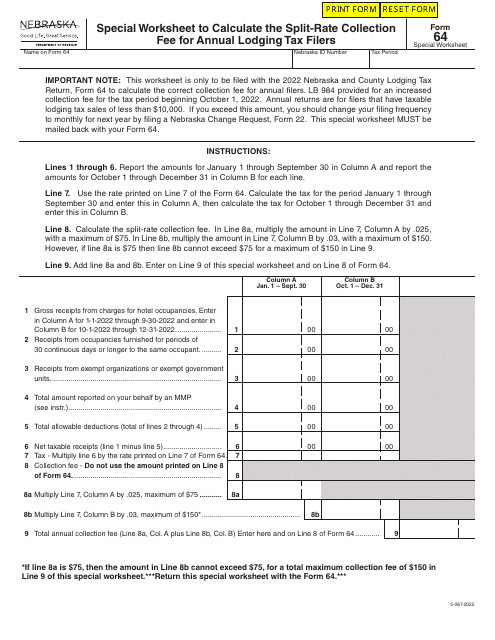

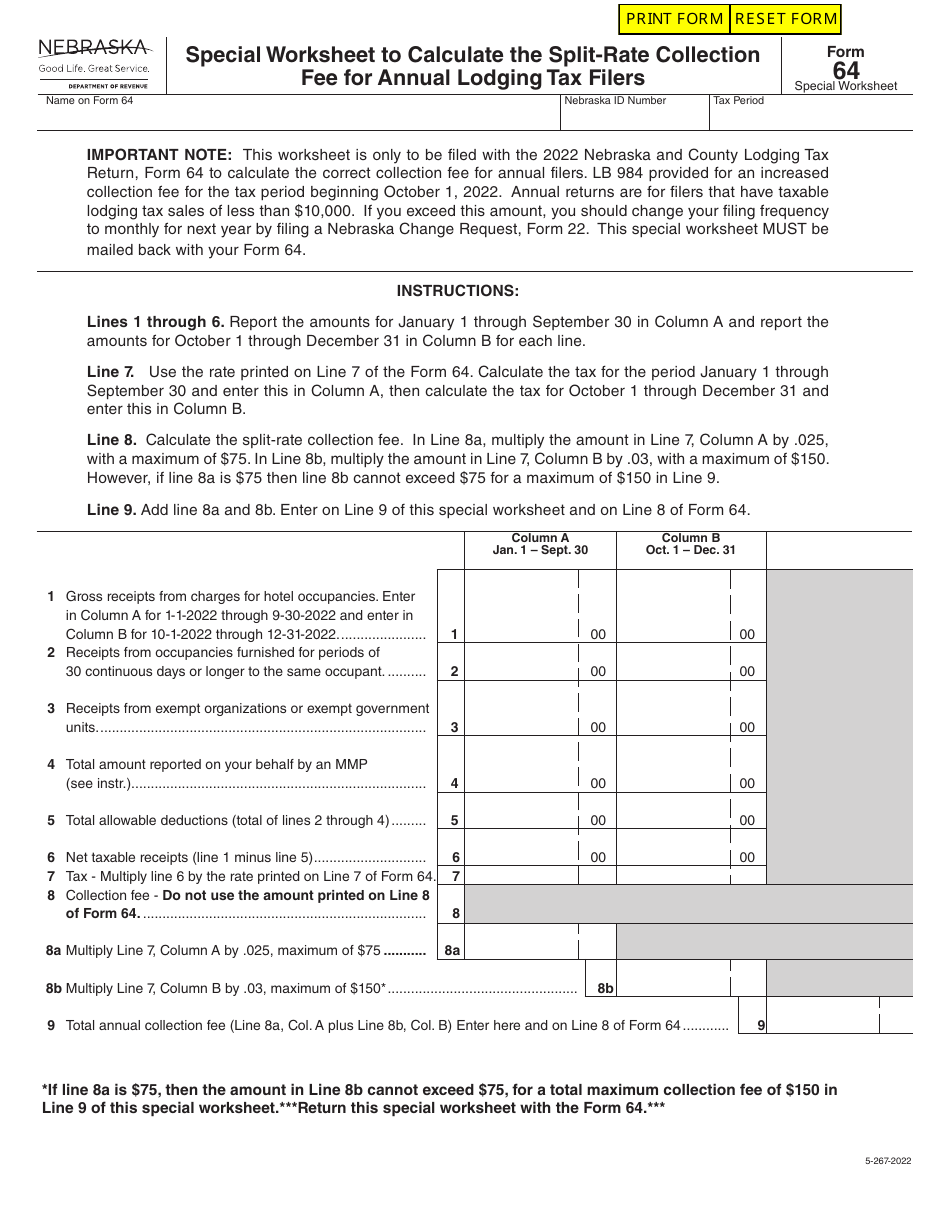

Form 64 Special Worksheet to Calculate the Split-Rate Collection Fee for Annual Lodging Tax Filers - Nebraska

What Is Form 64?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 64?

A: Form 64 is a special worksheet used to calculate the split-rate collection fee for annual lodging tax filers in Nebraska.

Q: Who should use Form 64?

A: Form 64 should be used by annual lodging tax filers in Nebraska.

Q: What is the purpose of Form 64?

A: The purpose of Form 64 is to calculate the split-rate collection fee for lodging tax filers.

Q: What is a split-rate collection fee?

A: A split-rate collection fee is a fee imposed on lodging tax filers in Nebraska, which is used to fund tourism promotion activities.

Q: How do I calculate the split-rate collection fee using Form 64?

A: You can calculate the split-rate collection fee by following the instructions provided on Form 64.

Q: Are there any specific requirements for lodging tax filers in Nebraska?

A: Yes, lodging tax filers in Nebraska are required to file Form 64 and pay the split-rate collection fee.

Q: Is Form 64 applicable only to Nebraska?

A: Yes, Form 64 is specific to lodging tax filers in Nebraska and is not applicable to other states.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 64 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.