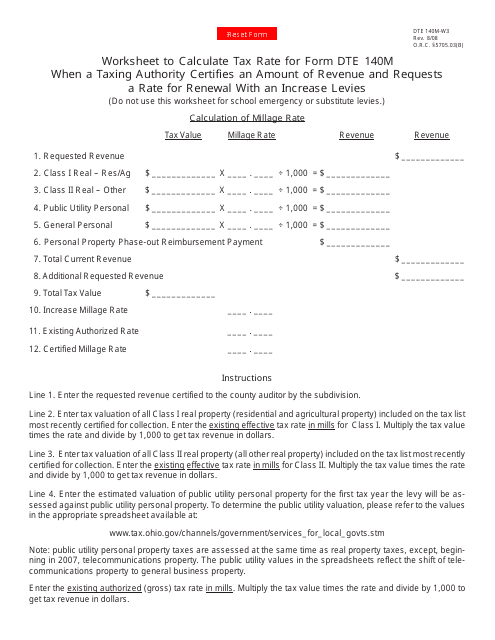

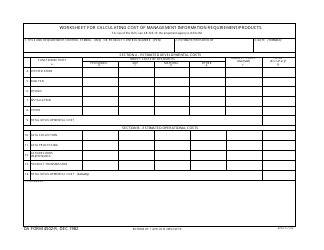

Form DTE140M-W3 Worksheet to Calculate Tax Rate for Form Dte 140m When a Taxing Authority Certifies an Amount of Revenue and Requests a Rate for Renewal With an Increase Levies - Ohio

What Is Form DTE140M-W3?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140M used for?

A: Form DTE140M is used to calculate the tax rate when a taxing authority certifies an amount of revenue and requests a rate for renewal with increased levies in Ohio.

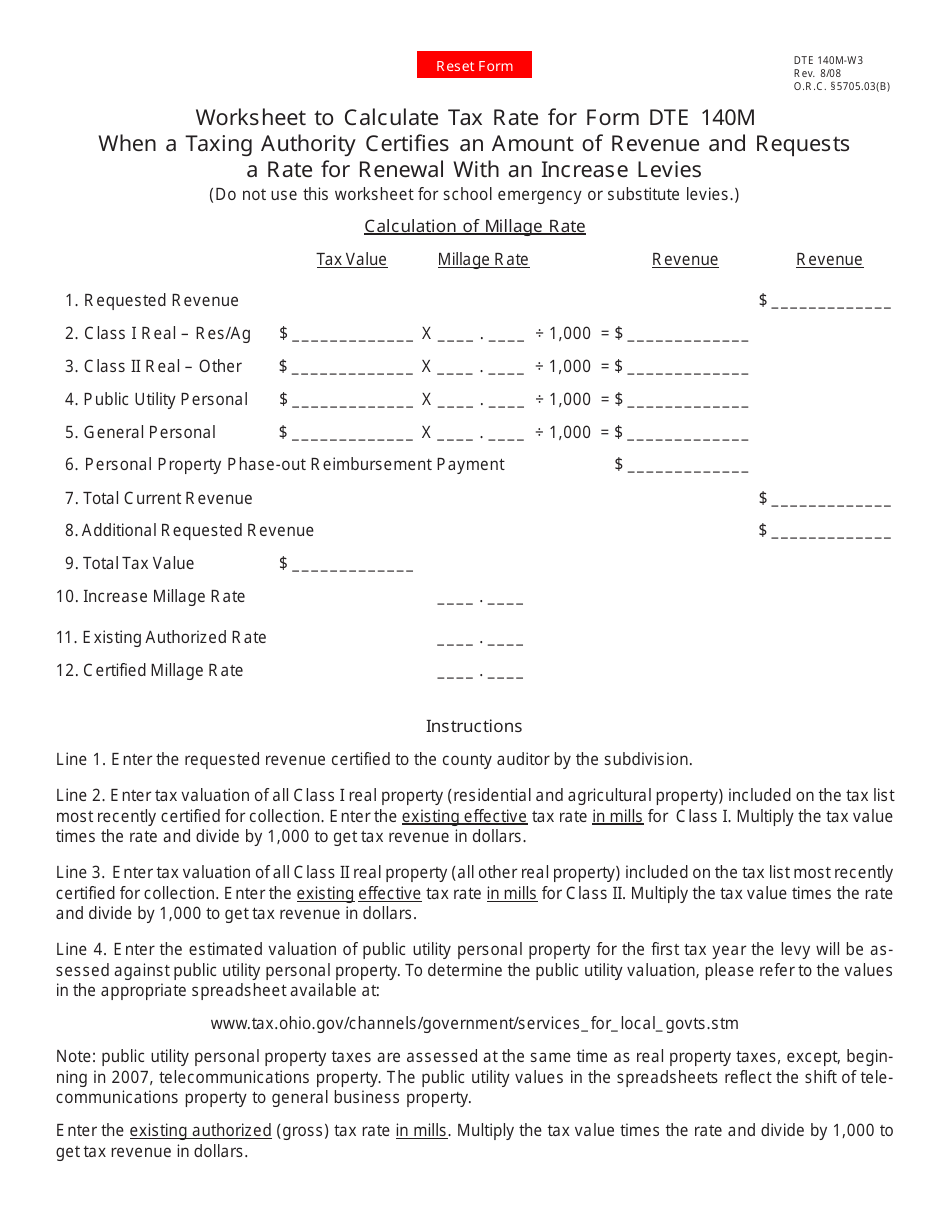

Q: How do I calculate the tax rate using Form DTE140M?

A: To calculate the tax rate, you need to enter the certified revenue amount and the levy amount into the worksheet provided on Form DTE140M. The form will then calculate the tax rate for you.

Q: What is the purpose of certifying the revenue amount?

A: Certifying the revenue amount helps determine the tax rate for renewal with increased levies. It ensures that the tax rate aligns with the requested additional revenue.

Q: Can I use Form DTE140M for other types of taxes besides renewal levies?

A: No, Form DTE140M is specifically designed for calculating the tax rate for renewals with increased levies in Ohio. It may not be applicable for other types of taxes or levies.

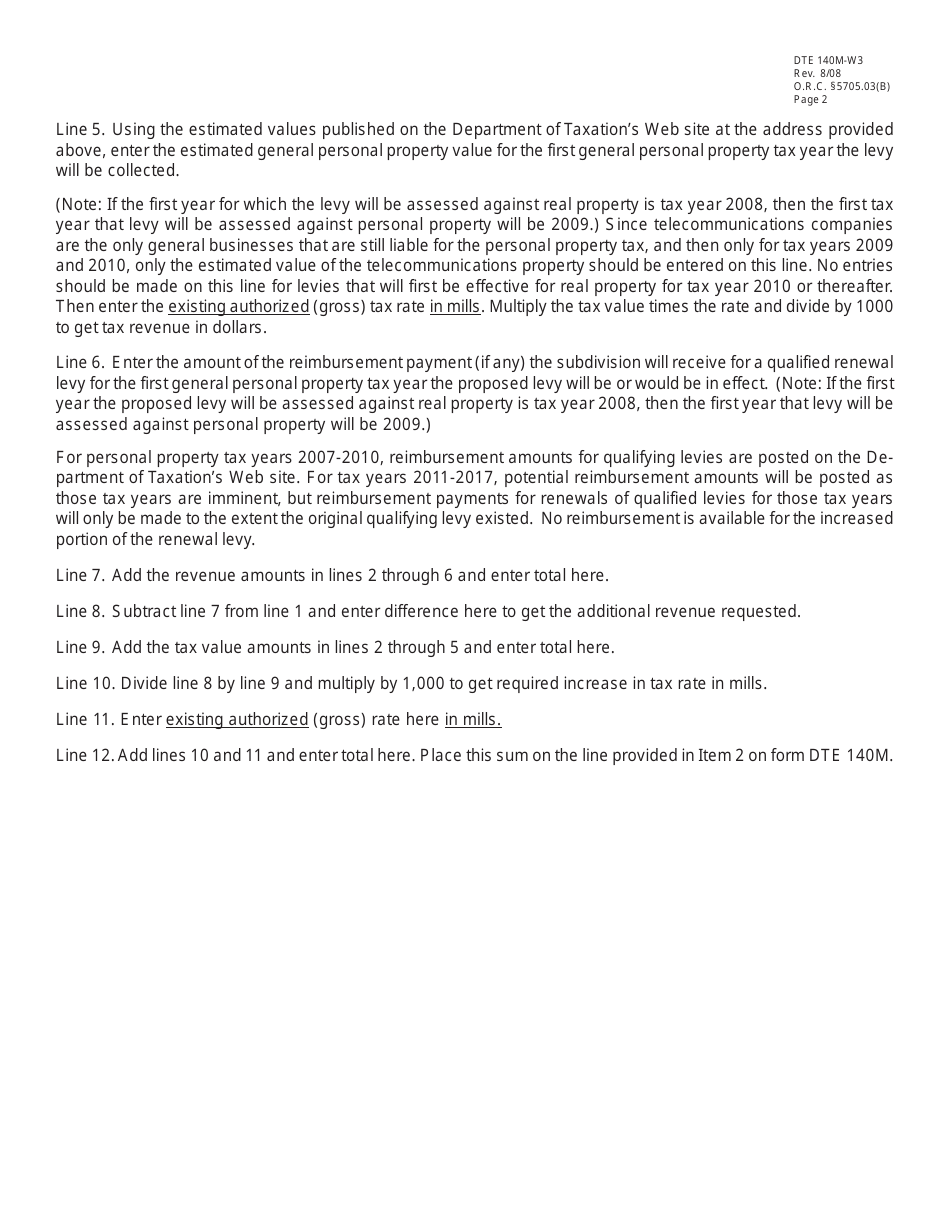

Q: Are there any specific instructions for filling out Form DTE140M?

A: Yes, Form DTE140M comes with detailed instructions that guide you through the process of calculating the tax rate. Make sure to follow the instructions carefully to ensure accurate calculations.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140M-W3 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.