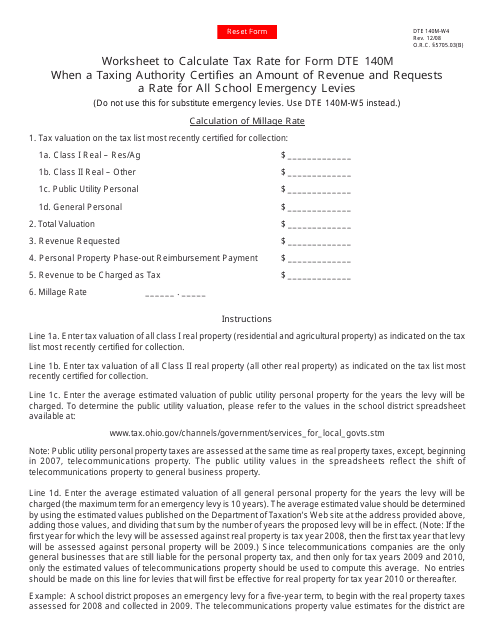

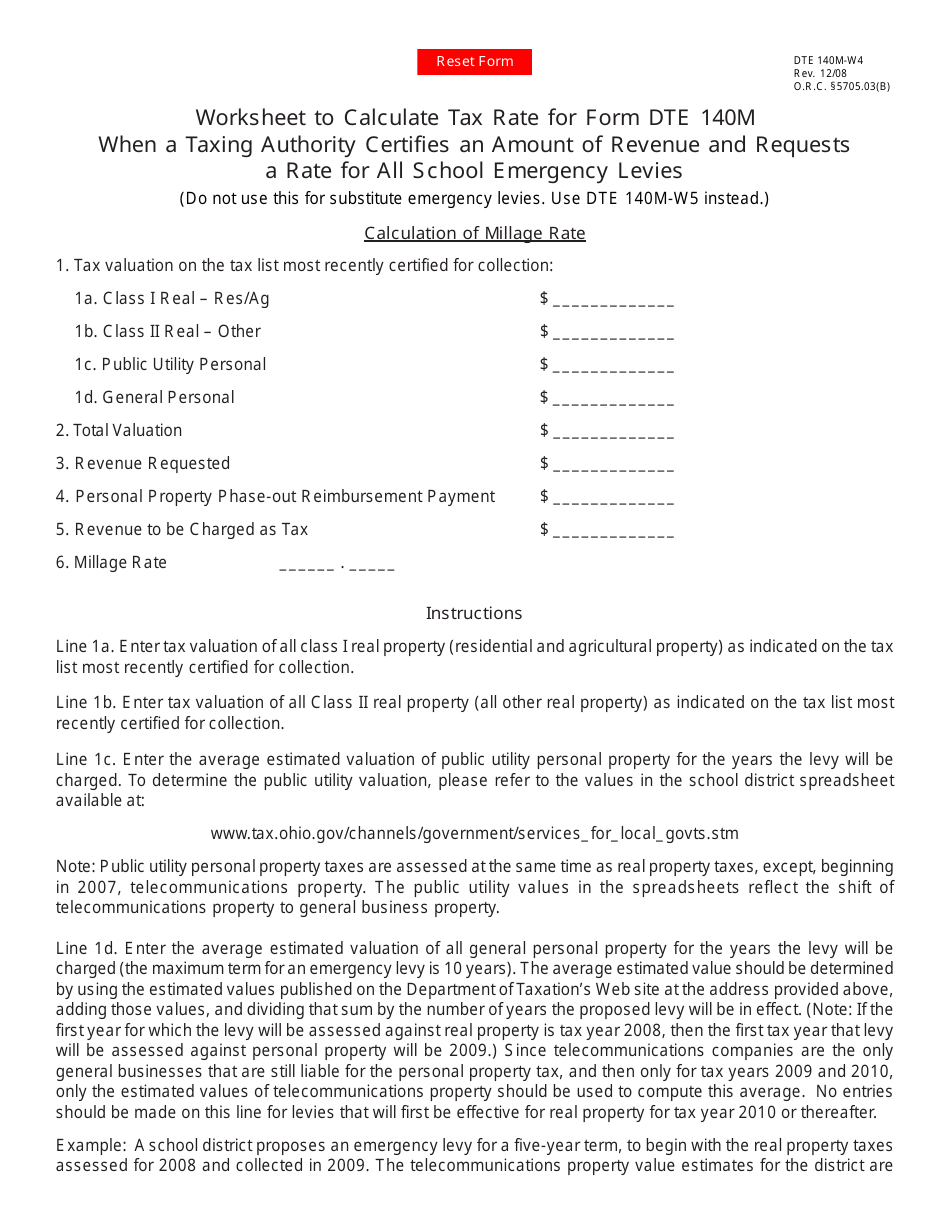

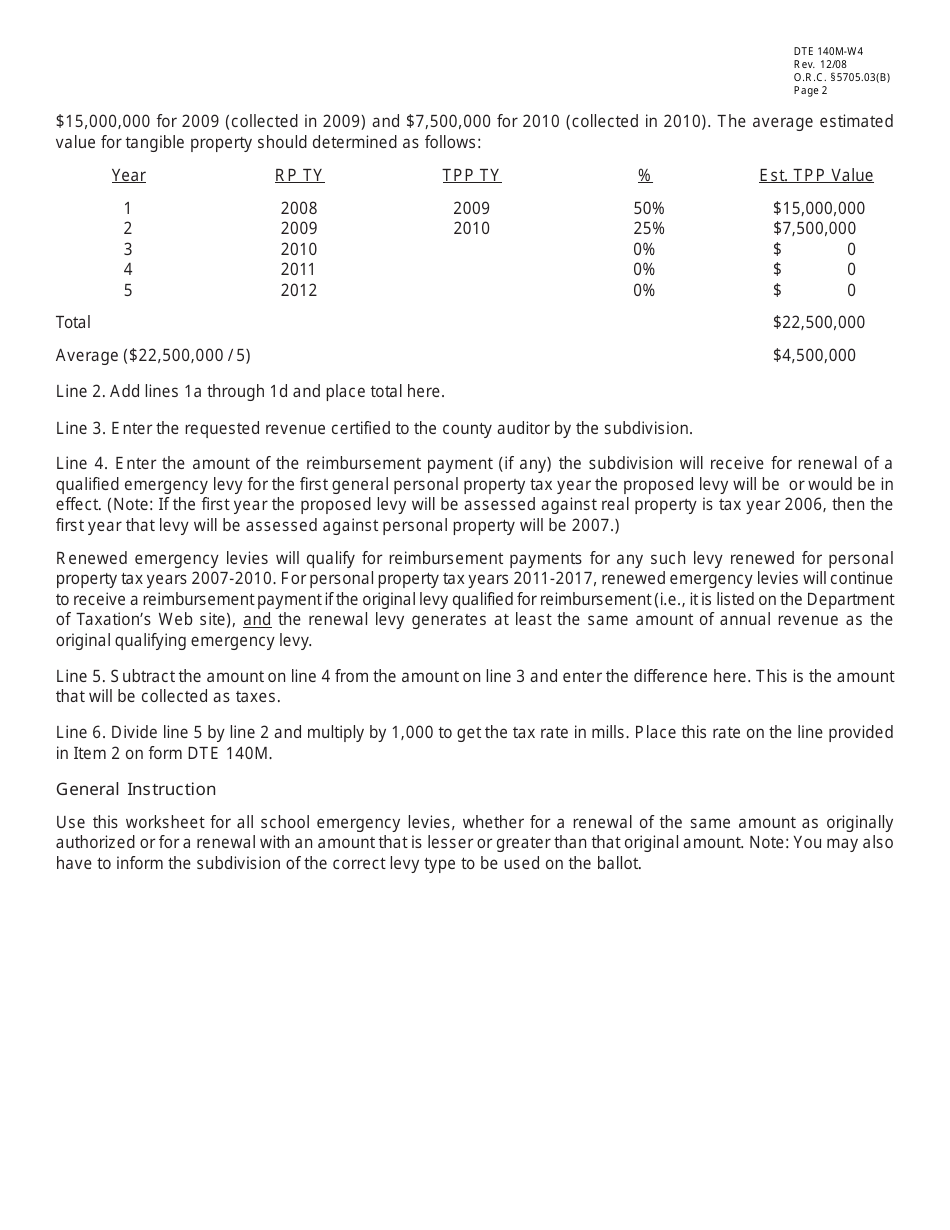

Form DTE140M-W4 Worksheet to Calculate Tax Rate for Form Dte 140m When a Taxing Authority Certifies an Amount of Revenue and Requests a Rate for All School Emergency Levies - Ohio

What Is Form DTE140M-W4?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140M-W4?

A: Form DTE140M-W4 is a worksheet used to calculate the tax rate for Form DTE140M.

Q: What is Form DTE140M?

A: Form DTE140M is a form used in Ohio to report property tax information for school emergency levies.

Q: When is Form DTE140M-W4 used?

A: Form DTE140M-W4 is used when a taxing authority certifies an amount of revenue and requests a rate for all school emergency levies.

Q: What does Form DTE140M-W4 calculate?

A: Form DTE140M-W4 calculates the tax rate for all school emergency levies based on the certified amount of revenue.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140M-W4 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.