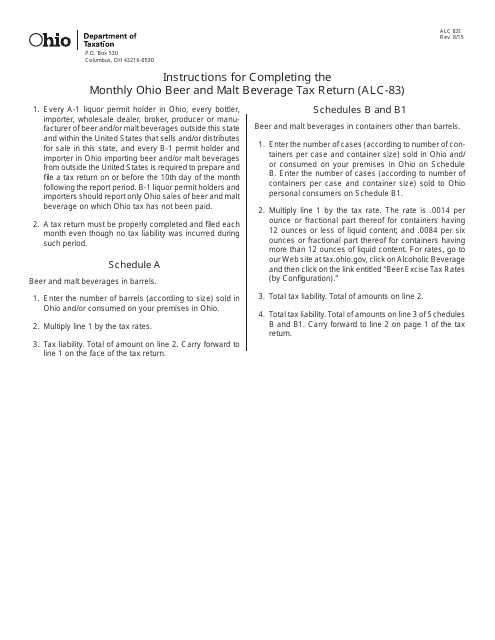

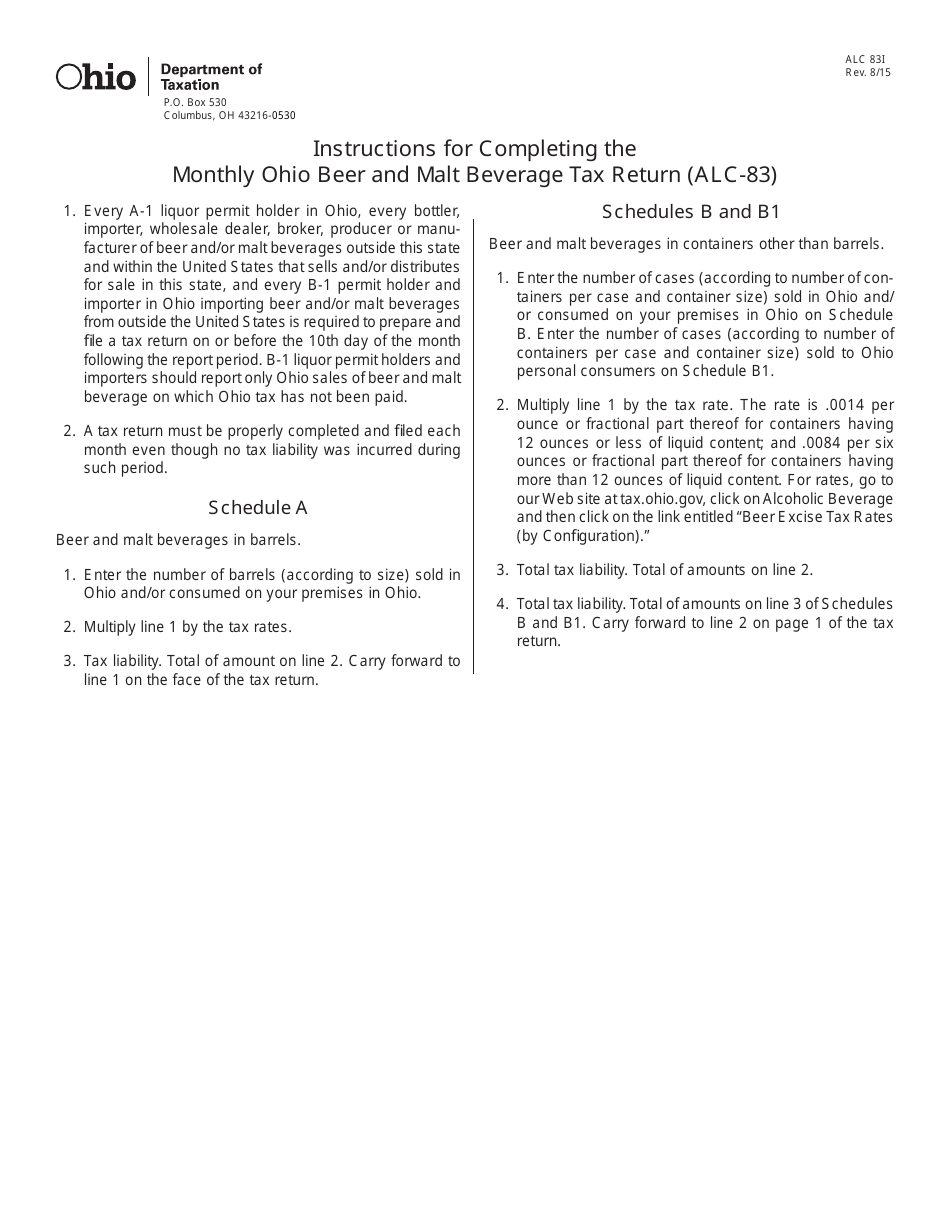

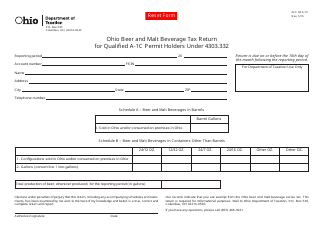

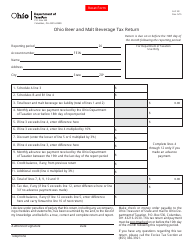

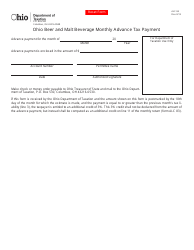

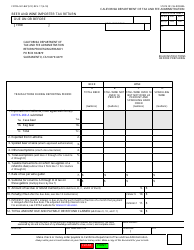

Instructions for Form ALC83I, ALC-83 Monthly Ohio Beer and Malt Beverage Tax Return - Ohio

This document contains official instructions for Form ALC83I , and Form ALC-83 . Both forms are released and collected by the Ohio Department of Taxation.

FAQ

Q: What is Form ALC83I?

A: Form ALC83I is the Ohio Beer and Malt Beverage Tax Return specifically for reporting the monthly beer and malt beverage tax in Ohio.

Q: Who needs to file Form ALC83I?

A: Any person or business that sells beer or malt beverages in Ohio and is required to collect and remit the beer and malt beverage tax must file Form ALC83I.

Q: When is Form ALC83I due?

A: Form ALC83I is due on the 10th day of the month following the reporting month. For example, the return for January is due on February 10th.

Q: What information do I need to complete Form ALC83I?

A: You will need to provide details such as sales of beer and malt beverages, taxable sales, tax due, and any credits or overpayments from previous periods.

Q: Are there any penalties for not filing Form ALC83I?

A: Yes, failure to file Form ALC83I or late filing can result in penalties, interest, and other enforcement actions by the Ohio Department of Taxation.

Q: Is there any assistance available for completing Form ALC83I?

A: Yes, you can contact the Ohio Department of Taxation or consult the instructions provided with the form for assistance in completing Form ALC83I.

Q: Are there any exemptions or deductions available for the beer and malt beverage tax?

A: Yes, there are certain exemptions and deductions available under Ohio law. Consult the instructions provided with Form ALC83I for more details.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.