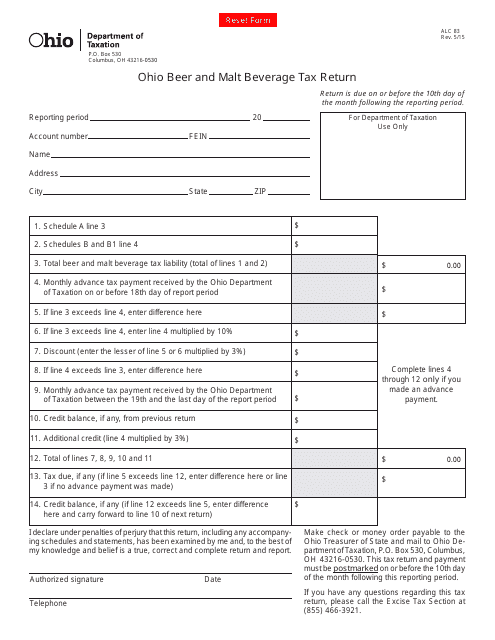

Form ALC83 Ohio Beer and Malt Beverage Tax Return - Ohio

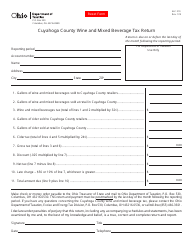

What Is Form ALC83?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

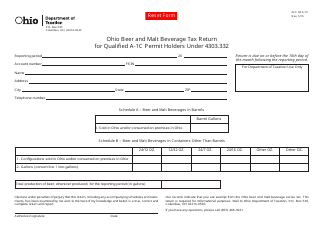

Q: What is Form ALC83?

A: Form ALC83 is the Ohio Beer and Malt Beverage Tax Return.

Q: Who needs to file Form ALC83?

A: Any person or entity engaged in the business of selling beer or malt beverages in Ohio needs to file Form ALC83.

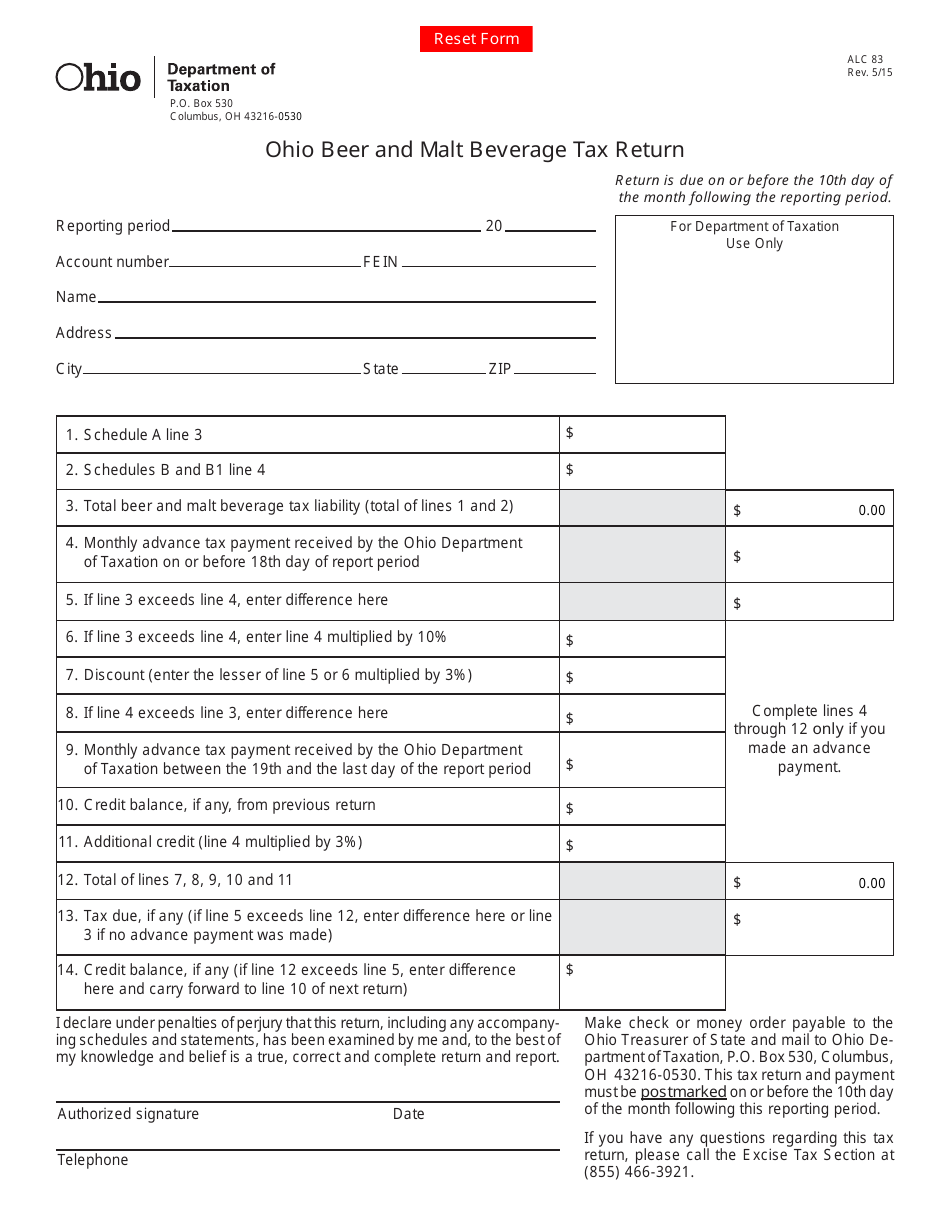

Q: What is the purpose of Form ALC83?

A: The purpose of Form ALC83 is to report and pay the beer and malt beveragetax owed to the state of Ohio.

Q: When is Form ALC83 due?

A: Form ALC83 is due on or before the 10th day of each month following the reporting period.

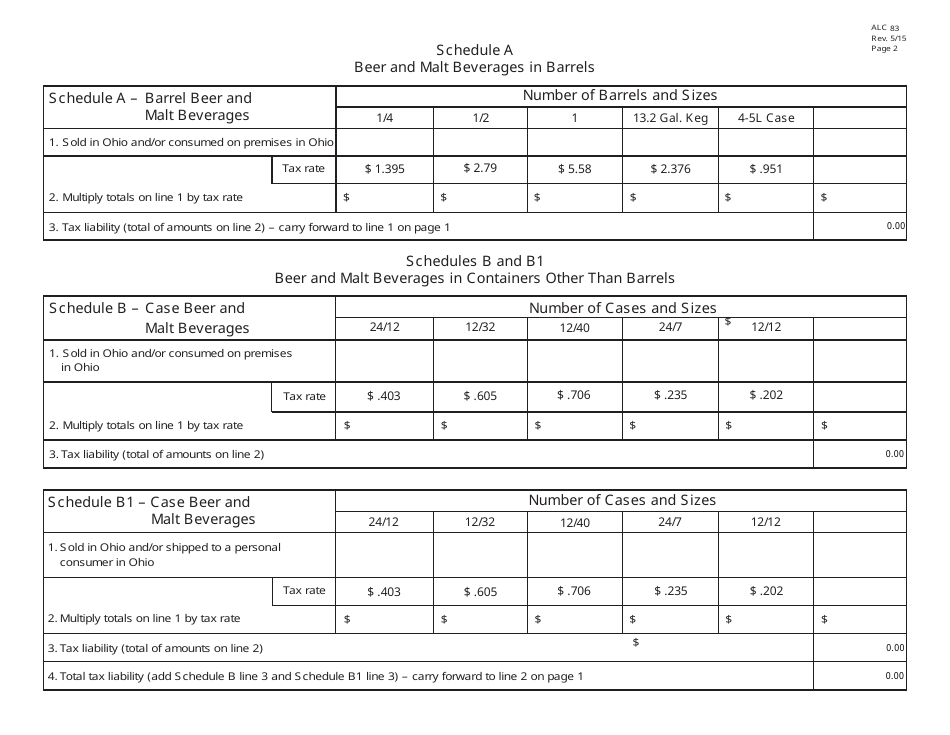

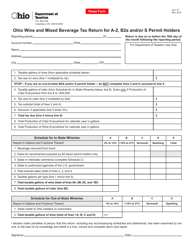

Q: What information is required on Form ALC83?

A: Form ALC83 requires information such as total sales of beer and malt beverages, tax rates, and calculation of tax due.

Q: Can Form ALC83 be filed electronically?

A: Yes, Form ALC83 can be filed electronically through the Ohio Business Gateway.

Q: What happens if I fail to file Form ALC83?

A: Failure to file Form ALC83 or pay the tax owed may result in penalties and interest being assessed by the state of Ohio.

Q: Can I request an extension to file Form ALC83?

A: No, there is no provision for an extension to file Form ALC83. It must be filed by the designated due date.

Q: Are there any exemptions or deductions available for the beer and malt beverage tax?

A: No, there are no exemptions or deductions available for the beer and malt beverage tax in Ohio.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC83 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.