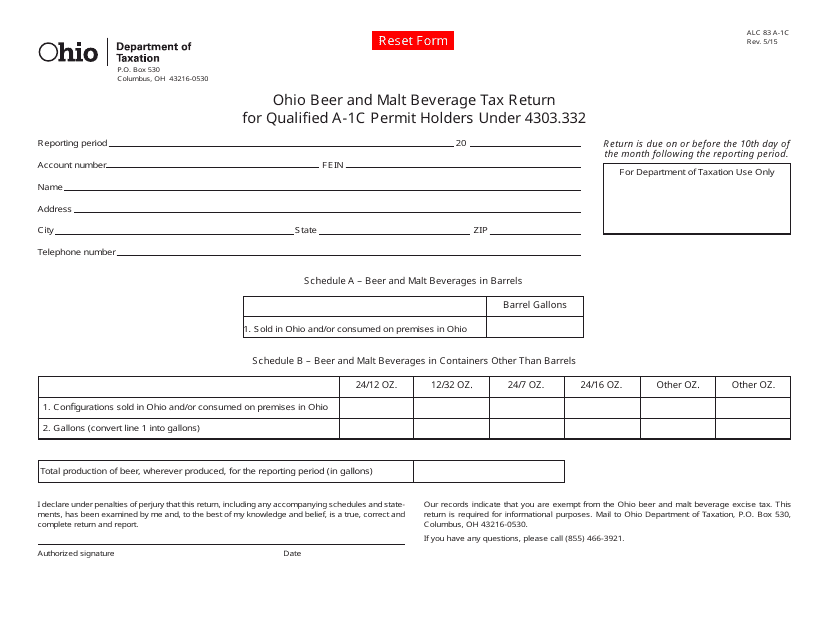

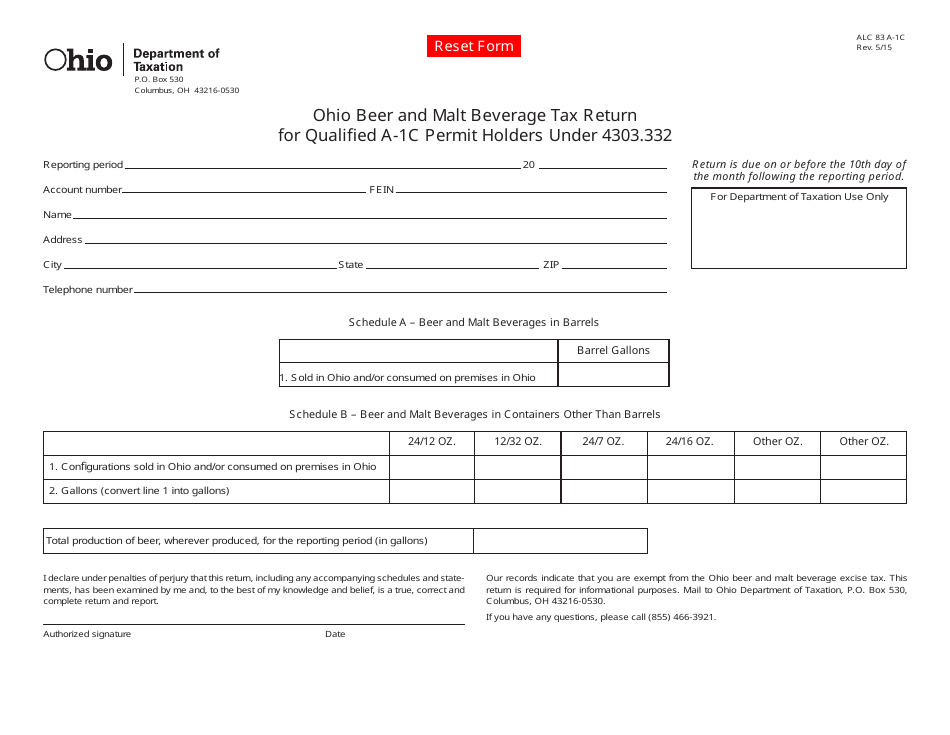

Form ALC83 A-1C Ohio Beer and Malt Beverage Tax Return for Qualified a-1c Permit Holders Under 4303.332 - Ohio

What Is Form ALC83 A-1C?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: It is a tax return form for qualified A-1C permit holders in Ohio.

Q: Who needs to file the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: Qualified A-1C permit holders in Ohio need to file this tax return.

Q: What is a Qualified A-1C permit holder?

A: A Qualified A-1C permit holder is someone who has been issued an A-1C permit under 4303.332 in Ohio.

Q: What is the purpose of the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: The purpose is to report and pay the Beer and Malt Beverage Tax for qualified A-1C permit holders.

Q: When is the deadline to file the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: The deadline varies, it is generally due quarterly. Please refer to the instructions on the form for specific due dates.

Q: What happens if I don't file the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: Failure to file the tax return may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for the Beer and Malt Beverage Tax?

A: Specific exemptions and deductions may apply. Please consult the instructions on the form or seek professional advice for more information.

Q: Who can I contact if I have questions about the ALC83 A-1C Ohio Beer and Malt Beverage Tax Return?

A: You can contact the Ohio Department of Taxation for assistance with any questions regarding this tax return form.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ALC83 A-1C by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.