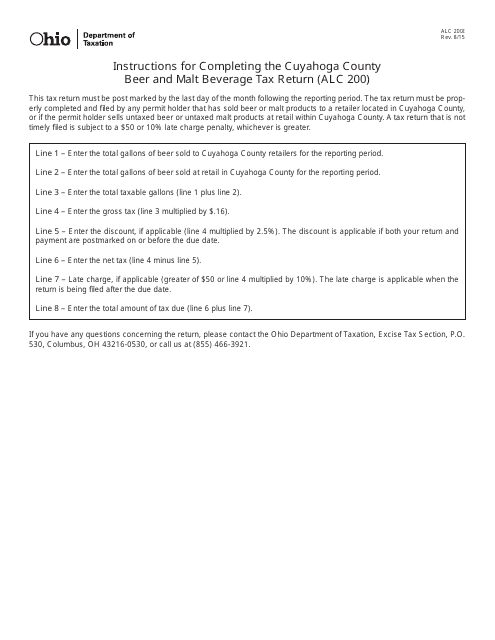

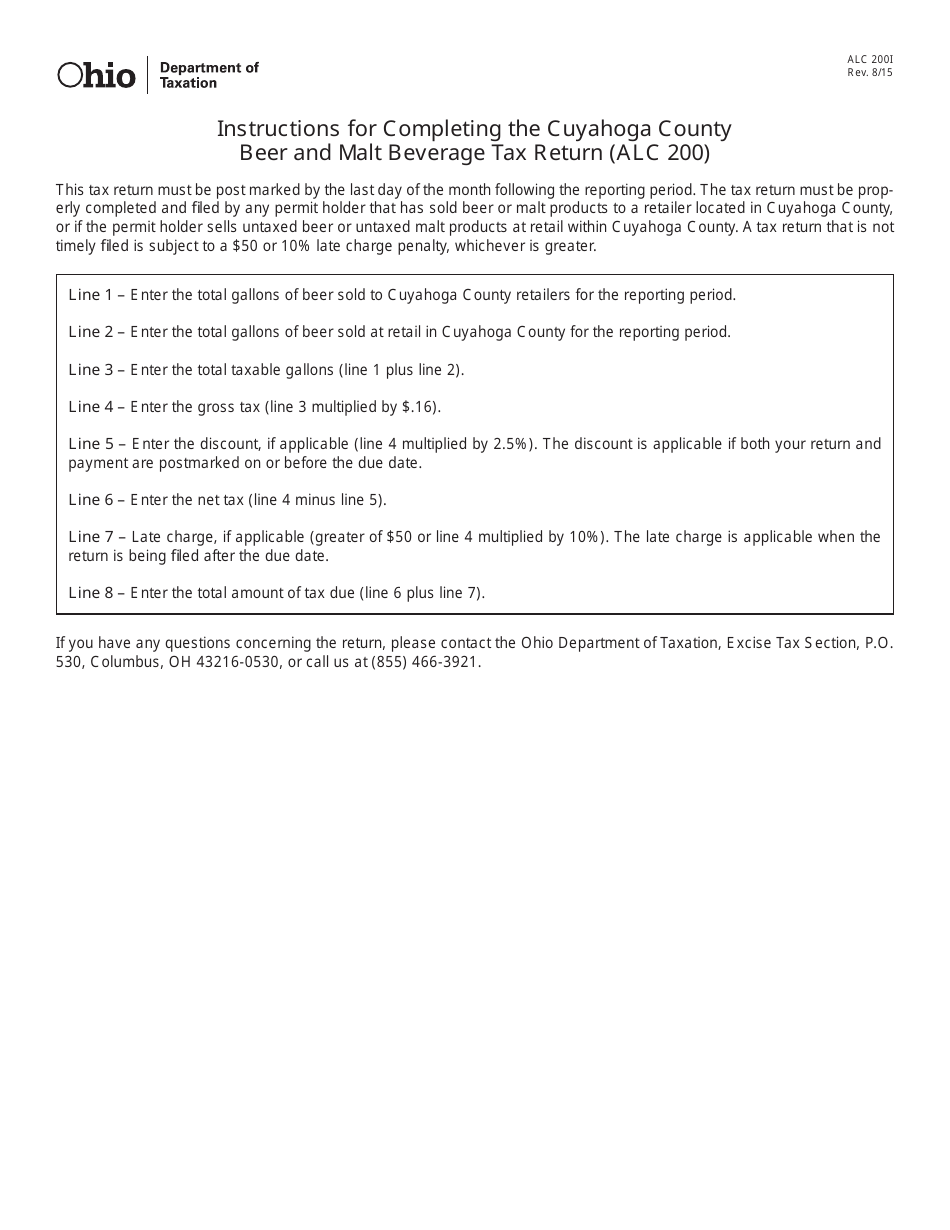

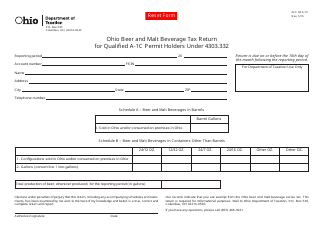

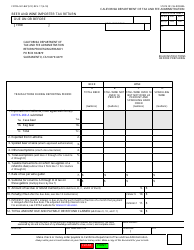

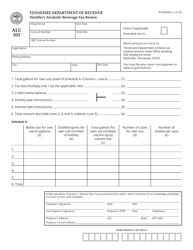

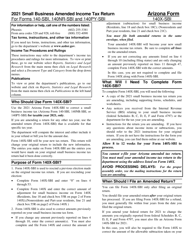

Instructions for Form ALC200 Cuyahoga County Beer and Malt Beverage Tax Return - Ohio

This document contains official instructions for Form ALC200 , Cuyahoga County Beer and Malt Beverage Tax Return - a form released and collected by the Ohio Department of Taxation.

FAQ

Q: What is Form ALC200?

A: Form ALC200 is the Cuyahoga County Beer and Malt Beverage Tax Return in Ohio.

Q: Who is required to file Form ALC200?

A: Any person or entity engaged in the sale of beer or malt beverages in Cuyahoga County, Ohio is required to file Form ALC200.

Q: When is the due date for filing Form ALC200?

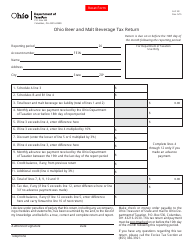

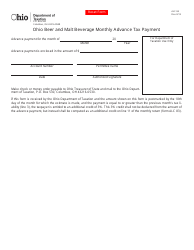

A: Form ALC200 must be filed monthly, and the due date is on or before the 20th day of the month following the reporting period.

Q: What information is required to be included in Form ALC200?

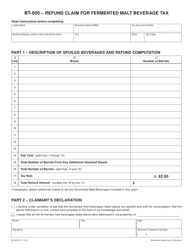

A: Form ALC200 requires information such as total sales of beer and malt beverages, tax due, and any deductions or exemptions claimed.

Q: What happens if I fail to file Form ALC200 or pay the tax on time?

A: Failure to file Form ALC200 or pay the tax on time may result in penalties and interest being assessed by the county.

Q: Are there any exemptions or deductions available on Form ALC200?

A: Yes, certain exemptions and deductions may be available, such as sales to government entities or sales made for consumption off the premises.

Q: Can I file Form ALC200 electronically?

A: Yes, electronic filing of Form ALC200 is available through the Ohio Business Gateway.

Q: Is there a penalty for filing Form ALC200 late?

A: Yes, if Form ALC200 is filed late, a penalty may be assessed based on the amount of tax due and the number of days late.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Taxation.