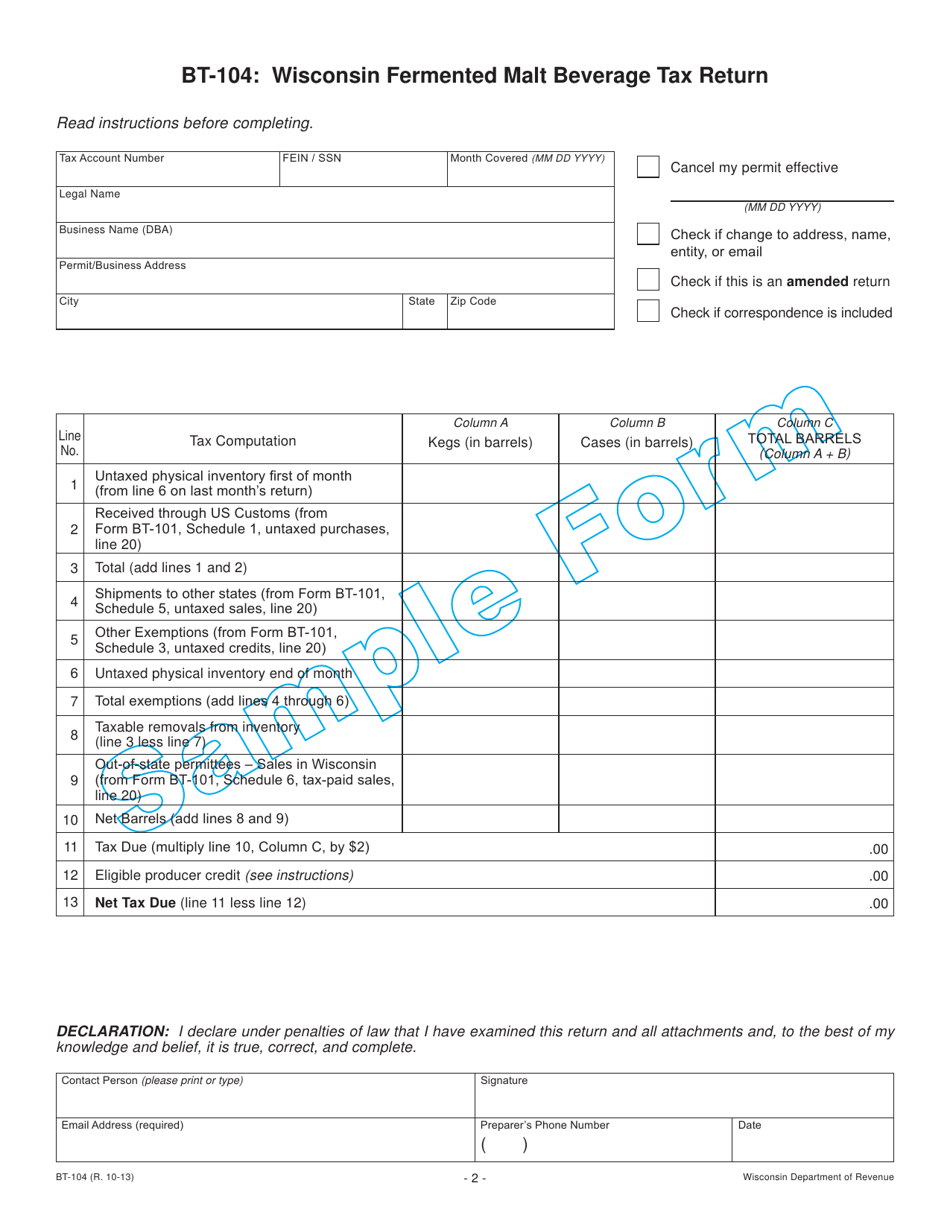

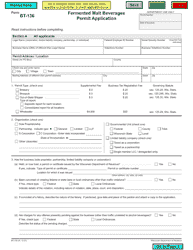

Form BT-104 Wisconsin Fermented Malt Beverage Tax Return - Sample - Wisconsin

What Is Form BT-104?

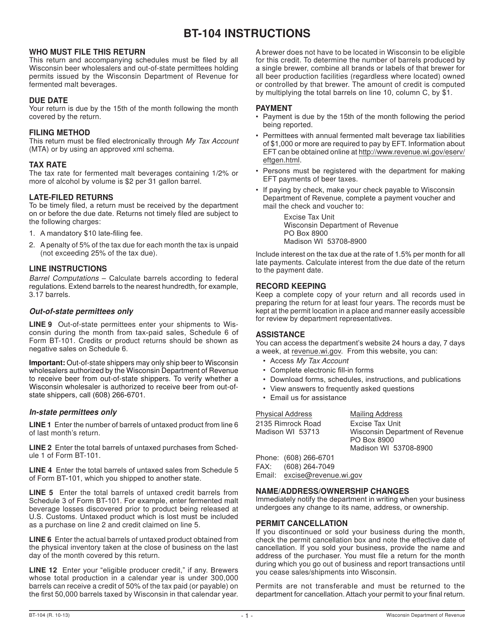

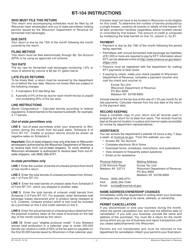

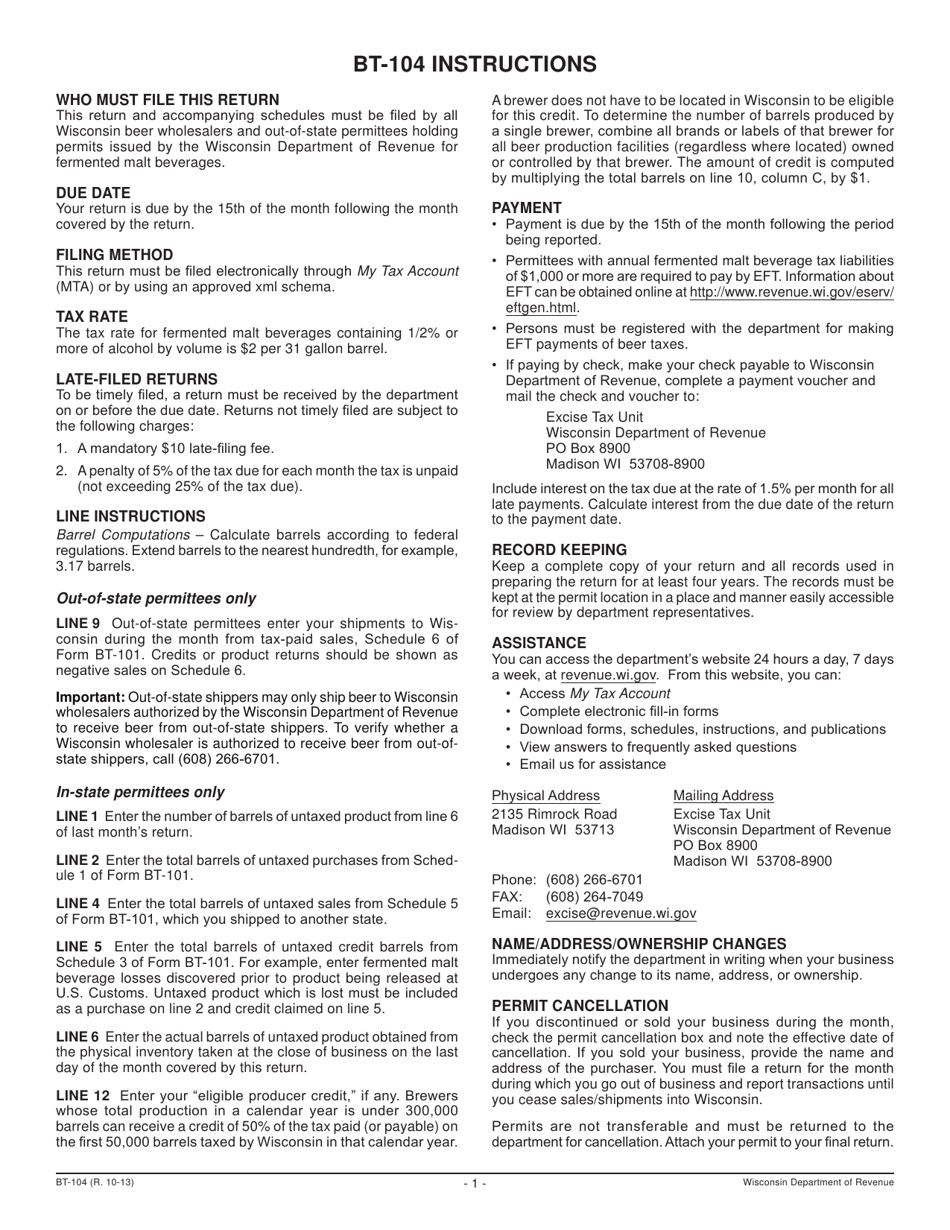

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form BT-104?

A: Form BT-104 is the Wisconsin Fermented Malt Beverage Tax Return.

Q: Who needs to file Form BT-104?

A: Anyone who sells fermented malt beverages in Wisconsin needs to file Form BT-104.

Q: What is the purpose of Form BT-104?

A: The purpose of Form BT-104 is to report and pay the tax on fermented malt beverages sold in Wisconsin.

Q: How often should Form BT-104 be filed?

A: Form BT-104 should be filed quarterly, on or before the 15th day of the month following the end of the quarter.

Q: What information is required on Form BT-104?

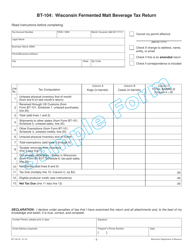

A: Form BT-104 requires information such as sales of fermented malt beverages, the amount of tax due, and any credits or other adjustments.

Q: Are there any penalties for late filing of Form BT-104?

A: Yes, there are penalties for late filing or failure to file Form BT-104, including interest charges and possible legal actions.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BT-104 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.