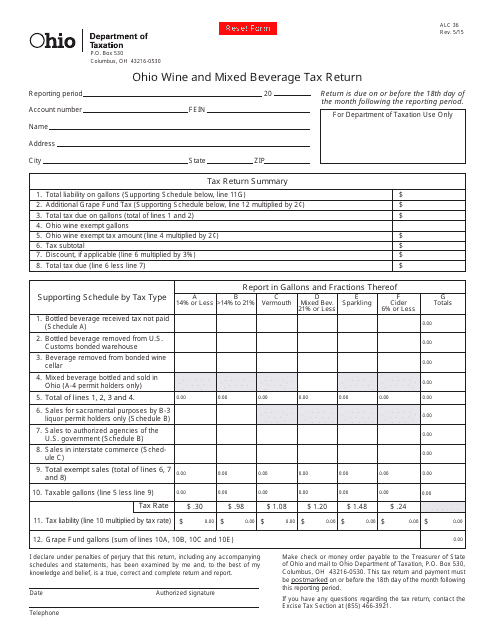

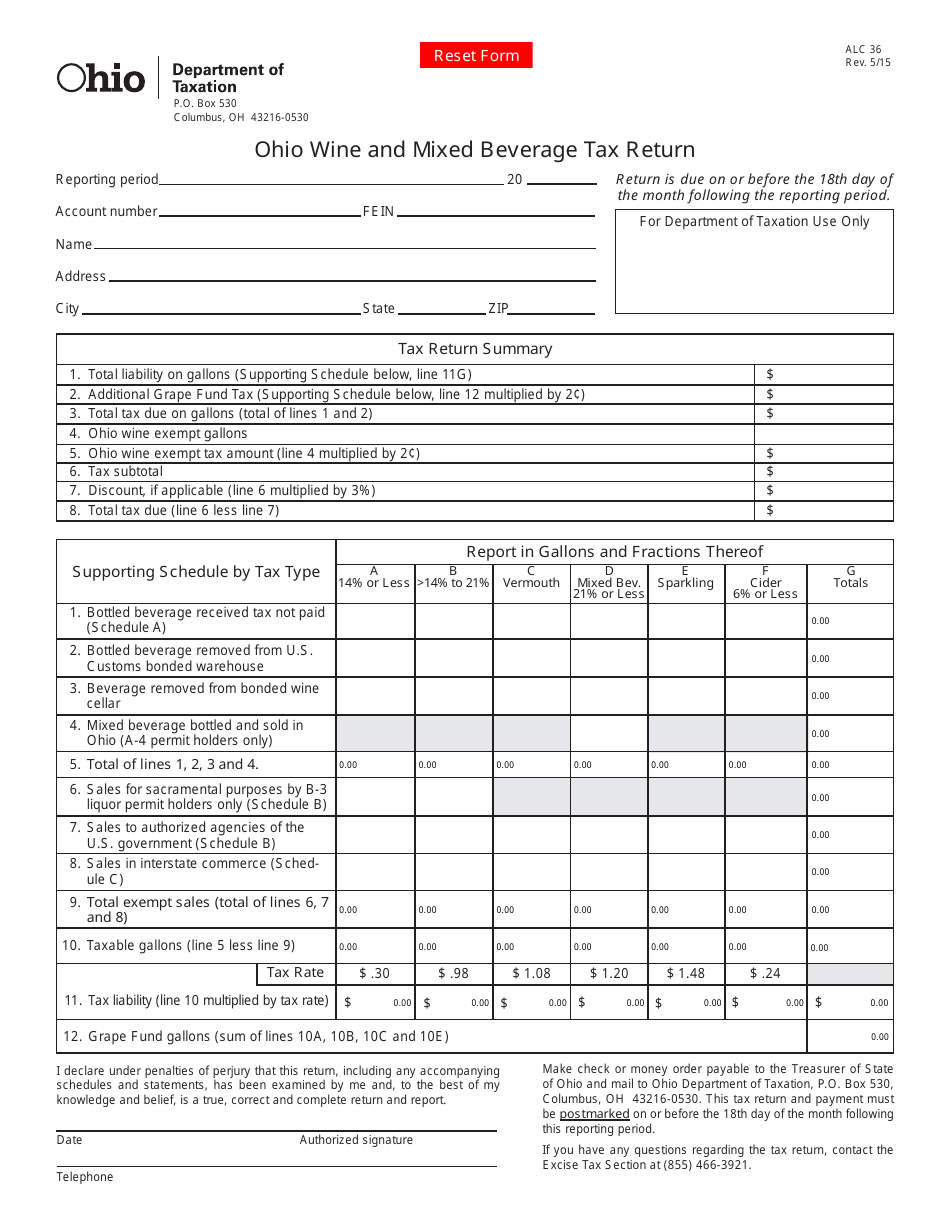

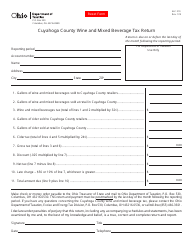

Form ALC36 Ohio Wine and Mixed Beverage Tax Return - Ohio

What Is Form ALC36?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: What is ALC36 Ohio Wine and Mixed Beverage Tax Return?

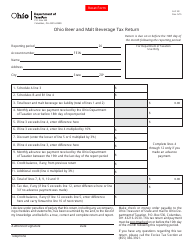

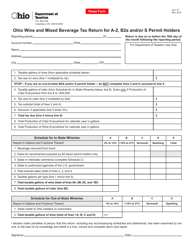

A: ALC36 is a tax return form used in Ohio for reporting and paying taxes on wine and mixed beverages.

Q: Who needs to file ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: Businesses that sell wine and mixed beverages in Ohio are required to file this tax return.

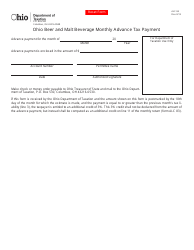

Q: How often do I need to file ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: The frequency of filing depends on the volume of sales. Typically, it is filed on a monthly basis.

Q: What taxes are reported on ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: The tax return reports state taxes on wine and mixed beverages sales in Ohio.

Q: Is there a deadline for filing ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: Yes, the tax return must be filed by the 10th day of the month following the reporting period.

Q: Are there any penalties for late filing of ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: Yes, late filing can result in penalties and interest charges.

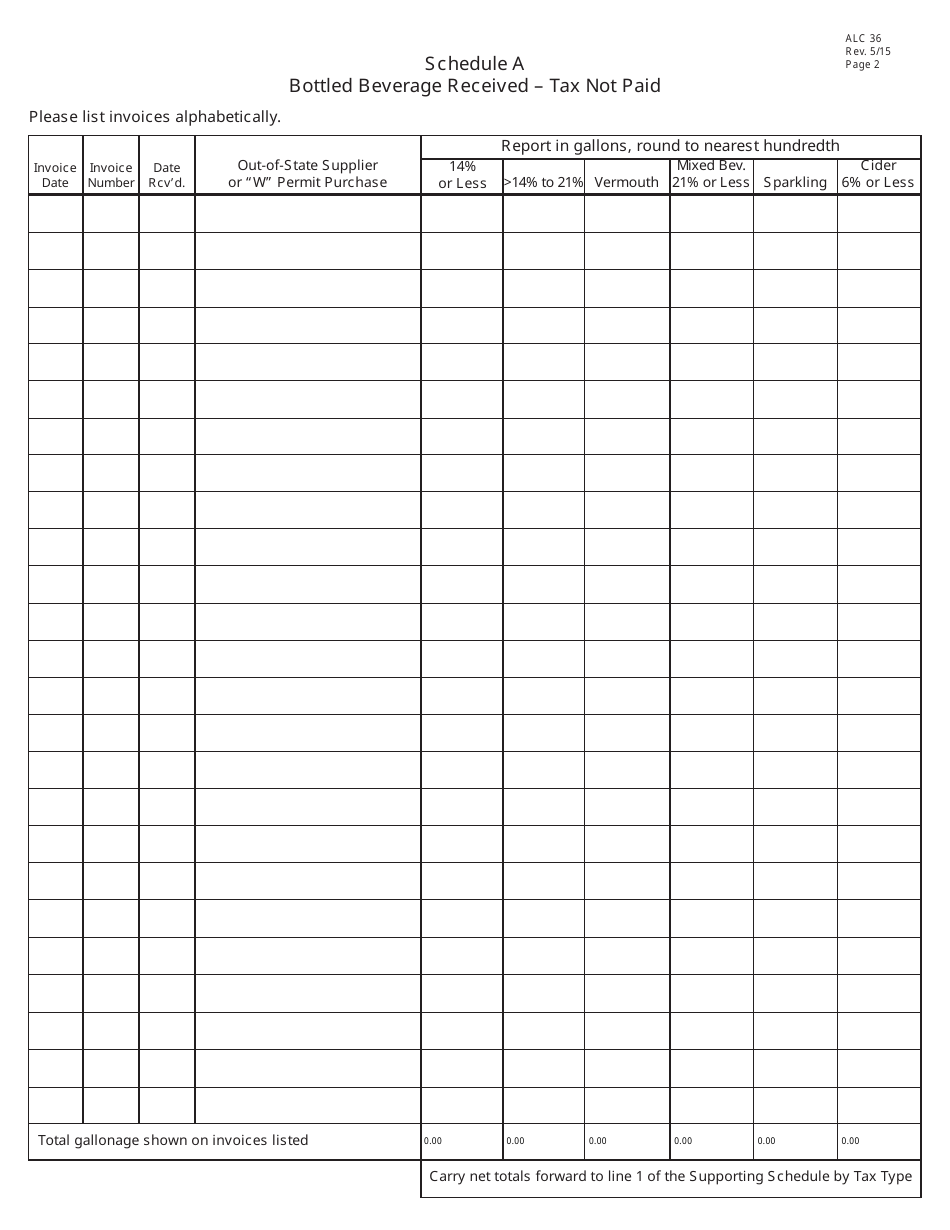

Q: What information do I need to complete ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: You will need to provide information about your sales of wine and mixed beverages, as well as information about any exemptions or deductions you are claiming.

Q: Who should I contact for more information about ALC36 Ohio Wine and Mixed Beverage Tax Return?

A: You can contact the Ohio Department of Taxation for more information about this tax return form.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC36 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.