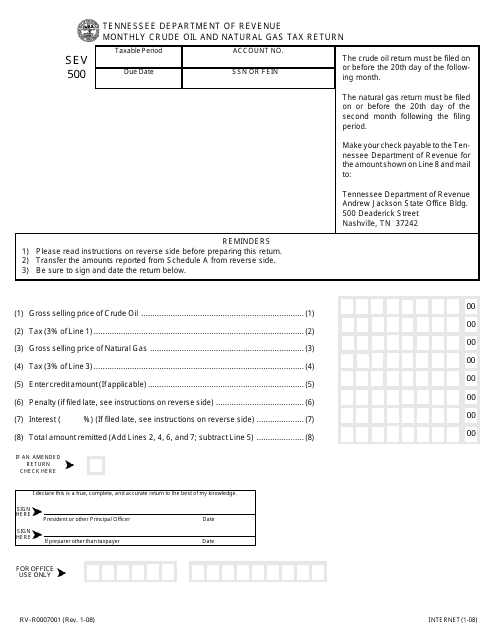

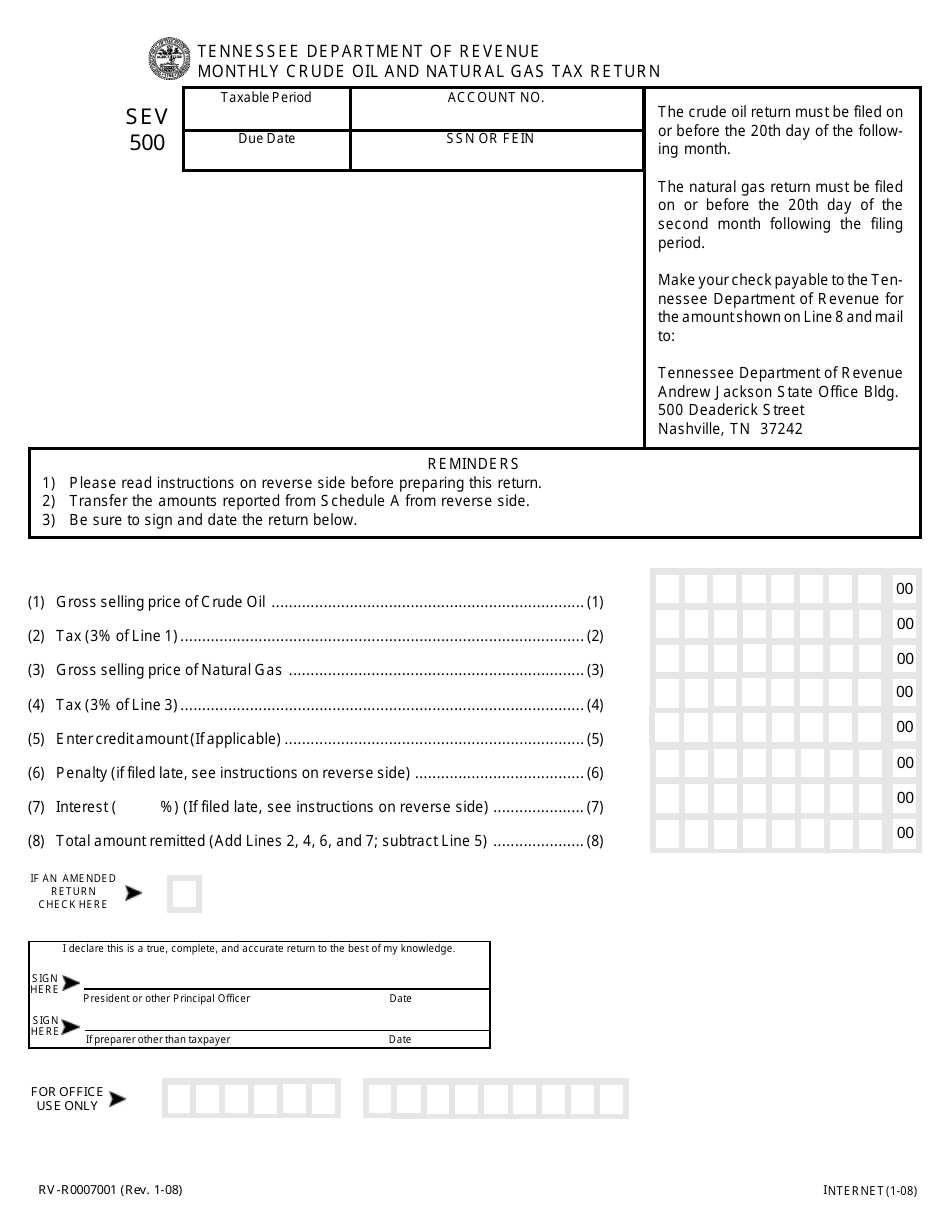

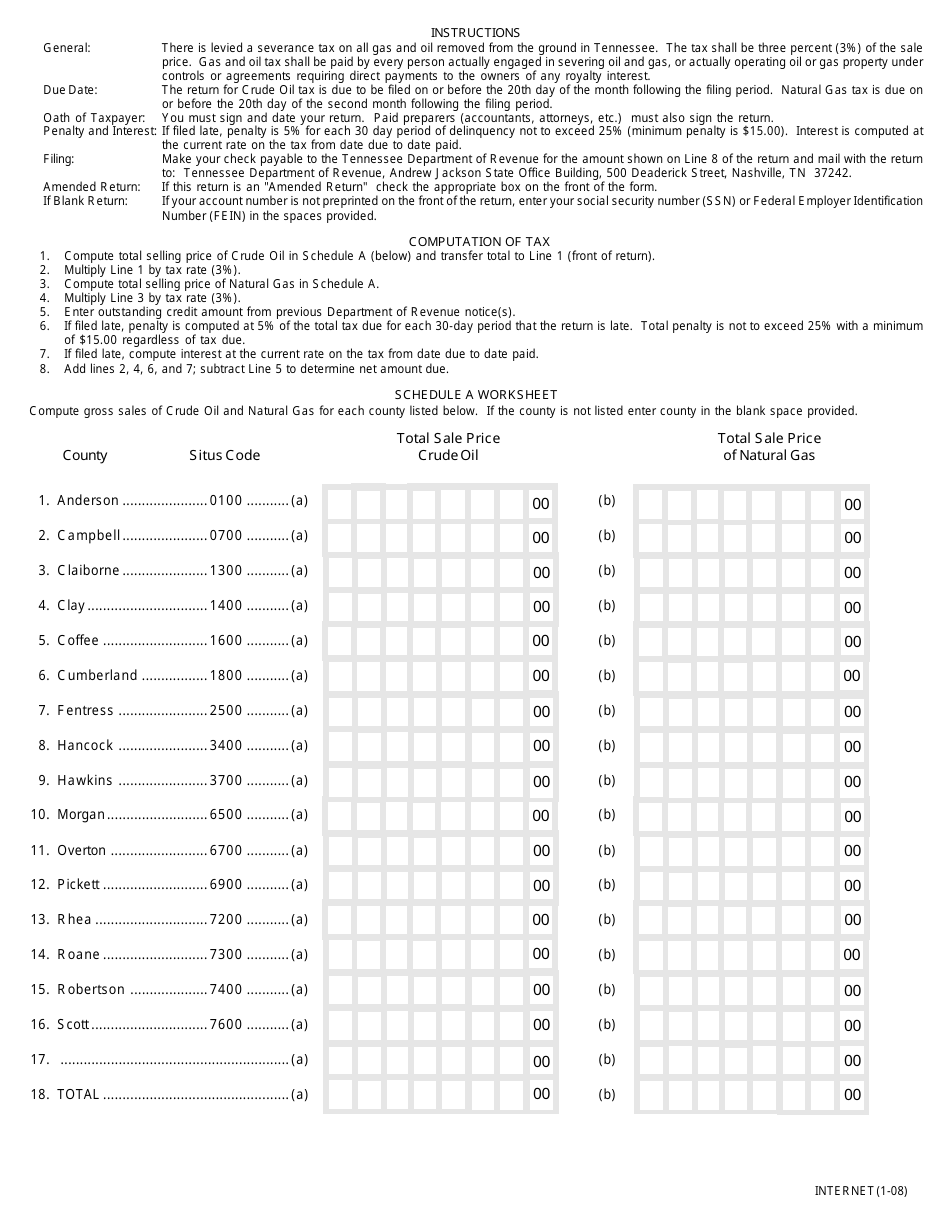

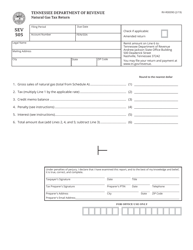

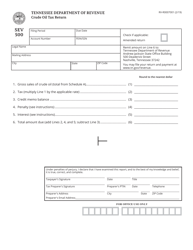

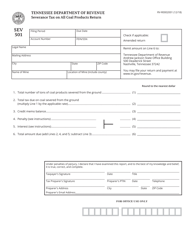

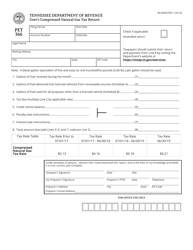

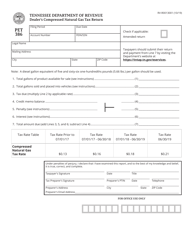

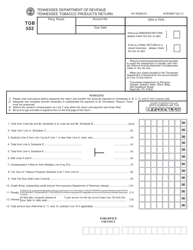

Form SEV500 (RV-R0007001) Monthly Crude Oil and Natural Gas Tax Return - for Tax Periods Prior to May 1, 2019 - Tennessee

What Is Form SEV500 (RV-R0007001)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SEV500?

A: Form SEV500 is the Monthly Crude Oil and Natural Gas Tax Return.

Q: What is the purpose of Form SEV500?

A: The purpose of Form SEV500 is to report and pay taxes on the production and sale of crude oil and natural gas.

Q: Who needs to file Form SEV500?

A: Individuals and businesses engaged in the production and sale of crude oil and natural gas in Tennessee need to file Form SEV500.

Q: What is the tax period for Form SEV500?

A: Form SEV500 is for tax periods prior to May 1, 2019.

Q: What taxes are reported on Form SEV500?

A: Form SEV500 is used to report and pay the severance tax on crude oil and natural gas production.

Q: What information is required on Form SEV500?

A: Form SEV500 requires information such as the taxpayer's name, address, and taxpayer identification number, as well as details about the production and sale of crude oil and natural gas.

Q: Is there a deadline for filing Form SEV500?

A: Yes, the deadline for filing Form SEV500 is typically the 20th of the month following the end of the tax period.

Q: Are there any penalties for late filing of Form SEV500?

A: Yes, late filing of Form SEV500 may result in penalties and interest charges.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SEV500 (RV-R0007001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.