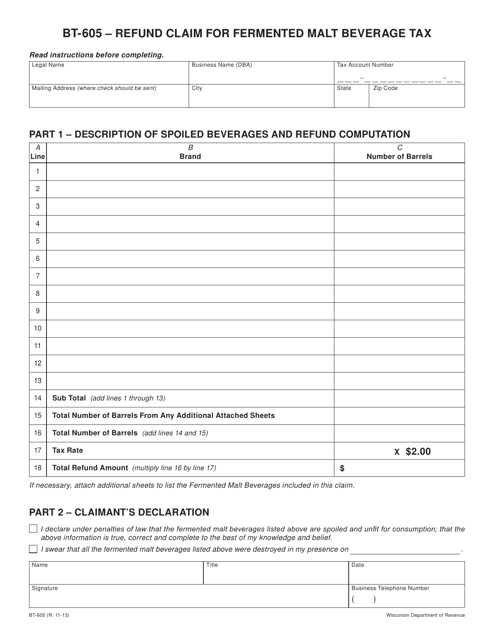

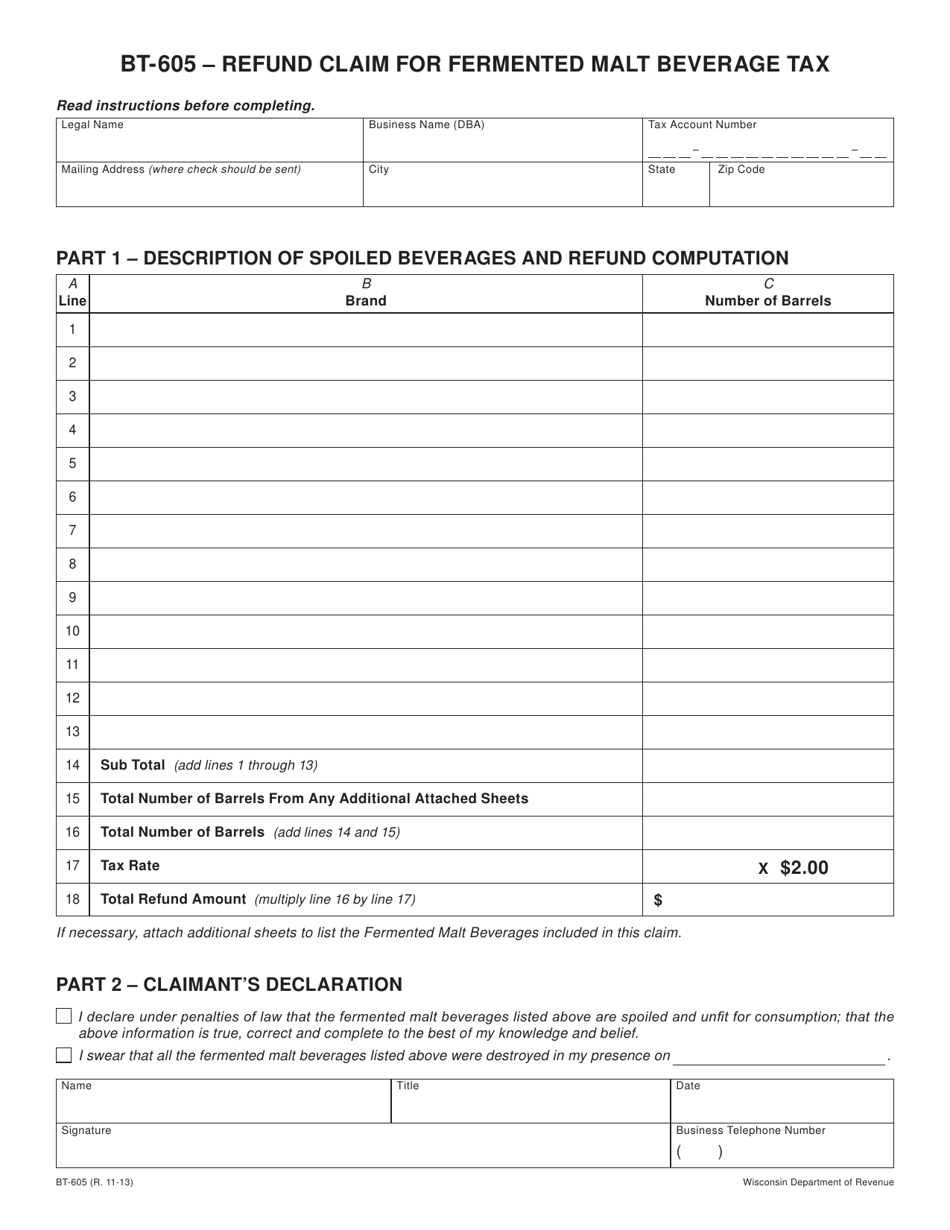

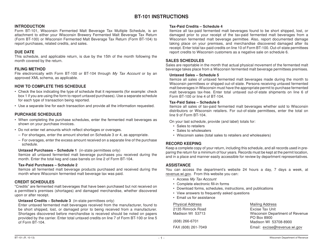

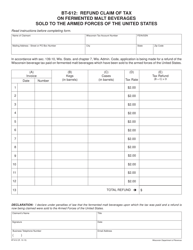

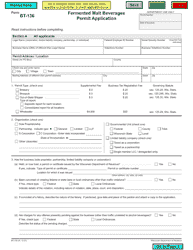

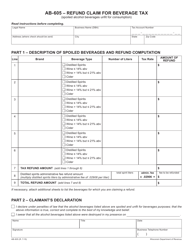

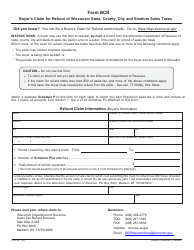

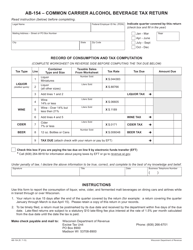

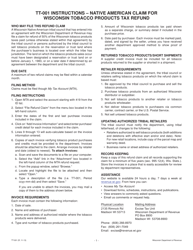

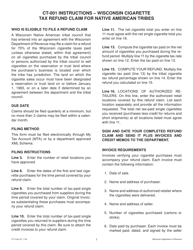

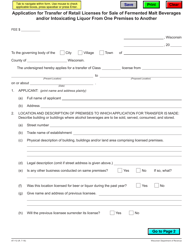

Form BT-605 Refund Claim for Fermented Malt Beverage Tax - Wisconsin

What Is Form BT-605?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-605?

A: Form BT-605 is a refund claim form for the Fermented Malt Beverage Tax in Wisconsin.

Q: What is the Fermented Malt Beverage Tax?

A: The Fermented Malt Beverage Tax is a tax imposed on the sale of beer and other malt beverages in Wisconsin.

Q: Who needs to file Form BT-605?

A: Any individual or entity that paid Fermented Malt Beverage Tax and is eligible for a refund can file Form BT-605.

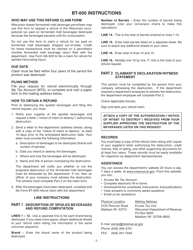

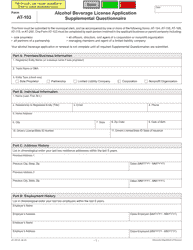

Q: What information is required on Form BT-605?

A: Form BT-605 requires information such as the taxpayer's name, address, sales information, and documentation to support the refund claim.

Q: What is the deadline to file Form BT-605?

A: Form BT-605 must be filed within 6 months from the end of the quarter in which the tax was paid.

Q: How long does it take to receive a refund?

A: The processing time for a refund claim can vary, but it generally takes around 8-12 weeks to receive a refund.

Q: Can I file Form BT-605 electronically?

A: Yes, the Wisconsin Department of Revenue allows electronic filing of Form BT-605.

Q: Are there any fees for filing Form BT-605?

A: There are no fees for filing Form BT-605.

Q: What should I do if I have more questions about Form BT-605?

A: If you have more questions about Form BT-605, you can contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BT-605 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.