IRS 1040 Forms, Schedules and Instructions for 2021

Related Articles

Documents:

60

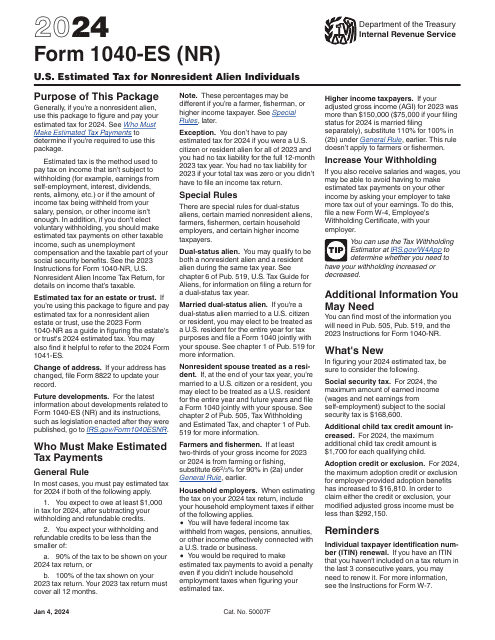

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

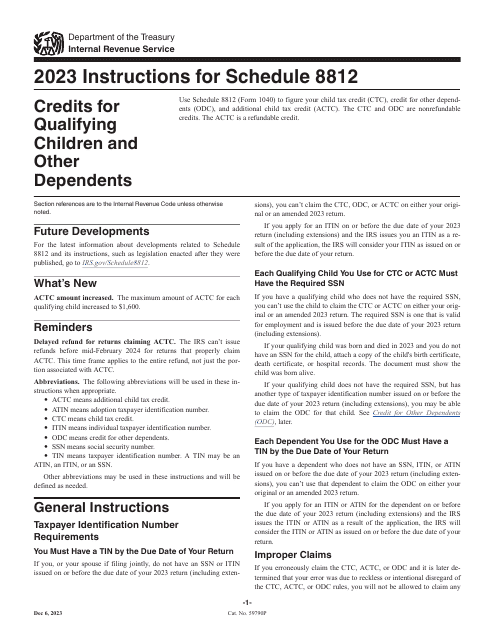

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

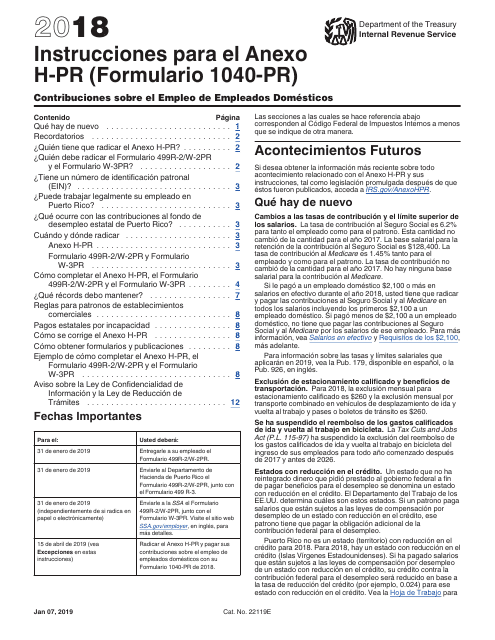

This type of document is used for filing Federal Income Tax returns for self-employed individuals in Puerto Rico. It also includes the Additional Child Tax Credit for bona fide residents of Puerto Rico.

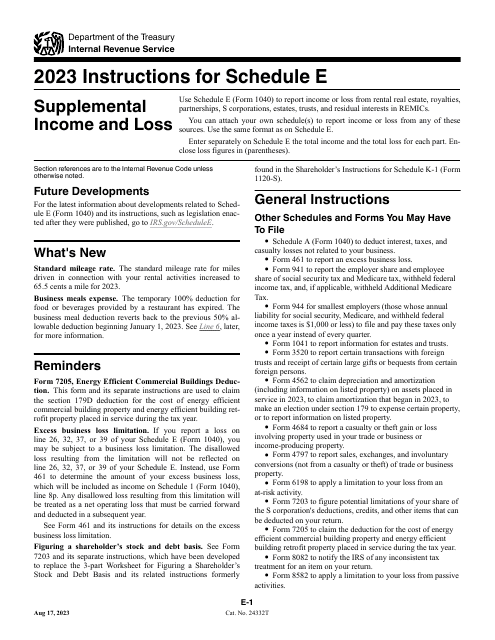

This form is used for filing an amended U.S. Individual Income Tax Return. It allows taxpayers to make corrections or changes to their previously filed tax return.

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This form is used for reporting income and paying taxes for nonresident aliens in the United States.