How to Fill Out an Invoice: Free Invoice Template

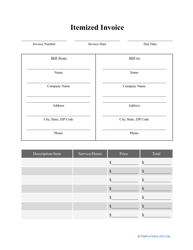

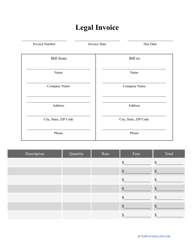

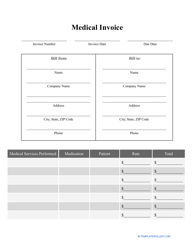

A basic invoice is a sales-related business document that records the purchase of goods or services between a company and their client. Similar to a bill of sale or a receipt, an invoice will usually specify the date of the transaction, the terms of the deal, the amount due, and the means and method of payment.

Ever since businesses have moved their recordkeeping online and have discontinued the use of paper documents, most invoices are generated and stored in specialized online or offline software.

What Should Be Included in an Invoice?

A well-made invoice can make the difference between coming across as a professional or a fraud. Being perceived well, in turn, will ensure you get paid quickly and on time. So what information should you include when writing an invoice? Any simple invoice (the one that disregards Value Added Tax, or “VAT”) must provide the following information:

- An invoice date and number.

- Your business name and legal address. You should use the official name and address of your business (think the address that any legal documentation should be delivered to).

- The name and address of your client. Make sure that both you and any parties involved can easily contact the client in case of a query or a dispute.

- The price of goods sold or services rendered.

- A description of the items sold.

- Payment information. You should strive to make paying you as easy as possible. Include the full details of your bank account and provide additional payment options (like PayPal or GoCardless).

It’s recommended to draft a basic invoice template if you plan to bill your clients on a regular basis. Make sure to consider coming up with your own branding. All documents associated with your business should be branded accordingly. Your invoice should be unique and recognizable - think logos, colors, and fonts.

What Is an Invoice Number?

An “Invoice Number” is a unique identifier that you assign to your invoice for the purpose of record-keeping and tracking orders. There are different strategies that you can implement when generating invoice numbers.

- Sequential Order. This is the most simple method of numbering your invoices. Most invoicing software will also utilize this method. It’s easy, consistent, and will make sure that you’re never left with duplicate invoices by accident.

- Customer-Based. Assign a unique identifier to each and every client and use this information when generating an invoice number.

- Project-Based. You can make your invoice numbers project-based - especially if you bill your clients by completed projects.

What Is an Invoice ID?

“Invoice Number” and “Invoice ID” may be used interchangeably when creating an invoice. Both refer to a record number you use to keep track of the invoices you issue. As previously mentioned, there’s no set standard when it comes to coming up with a strategy for numbering invoices, however, it is highly recommended to be as clear and consistent as possible.

Here’s some tips to utilize when coming up with a basic strategy for numbering invoices:

- Include an identifier relating to your business. Use the abbreviated name of your company, the first several letters of its name, or some other unique letter-based code when creating invoice numbers.

- Assign numeric codes when referring to your customers. This will make it easier to analyze and log recurring customers and keep track of their orders.

- Include the invoice - either partially or in full - to further diversify your invoice number. This will allow you to group invoices by year, month, or day, especially when using a computer-based invoicing software.

What Is an Invoice Date?

“Invoice Date” refers to the date when your invoice was originally issued. The terms of payment specified on the document should be interpreted in relation to this date. Make sure to specify this information on the very top of your invoice - ideally, right next to the invoice number.

On the other hand, an “Invoice Due Date” is the date by which the payment is expected to be fully fulfilled. This date can usually be found in the payment terms along with the amount due and payment information.

What Is an Invoice Address?

“Invoice address” refers to the official address of the buyer (i.e., their “legal address” or “mailing address”). This address can differ from the buyer’s shipping address where the goods will be delivered.

If the addresses are different, both should be specified and clearly labeled on the invoice in order to avoid any confusion.

How to Show Credit on an Invoice?

There are many situations that can lead to you needing to show credit on your invoices. Here’s just a few examples:

- Refunds. Whenever your customer asks for a refund - either partial or full - they are entitled to receive their money back. This can be reflected on a credit note with the amount later being subtracted out of a future invoice.

- Errors. The amount the customer was originally charged could have been calculated incorrectly. Again, a credit note can be provided in order to rectify the problem.

- Prepayment. Long-time customers may already have some money on account with your business. This amount can be reflected on a credit invoice with a further credit memo specifying any outstanding balance due.

What Bank Details Are Needed on an Invoice?

The payment details you include on your invoice should feature all of the information your client may need to pay you. At the very least, this includes your bank name and account number, the official name of the account holder, your IBAN and SWIFT/BIC code (if billing internationally) and any information about applicable taxes.

You can learn more about the required bank details in our article about all of the information necessary on an invoice, both for domestic and foreign clients.

How to Fill Out a Commercial Invoice?

Generally, any official invoice you issue to your clients is commercial. However, if you’re planning to use your invoice for billing international clients and shipping goods across borders, you will need to make sure to include some vital pieces of information:

- Reason for export. Your invoice must clearly determine the reason you are sending the items in the shipment.

- A thorough description of goods. This must include the contents, materials, colors, and brands without product codes or other seller-specific or private information.

- Overall quantity, weight, and units of measurement. This includes volume for liquids, weight for small goods, and pieces for individual items.

- A Harmonized System (HS) code. This universal code is assigned to specific categories of goods in order to help local authorities determine the type of item you’re shipping.

- The true value of the shipment. Make sure to declare the up-to-date value of the goods along with the applicable currency.

- Country of manufacture. Your invoice has to specify the origin country of the goods you’re selling.

Related Topics: