Your Complete Guide on How to Rent out a House

How to Rent out Your Home?

More and more homeowners are wondering how to transition into landlords. The reasons may be different. Some have difficulties with paying out their mortgage. Others just do not live in the house anymore and want to put their personal property to business use instead of selling it. A handful of homeowners would just like to rent out their house for a party or an event for a bit of extra cash. Before putting a "For Rent" sign up or posting your ad online, check what steps to take before signing a personal property rental agreement form to attract premium tenants and ensure the safety of your property.

What Do I Need to Do to Rent out My House?

The first thing you have to do before you rent your home is to determine how much you can ask for renting it. When calculating, do not forget to include the costs of maintenance, property manager’s fee (if you are going to hire one), and mortgage fee if you have to pay any. Find out how much tenants usually pay for the house like yours. If the profit is worth it – proceed with the rental preparations.

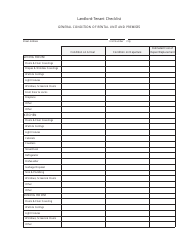

To avoid potential issues and numerous maintenance calls from your tenants in the first few weeks of renting out a house, inspect your home in advance and make all major repairs. Create a rental property inspection checklist. It will help you not to miss anything important and come in handy during regular inspections of your property. Order a professional inspection of your house after your tenants move out. This additional third-party documentation will substantiate your compensation claims in case of any damage caused to your property. Most tenants will need to have their own rental property inspection checklist. They use it when making a tour of the house. To make your home more appealing, ask the tenants about their checklist and consider fixing the issues they have found.

Decide how you will manage the property. The easiest way is to hire a professional manager to handle rental and IRS payments, arrange all documents and forms needed to rent a house, deal with arising problems, and screen the potential tenants. At the same time, property management companies may charge 4%-12% of the monthly rent for the services they perform.

If you plan to handle the management by yourself, get acquainted with the forthcoming paperwork. If you’ve been a homeowner for some time now, you must already be well acquainted with the tax deductions you may be eligible for. Being a landlord changes the situation quite a bit. Now you have to report your rental of personal property income and learn about rental property deductions. The job can be easily done with Schedule C-EZ (Form 1040). If you are not sure what documents you need to support your deductions, consult a professional accountant.

What Forms Do You Need to Rent a House?

There is a couple of essential documents and forms for renting personal property:

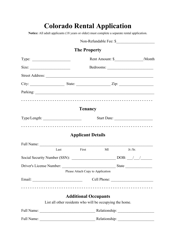

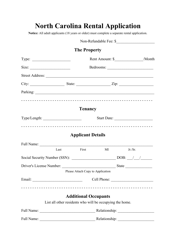

- A rental application. This form will allow you to get a written authorization from your potential tenant to conduct a background screening and to check the references;

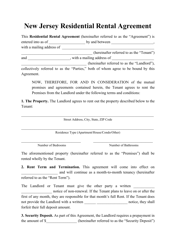

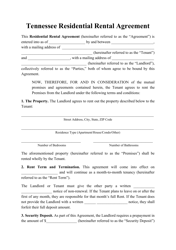

- A rental agreement for personal property or a lease agreement. Both are legally binding documents that may be used in a court. There is no formal jargon that must be used. Just include all the rental terms, parties of the agreement, personal details of all adults who will live in the household, amount of payments, dates, and signatures of both parties. The agreement containing all these details will be considered valid;

- Some states have several legally-required disclosures you must provide to your tenants. These most commonly include disclosures regarding the presence of health hazards, including lead-based paints and mold. Contact state authorities for a full list of the required documentation.

Note that local law in some states may require additional documentation. Consult a local lawyer or housing court to confirm the paperwork you need to do.

To make sure your property is in reliable hands, you have the right to ask your tenants about the following items:

- Copy of photo ID (e.g., driving license);

- Social Security number;

- A recommendation letter the previous landlords;

- A copy of the most recent W-2 Form;

- Three most recent pay stubs and bank statements;

- A verification letter from the company the potential tenant is employed at stating the job title, function, salary, and length of employment;

- The first page and signature page of the last federal tax return.

All this information is useful for checking your tenants’ background and ability to pay.