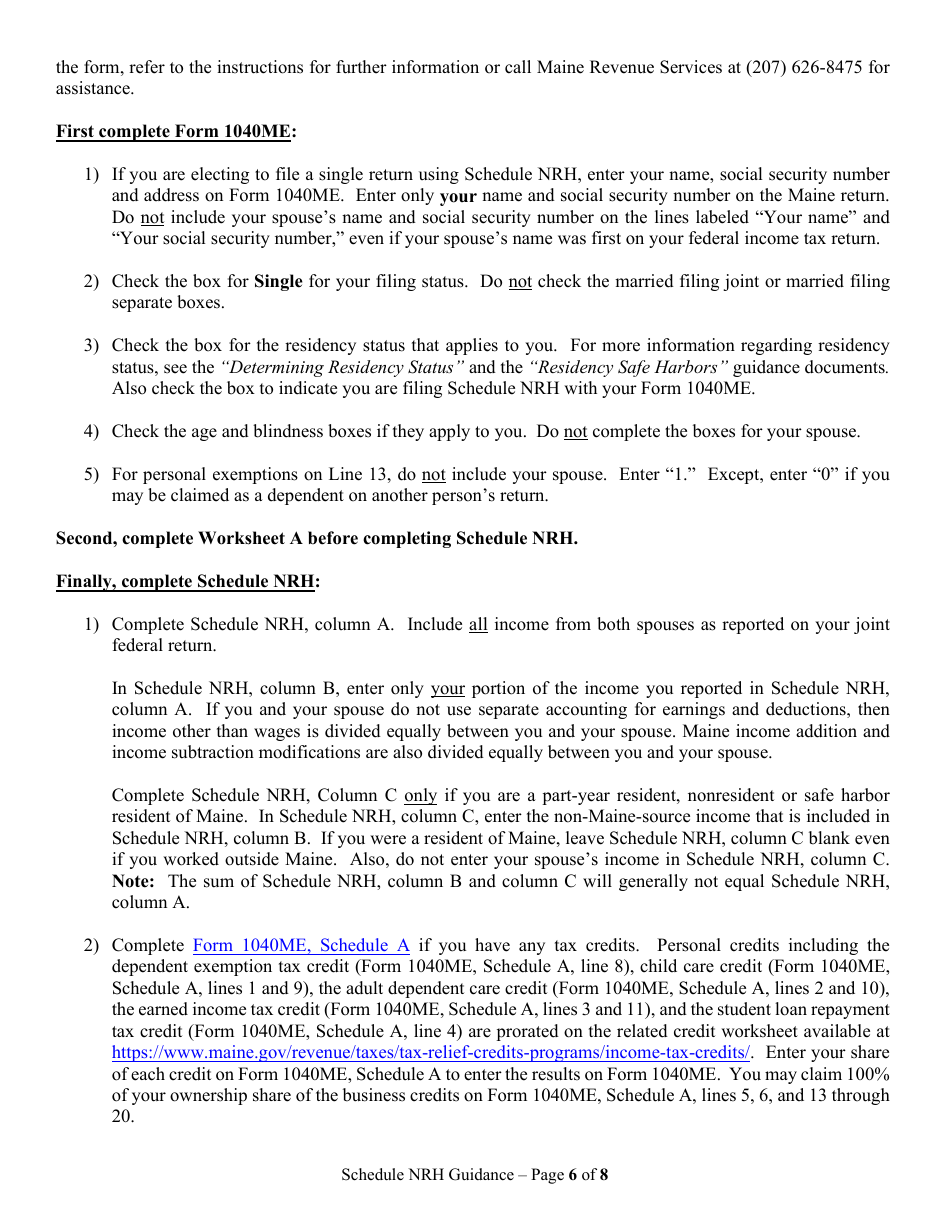

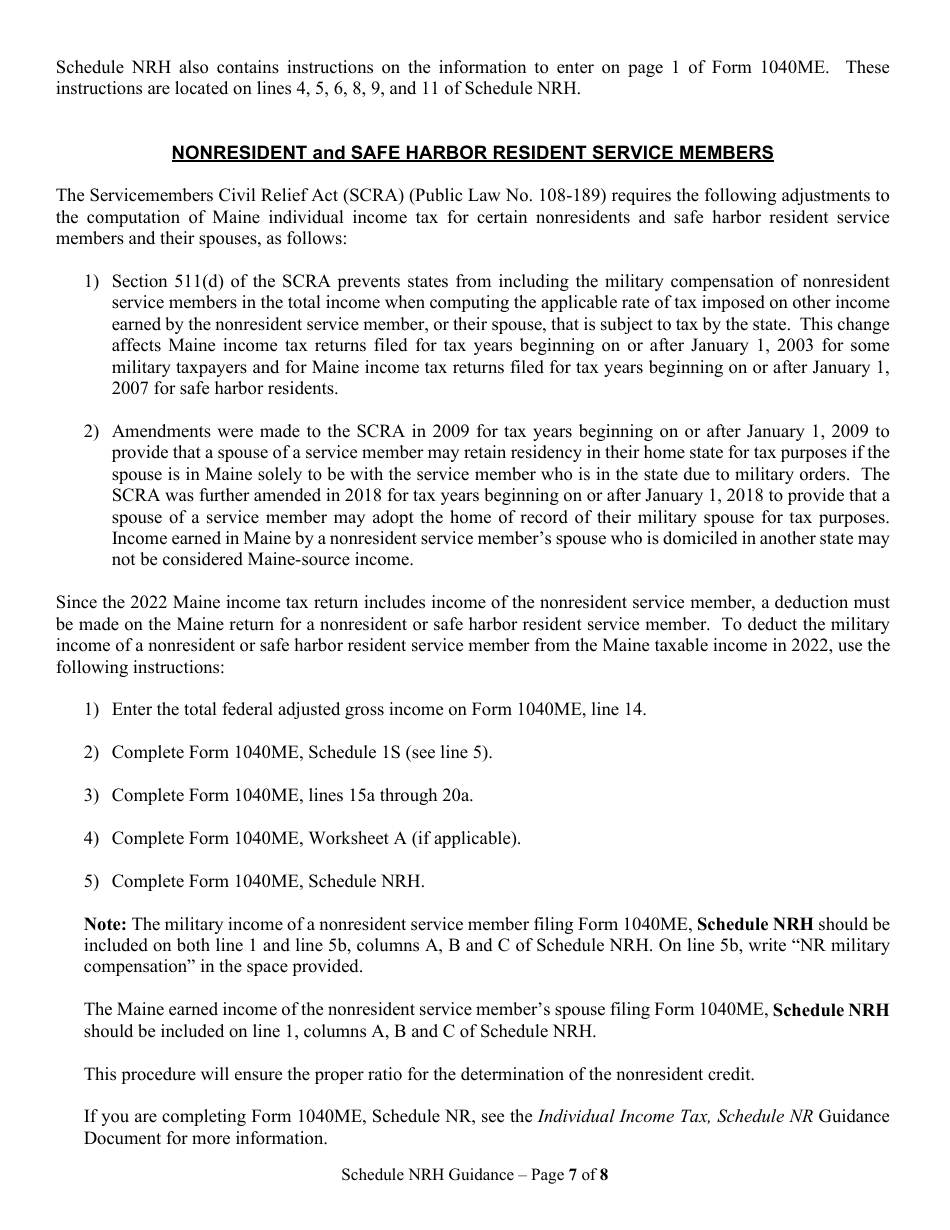

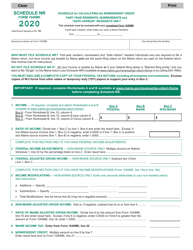

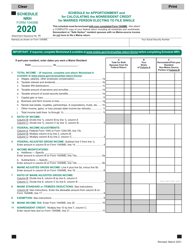

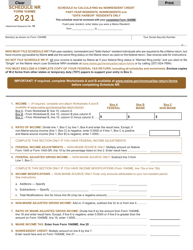

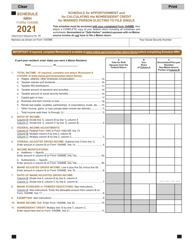

Instructions for Form 1040ME Schedule NRH Schedule for Apportionment and for Calculating the Nonresident Credit for Married Person Electing to File Single - Maine

This document contains official instructions for Form 1040ME Schedule NRH, Schedule for Apportionment and for Calculating the Nonresident Credit for Married Person Electing to File Single - a form released and collected by the Maine Revenue Services.

FAQ

Q: What is Form 1040ME Schedule NRH?

A: Form 1040ME Schedule NRH is a schedule used for apportionment and calculating the nonresident credit for a married person who elects to file as single in Maine.

Q: Who needs to use Form 1040ME Schedule NRH?

A: Married individuals who elect to file as single in Maine and need to apportion income and calculate the nonresident credit.

Q: What is the purpose of Form 1040ME Schedule NRH?

A: The purpose of this form is to determine the amount of income that can be attributed to a nonresident spouse in Maine and calculate the nonresident credit.

Q: What information is required on Form 1040ME Schedule NRH?

A: You need to provide information about your federal adjusted gross income, the total income subject to tax in Maine, and the nonresident credit.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Revenue Services.