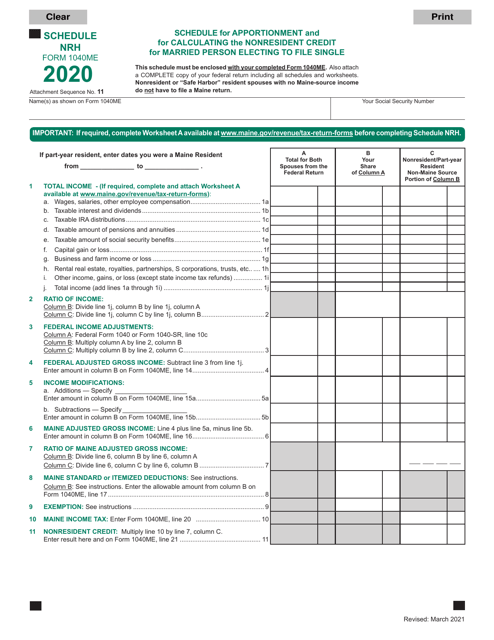

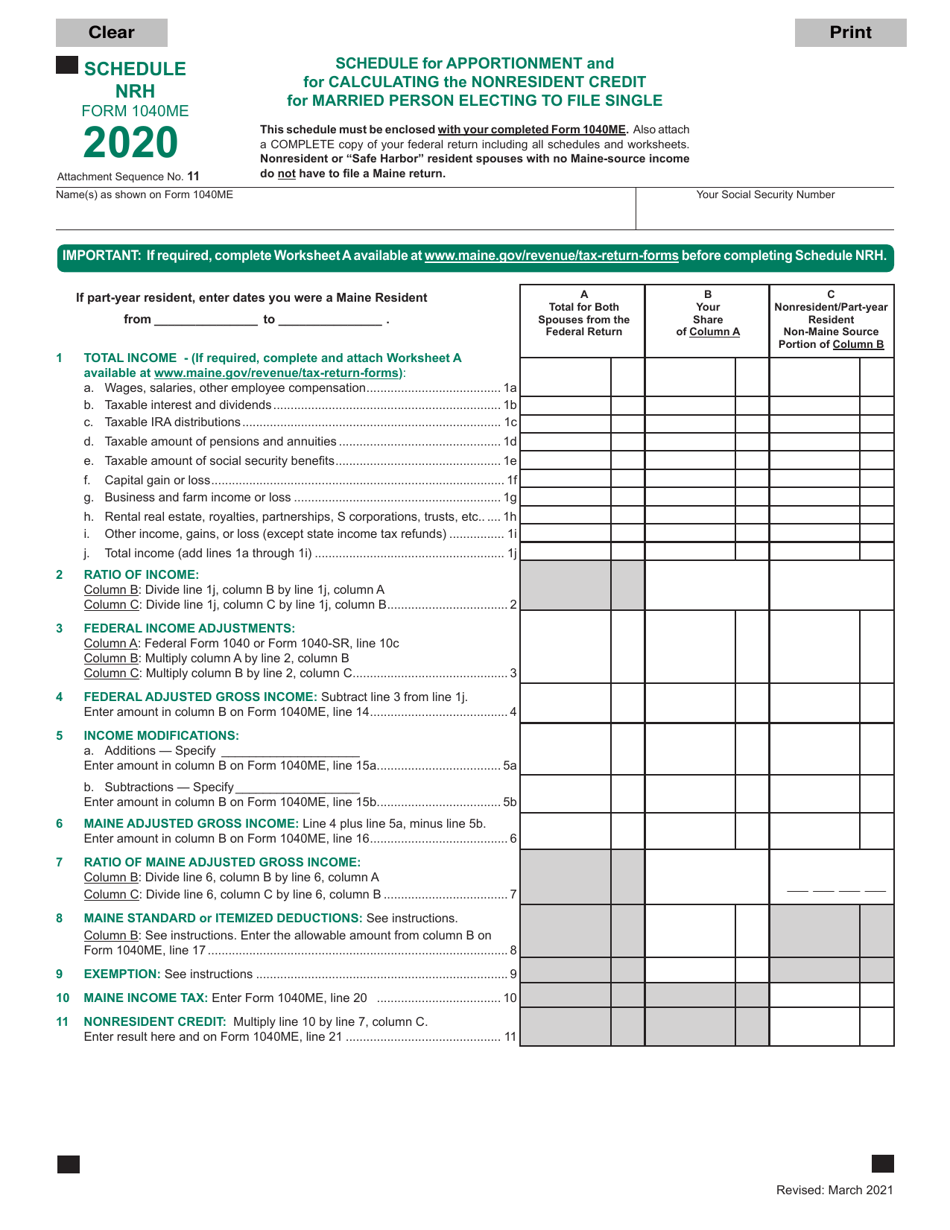

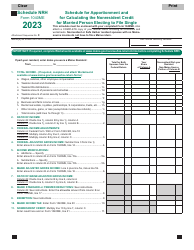

Form 1040ME Schedule NRH Schedule for Apportionment and for Calculating the Nonresident Credit for Married Person Electing to File Single - Maine

What Is Form 1040ME Schedule NRH?

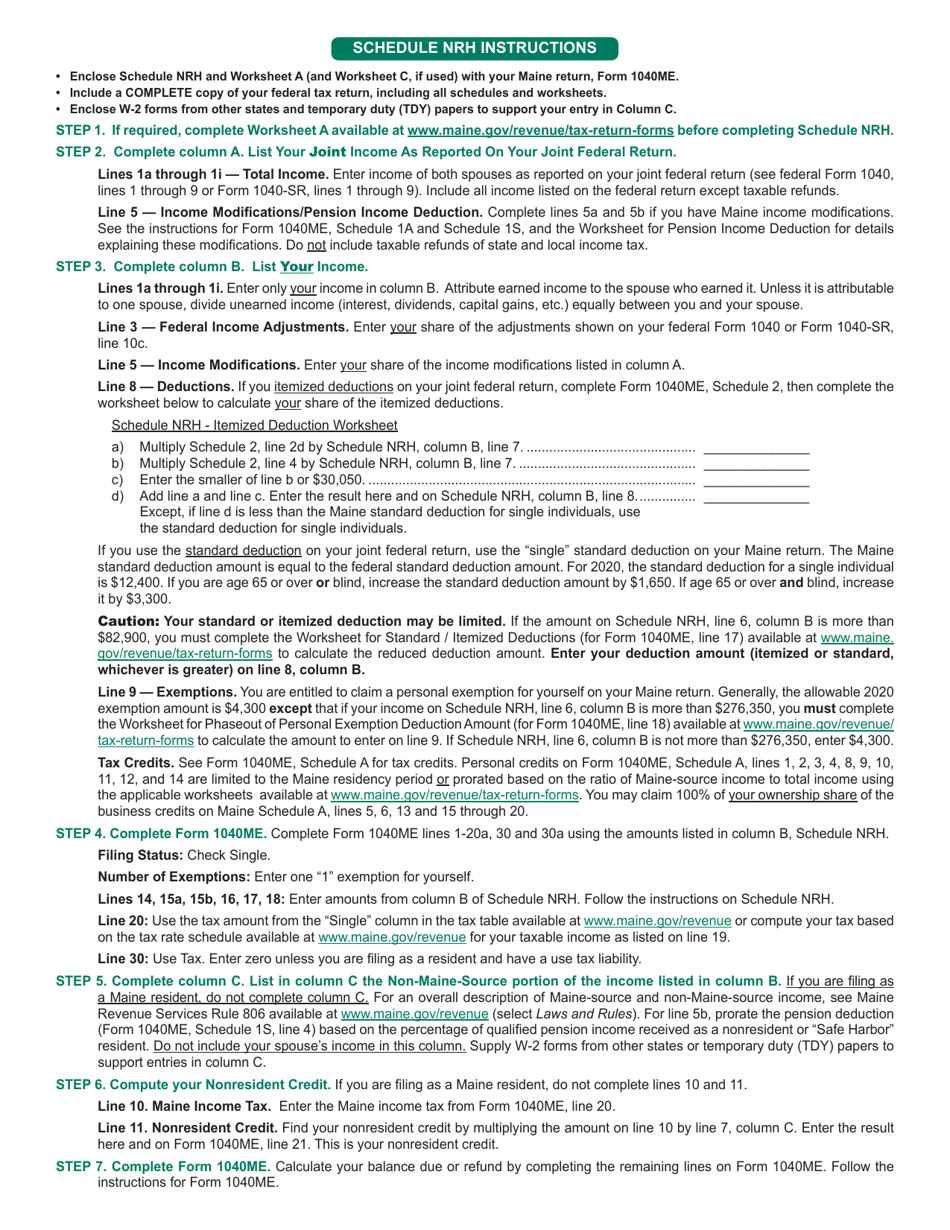

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule NRH?

A: Form 1040ME Schedule NRH is a schedule used in Maine to calculate the nonresident credit for a married person electing to file single.

Q: What is the purpose of Form 1040ME Schedule NRH?

A: The purpose of Form 1040ME Schedule NRH is to apportion income and calculate the nonresident credit for individuals in Maine.

Q: Who uses Form 1040ME Schedule NRH?

A: Residents of Maine who are married but elect to file as single use Form 1040ME Schedule NRH.

Q: What is the nonresident credit?

A: The nonresident credit is a credit that reduces the tax liability of a married person electing to file single in Maine.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule NRH by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.