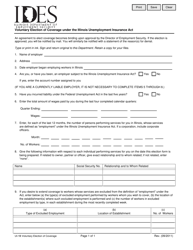

Form UI-51 Election to File Annually as a Household Employer - Illinois

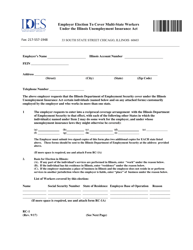

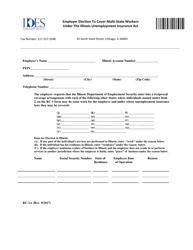

What Is Form UI-51?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UI-51?

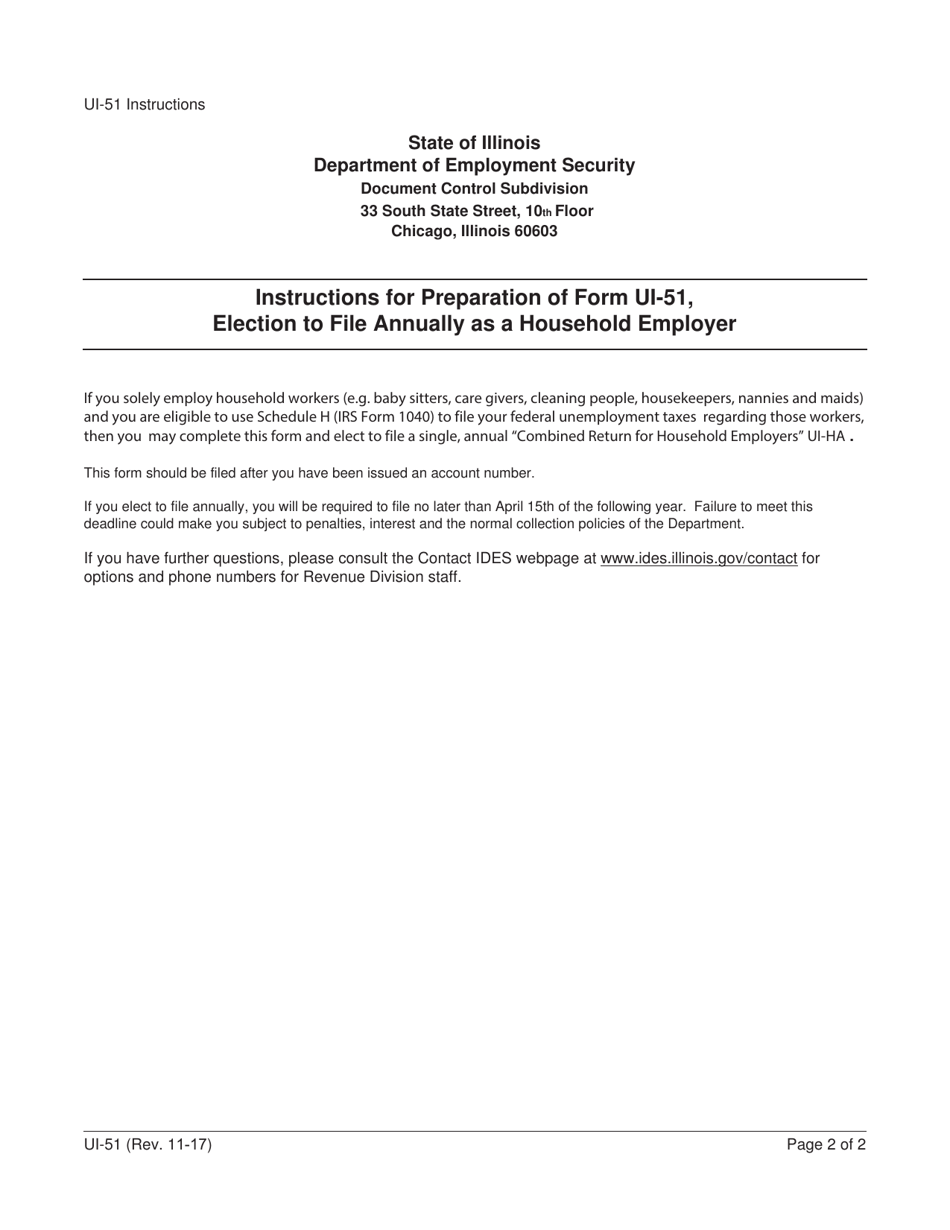

A: Form UI-51 is a document used in Illinois to elect to file annual household employer taxes.

Q: Who should use Form UI-51?

A: Form UI-51 should be used by household employers in Illinois who want to file their employment taxes annually.

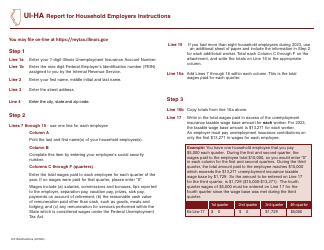

Q: What is a household employer?

A: A household employer is an individual or family who employs someone to work in their private home.

Q: What are household employer taxes?

A: Household employer taxes are taxes paid by individuals or families who employ someone to work in their private home.

Q: What is the purpose of filing annually as a household employer?

A: Filing annually as a household employer allows individuals or families to simplify their tax reporting obligations.

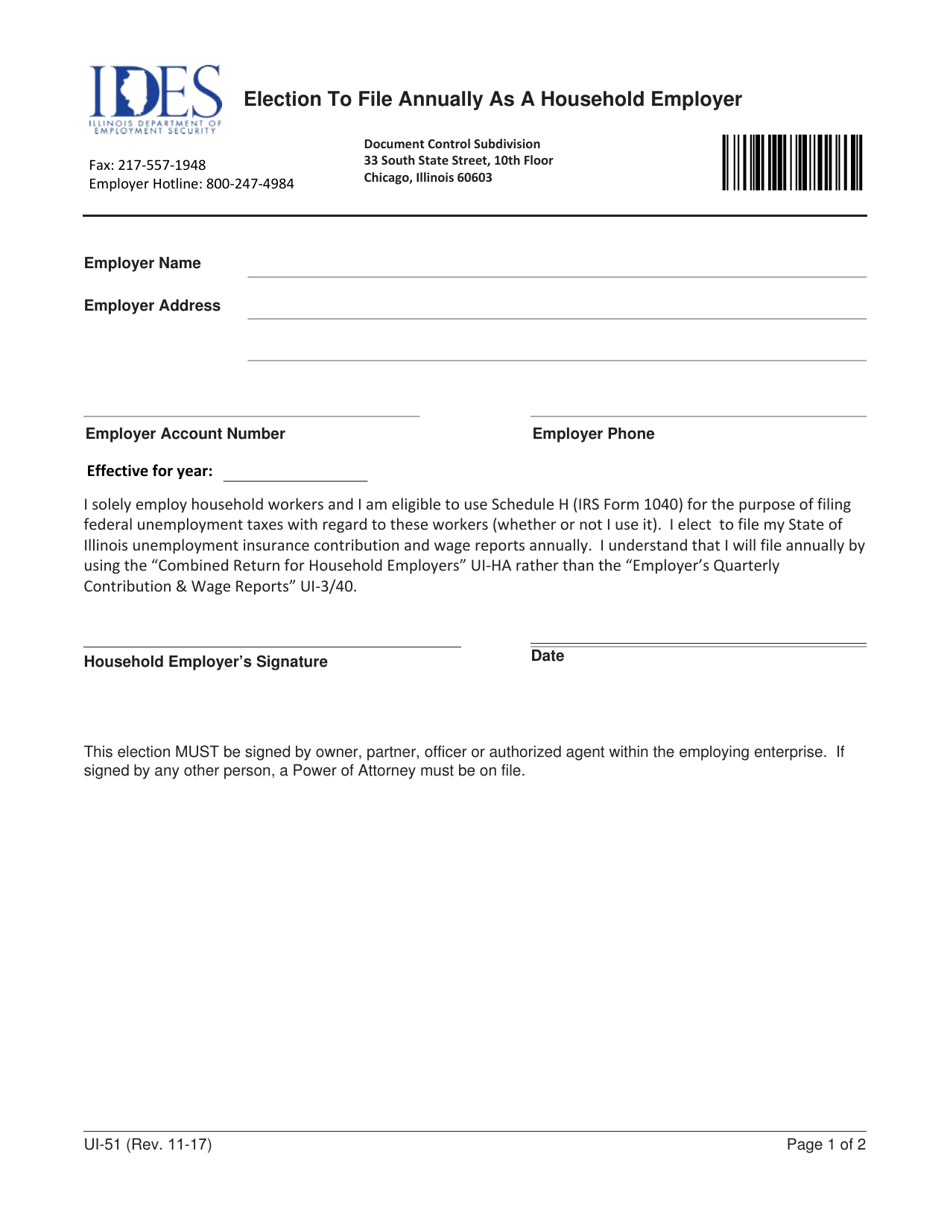

Q: Are there any deadlines for filing Form UI-51?

A: Yes, the deadline for filing Form UI-51 is typically January 31st of the year following the tax year being reported.

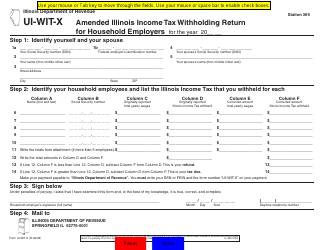

Q: What information is required on Form UI-51?

A: Form UI-51 requires the household employer's name, address, Social Security number or employer identification number, and information about the employees.

Q: Is there a fee for filing Form UI-51?

A: No, there is no fee for filing Form UI-51.

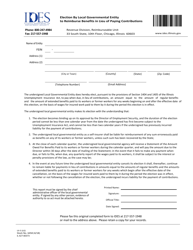

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-51 by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.