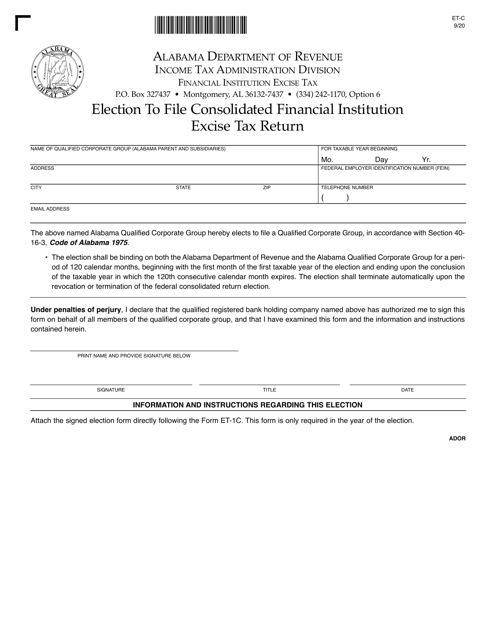

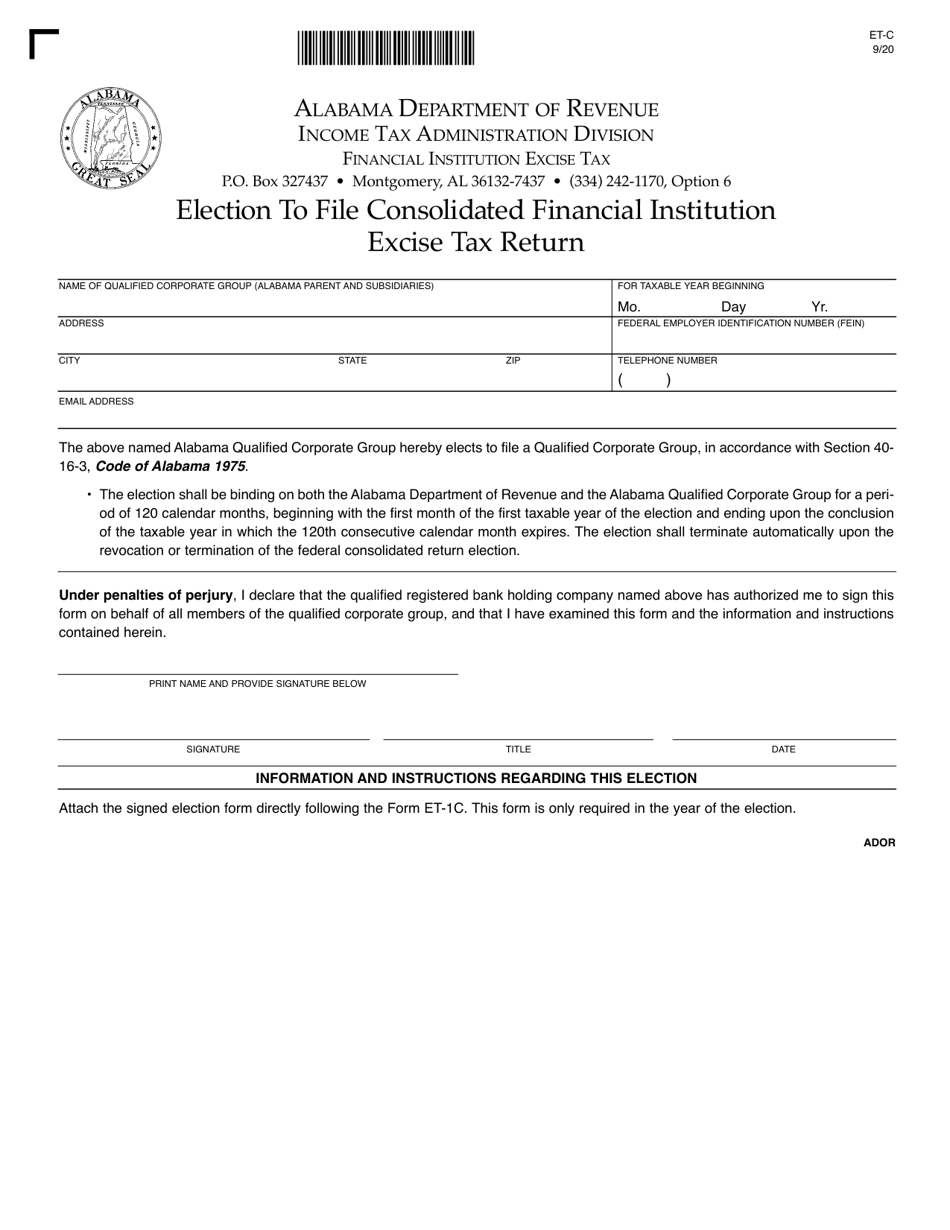

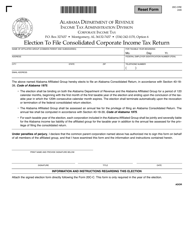

Form ET-C Election to File Consolidated Financial Institution Excise Tax Return - Alabama

What Is Form ET-C?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ET-C?

A: Form ET-C is a form used to elect to file a Consolidated Financial Institution Excise Tax Return.

Q: Who needs to file Form ET-C?

A: Financial institutions in Alabama who want to file a consolidated tax return need to file Form ET-C.

Q: What is the purpose of filing a consolidated tax return?

A: Filing a consolidated tax return allows multiple related financial institutions to file as a single entity, combining their income and deductions.

Q: When is Form ET-C due?

A: Form ET-C is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: What are the consequences of not filing Form ET-C?

A: Failure to file Form ET-C may result in penalties and interest on any unpaid taxes.

Q: Are there any fees associated with filing Form ET-C?

A: There are no fees associated with filing Form ET-C.

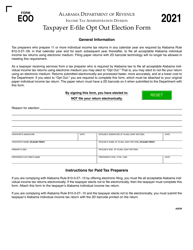

Q: Can I electronically file Form ET-C?

A: Yes, you can electronically file Form ET-C through the Alabama Department of Revenue's electronic filing system.

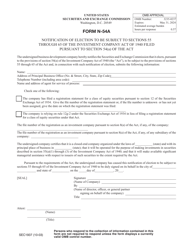

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET-C by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.