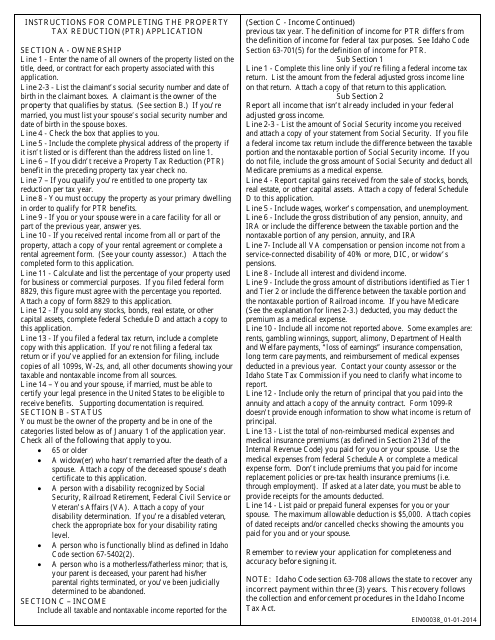

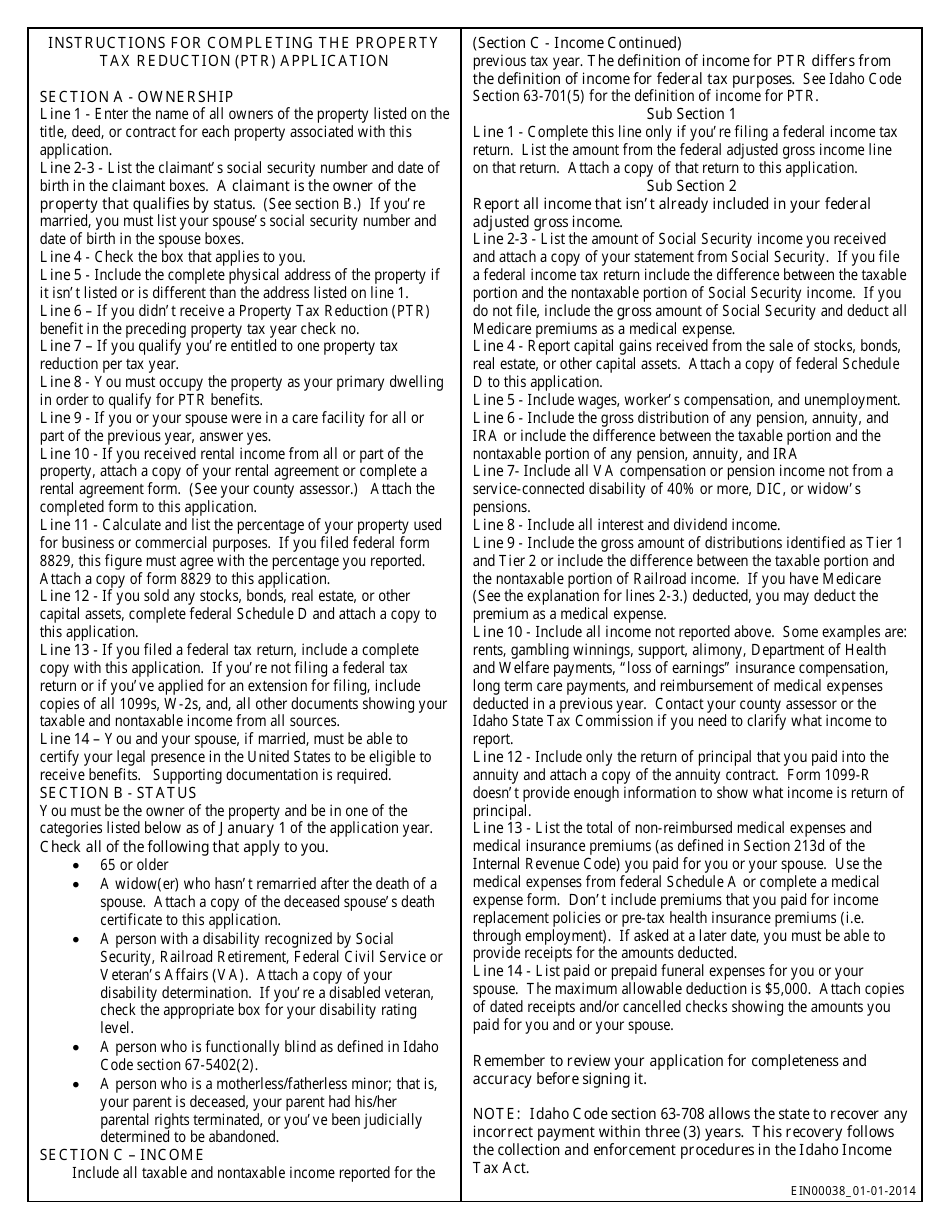

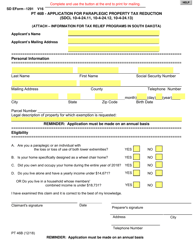

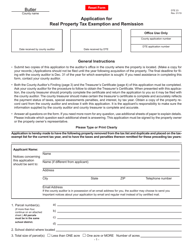

Instructions for Form EFO00002 Application for Property Tax Reduction - Idaho

This document contains official instructions for Form EFO00002 , Application for Property Tax Reduction - a form released and collected by the Idaho State Tax Commission.

FAQ

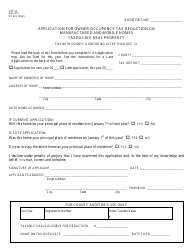

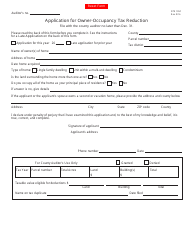

Q: What is Form EFO00002?

A: Form EFO00002 is an application for property tax reduction in Idaho.

Q: Who can use Form EFO00002?

A: Homeowners in Idaho who meet certain criteria can use Form EFO00002.

Q: What is the purpose of Form EFO00002?

A: The purpose of Form EFO00002 is to apply for a reduction in property taxes.

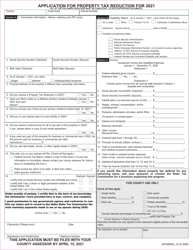

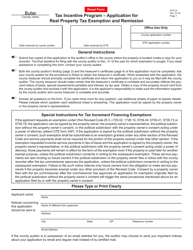

Q: What criteria do I need to meet to use Form EFO00002?

A: To use Form EFO00002, you must meet certain income and residency requirements set by the state of Idaho.

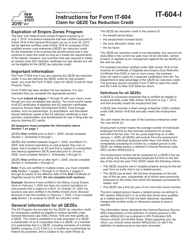

Q: What documents do I need to submit with Form EFO00002?

A: You may need to submit proof of income and residency along with Form EFO00002. Check the instructions on the form for specific requirements.

Q: When is the deadline to submit Form EFO00002?

A: The deadline to submit Form EFO00002 is usually April 15th, but it may vary. Check the instructions on the form for the current year's deadline.

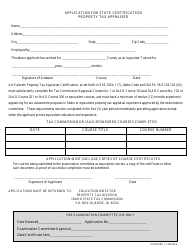

Q: Can I appeal if my application for property tax reduction is denied?

A: Yes, you can appeal the decision if your application for property tax reduction is denied. Follow the instructions on the denial notice for more information.

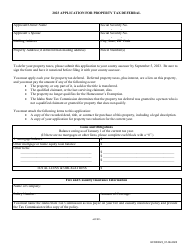

Q: Are there any fees associated with submitting Form EFO00002?

A: There are no fees associated with submitting Form EFO00002.

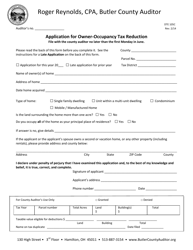

Q: Who can I contact for more information about Form EFO00002?

A: You can contact the Idaho State Tax Commission for more information about Form EFO00002.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.