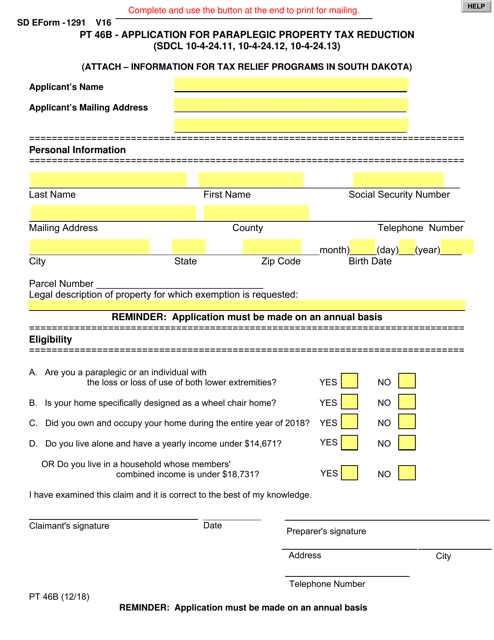

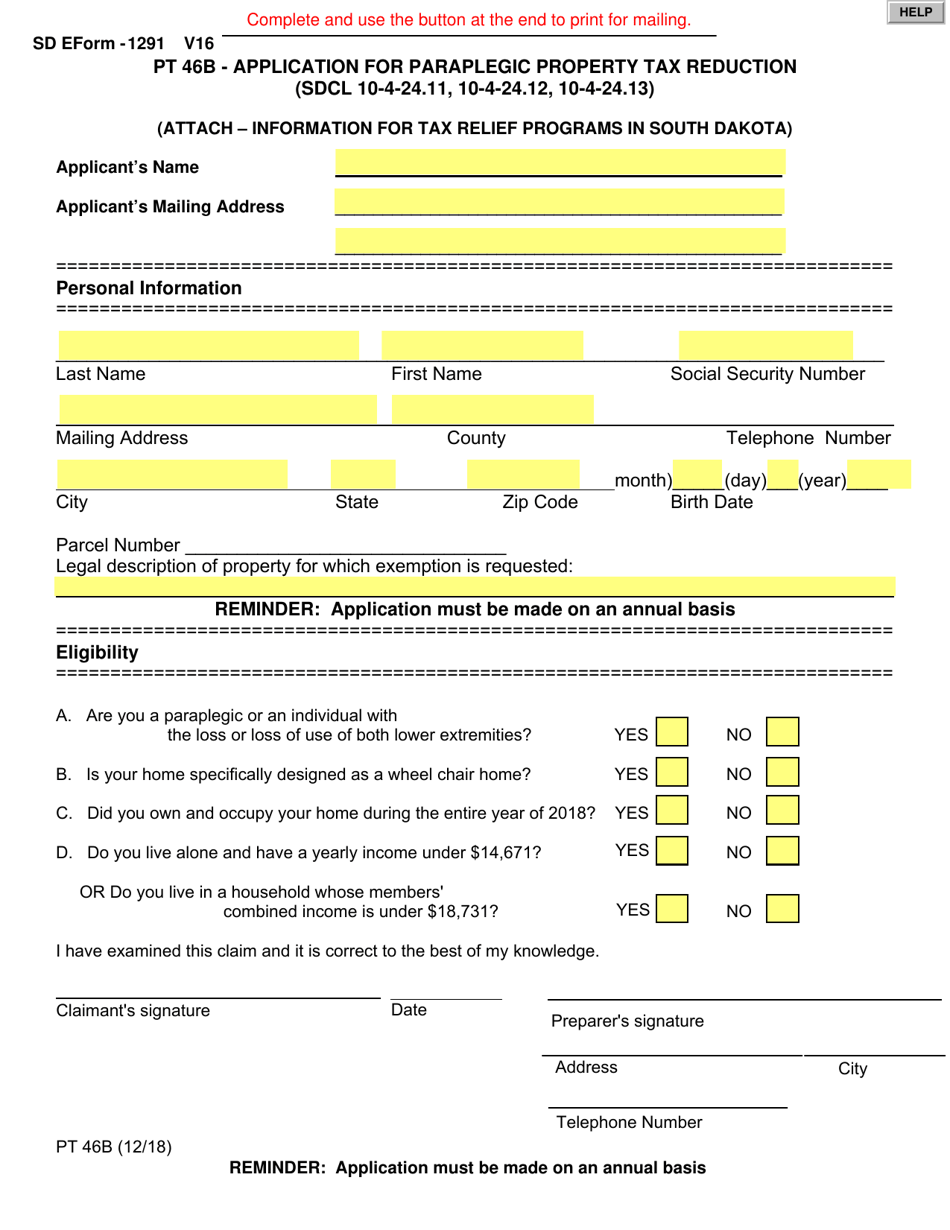

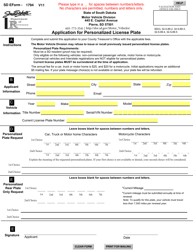

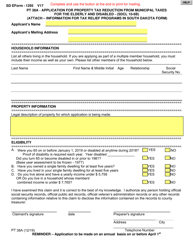

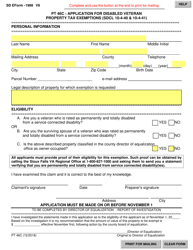

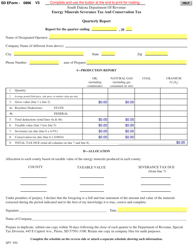

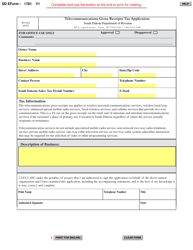

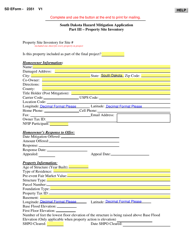

SD Form 1291 (PT46B) Application for Paraplegic Property Tax Reduction - South Dakota

What Is SD Form 1291 (PT46B)?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1291 (PT46B)?

A: SD Form 1291 (PT46B) is the application form for Paraplegic Property Tax Reduction in South Dakota.

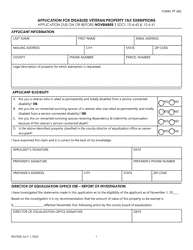

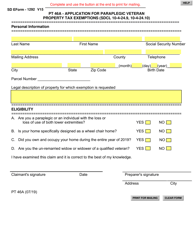

Q: Who is eligible for Paraplegic Property Tax Reduction in South Dakota?

A: Individuals who are paraplegic and meet certain criteria are eligible for Paraplegic Property Tax Reduction in South Dakota.

Q: What is the purpose of the Paraplegic Property Tax Reduction?

A: The purpose of the Paraplegic Property Tax Reduction is to provide a reduced property tax burden for individuals who are paraplegic.

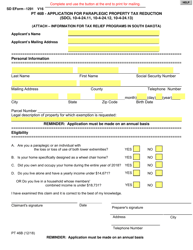

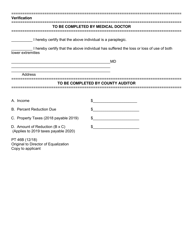

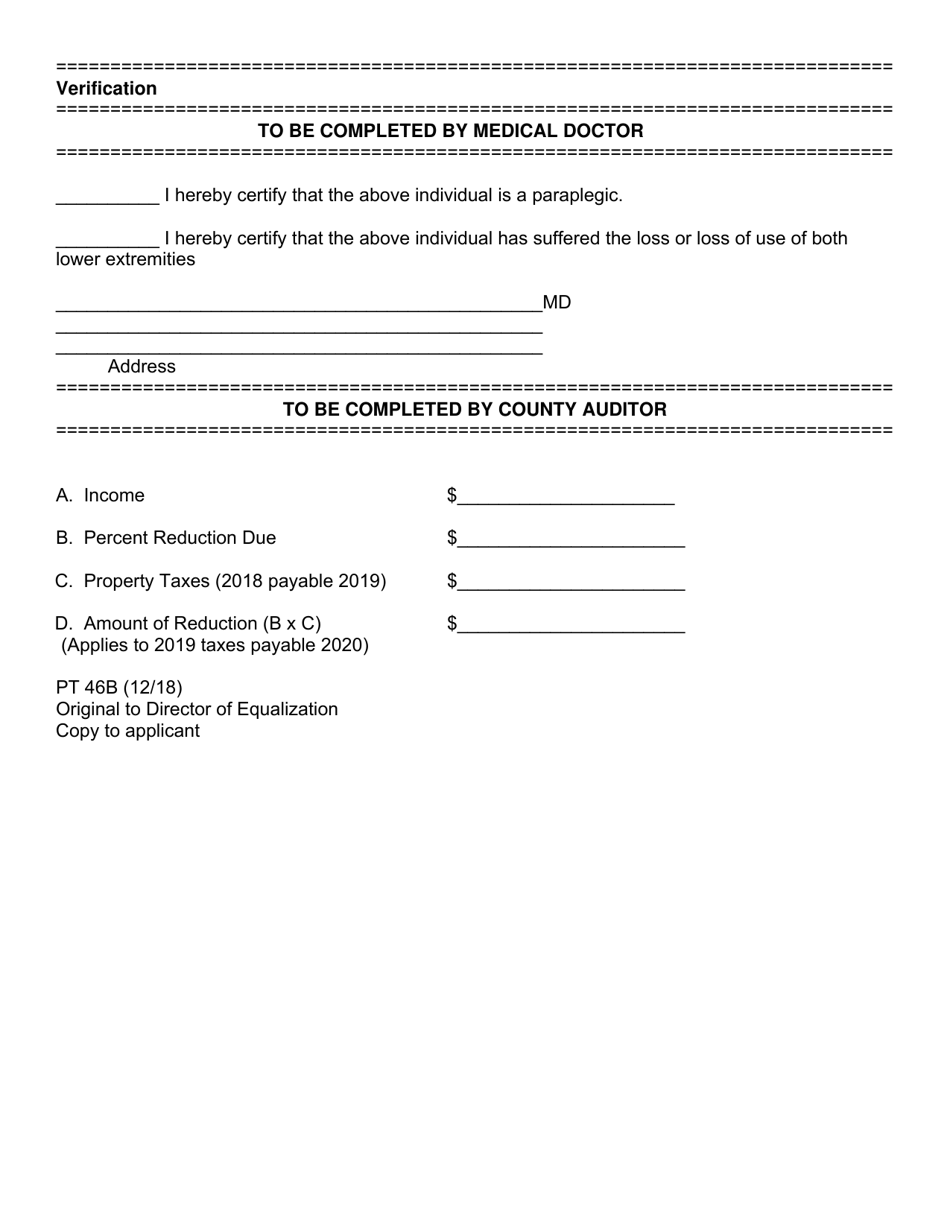

Q: What information is required on SD Form 1291 (PT46B)?

A: SD Form 1291 (PT46B) requires information such as the applicant's name, address, paraplegic status, and supporting documentation.

Q: Is there a deadline to submit SD Form 1291 (PT46B)?

A: Yes, the deadline to submit SD Form 1291 (PT46B) is typically March 15th of the assessment year.

Q: Are there any fees associated with the Paraplegic Property Tax Reduction?

A: No, there are no fees associated with the Paraplegic Property Tax Reduction in South Dakota.

Q: What happens after I submit SD Form 1291 (PT46B)?

A: After you submit SD Form 1291 (PT46B), the South Dakota Department of Revenue will review your application and notify you of their decision.

Q: Can I appeal if my application for Paraplegic Property Tax Reduction is denied?

A: Yes, if your application is denied, you have the right to appeal the decision.

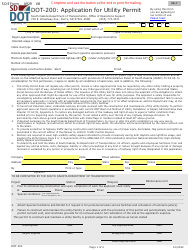

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1291 (PT46B) by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.