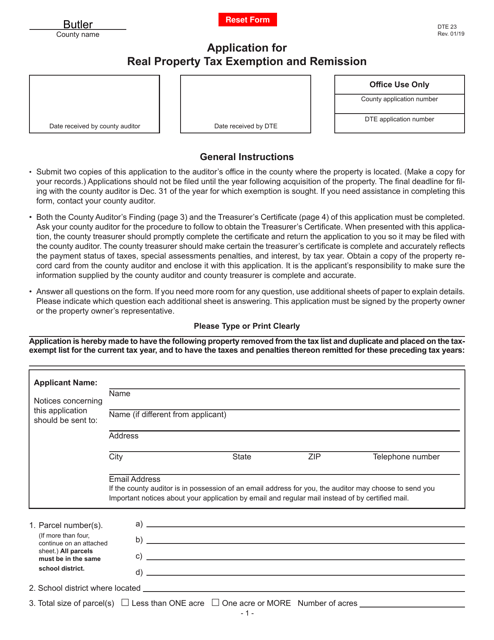

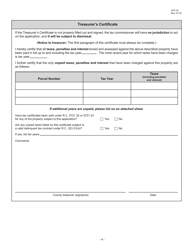

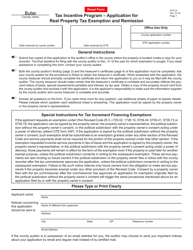

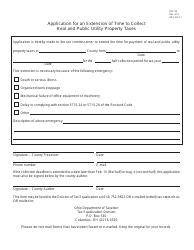

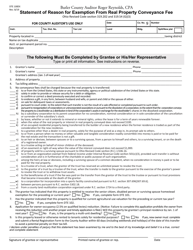

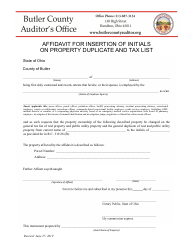

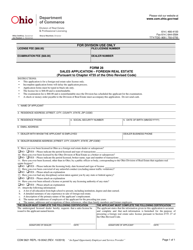

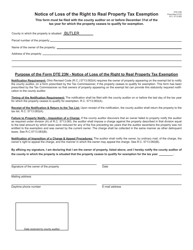

Form DTE23 Application for Real Property Tax Exemption and Remission - Butler County, Ohio

What Is Form DTE23?

This is a legal form that was released by the County Auditor's Office - Butler County, Ohio - a government authority operating within Ohio. The form may be used strictly within Butler County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

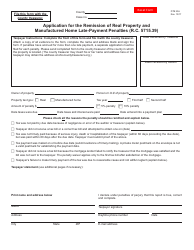

Q: What is Form DTE23?

A: Form DTE23 is the Application for Real Property Tax Exemption and Remission.

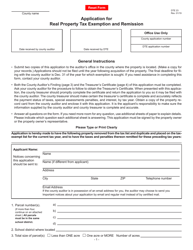

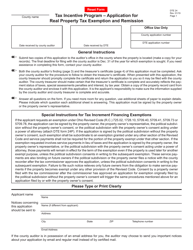

Q: What is the purpose of Form DTE23?

A: The purpose of Form DTE23 is to apply for real property tax exemption and remission.

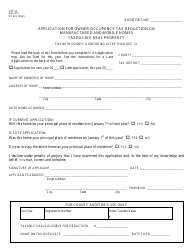

Q: Who can use this form?

A: This form can be used by individuals and organizations seeking real property tax exemption and remission in Butler County, Ohio.

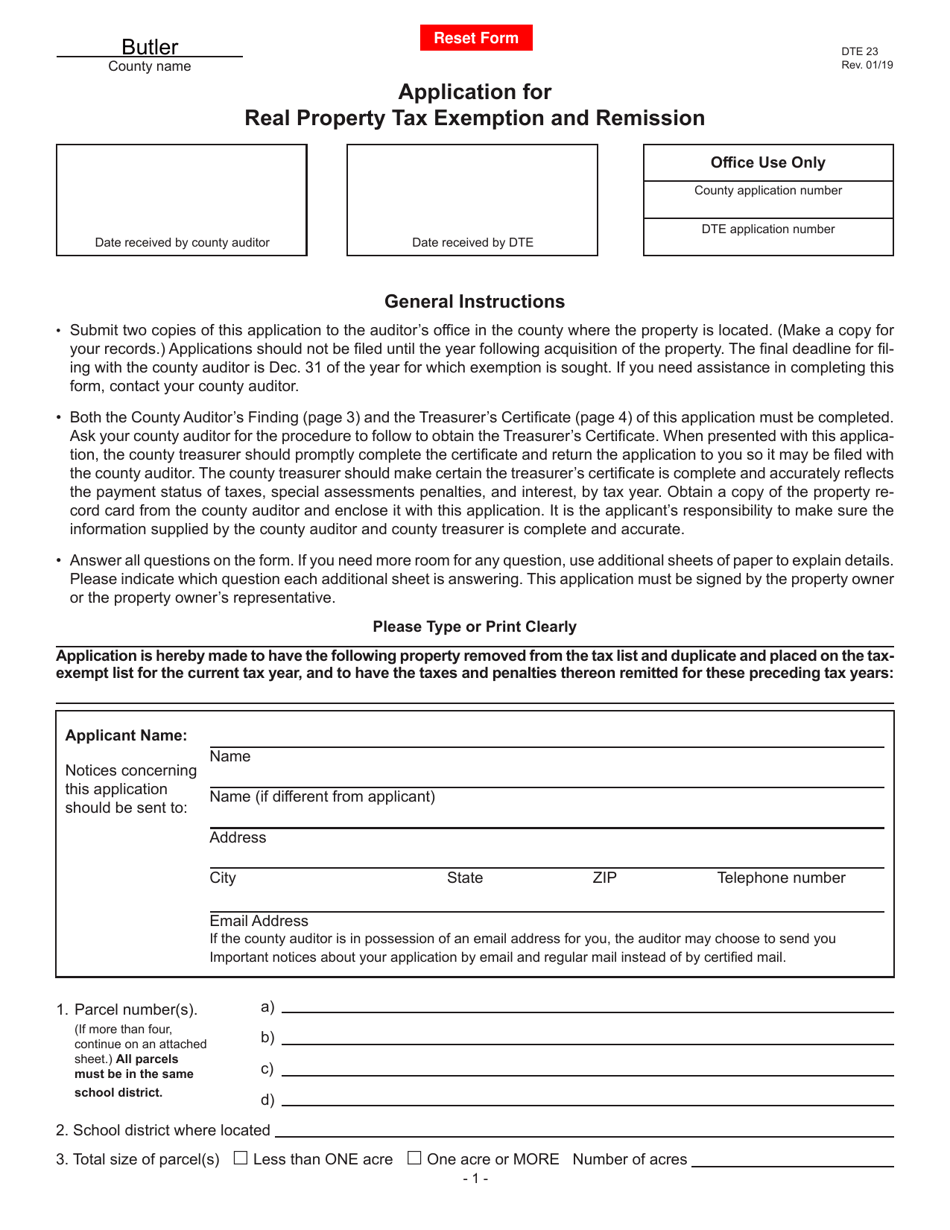

Q: What types of exemptions can be applied for with this form?

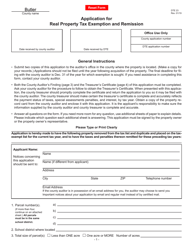

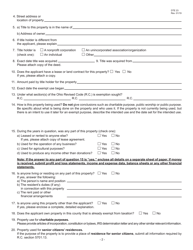

A: This form allows individuals and organizations to apply for exemptions such as homestead exemption, senior citizen exemption, disabled veteran exemption, and more.

Q: What documents do I need to submit with this form?

A: The specific documents required may vary depending on the type of exemption being applied for. Generally, you may need to submit proof of eligibility, such as a deed, identification, income information, and other relevant documentation.

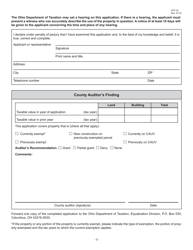

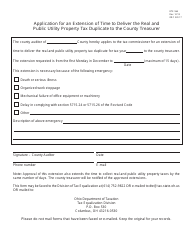

Q: What happens after I submit Form DTE23?

A: After submitting Form DTE23, the Butler County Auditor's office will review your application and determine your eligibility for the requested exemption. You will be notified of their decision.

Q: Can I appeal the decision if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision. The appeals process and requirements may vary, so it is recommended to consult with the Butler County Auditor's office for more information.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the County Auditor's Office - Butler County, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE23 by clicking the link below or browse more documents and templates provided by the County Auditor's Office - Butler County, Ohio.