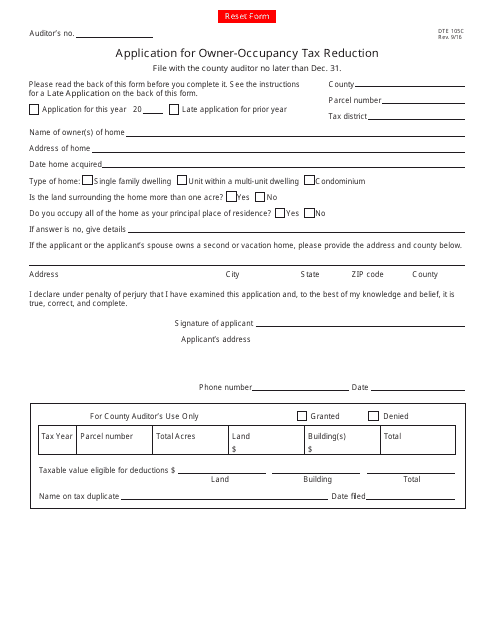

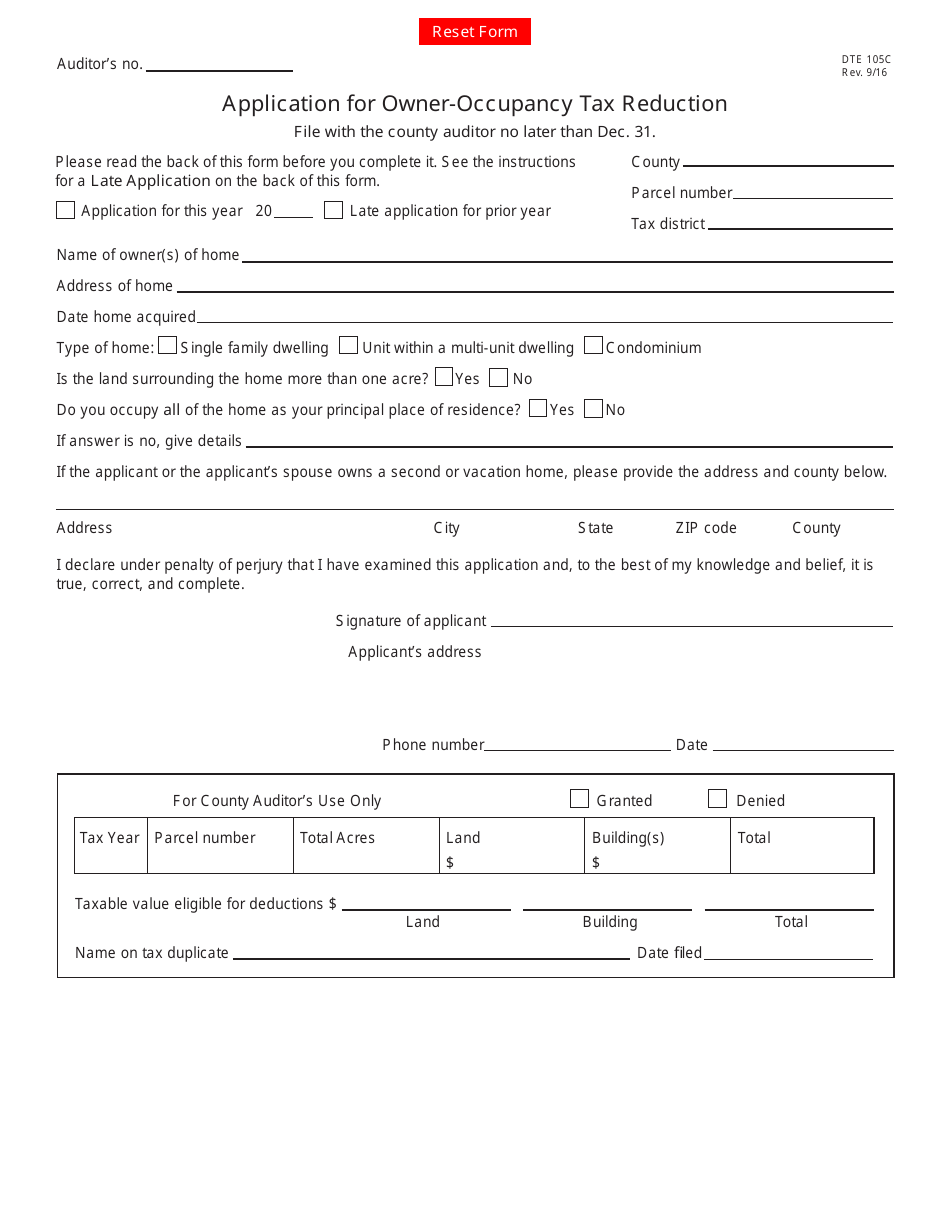

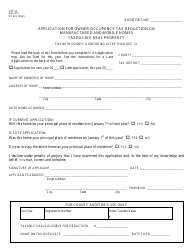

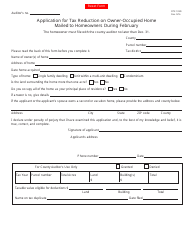

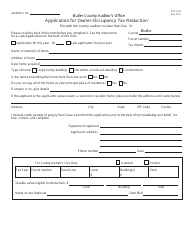

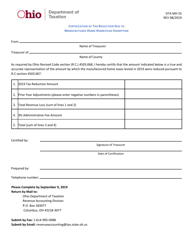

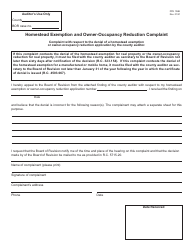

Form DTE105C Application for Owner-Occupancy Tax Reduction - Ohio

What Is Form DTE105C?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE105C?

A: Form DTE105C is the Application for Owner-Occupancy Tax Reduction in Ohio.

Q: What is the purpose of Form DTE105C?

A: The purpose of Form DTE105C is to apply for a tax reduction for owner-occupied properties in Ohio.

Q: Who is eligible for the owner-occupancy tax reduction in Ohio?

A: Property owners who occupy their property as their primary residence may be eligible for the owner-occupancy tax reduction in Ohio.

Q: What information is required on Form DTE105C?

A: Form DTE105C requires information such as the property owner's name, address, and Social Security number, as well as details about the property.

Q: When should I file Form DTE105C?

A: Form DTE105C should be filed with your local county auditor's office between January 1 and the first Monday in June of the year for which you are applying for the tax reduction.

Q: Is there a fee for filing Form DTE105C?

A: No, there is no fee for filing Form DTE105C.

Q: What is the deadline for filing Form DTE105C?

A: The deadline for filing Form DTE105C is the first Monday in June of the year for which you are applying for the tax reduction.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105C by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.