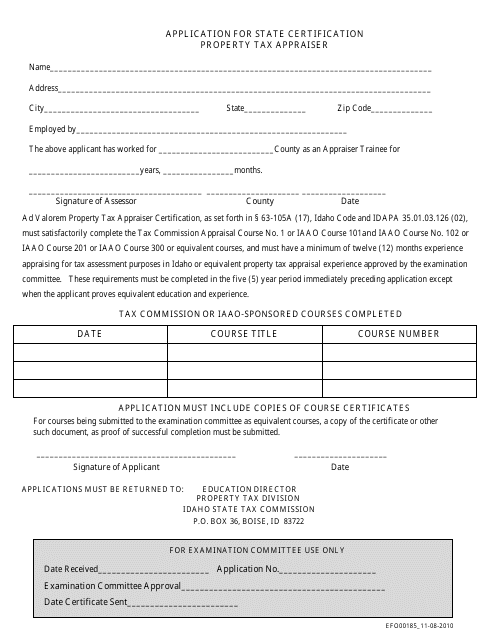

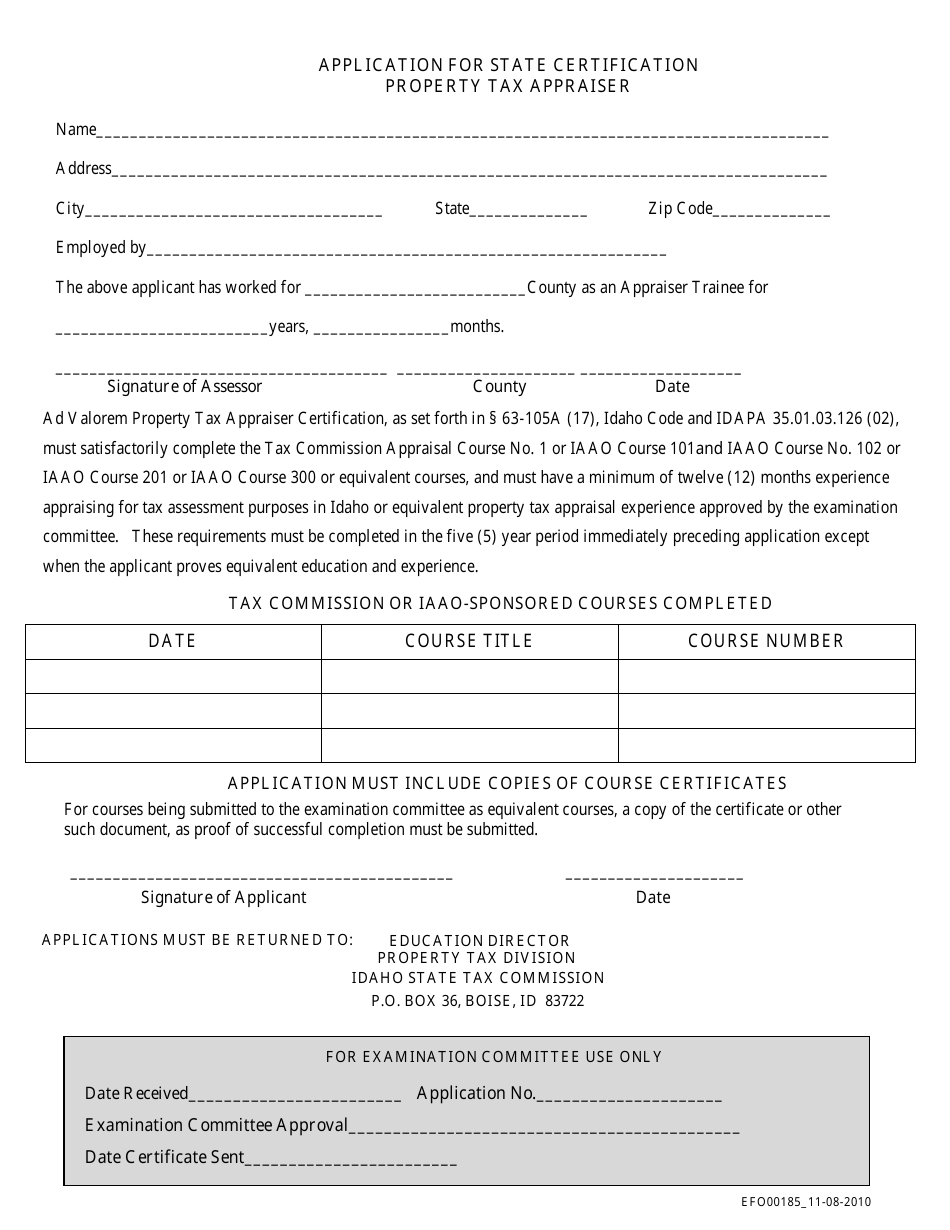

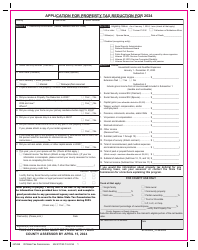

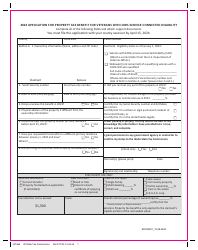

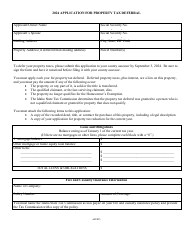

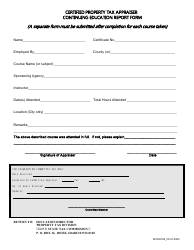

Form EFO00185 Application for State Certification Property Tax Appraiser - Idaho

What Is Form EFO00185?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00185?

A: Form EFO00185 is the application for state certification as a property tax appraiser in Idaho.

Q: Who can use Form EFO00185?

A: Anyone seeking state certification as a property tax appraiser in Idaho can use Form EFO00185.

Q: What is the purpose of Form EFO00185?

A: The purpose of Form EFO00185 is to apply for state certification as a property tax appraiser in Idaho.

Q: Is there a fee associated with Form EFO00185?

A: Yes, there is a fee associated with Form EFO00185. Please refer to the instructions on the form for the current fee amount.

Q: Are there any prerequisites to filing Form EFO00185?

A: Yes, there are prerequisites to filing Form EFO00185. Please refer to the instructions on the form for the specific requirements.

Q: How long does it take to process Form EFO00185?

A: The processing time for Form EFO00185 may vary. Please contact the Idaho State Tax Commission for more information.

Q: Can I apply for state certification as a property tax appraiser without using Form EFO00185?

A: No, you must use Form EFO00185 to apply for state certification as a property tax appraiser in Idaho.

Q: What supporting documents are required with Form EFO00185?

A: Please refer to the instructions on Form EFO00185 for the list of supporting documents required.

Q: Can I submit Form EFO00185 electronically?

A: No, Form EFO00185 must be submitted by mail or in person to the Idaho State Tax Commission.

Form Details:

- Released on November 8, 2010;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFO00185 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.