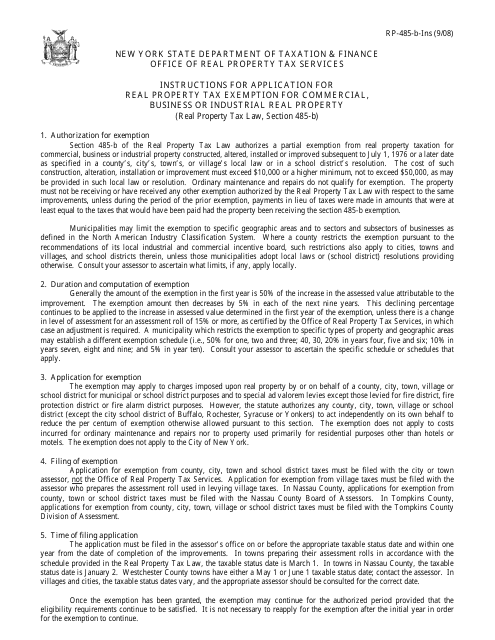

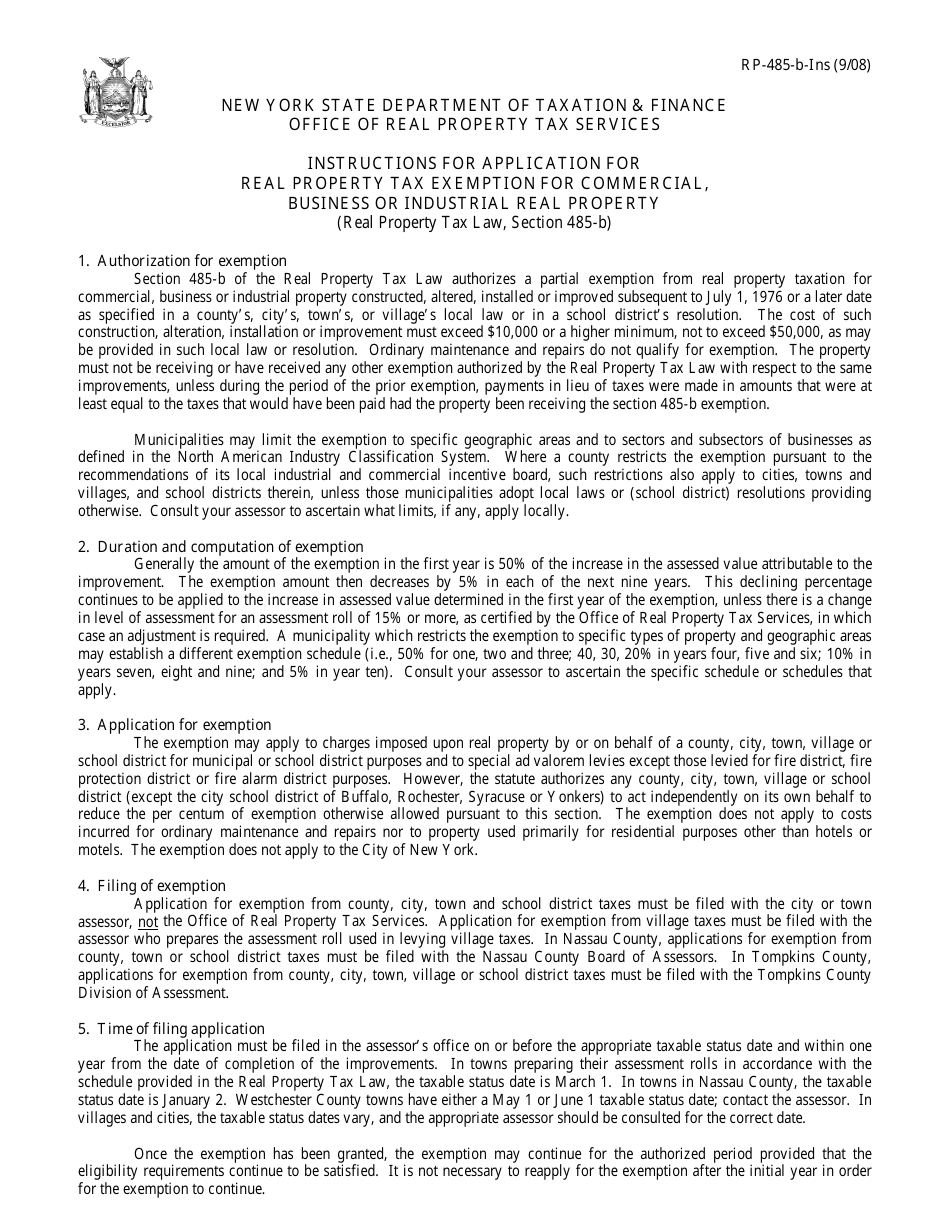

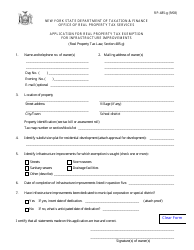

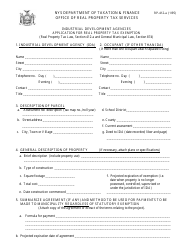

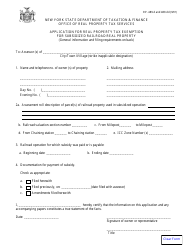

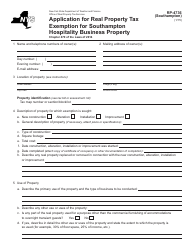

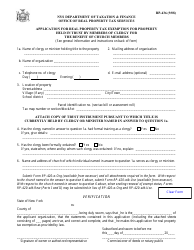

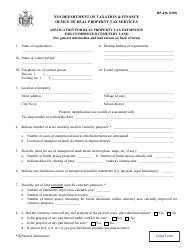

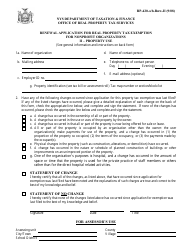

Instructions for Form RP-485-B Application for Real Property Tax Exemption for Commercial, Business or Industrial Real Property - New York

This document contains official instructions for Form RP-485-B , Application for Real Property Tax Exemption for Commercial, Business or Industrial Real Property - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-485-b is available for download through this link.

FAQ

Q: What is Form RP-485-B?

A: Form RP-485-B is an application for real property tax exemption for commercial, business, or industrial real property in New York.

Q: Who needs to fill out Form RP-485-B?

A: Owners of commercial, business, or industrial real property in New York who are seeking a tax exemption need to fill out Form RP-485-B.

Q: What is the purpose of Form RP-485-B?

A: The purpose of Form RP-485-B is to apply for a real property tax exemption for commercial, business, or industrial real property in New York.

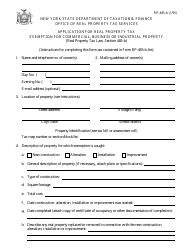

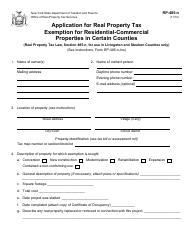

Q: What information is required on Form RP-485-B?

A: Some of the information required on Form RP-485-B includes property details, ownership information, and documentation supporting the exemption request.

Q: Are there any filing fees for Form RP-485-B?

A: No, there are no filing fees for submitting Form RP-485-B.

Q: Is there a deadline for submitting Form RP-485-B?

A: Yes, Form RP-485-B must be filed on or before the taxable status date of the jurisdiction where the property is located.

Q: What happens after I submit Form RP-485-B?

A: After submitting Form RP-485-B, the assessors' office will review the application and make a determination regarding the tax exemption.

Q: How long is the tax exemption valid if approved?

A: If approved, the tax exemption is typically valid for a certain number of years, as specified by the applicable laws and regulations.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.