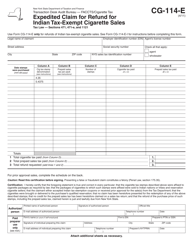

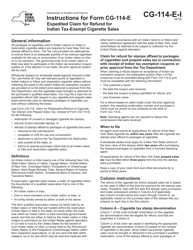

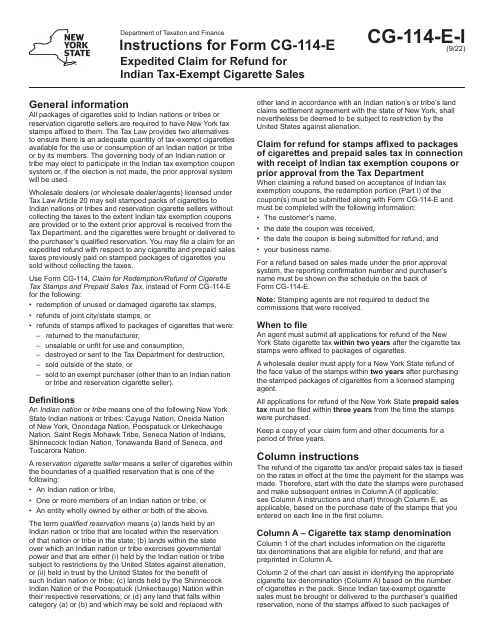

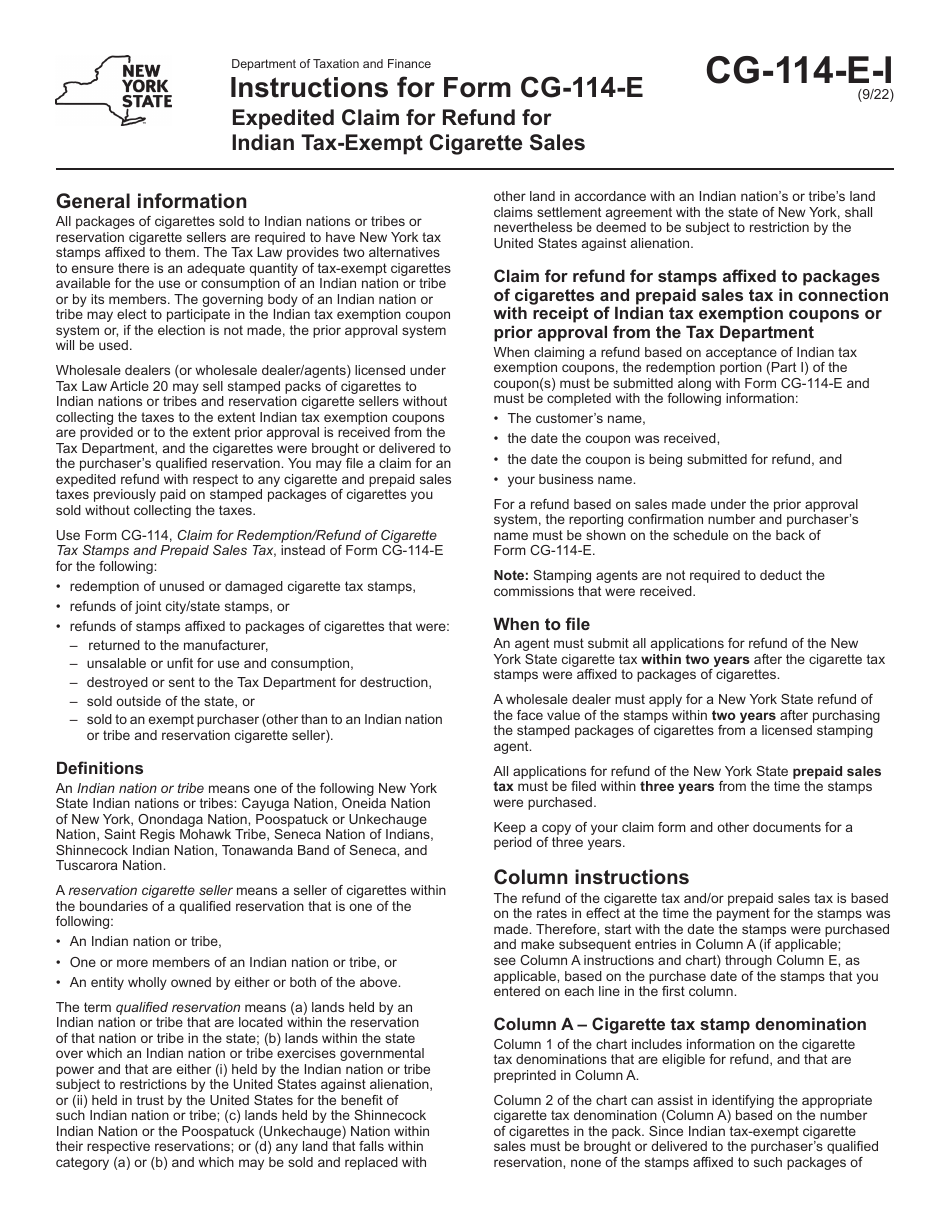

Instructions for Form GC-114-E Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - New York

This document contains official instructions for Form GC-114-E , Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form GC-114-E?

A: Form GC-114-E is an expedited claim for refund for Indian tax-exempt cigarette sales in New York.

Q: Who is eligible to use Form GC-114-E?

A: Individuals or businesses who are Indian tribes or tribally-owned businesses engaged in tax-exempt cigarette sales in New York.

Q: What is the purpose of Form GC-114-E?

A: The purpose of Form GC-114-E is to claim a refund for taxes paid on cigarettes that are sold exempt from state and local taxes to Indians.

Q: How can I obtain Form GC-114-E?

A: You can obtain Form GC-114-E from the New York State Department of Taxation and Finance.

Q: What documents do I need to submit along with Form GC-114-E?

A: You need to submit copies of invoices, sales records, and tribal enrollment or membership verifications with Form GC-114-E.

Q: How long does it take to process Form GC-114-E?

A: The processing time for Form GC-114-E varies, but it generally takes several weeks to several months.

Q: Is there a deadline to submit Form GC-114-E?

A: Yes, Form GC-114-E must be filed within 3 years from the due date of the original tax return or 1 year from the date the tax was paid, whichever is later.

Q: Can I file Form GC-114-E electronically?

A: No, Form GC-114-E cannot be filed electronically. It must be filed by mail.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

![Document preview: Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york.png)

![Document preview: Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york.png)

![Document preview: Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york.png)

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)