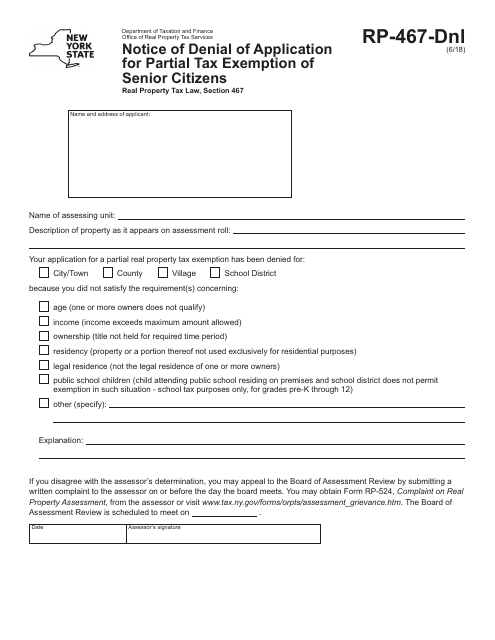

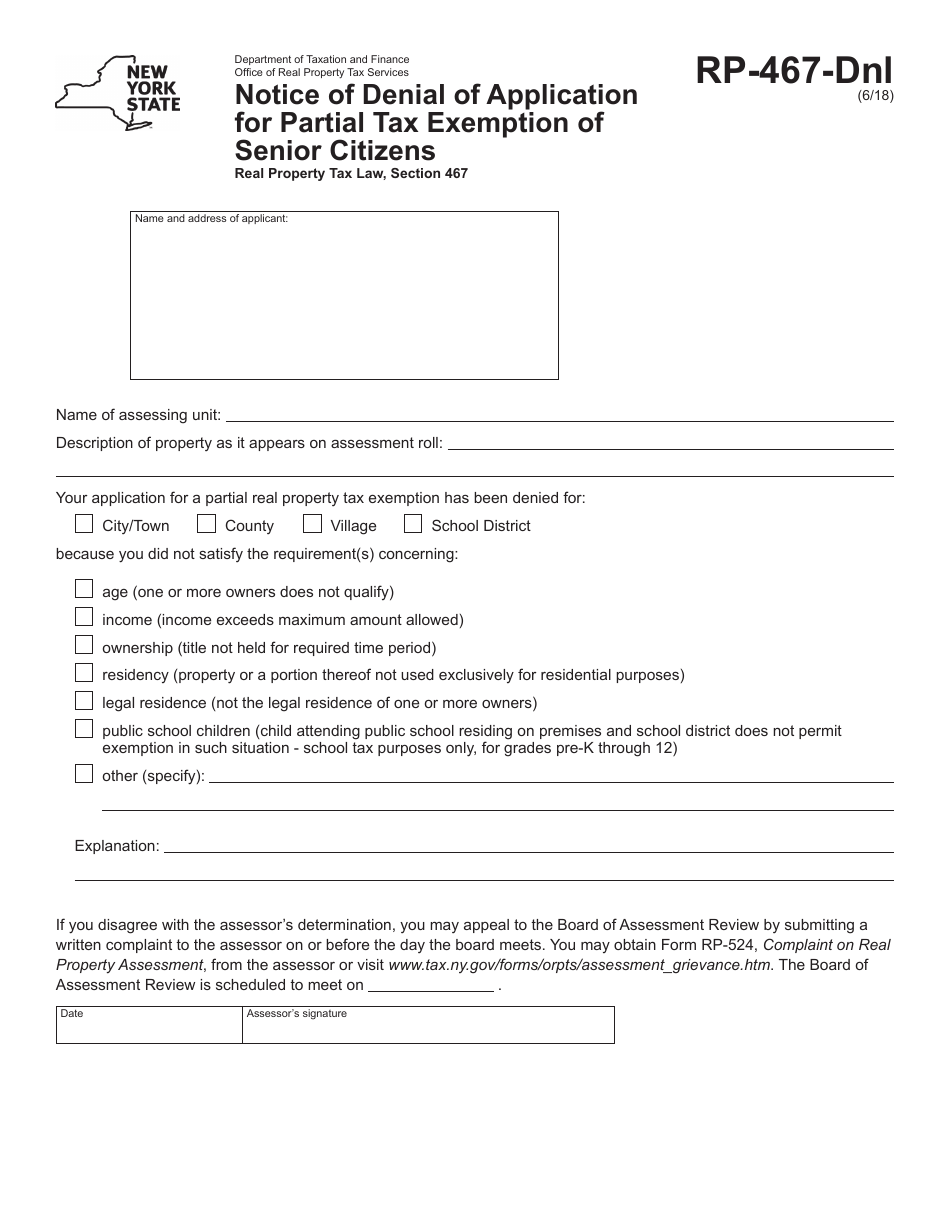

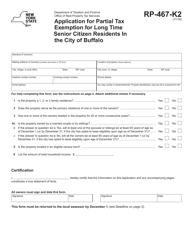

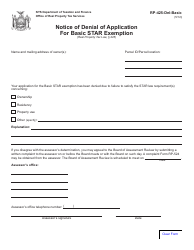

Form RP-467-DNL Notice of Denial of Application for Partial Tax Exemption of Senior Citizens - New York

What Is Form RP-467-DNL?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-467-DNL?

A: Form RP-467-DNL is the Notice of Denial of Application for Partial Tax Exemption of Senior Citizens in New York.

Q: Who is this form for?

A: This form is for senior citizens in New York who have applied for a partial tax exemption.

Q: What does this form signify?

A: This form signifies that the application for a partial tax exemption for senior citizens has been denied.

Q: Why would an application be denied?

A: An application for a partial tax exemption may be denied if the applicant does not meet the eligibility requirements or if there are errors in the application.

Q: What should I do if my application is denied?

A: If your application is denied, you may have the option to appeal the decision or reapply with the necessary corrections.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-467-DNL by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.