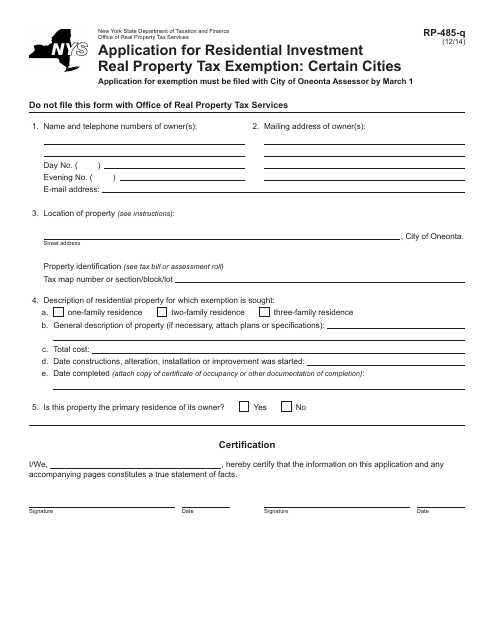

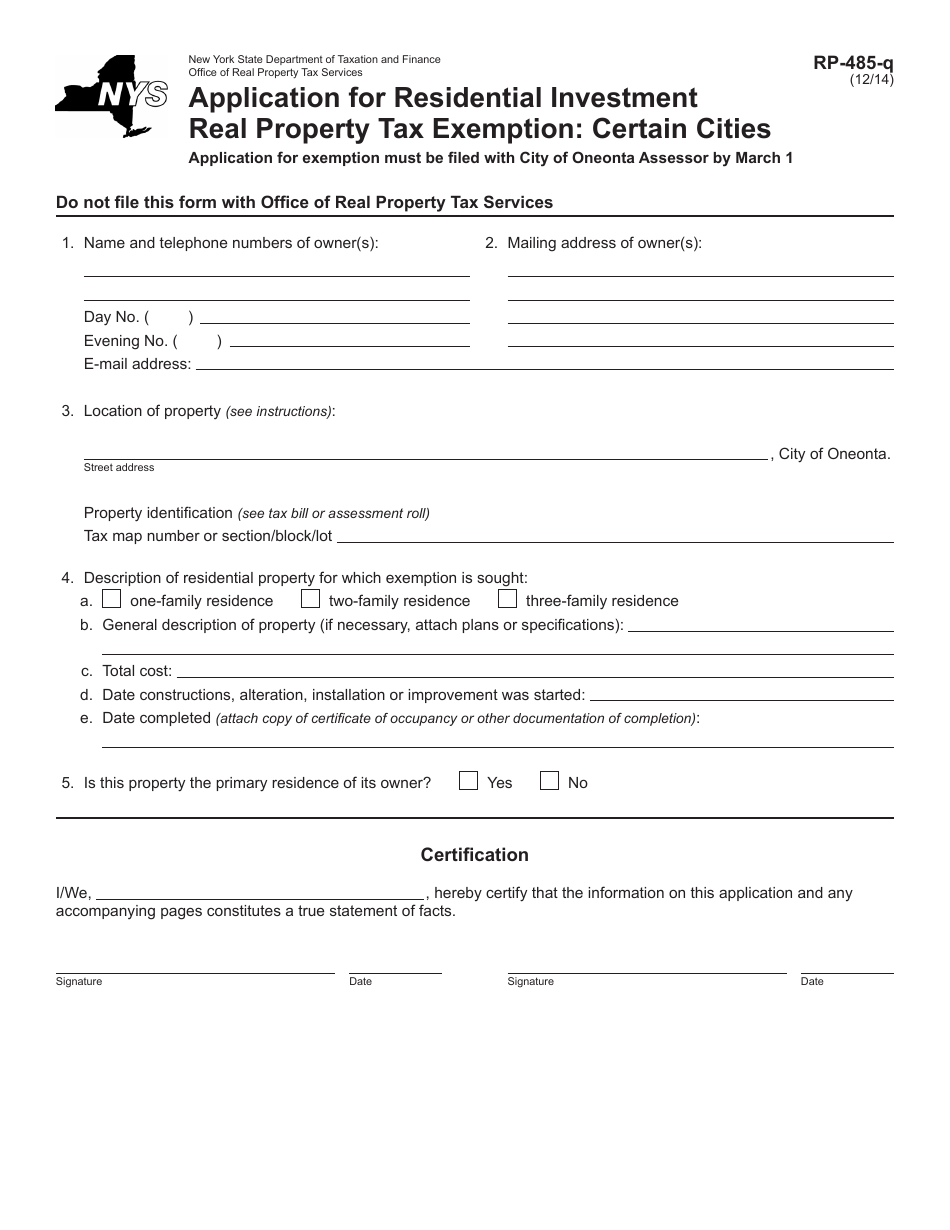

Form RP-485-Q Application for Residential Investment Real Property Tax Exemption: Certain Cities - New York

What Is Form RP-485-Q?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-485-Q?

A: RP-485-Q is an application form for Residential InvestmentReal Property Tax Exemption: Certain Cities in New York.

Q: What is the purpose of RP-485-Q?

A: The purpose of RP-485-Q is to apply for a tax exemption for residential investment properties in certain cities in New York.

Q: Who can use RP-485-Q?

A: Property owners in certain cities in New York who have invested in residential real estate can use RP-485-Q.

Q: What information do I need to provide in RP-485-Q?

A: You need to provide information about the property, your investment, and any other required documentation specified in the form.

Q: Are there any eligibility criteria for the tax exemption?

A: Yes, there are eligibility criteria that vary depending on the specific city in New York. You need to meet the requirements outlined in the form and any additional guidelines provided by the city.

Q: What happens after I submit RP-485-Q?

A: After you submit RP-485-Q, the city's tax department will review your application and determine whether you qualify for the residential investment real property tax exemption.

Q: Can I appeal if my application is denied?

A: Yes, if your application for the tax exemption is denied, you may have the option to appeal the decision. The specific appeal process and requirements will be provided by the city's tax department.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-Q by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

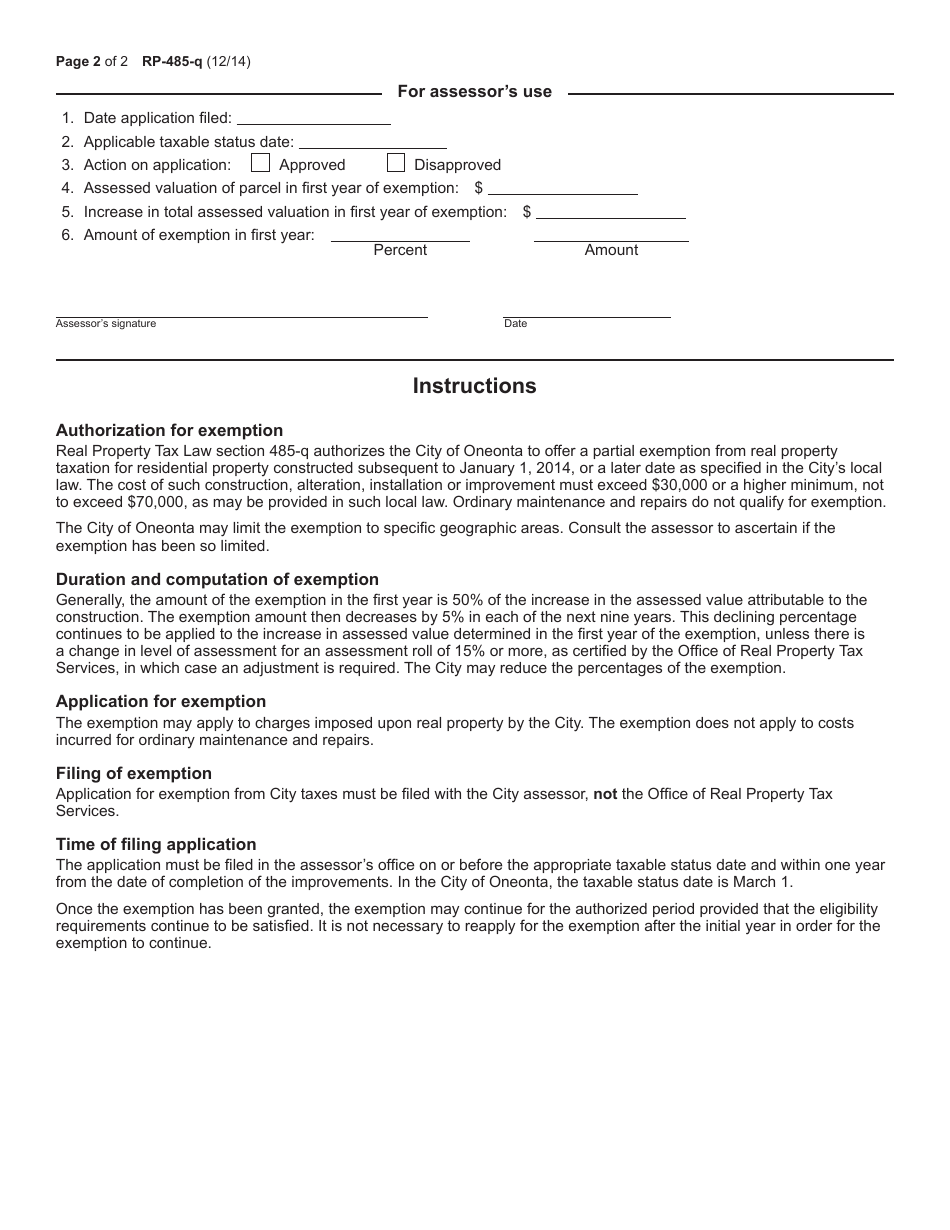

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

![Document preview: Form RP-485-J [UTICA] Application for Residential Investment Real Property Tax Exemption - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578659/form-rp-485-j-utica-application-for-residential-investment-real-property-tax-exemption-city-of-utica-new-york.png)

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-485-J [SYRACUSE] Application for Residential Investment Real Property Tax Exemption - City of Syracuse, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578658/form-rp-485-j-syracuse-application-for-residential-investment-real-property-tax-exemption-city-of-syracuse-new-york.png)

![Document preview: Form RP-485-J [AMSTERDAM] Application for Residential Investment Real Property Tax Exemption - City of Amsterdam, New York](https://data.templateroller.com/pdf_docs_html/578/5786/578657/form-rp-485-j-amsterdam-application-for-residential-investment-real-property-tax-exemption-city-of-amsterdam-new-york.png)

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

![Document preview: Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york.png)