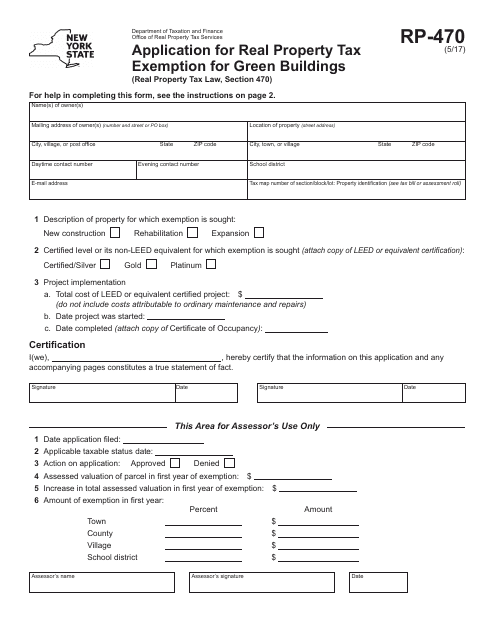

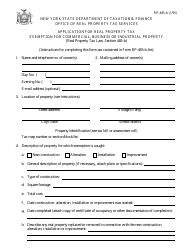

Form RP-470 Application for Real Property Tax Exemption for Green Buildings - New York

What Is Form RP-470?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-470?

A: Form RP-470 is an application for real property tax exemption for green buildings in New York.

Q: What is a green building?

A: A green building is a building that is designed and constructed to be environmentally sustainable and energy-efficient.

Q: Who can file Form RP-470?

A: Owners or lessees of eligible green buildings in New York can file Form RP-470.

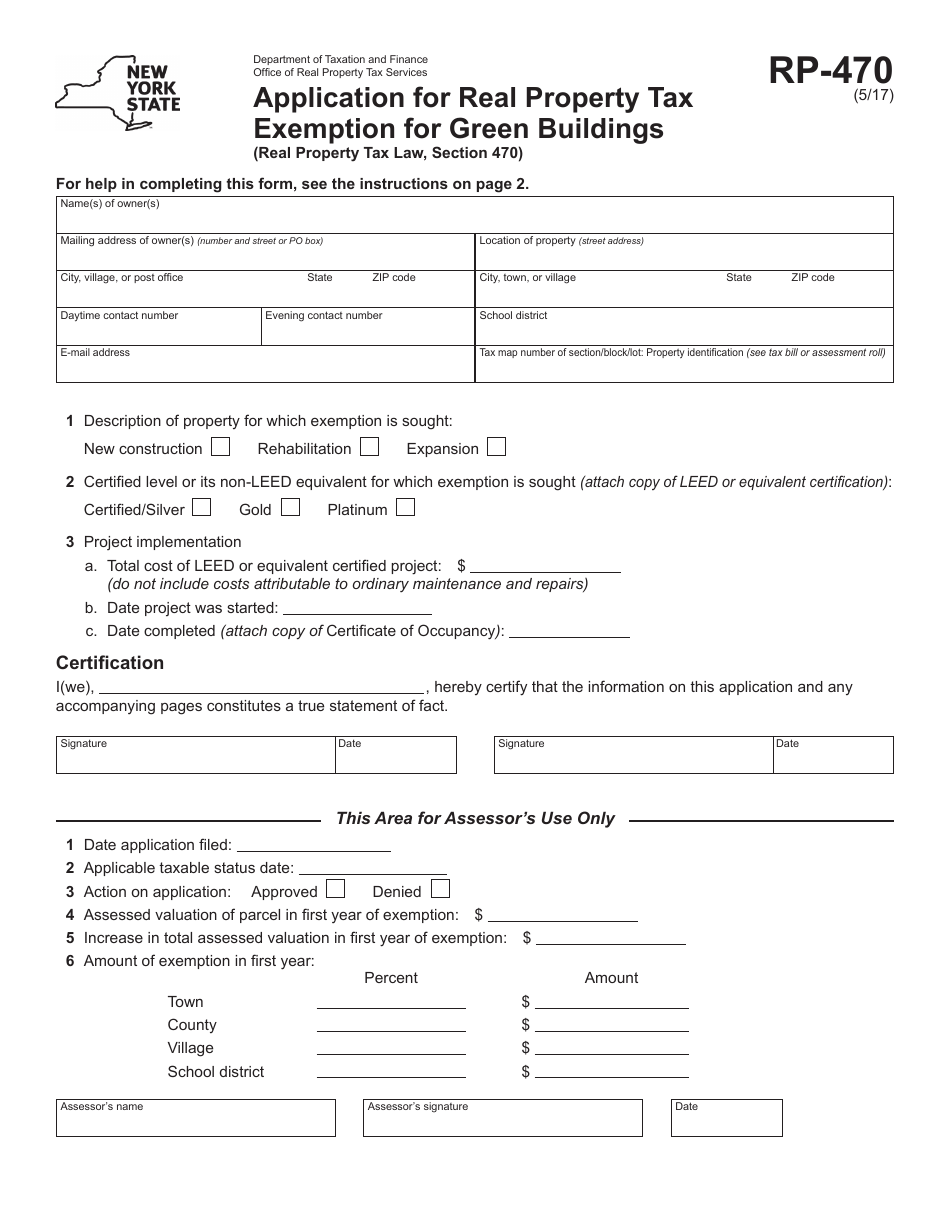

Q: What are the eligibility requirements for the tax exemption?

A: The building must meet certain criteria for energy efficiency and sustainability, as outlined in the application.

Q: What are the benefits of the tax exemption?

A: The tax exemption can provide substantial savings on real property taxes for eligible green buildings.

Q: Are there any deadlines for filing Form RP-470?

A: Yes, the application must be filed with the assessor's office on or before the applicable taxable status date for the assessment roll.

Q: Can I appeal if my application for the tax exemption is denied?

A: Yes, you have the right to appeal the denial of your application if you believe it was unjust.

Q: Are there any fees associated with filing Form RP-470?

A: There are no fees required to file Form RP-470.

Q: Can I get a tax exemption for a green building that is already constructed?

A: Yes, as long as the building meets the eligibility criteria, you can still apply for the tax exemption even if the building is already constructed.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-470 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

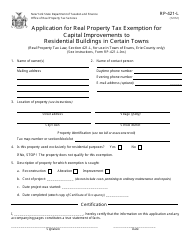

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

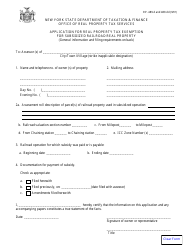

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

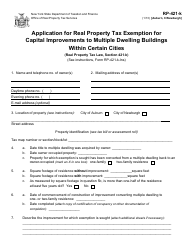

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york.png)