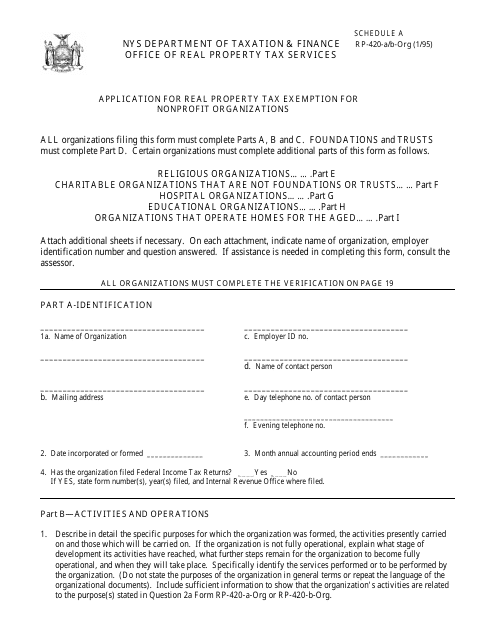

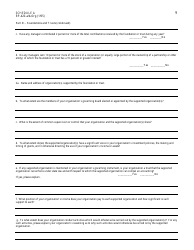

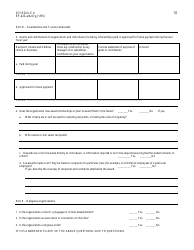

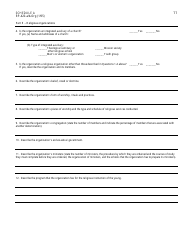

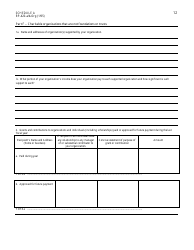

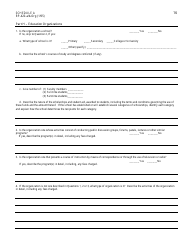

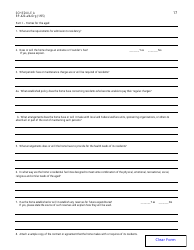

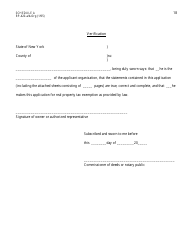

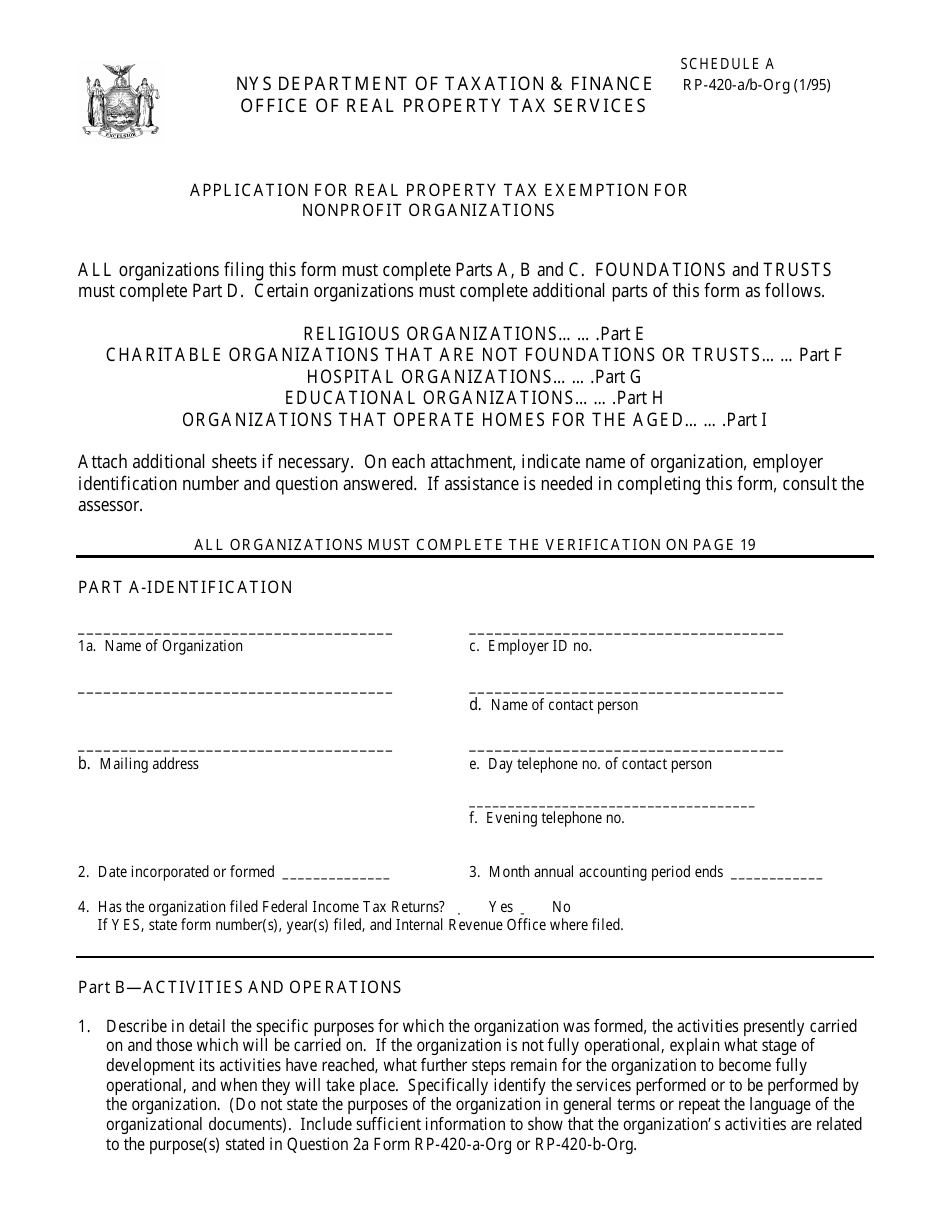

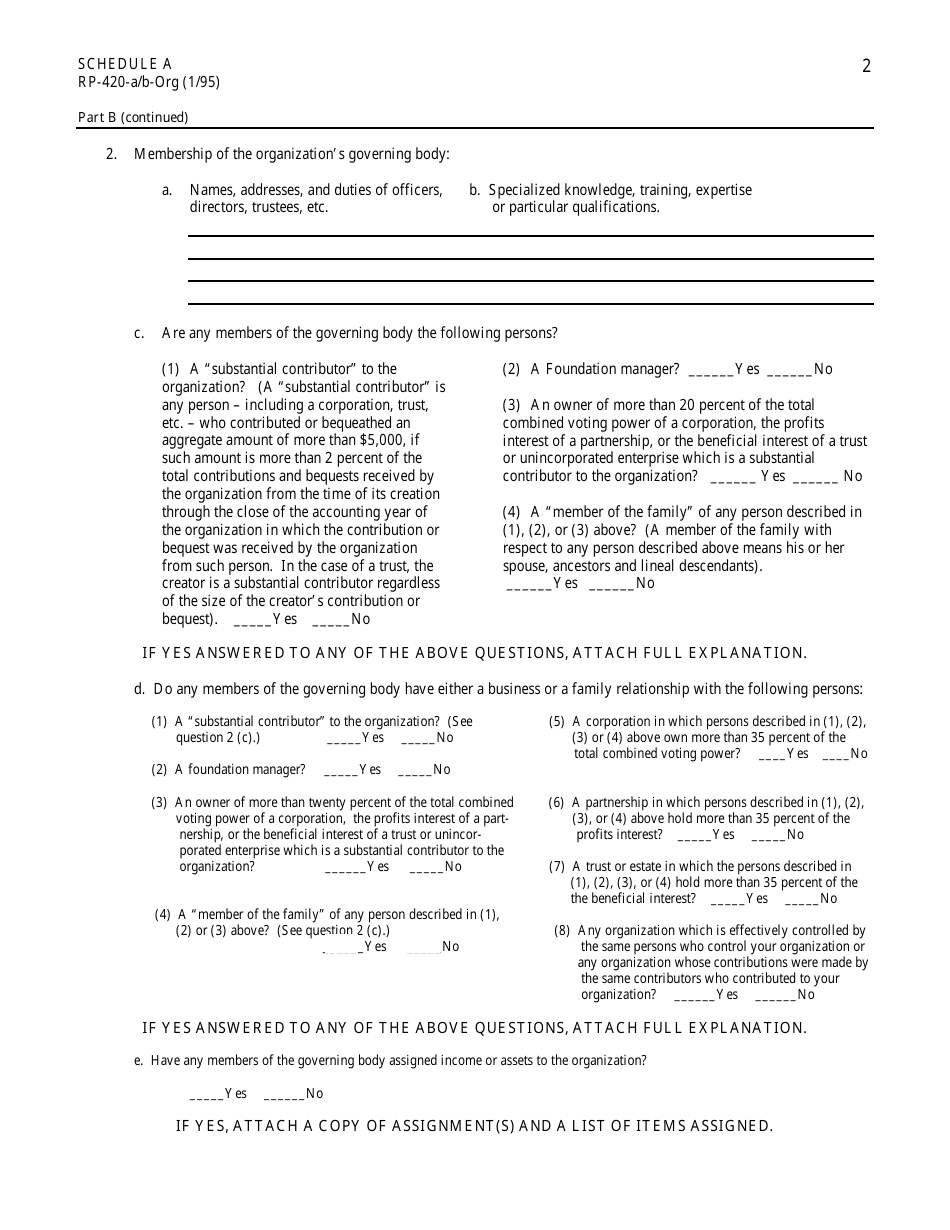

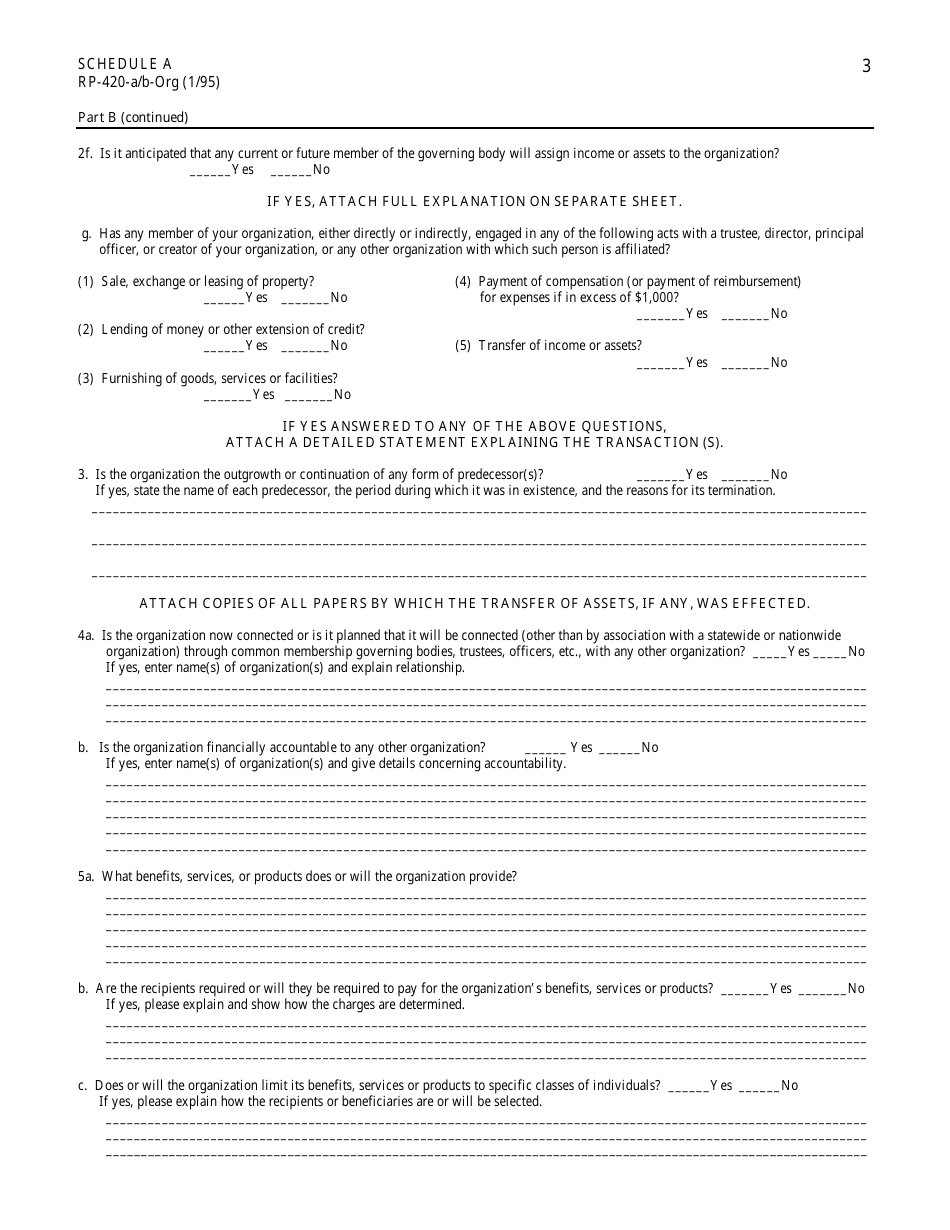

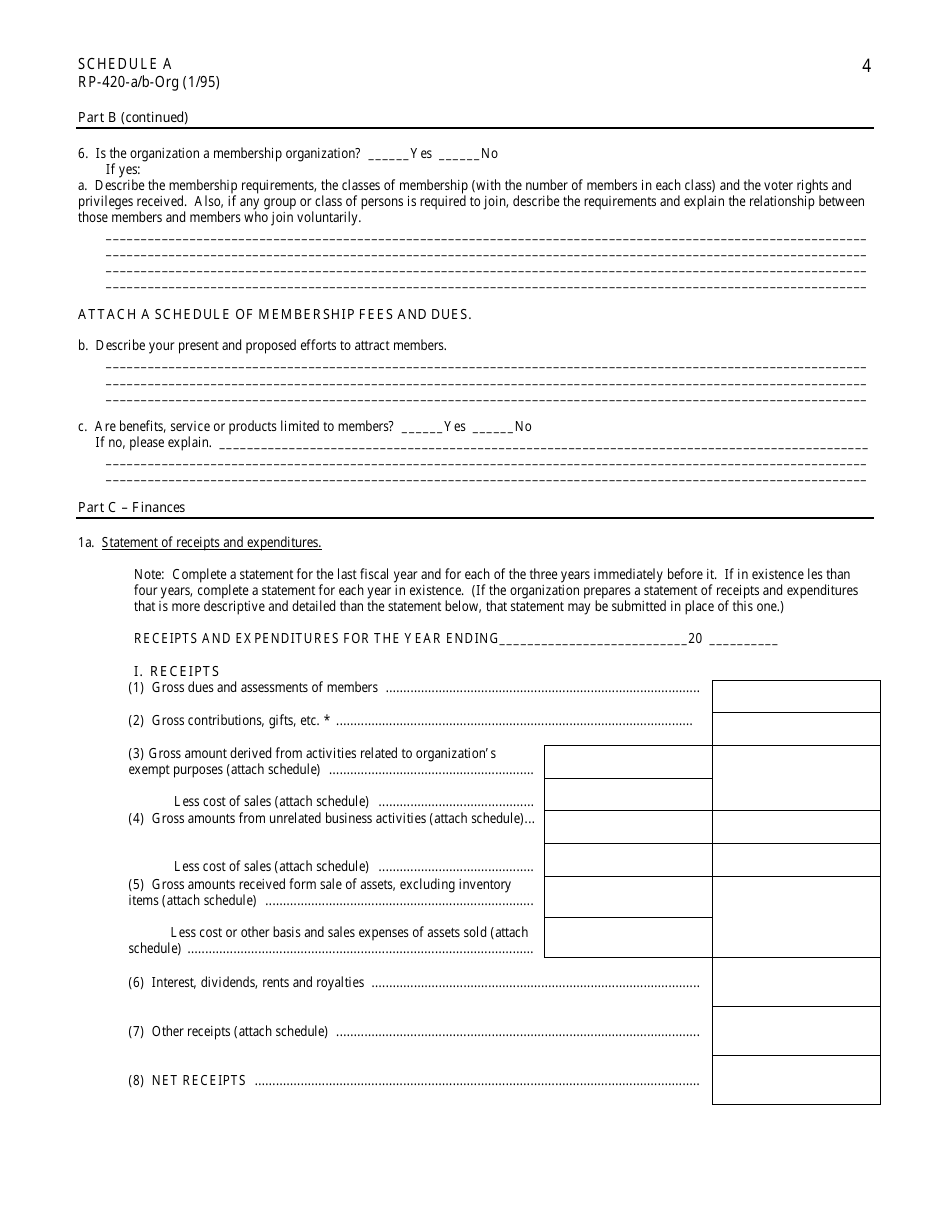

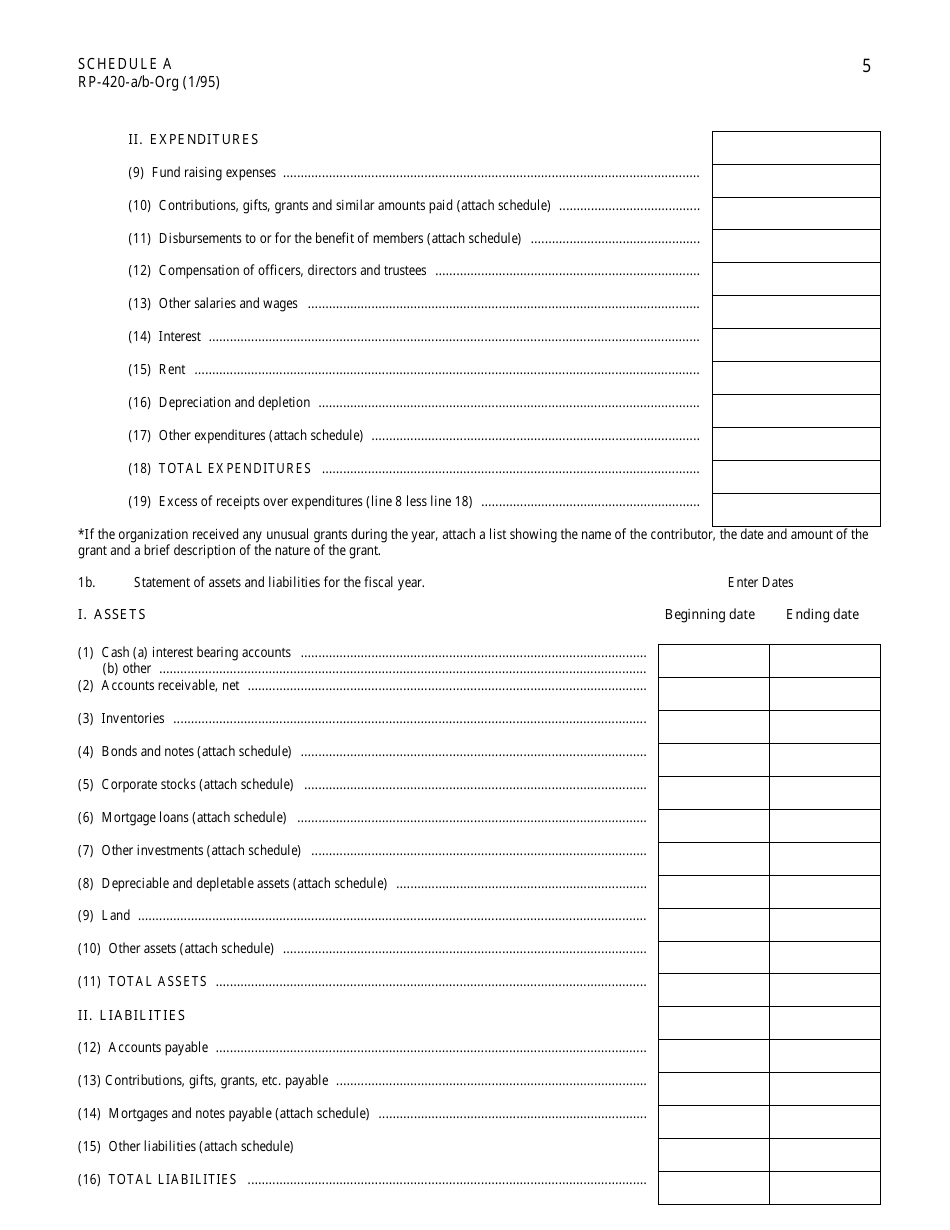

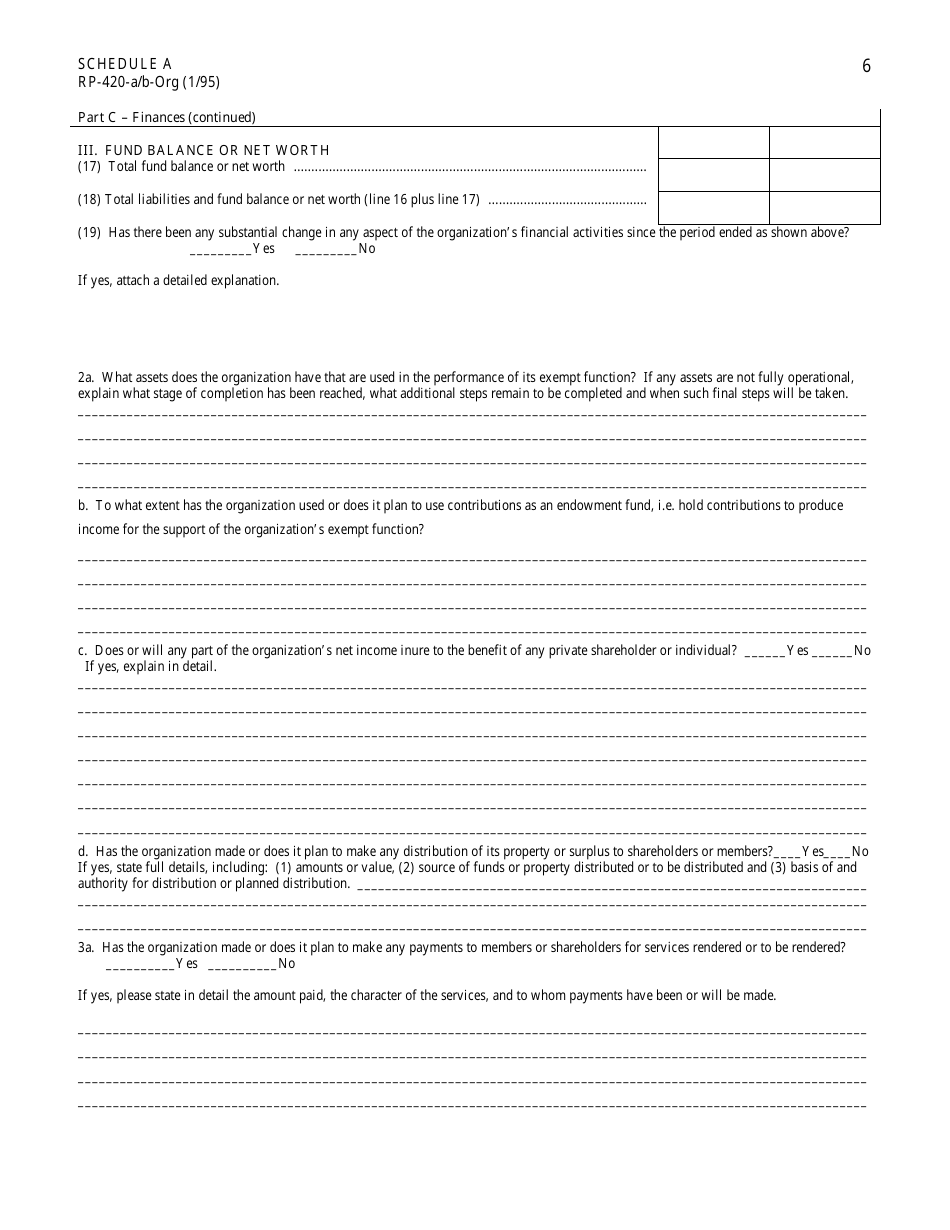

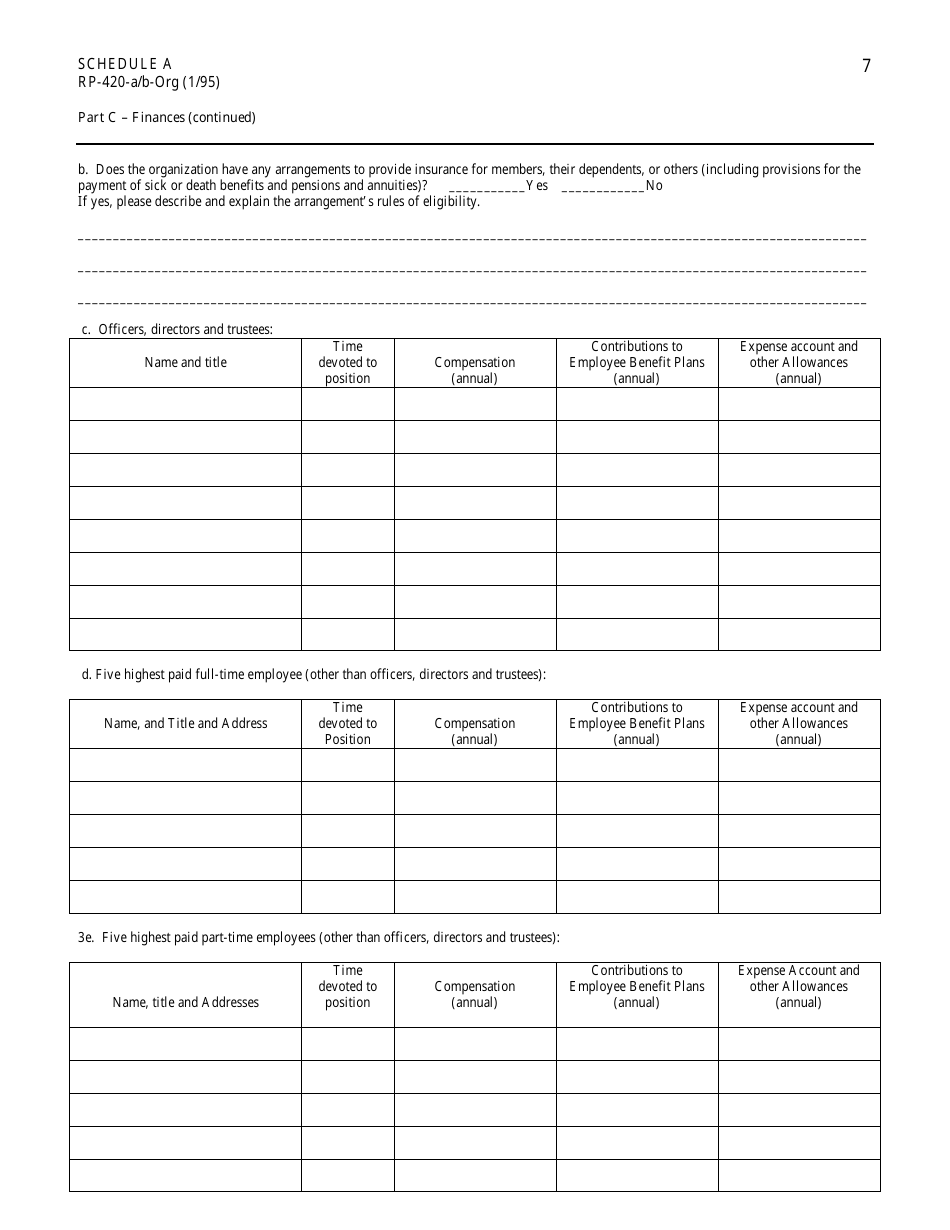

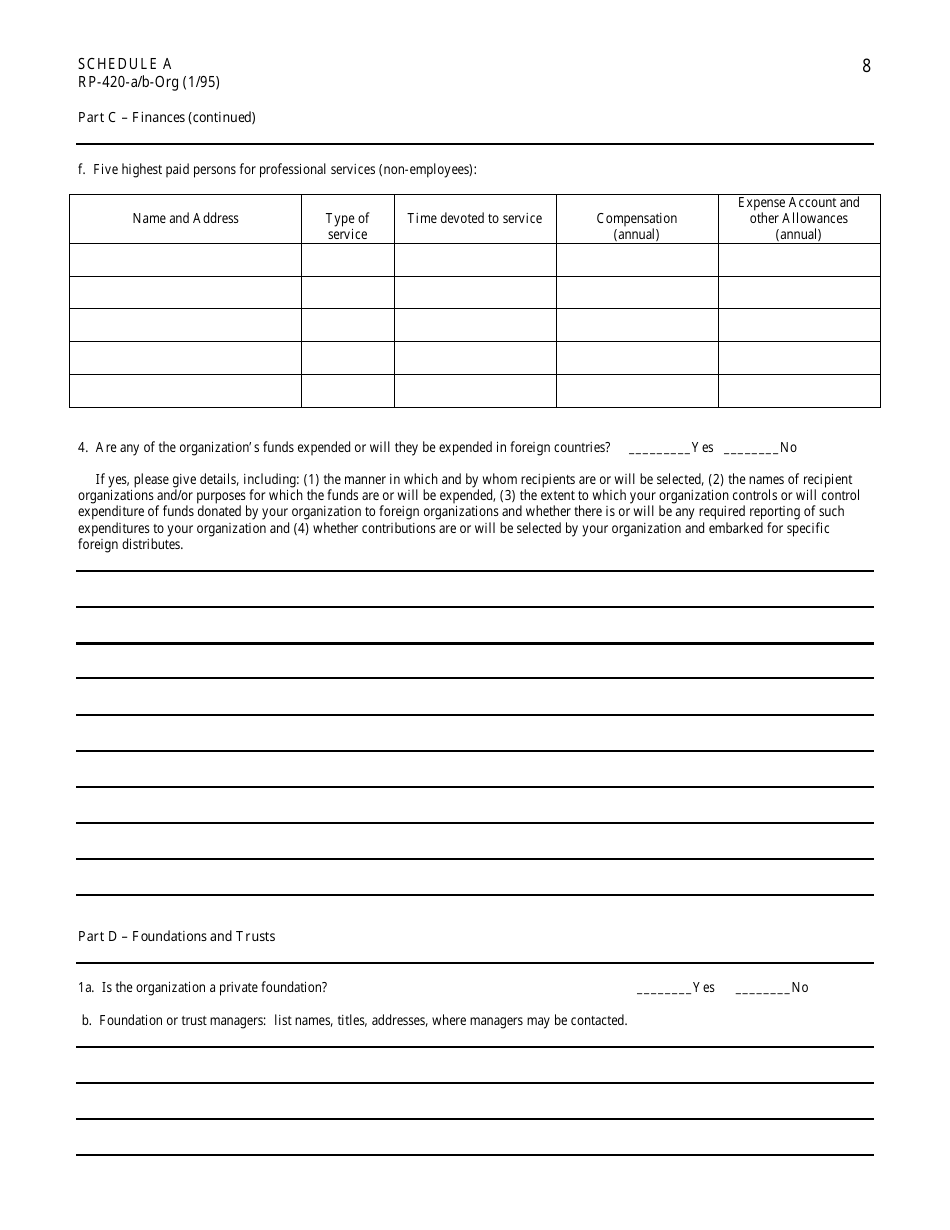

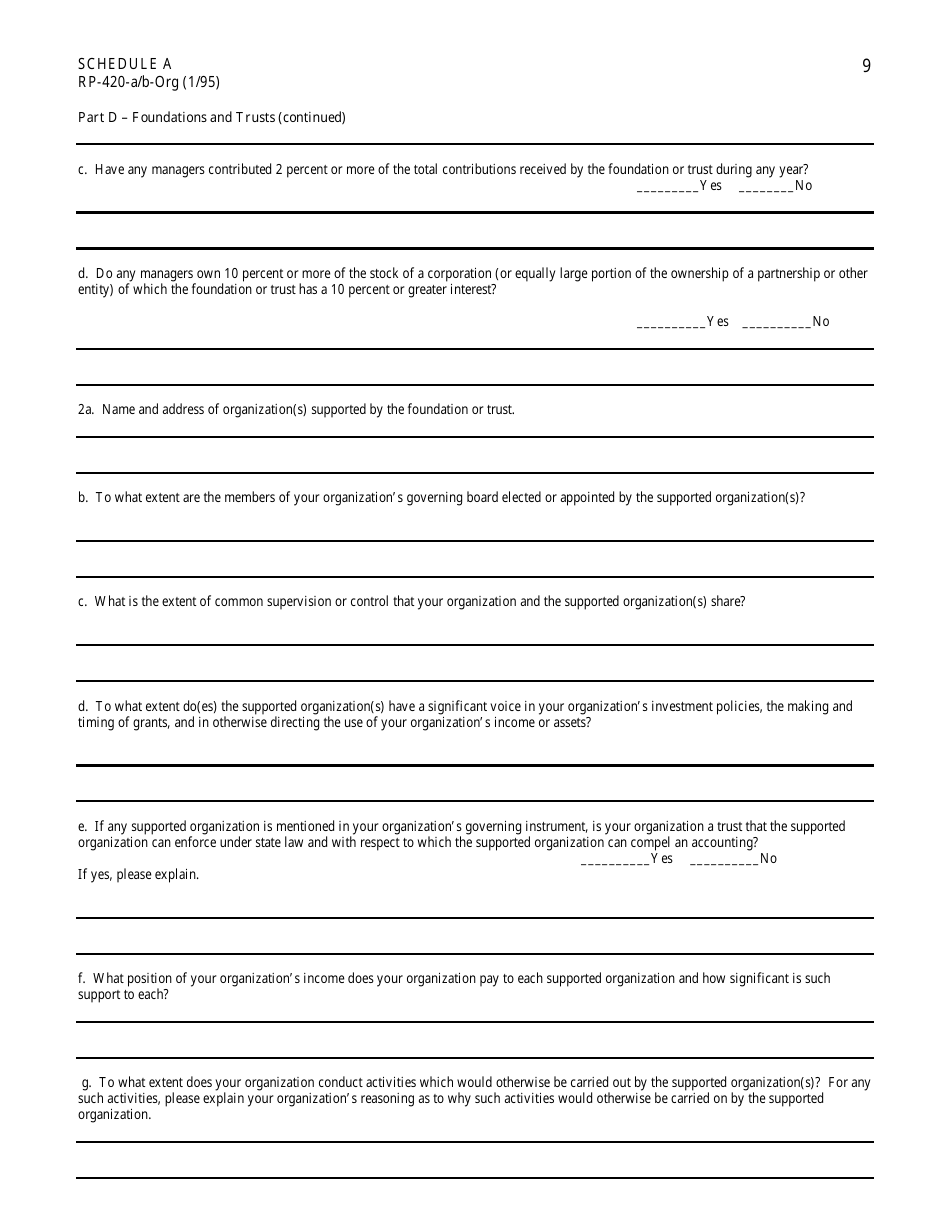

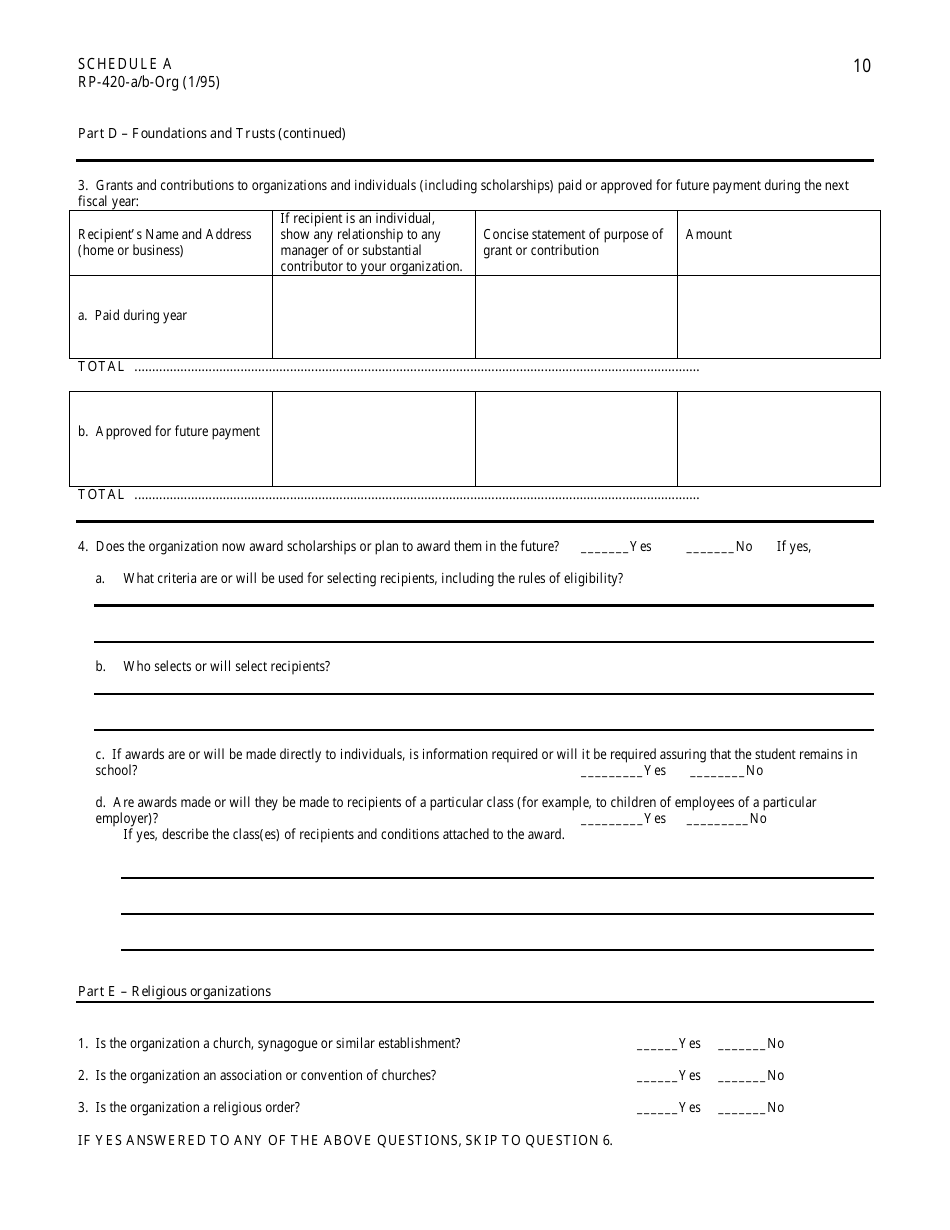

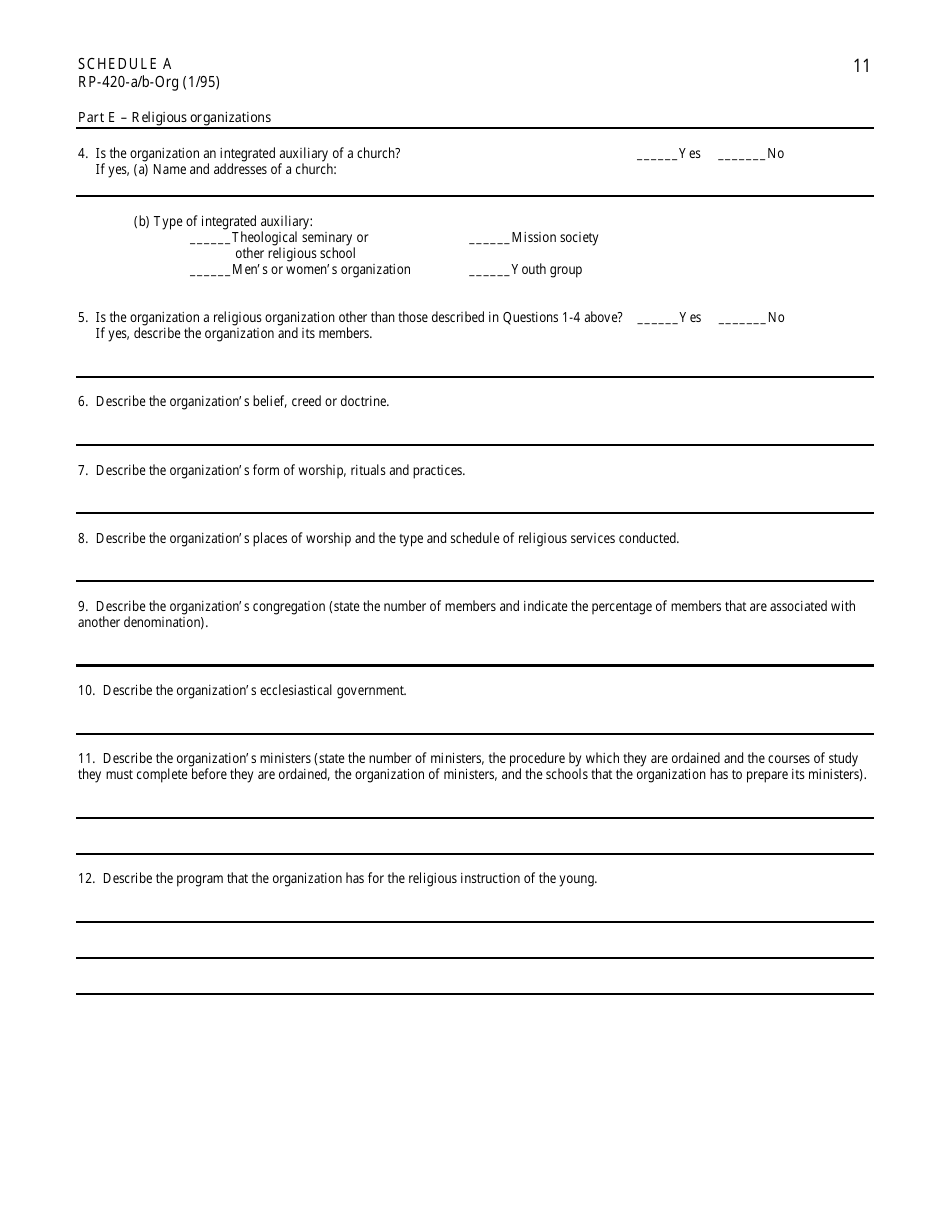

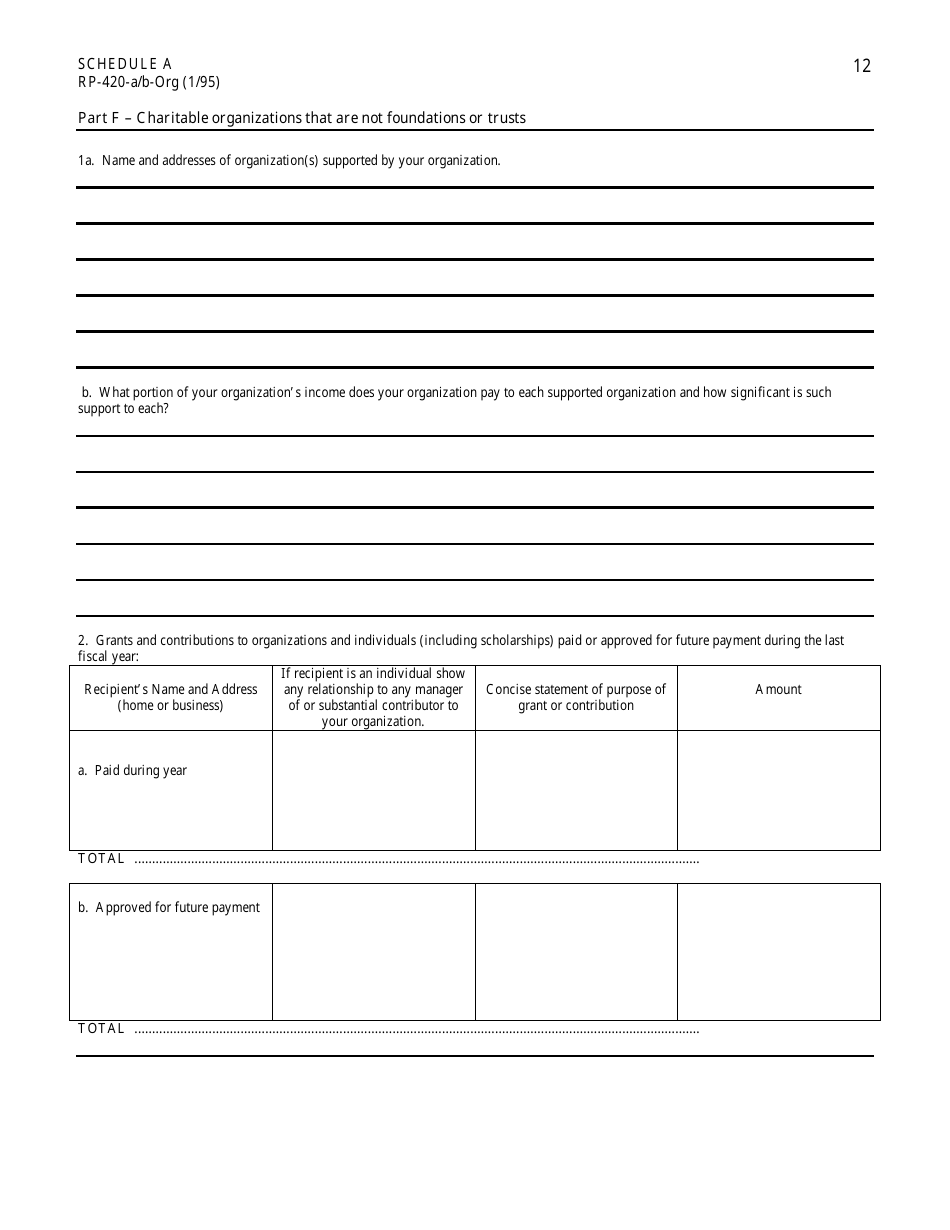

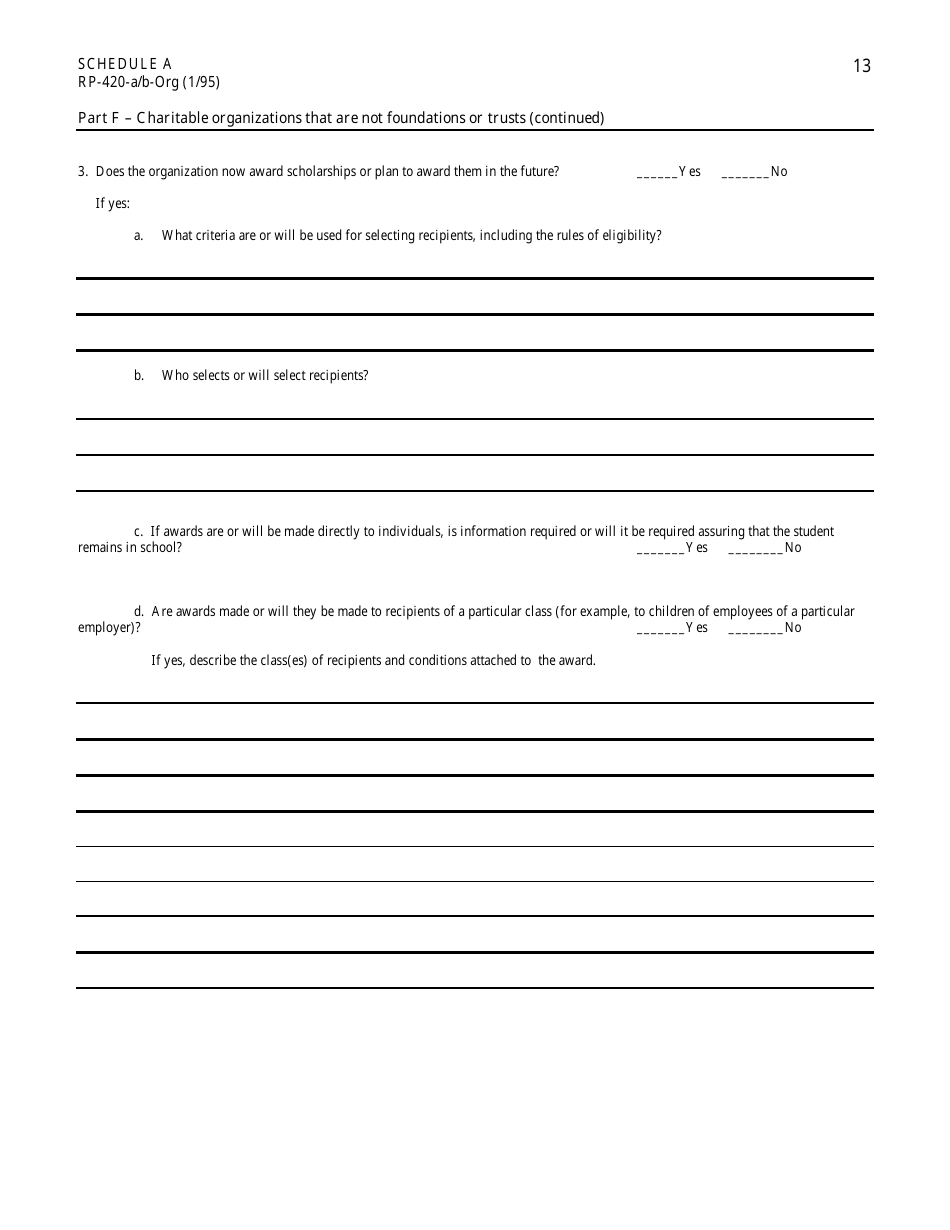

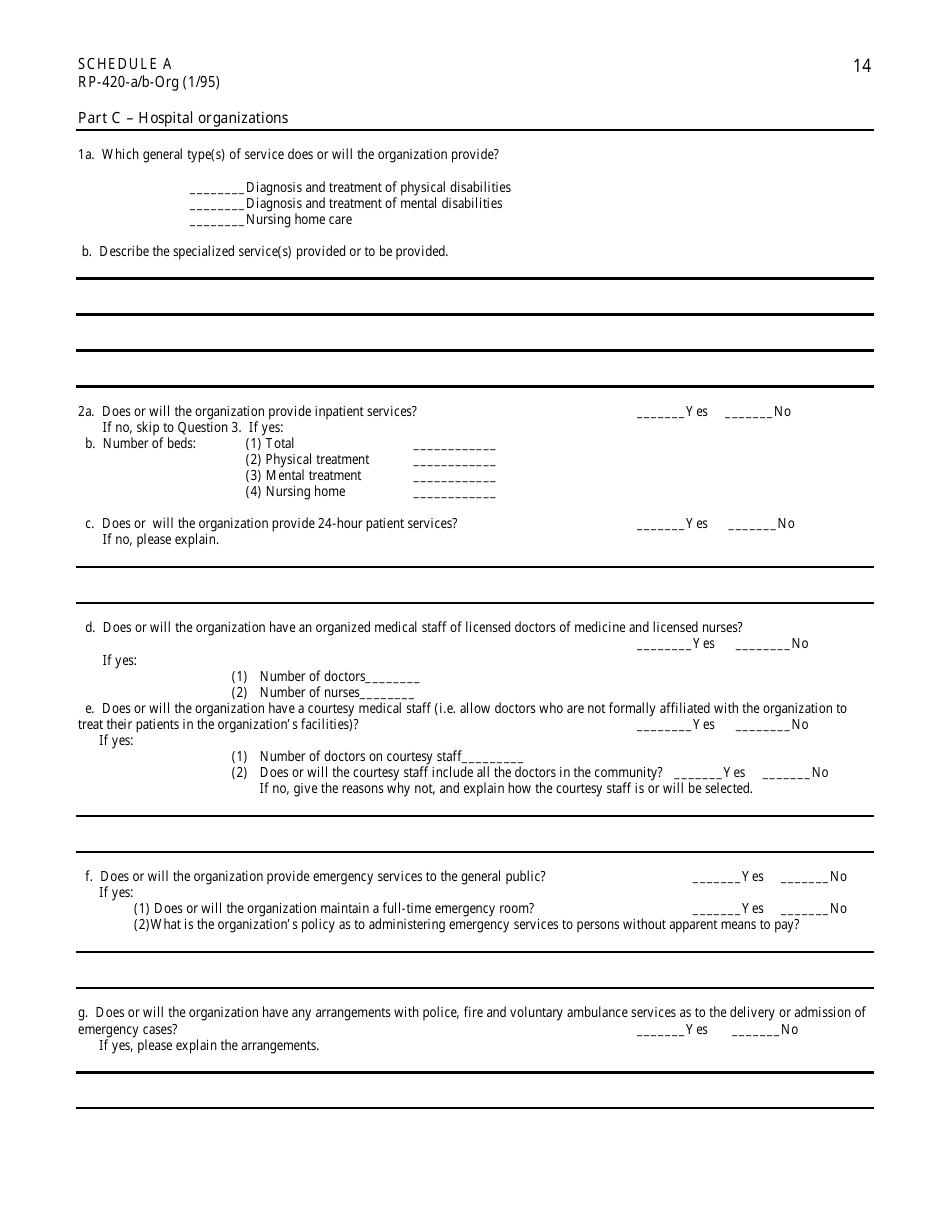

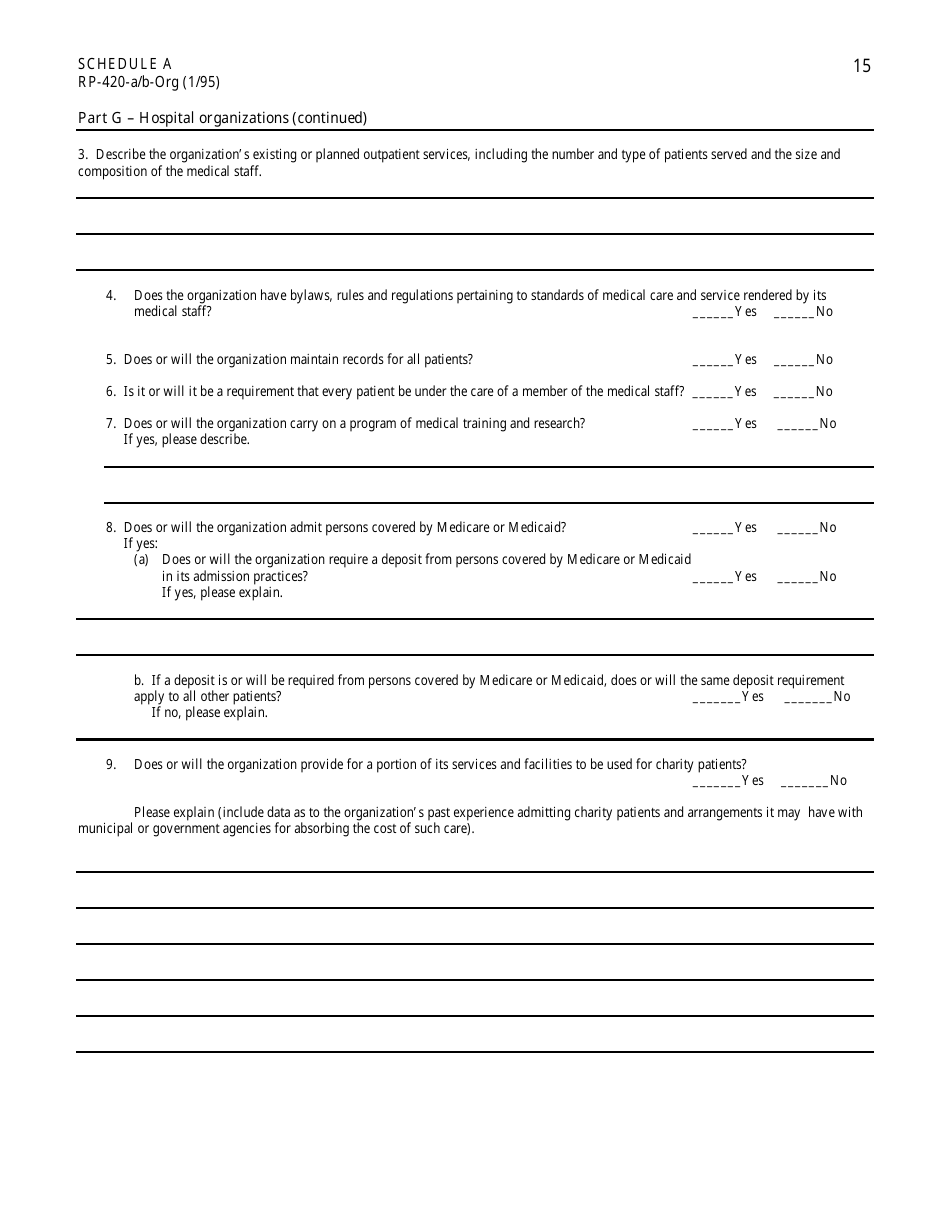

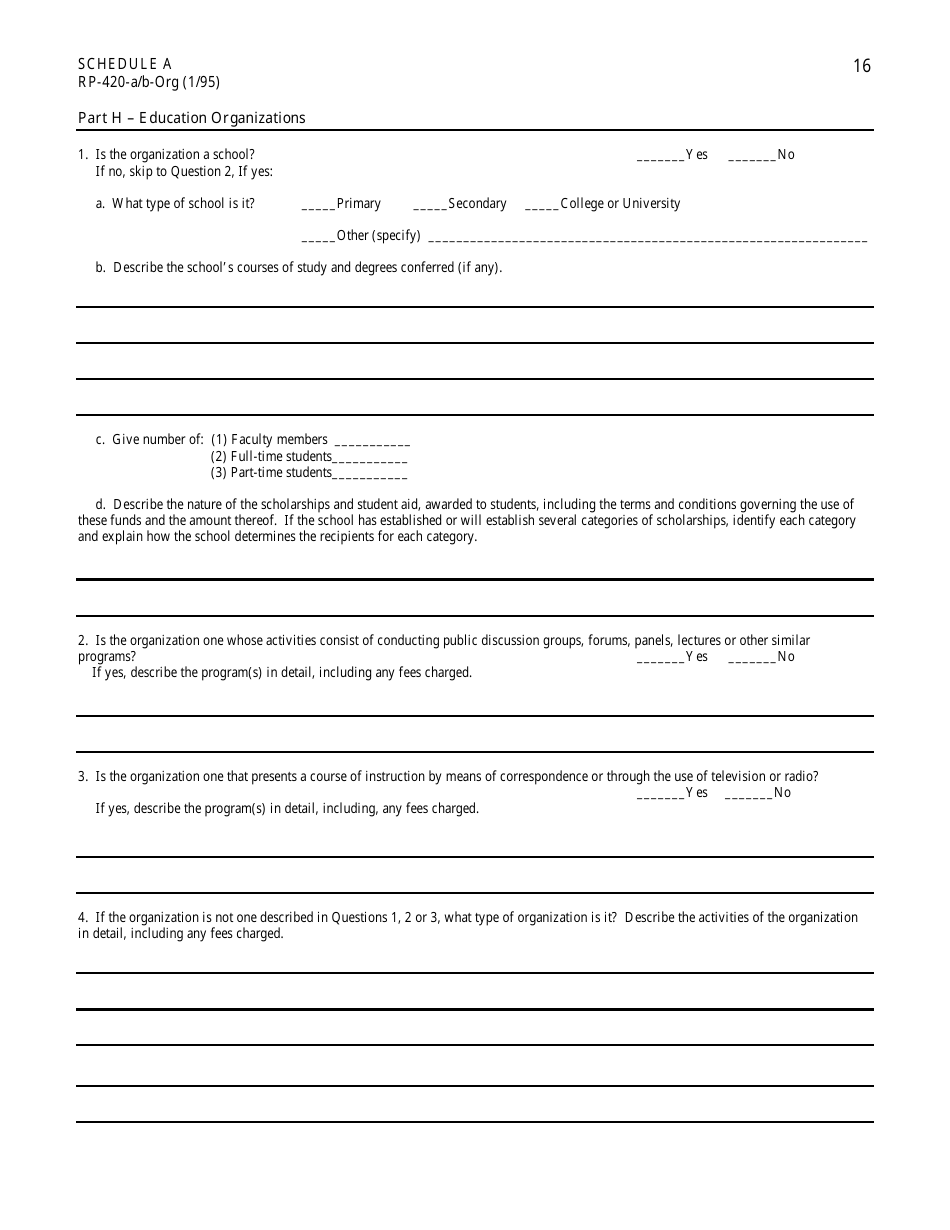

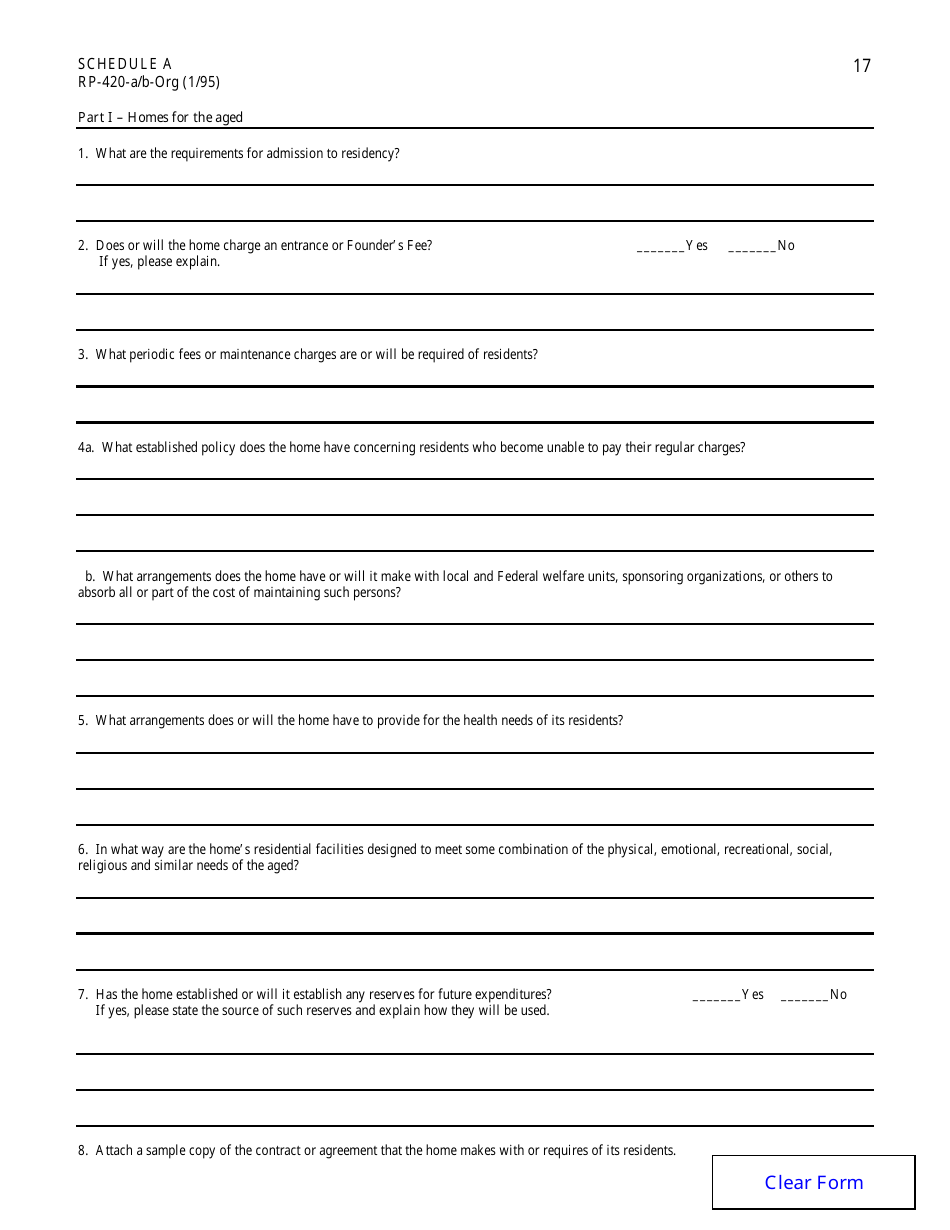

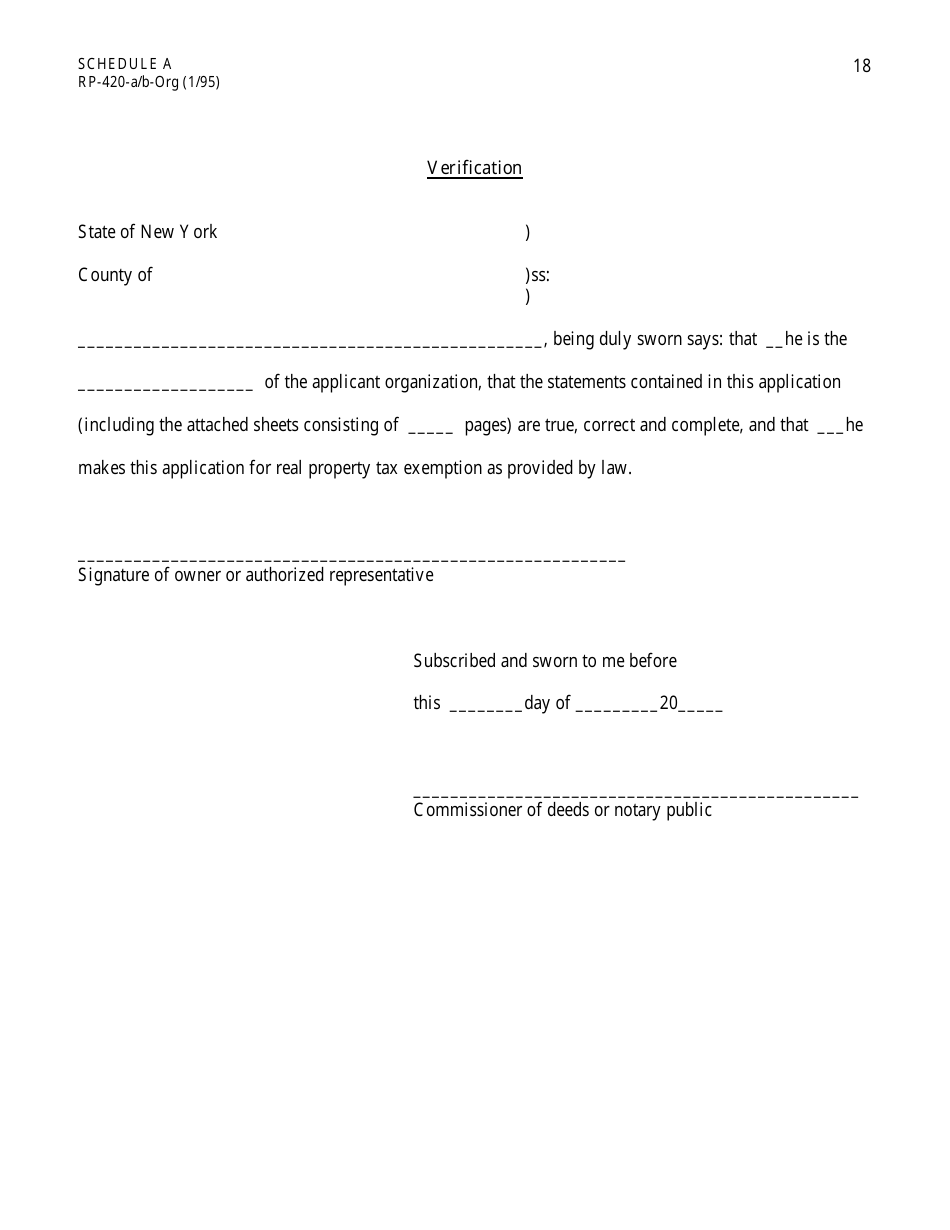

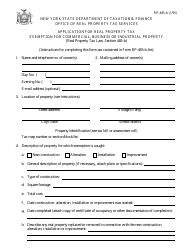

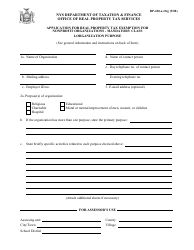

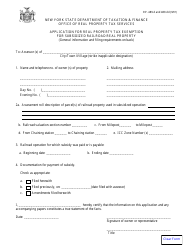

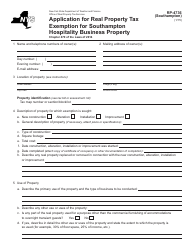

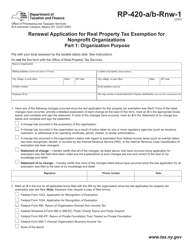

Form RP-420-A / B-ORG Schedule A Application for Real Property Tax Exemption for Nonprofit Organizations - New York

What Is Form RP-420-A/B-ORG Schedule A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP-420-A/B-ORG?

A: RP-420-A/B-ORG is the application form for real property tax exemption for nonprofit organizations in New York.

Q: Who can apply for RP-420-A/B-ORG?

A: Nonprofit organizations in New York can apply for RP-420-A/B-ORG.

Q: What is the purpose of RP-420-A/B-ORG?

A: RP-420-A/B-ORG is used to apply for a real property tax exemption for nonprofit organizations.

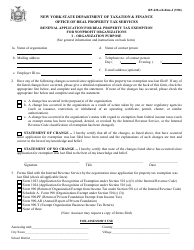

Q: What type of organizations are eligible for tax exemption with RP-420-A/B-ORG?

A: Nonprofit organizations that meet certain criteria are eligible for tax exemption with RP-420-A/B-ORG.

Q: Are there any fees associated with RP-420-A/B-ORG?

A: There are no fees associated with submitting RP-420-A/B-ORG.

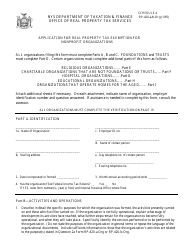

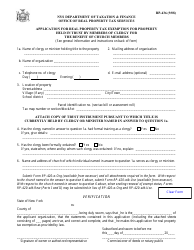

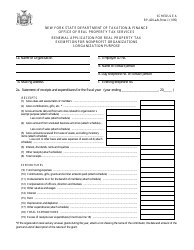

Q: What documents are required to be submitted with RP-420-A/B-ORG?

A: RP-420-A/B-ORG requires certain documents, such as the organization's certificate of incorporation and financial statements.

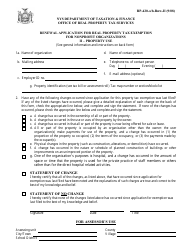

Q: How long does it take to process RP-420-A/B-ORG application?

A: The processing time for RP-420-A/B-ORG application varies, but it usually takes several months to be reviewed and approved.

Q: What happens after RP-420-A/B-ORG is approved?

A: After RP-420-A/B-ORG is approved, the nonprofit organization will be granted a real property tax exemption.

Form Details:

- Released on January 1, 1995;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-420-A/B-ORG Schedule A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.