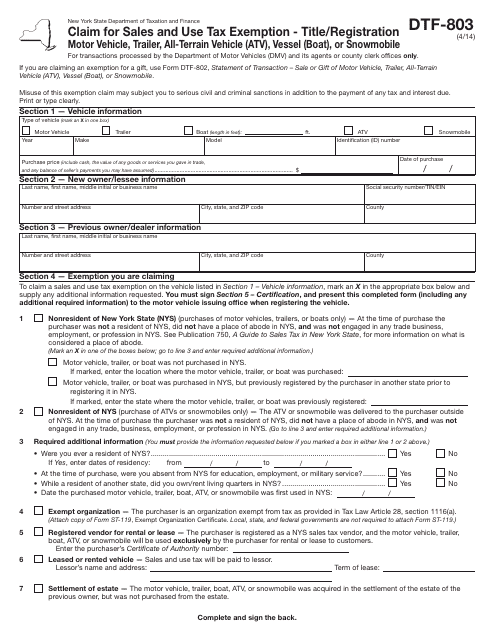

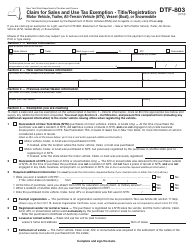

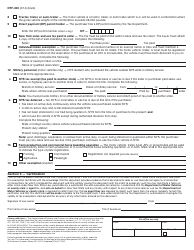

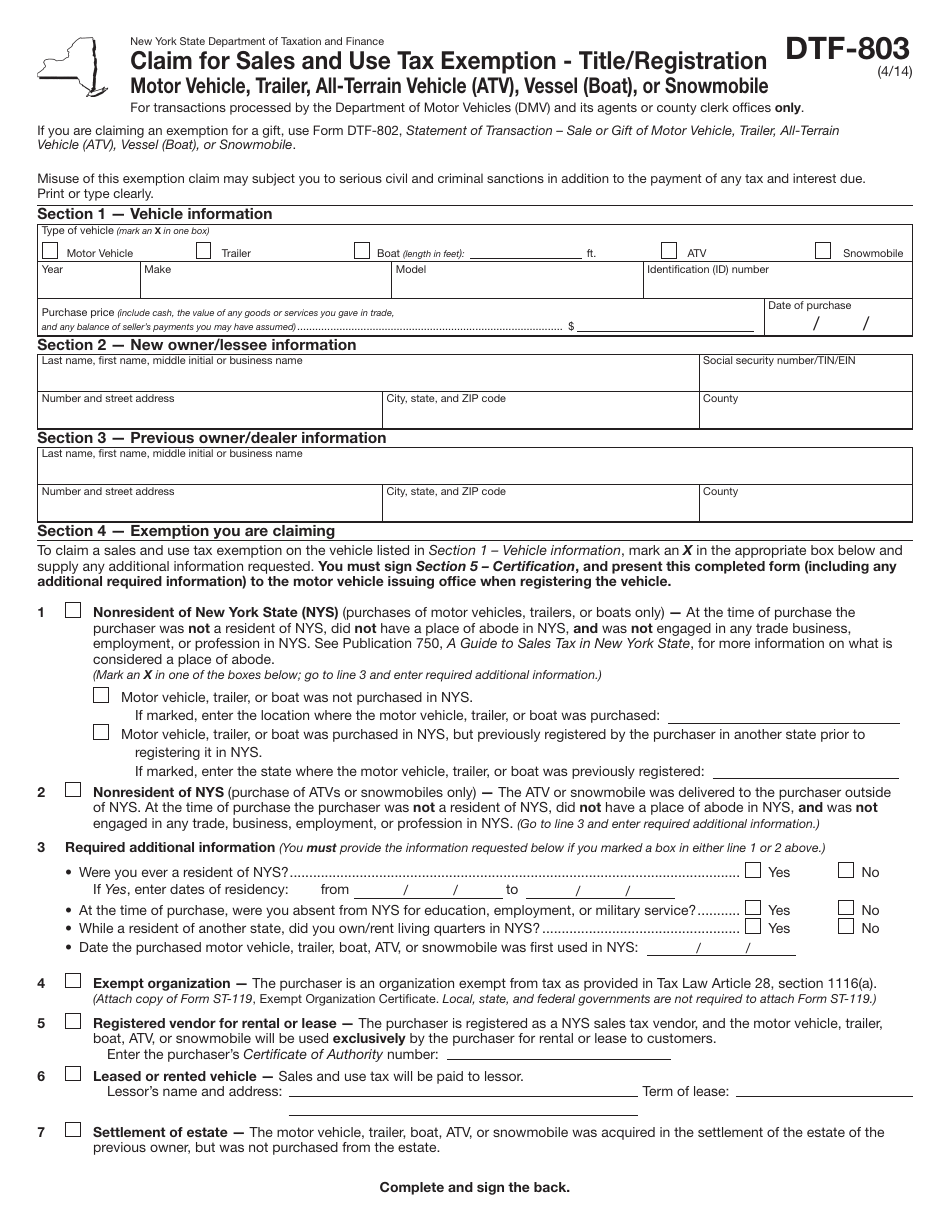

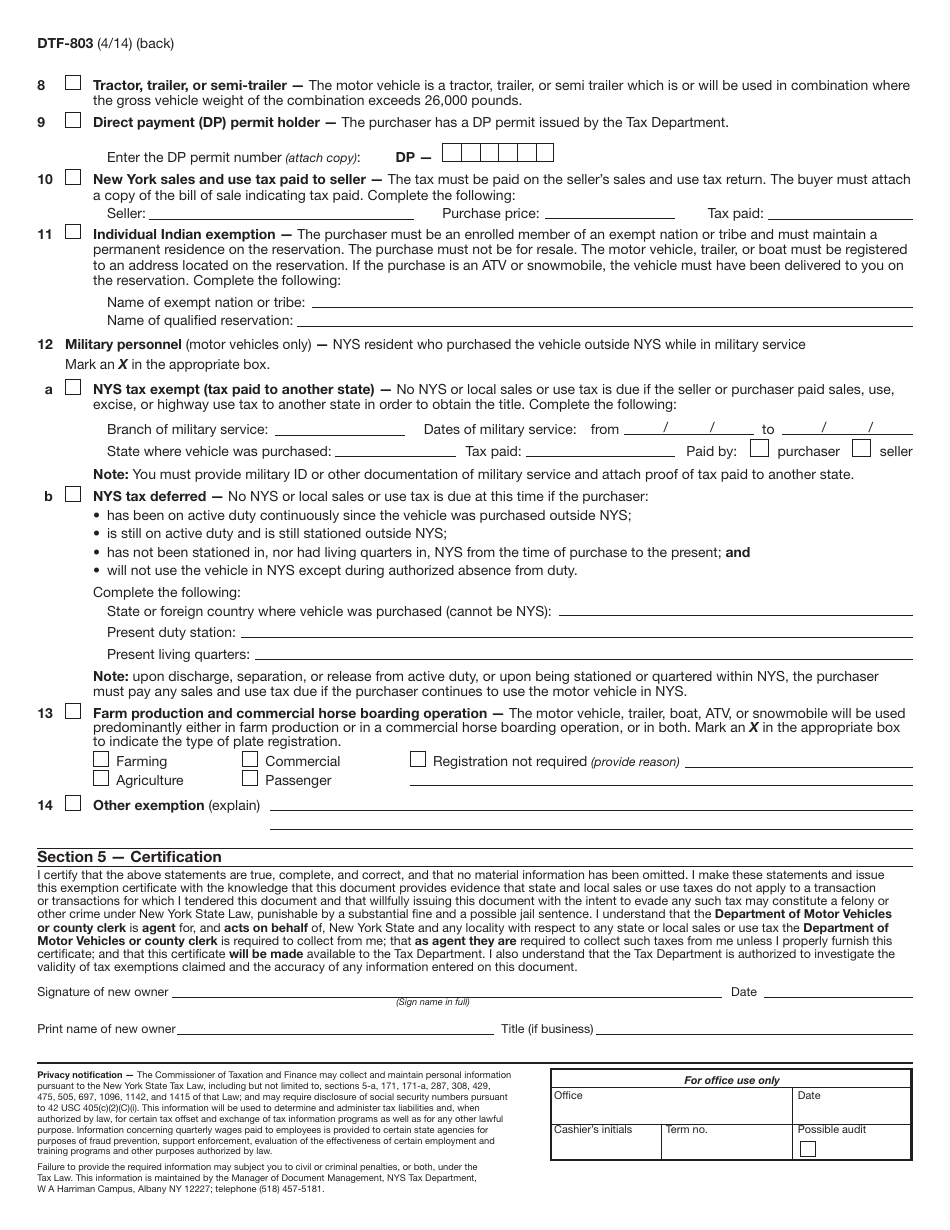

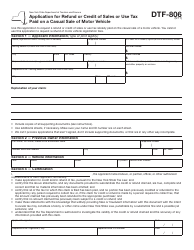

Form DTF-803 Claim for Sales and Use Tax Exemption - Title / Registration - New York

What Is Form DTF-803?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-803?

A: Form DTF-803 is a claim for sales and use tax exemption for title/registration in New York.

Q: What is the purpose of Form DTF-803?

A: The purpose of Form DTF-803 is to apply for a sales and use tax exemption for title/registration in New York.

Q: Who needs to fill out Form DTF-803?

A: Anyone who wants to claim a sales and use tax exemption for title/registration in New York needs to fill out Form DTF-803.

Q: How do I fill out Form DTF-803?

A: You can fill out Form DTF-803 by providing the required information, such as your personal details and information about the vehicle.

Q: Are there any fees associated with filing Form DTF-803?

A: There are no fees associated with filing Form DTF-803.

Q: What supporting documents do I need to include with Form DTF-803?

A: You may need to include supporting documents such as proof of eligibility for the sales and use tax exemption.

Q: How long does it take to process Form DTF-803?

A: The processing time for Form DTF-803 may vary, but it is typically processed within a few weeks.

Q: What should I do if I have more questions about Form DTF-803?

A: If you have more questions about Form DTF-803, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTF-803 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.