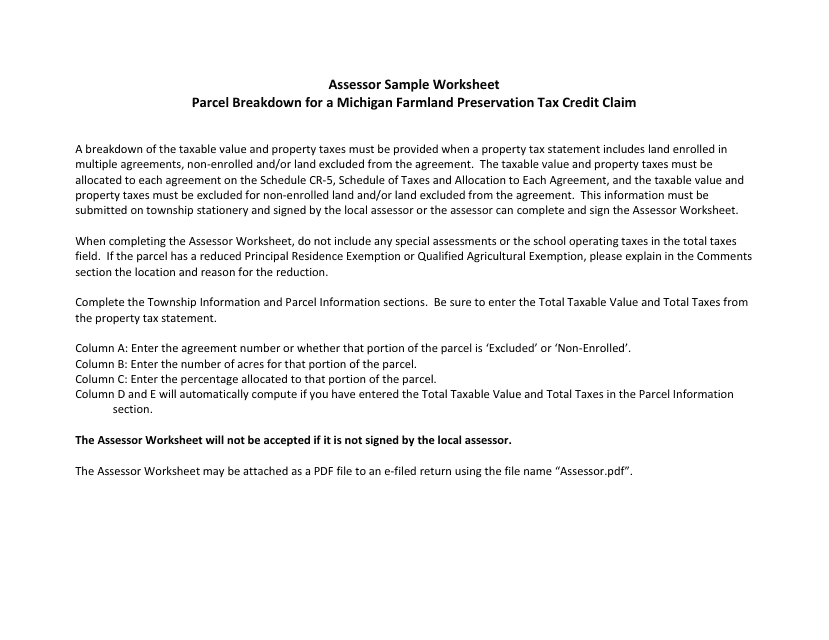

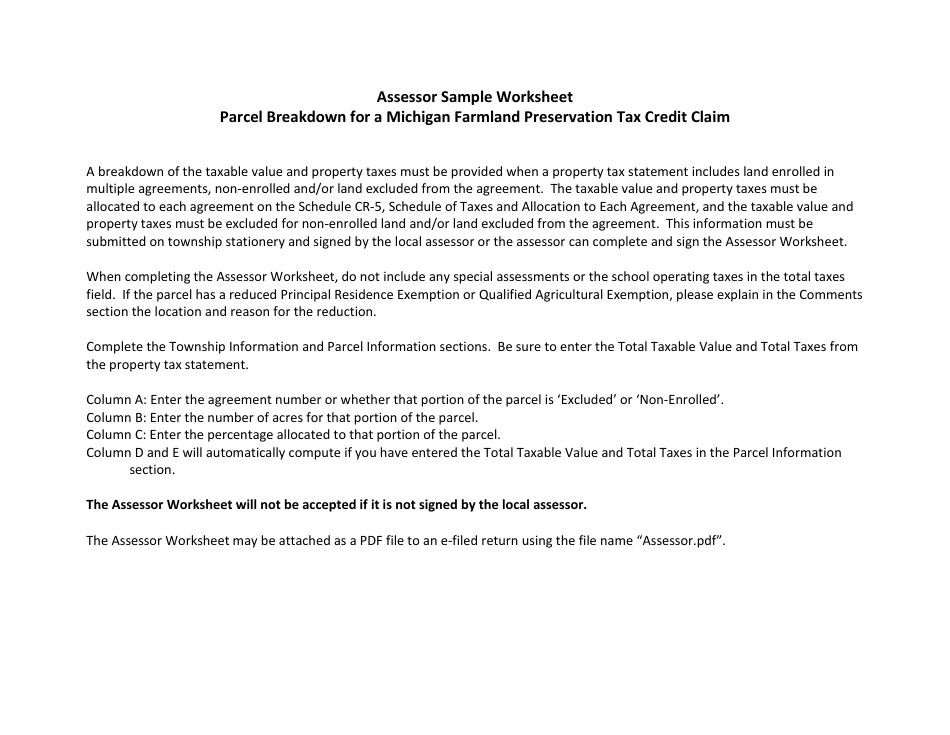

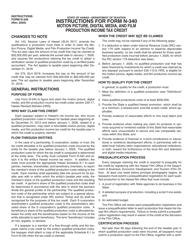

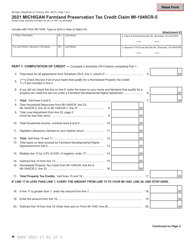

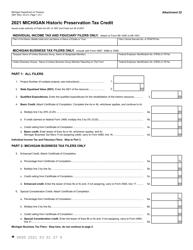

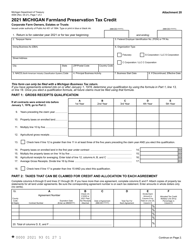

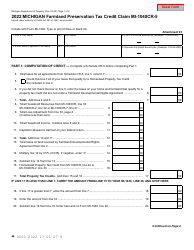

Instructions for Assessor Sample Worksheet Parcel Breakdown for a Michigan Farmland Preservation Tax Credit Claim - Michigan

This document was released by Michigan Department of Treasury and contains the most recent official instructions for Assessor Sample Worksheet Parcel Breakdown for a Michigan Tax Credit Claim .

FAQ

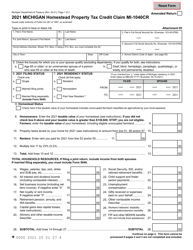

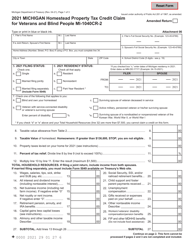

Q: What is the Assessor Sample Worksheet Parcel Breakdown?

A: The Assessor Sample Worksheet Parcel Breakdown is a document used for calculating the Michigan Farmland Preservation Tax Credit claim.

Q: What is the purpose of the Michigan Farmland Preservation Tax Credit?

A: The purpose of the Michigan Farmland Preservation Tax Credit is to provide a tax credit to qualifying landowners who preserve their farmland.

Q: How is the Assessor Sample Worksheet Parcel Breakdown used?

A: The Assessor Sample Worksheet Parcel Breakdown is used to determine the percentage of a parcel that qualifies for the farmland preservation tax credit.

Q: Who can claim the Michigan Farmland Preservation Tax Credit?

A: Qualifying landowners who preserve their farmland can claim the Michigan Farmland Preservation Tax Credit.

Q: What is the benefit of claiming the Michigan Farmland Preservation Tax Credit?

A: The benefit of claiming the Michigan Farmland Preservation Tax Credit is a reduction in property taxes.

Q: Are there any eligibility criteria for the Michigan Farmland Preservation Tax Credit?

A: Yes, there are eligibility criteria that landowners must meet in order to claim the Michigan Farmland Preservation Tax Credit.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Michigan Department of Treasury.