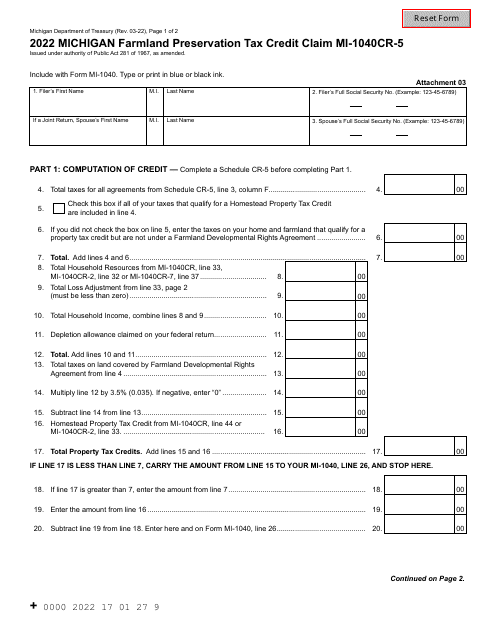

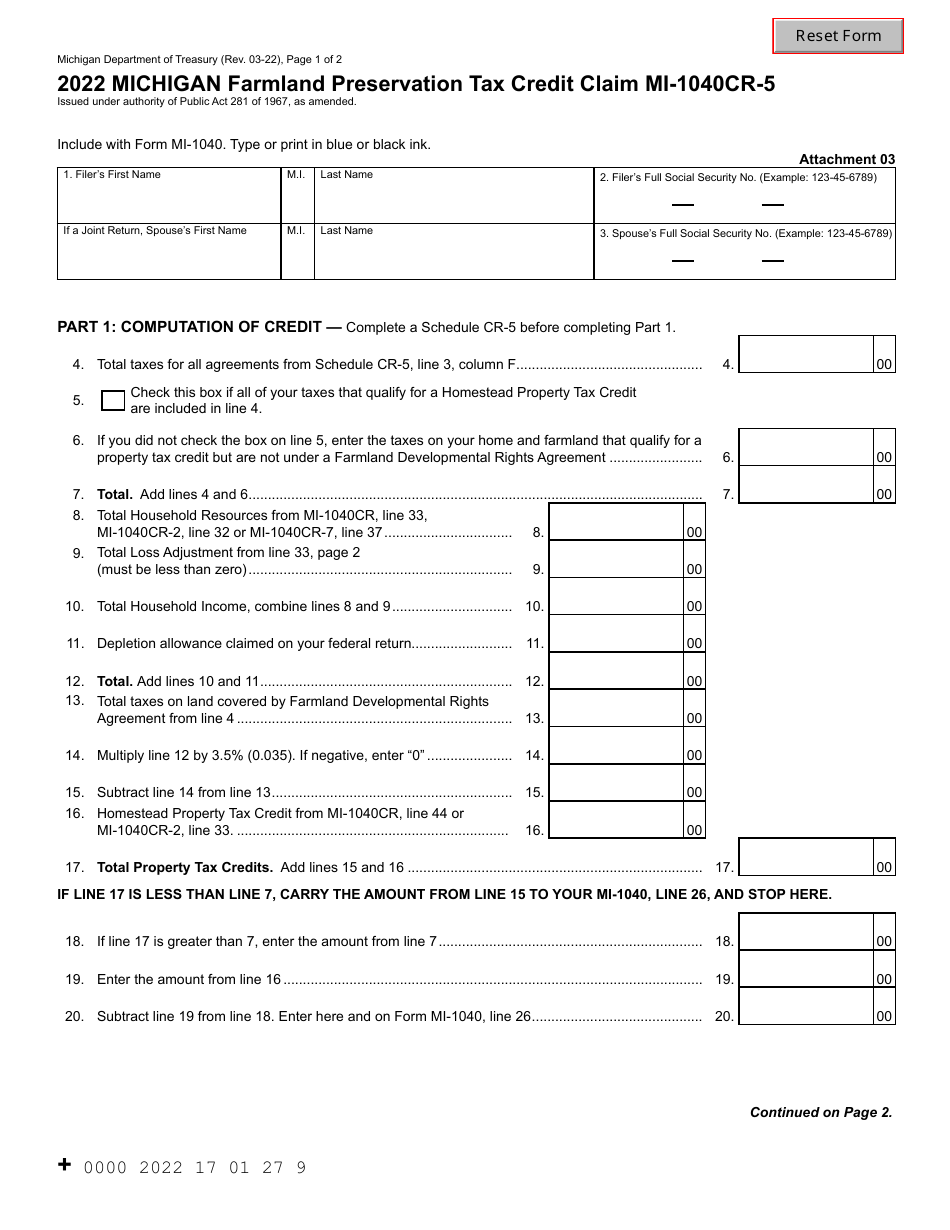

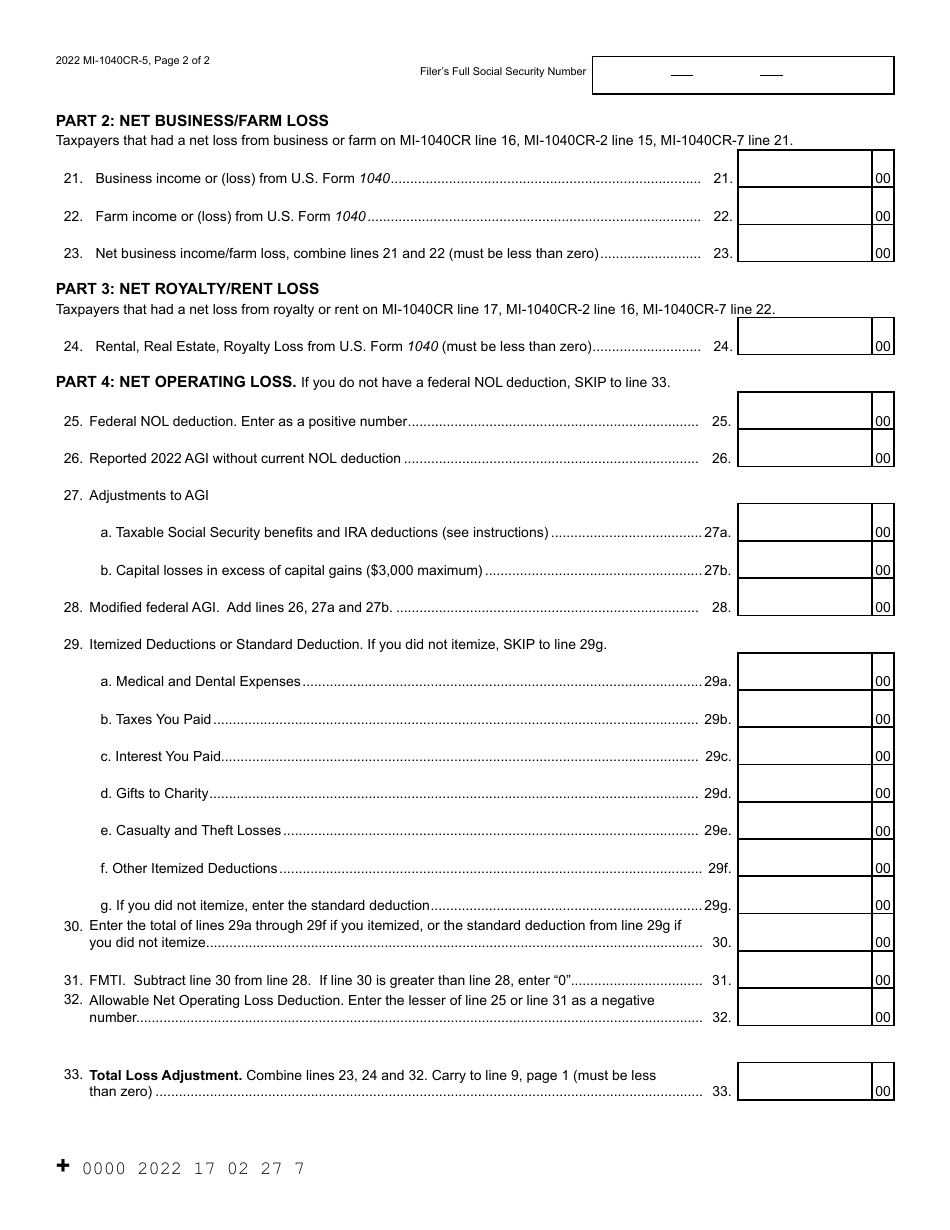

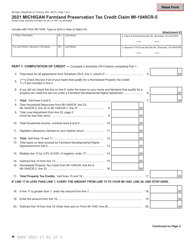

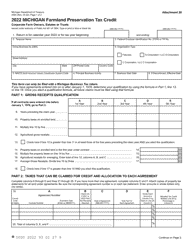

Form MI-1040CR-5 Michigan Farmland Preservation Tax Credit Claim - Michigan

What Is Form MI-1040CR-5?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MI-1040CR-5 form?

A: The MI-1040CR-5 form is used to claim the Farmland Preservation Tax Credit in Michigan.

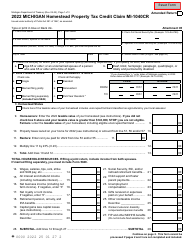

Q: What is the Farmland Preservation Tax Credit?

A: The Farmland Preservation Tax Credit is a tax credit in Michigan for landowners who actively engage in agricultural production.

Q: Who is eligible to claim the Farmland Preservation Tax Credit?

A: Landowners who meet the requirements for agricultural production and participate in a farmland preservation program are eligible to claim the credit.

Q: What are the requirements for agricultural production?

A: To qualify for the Farmland Preservation Tax Credit, landowners must engage in activities such as crop production, livestock raising, or forestry.

Q: What is a farmland preservation program?

A: A farmland preservation program is a government initiative that aims to protect and preserve agricultural land for future generations.

Q: How much is the Farmland Preservation Tax Credit?

A: The amount of the tax credit varies depending on the individual's annual allowable expenses and the total amount of available credits.

Q: How do I claim the Farmland Preservation Tax Credit?

A: To claim the credit, you need to complete the MI-1040CR-5 form and include it with your Michigan individual income tax return.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040CR-5 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.