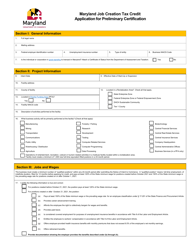

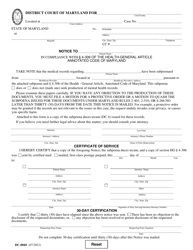

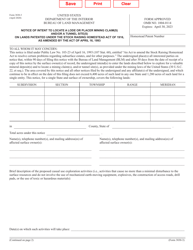

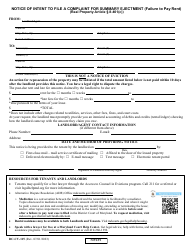

Sample Notice of Intent to Qualify for the Maryland Job Creation Tax Credit - Maryland

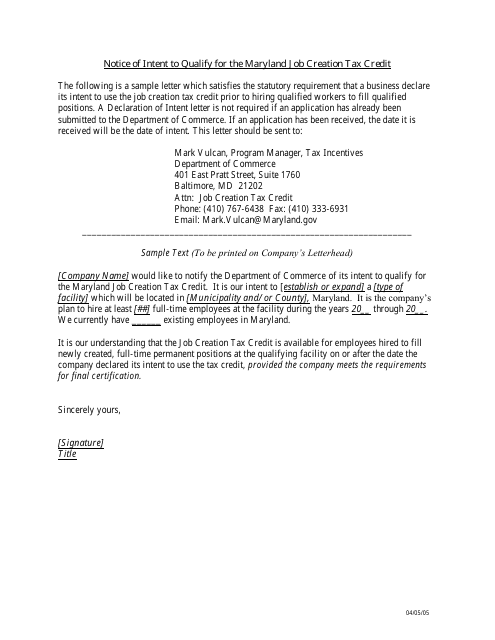

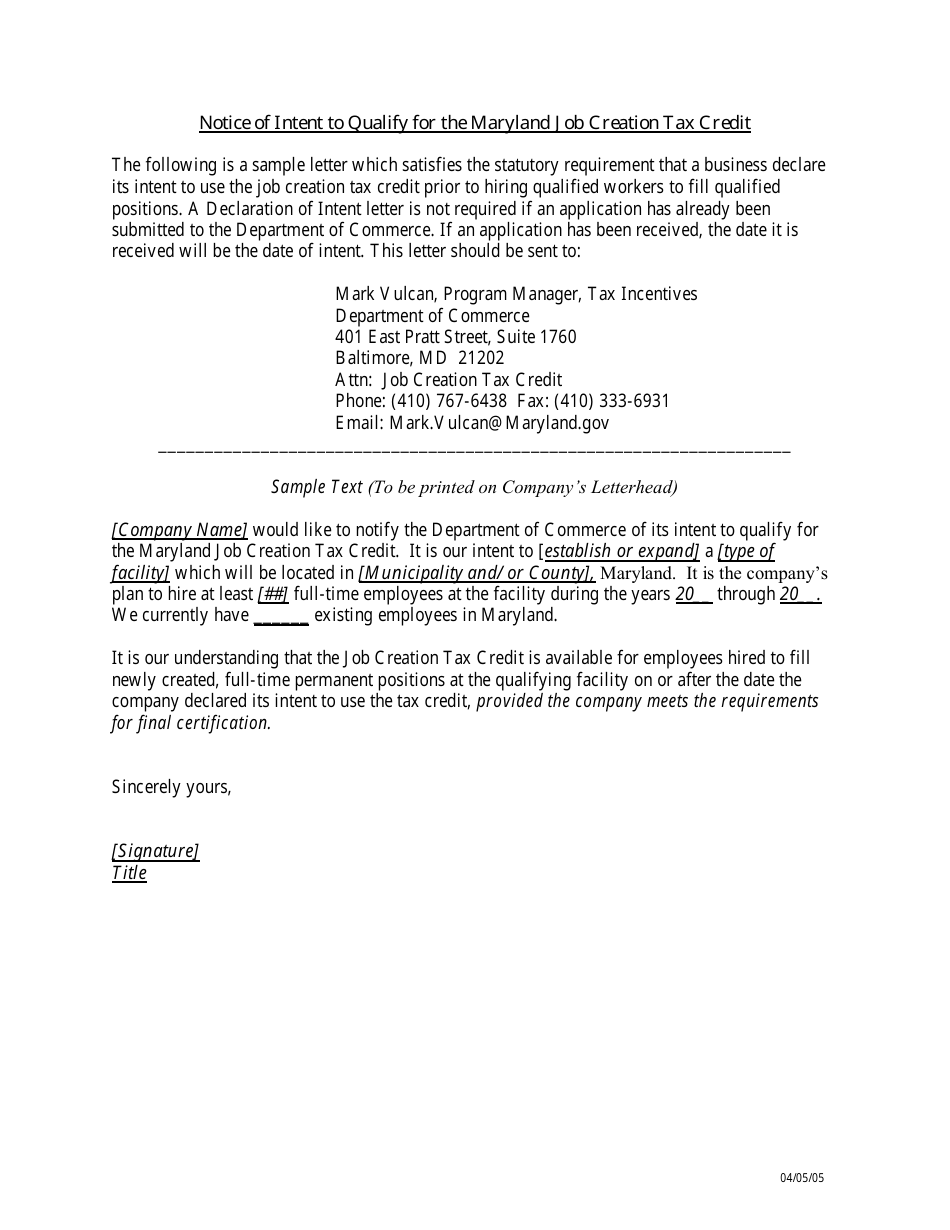

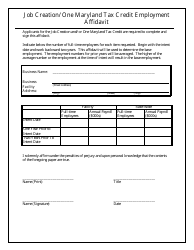

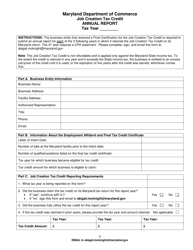

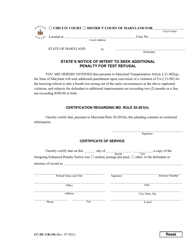

Notice of Intent to Qualify for the Maryland Job Creation Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

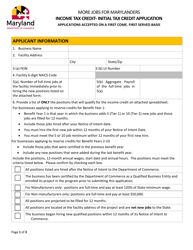

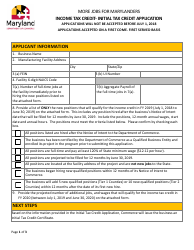

Q: What is the Maryland Job Creation Tax Credit?

A: The Maryland Job Creation Tax Credit is a tax credit offered by the State of Maryland to businesses that create new jobs in the state.

Q: Who is eligible for the Maryland Job Creation Tax Credit?

A: Businesses that create qualified new positions in Maryland may be eligible for the tax credit.

Q: How much is the Maryland Job Creation Tax Credit?

A: The tax credit is typically 3% of wages paid to qualified employees for a specified number of years.

Q: What are the requirements to qualify for the Maryland Job Creation Tax Credit?

A: To qualify, businesses must create a certain number of new positions, pay wages above the state or county average, and meet certain industry-specific requirements.

Q: How do businesses apply for the Maryland Job Creation Tax Credit?

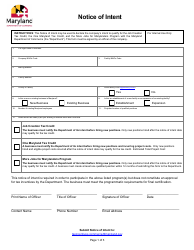

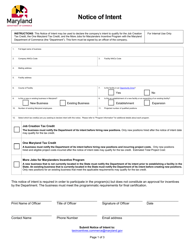

A: Businesses can apply for the tax credit by submitting a Notice of Intent to Qualify form to the Maryland Department of Commerce.

Q: What is the purpose of the Notice of Intent to Qualify?

A: The Notice of Intent to Qualify is a form that businesses use to officially declare their intention to qualify for the Maryland Job Creation Tax Credit.

Q: What information is required in the Notice of Intent to Qualify?

A: The form requires information such as the business name, address, number of new positions to be created, and estimated wages of the new positions.

Q: Are there any deadlines for submitting the Notice of Intent to Qualify?

A: Yes, businesses must submit the Notice of Intent to Qualify before the first day of the tax year for which the tax credit is being claimed.

Q: What happens after a business submits the Notice of Intent to Qualify?

A: After submitting the form, the Maryland Department of Commerce will review the application and notify the business of its eligibility for the tax credit.

Q: Can businesses claim the Maryland Job Creation Tax Credit for part-time positions?

A: No, the tax credit is only available for full-time positions that meet the specified wage requirements.

Form Details:

- Released on April 5, 2005;

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.