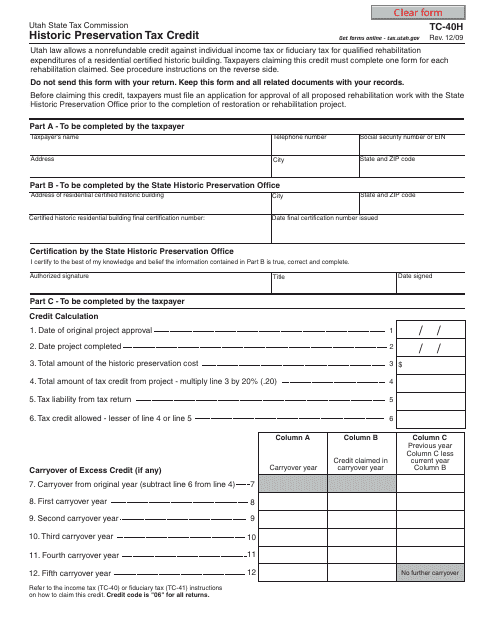

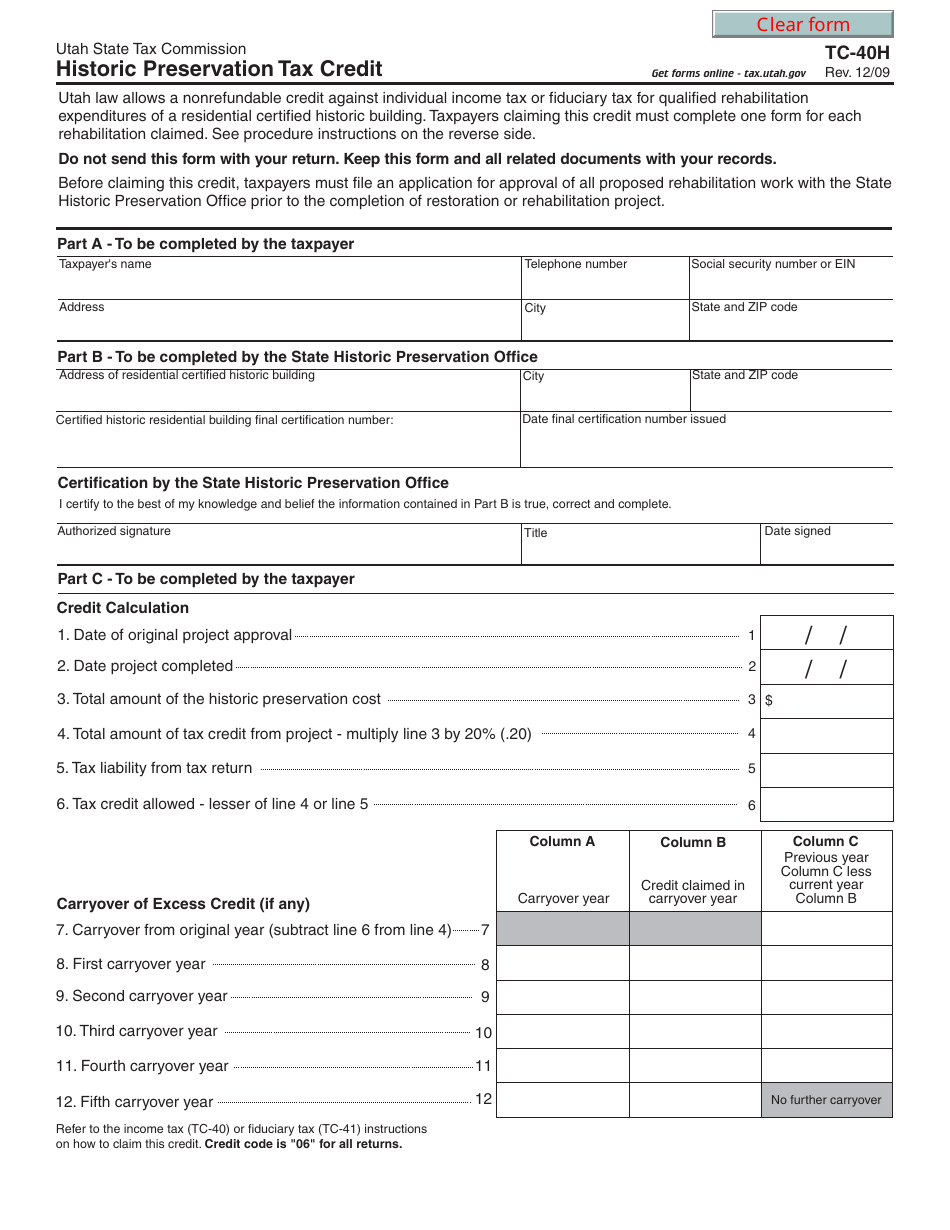

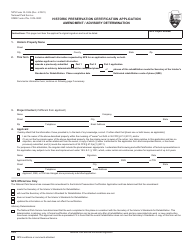

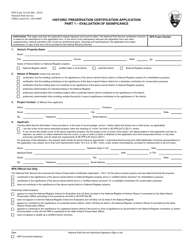

Form TC-40H Historic Preservation Tax Credit - Utah

What Is Form TC-40H?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-40H?

A: Form TC-40H is the Historic PreservationTax Credit form for Utah.

Q: What is the purpose of Form TC-40H?

A: The purpose of Form TC-40H is to claim the Historic Preservation Tax Credit in Utah.

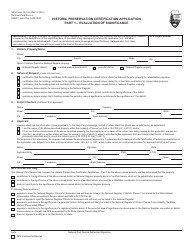

Q: Who is eligible to use Form TC-40H?

A: Property owners who have completed qualified historic preservation projects in Utah are eligible to use Form TC-40H.

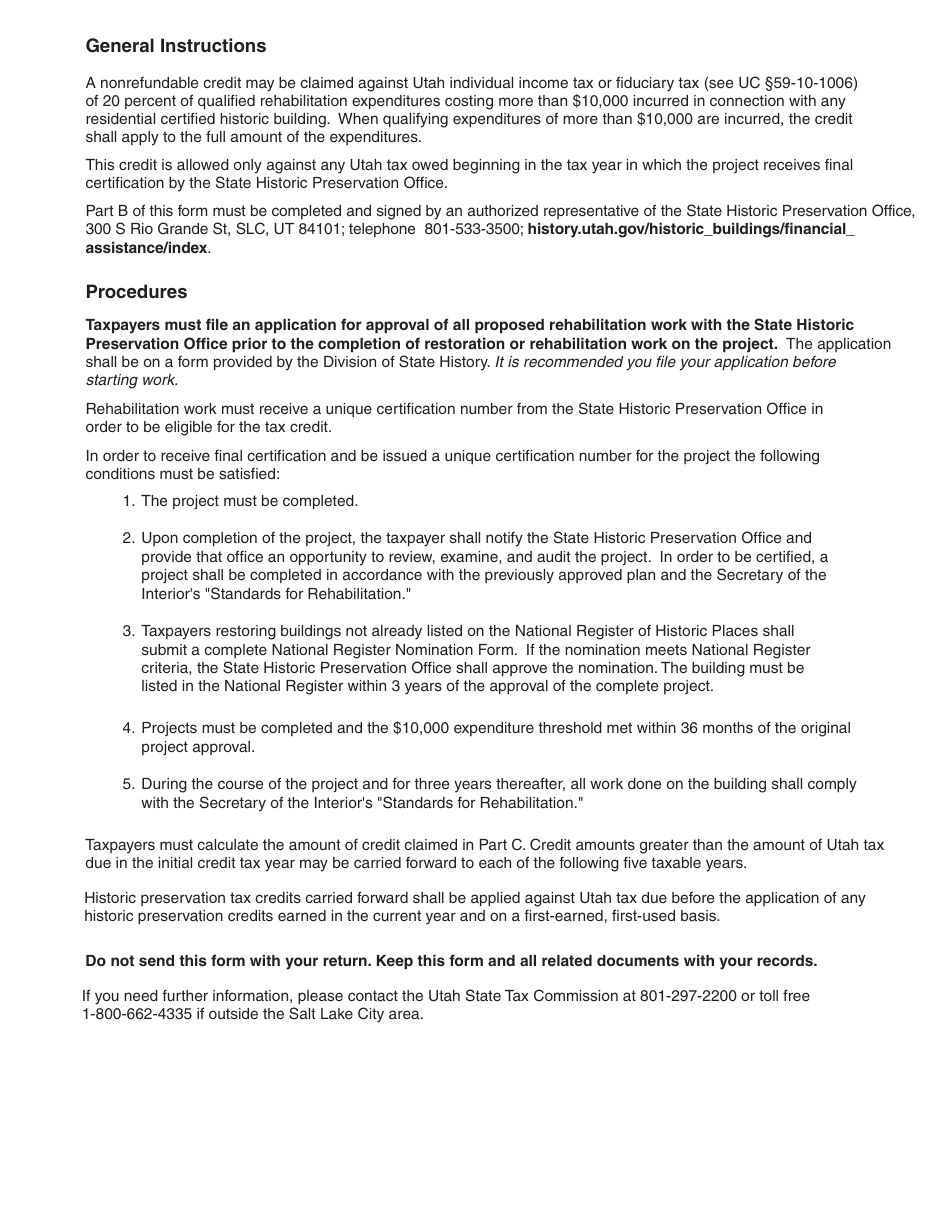

Q: What is the Historic Preservation Tax Credit?

A: The Historic Preservation Tax Credit is a tax incentive program in Utah that provides financial incentives for the rehabilitation and preservation of historic properties.

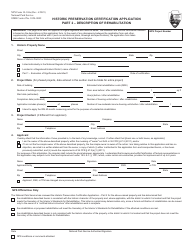

Q: How do I complete Form TC-40H?

A: To complete Form TC-40H, you will need to provide information about the historic property, the rehabilitation project, and the expenses incurred.

Q: What documentation do I need to submit with Form TC-40H?

A: You will need to submit documentation such as photographs, architectural plans, and receipts to support your claim on Form TC-40H.

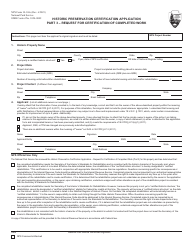

Q: What is the deadline for filing Form TC-40H?

A: The deadline for filing Form TC-40H is the same as the deadline for filing your Utah state income tax return.

Q: Can I claim the Historic Preservation Tax Credit on my federal tax return?

A: No, the Historic Preservation Tax Credit in Utah is specific to the state and cannot be claimed on your federal tax return.

Q: Are there any limitations on the amount of the Historic Preservation Tax Credit that can be claimed?

A: Yes, there are certain limitations on the amount of the Historic Preservation Tax Credit that can be claimed, including a maximum credit of $500,000 per project.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40H by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.