Claiming Tax Credits Templates

Are you eligible for tax credits? Do you know how to make a claim for these credits? Look no further, as we have the information you need to navigate through the process of claiming tax credits. Whether you refer to it as claiming tax credits or tax credit claim, our collection of documents provides detailed instructions and forms for various types of tax credits.

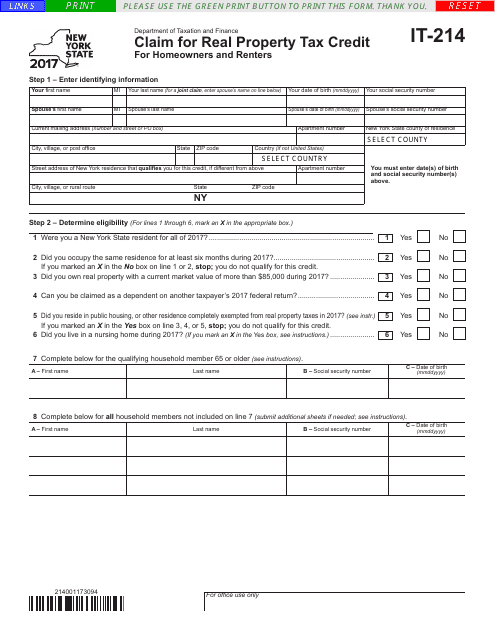

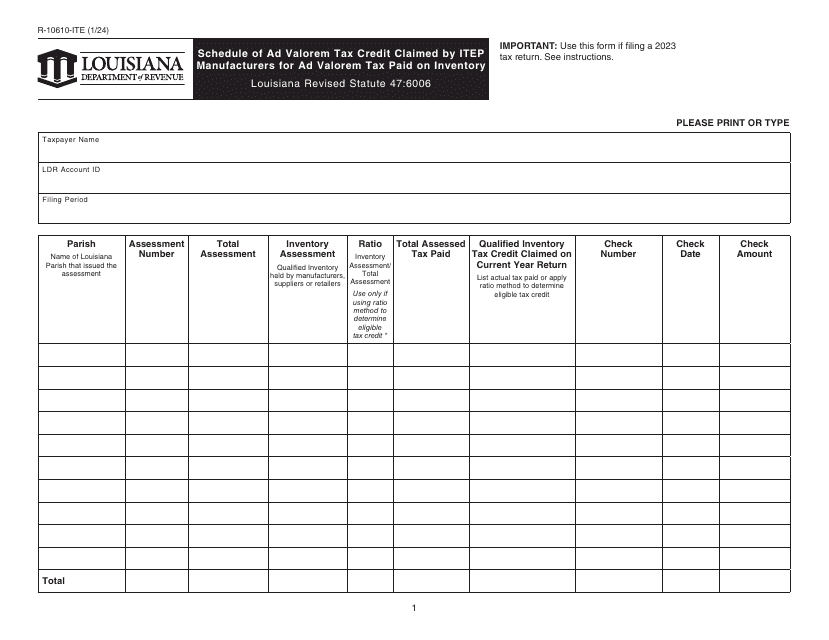

One of the documents in our collection is the Form IT-214 Claim for Real Property Tax Credit from New York. This form is specifically designed for individuals looking to claim a tax credit for real propertytaxes paid. Similarly, the Form R-10610-ITE Schedule of Ad Valorem Tax Credit Claimed by Itepmanufacturers for Ad Valorem Tax Paid on Inventory from Louisiana is geared towards manufacturers who want to claim a tax credit for ad valorem tax expenses on inventory.

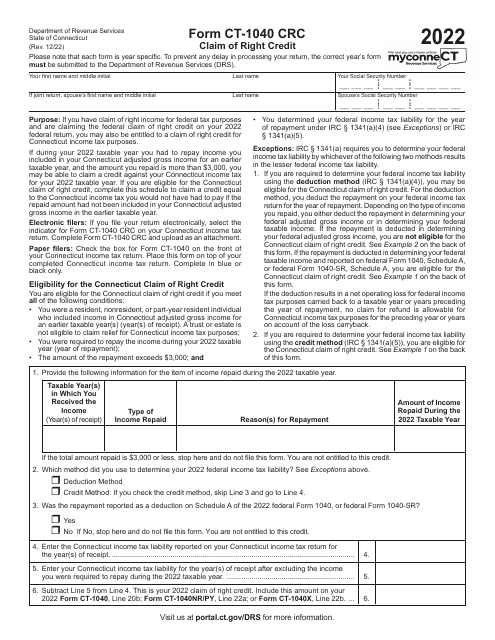

For Connecticut residents, the Form CT-1040 CRC Claim of Right Credit is the go-to form for claiming a credit referred to as the Claim of Right Credit. This credit applies to those who have had to return previously reported income due to litigation or other circumstances.

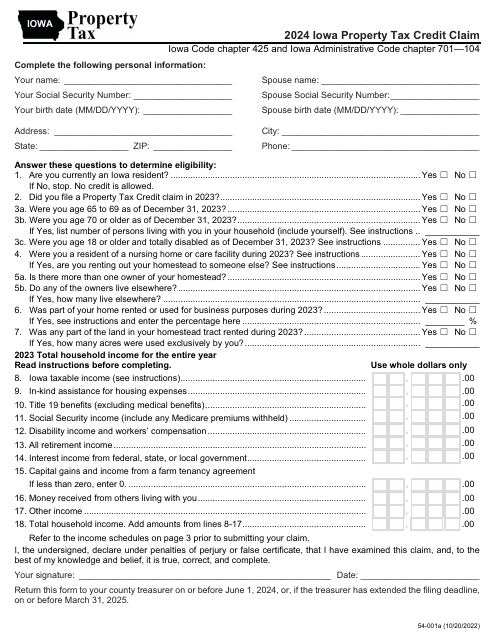

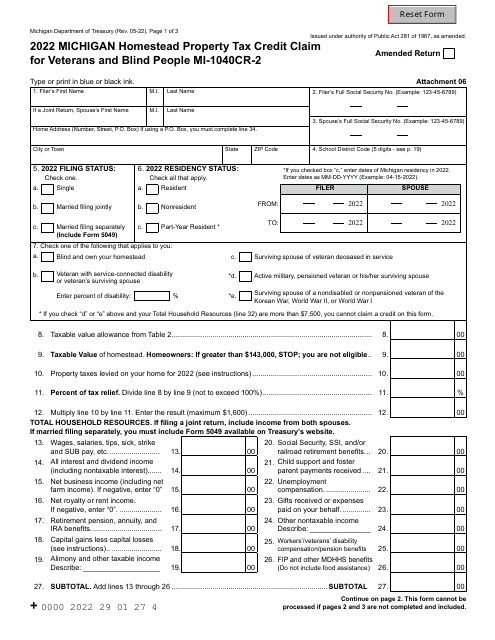

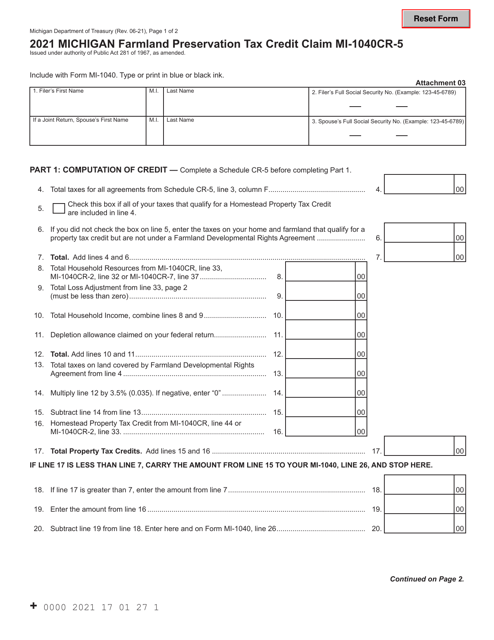

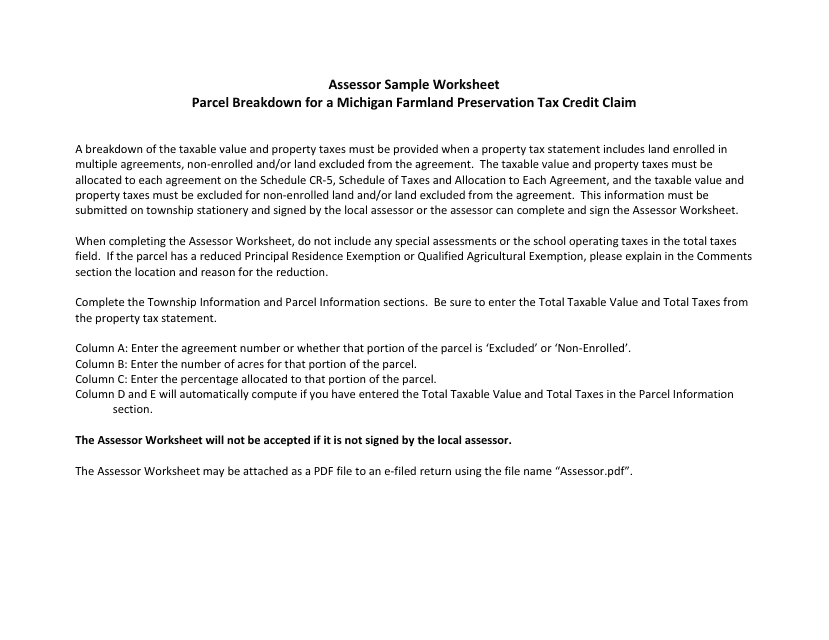

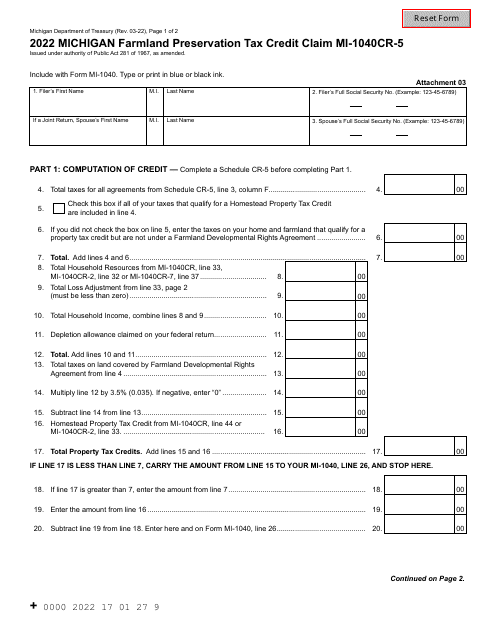

Another document in our collection is the Iowa Property Tax Credit Claim, also known as Form 54-001. This form is specific to Iowa residents seeking to claim a property tax credit. Additionally, we offer instructions for the Assessor Sample Worksheet Parcel Breakdown for a Michigan Farmland Preservation Tax Credit Claim. This document provides guidance on how to calculate and claim a tax credit for preserving farmland in Michigan.

No matter what type of tax credit you are looking to claim, our comprehensive collection of documents provides the information and resources you need. Don't miss out on the opportunity to maximize your tax savings. Explore our library of tax credit claim documents today.

Documents:

12

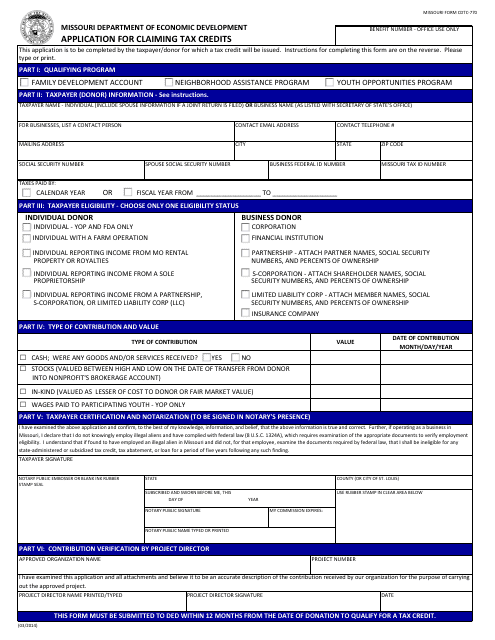

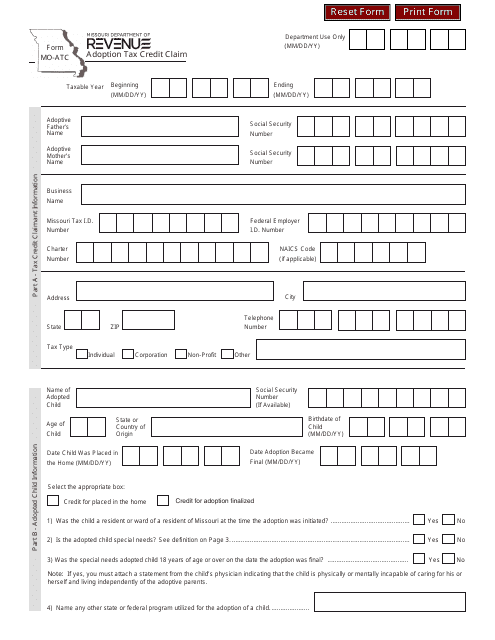

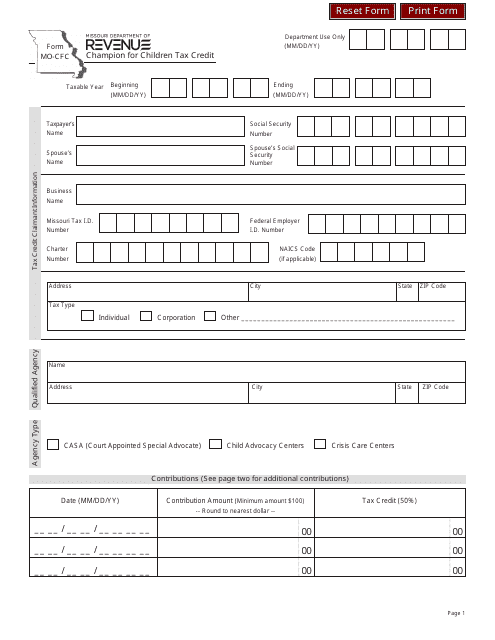

This Form is used for applying for tax credits in the state of Missouri.

This form is used for claiming a real property tax credit in New York. It allows residents to receive a credit for the taxes they paid on their residential property.

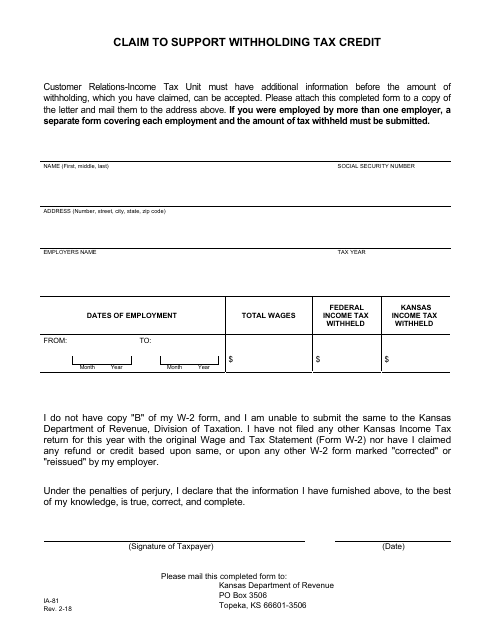

This Form is used for residents of Kansas to claim a withholding tax credit.

This document is for claiming the Michigan Farmland Preservation Tax Credit in Michigan. It is used to apply for tax credits for preserving farmland in the state.

This document provides instructions on how to fill out the Assessor Sample Worksheet Parcel Breakdown for a Michigan Farmland Preservation Tax Credit Claim. It is a helpful resource for individuals looking to claim the tax credit for farmland preservation in Michigan.

This form is used for claiming the Farmland Preservation Tax Credit in Michigan.