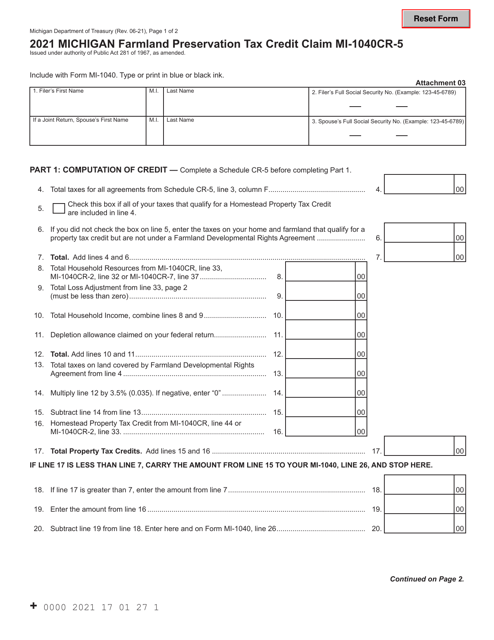

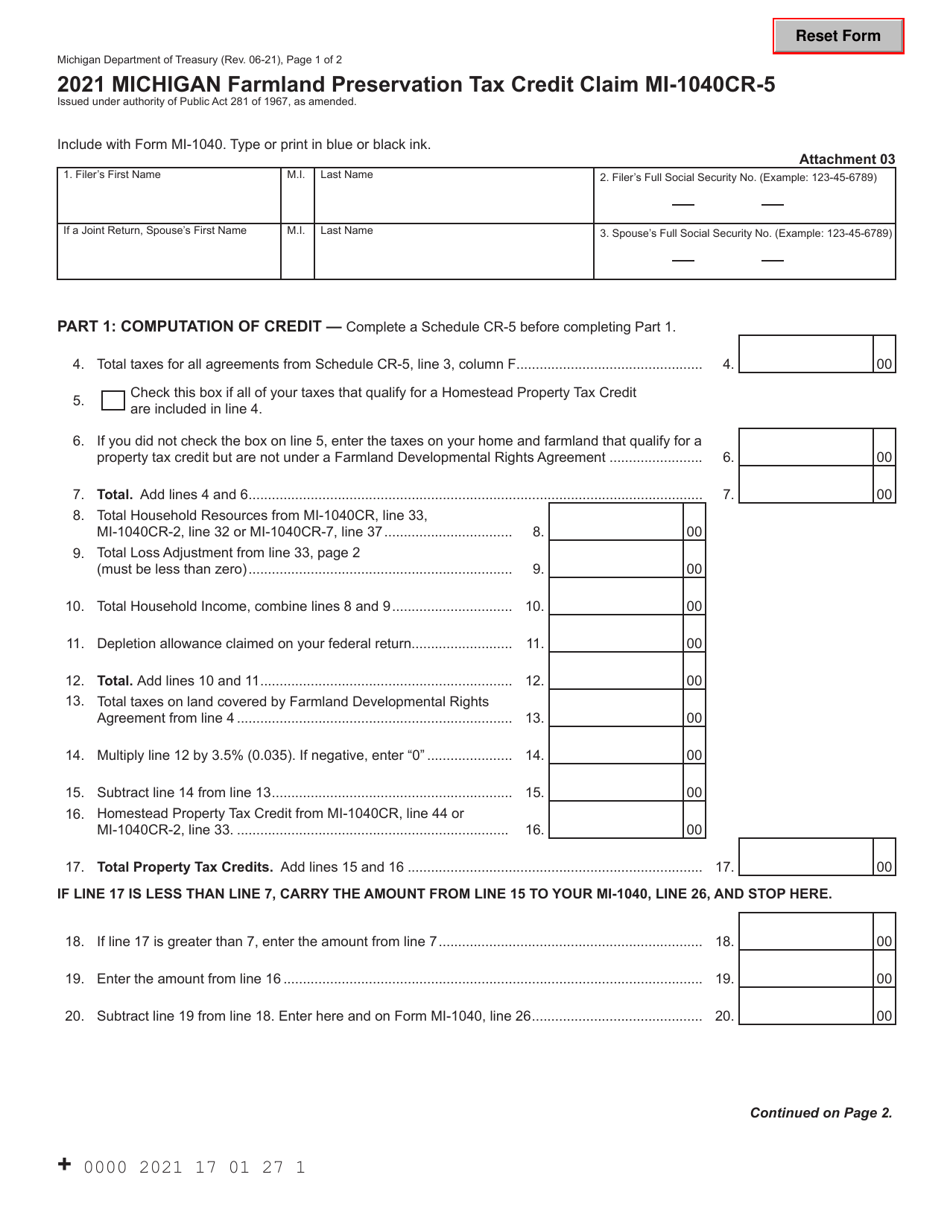

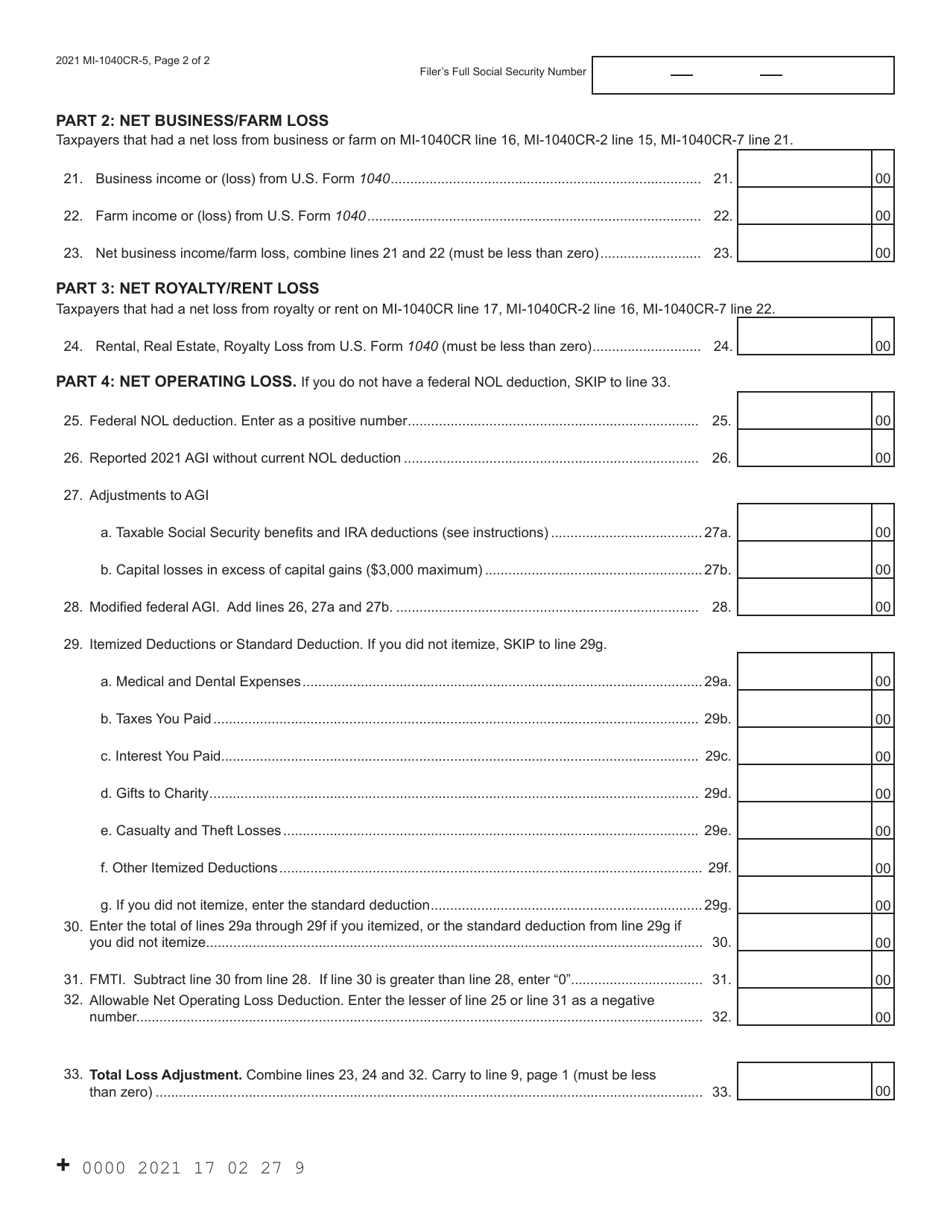

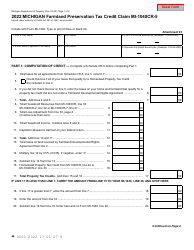

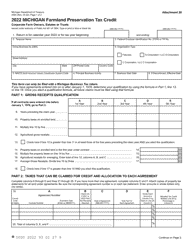

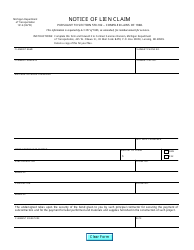

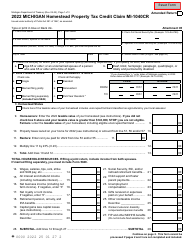

Form MI1040CR-5 Michigan Farmland Preservation Tax Credit Claim - Michigan

What Is Form MI1040CR-5?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form MI-1040CR-5?

A: Form MI-1040CR-5 is used to claim the Farmland PreservationTax Credit in Michigan.

Q: What is the Farmland Preservation Tax Credit?

A: The Farmland Preservation Tax Credit is a tax incentive for qualifying farmland owners in Michigan.

Q: Who is eligible to claim the Farmland Preservation Tax Credit?

A: Farmers and farmland owners in Michigan who meet certain criteria are eligible to claim the Farmland Preservation Tax Credit.

Q: What are the requirements to qualify for the Farmland Preservation Tax Credit?

A: To qualify for the Farmland Preservation Tax Credit, the farmland must meet specific criteria and the landowner must meet certain eligibility requirements set by the state of Michigan.

Q: How can I claim the Farmland Preservation Tax Credit?

A: To claim the Farmland Preservation Tax Credit, you need to file Form MI-1040CR-5 along with your Michigan income tax return (Form MI-1040).

Q: Is there a deadline for filing Form MI-1040CR-5?

A: Yes, the deadline for filing Form MI-1040CR-5 is the same as the deadline for filing your Michigan income tax return, which is usually April 15th.

Q: What should I do if I have questions or need assistance with Form MI-1040CR-5?

A: If you have questions or need assistance with Form MI-1040CR-5, you can contact the Michigan Department of Treasury or consult with a tax professional.

Q: Is the Farmland Preservation Tax Credit refundable?

A: No, the Farmland Preservation Tax Credit is non-refundable. It can only be used to offset your Michigan income tax liability.

Q: Can I carry forward any unused Farmland Preservation Tax Credit?

A: Yes, any unused Farmland Preservation Tax Credit can be carried forward for up to 10 years.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI1040CR-5 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.