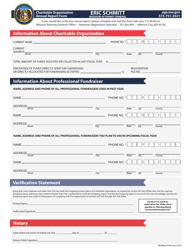

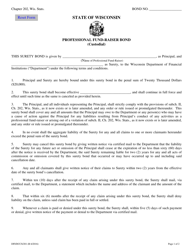

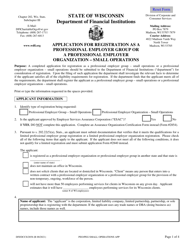

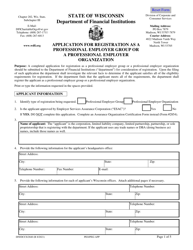

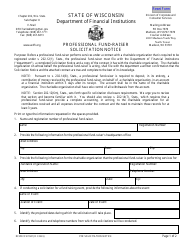

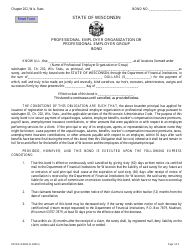

Instructions for Form DFI / DCCS / 308 Charitable Organization Annual Report - Wisconsin

This document contains official instructions for Form DFI/DCCS/308 , Charitable Organization Annual Report - a form released and collected by the Wisconsin Department of Financial Institutions.

FAQ

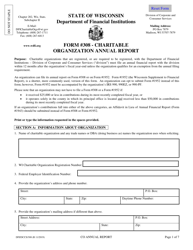

Q: Who needs to file Form DFI/DCCS/308?

A: Charitable organizations in Wisconsin.

Q: When is the deadline to file Form DFI/DCCS/308?

A: The annual report is due by the 15th day of the 5th month following the end of the organization's fiscal year.

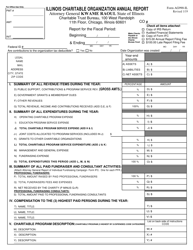

Q: What information is required on Form DFI/DCCS/308?

A: The form requires information about the organization's finances, activities, and board members.

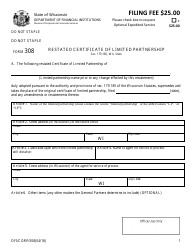

Q: Are there any fees associated with Form DFI/DCCS/308?

A: Yes, there is a filing fee that varies based on the organization's gross revenue.

Q: Is there a penalty for late filing?

A: Yes, there are late filing penalties for organizations that fail to submit the annual report on time.

Q: Can I request an extension to file Form DFI/DCCS/308?

A: Yes, you may request an extension before the original due date, but it must be approved by the Wisconsin Department of Financial Institutions.

Q: What happens if my organization does not file Form DFI/DCCS/308?

A: Failure to file the annual report may result in the revocation of the organization's charitable solicitation registration in Wisconsin.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Financial Institutions.