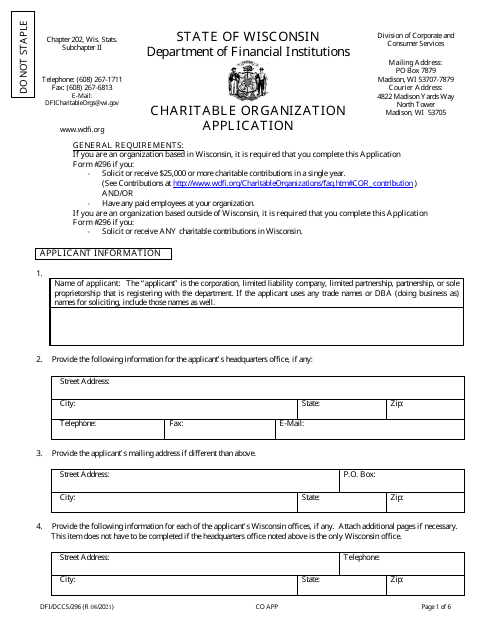

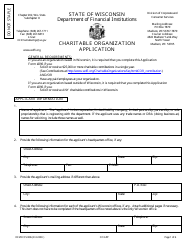

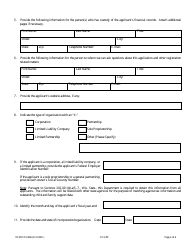

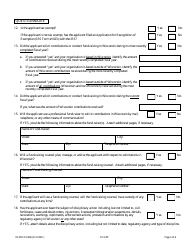

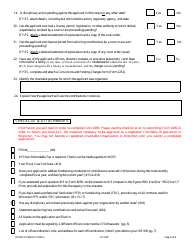

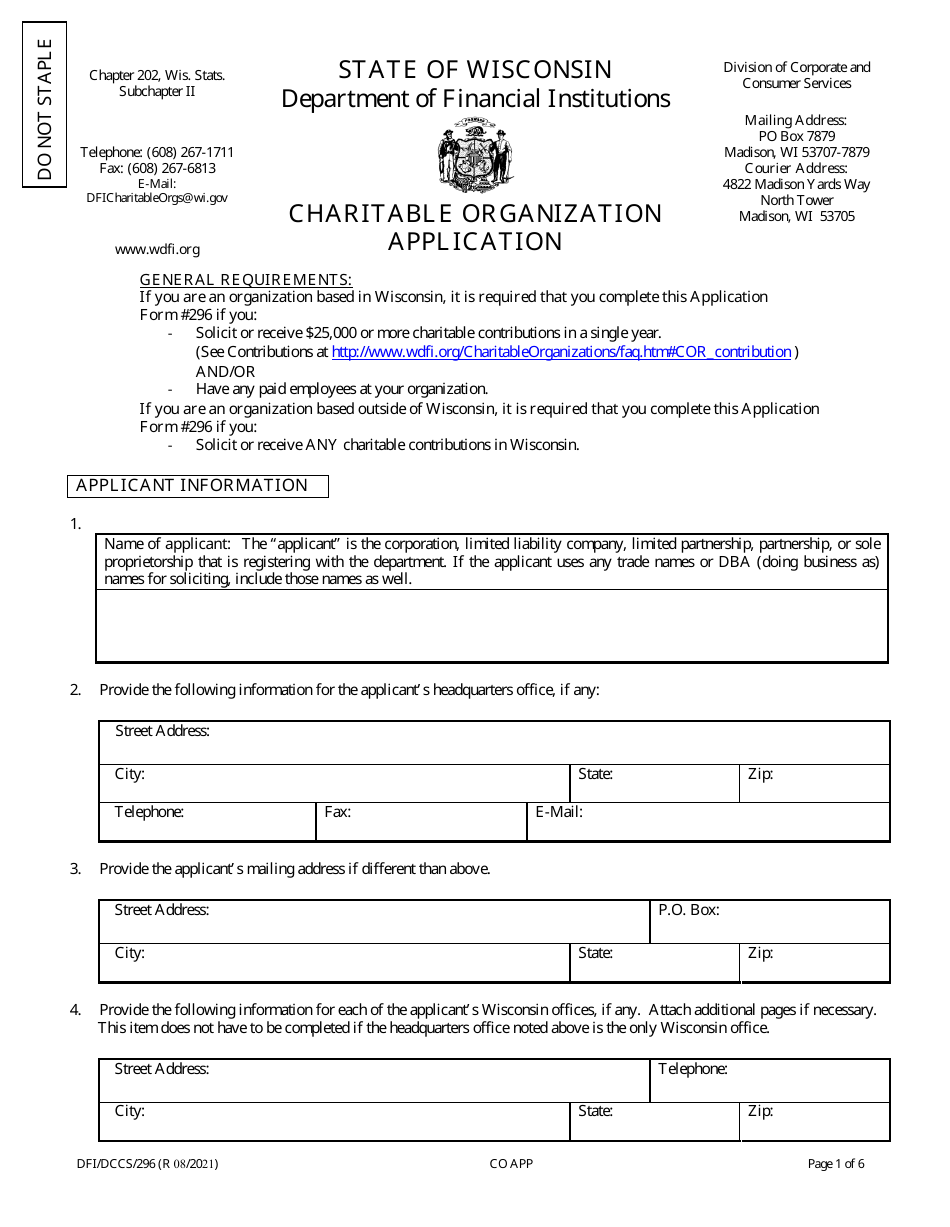

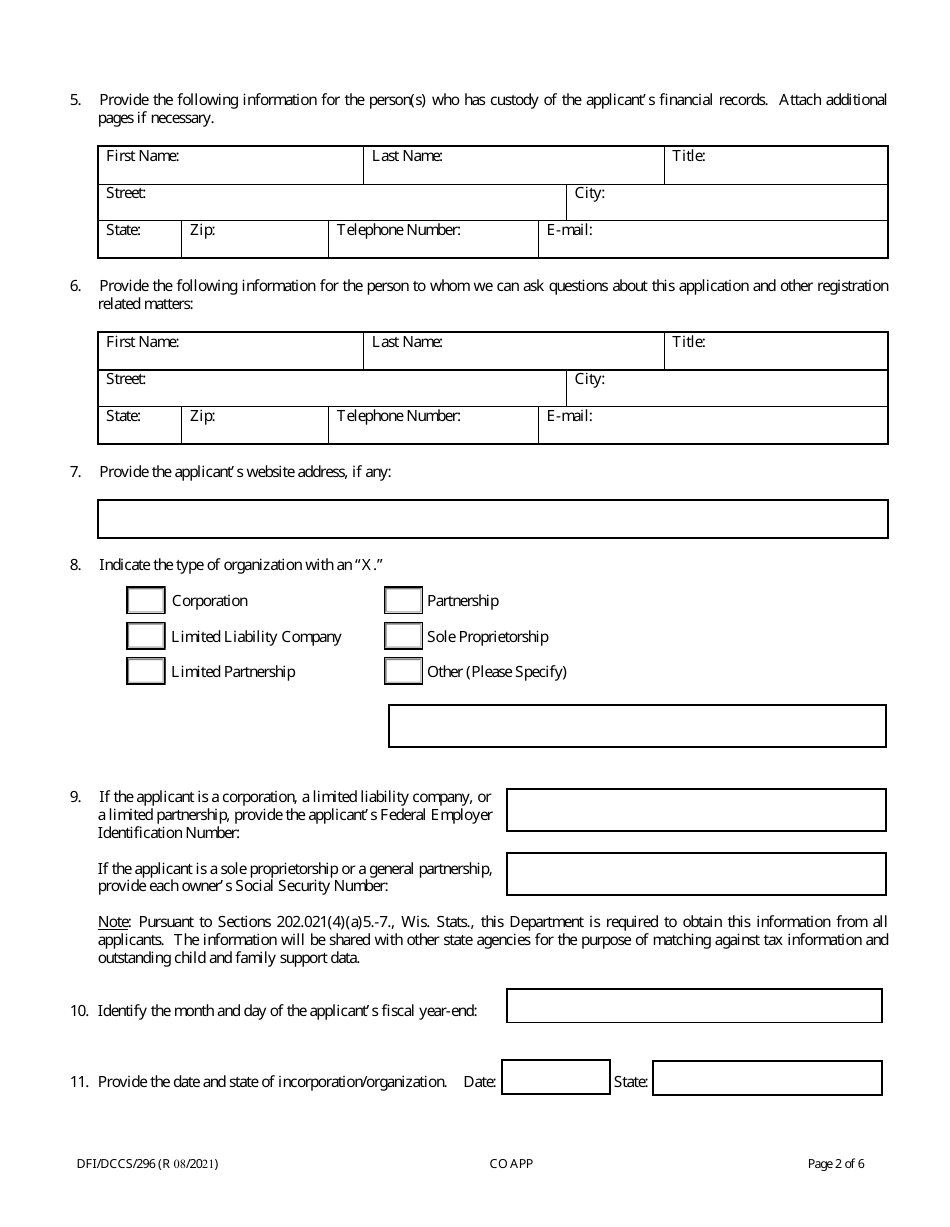

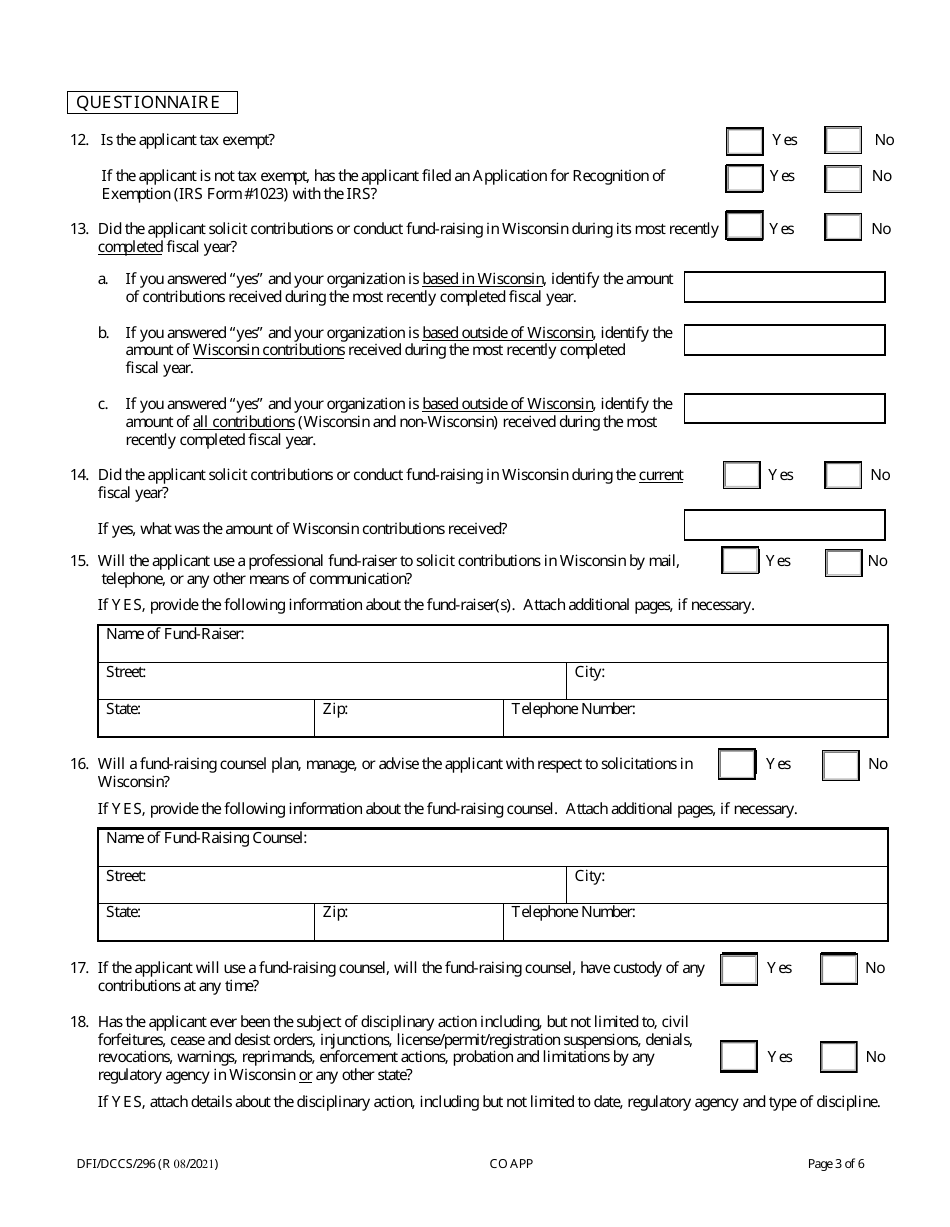

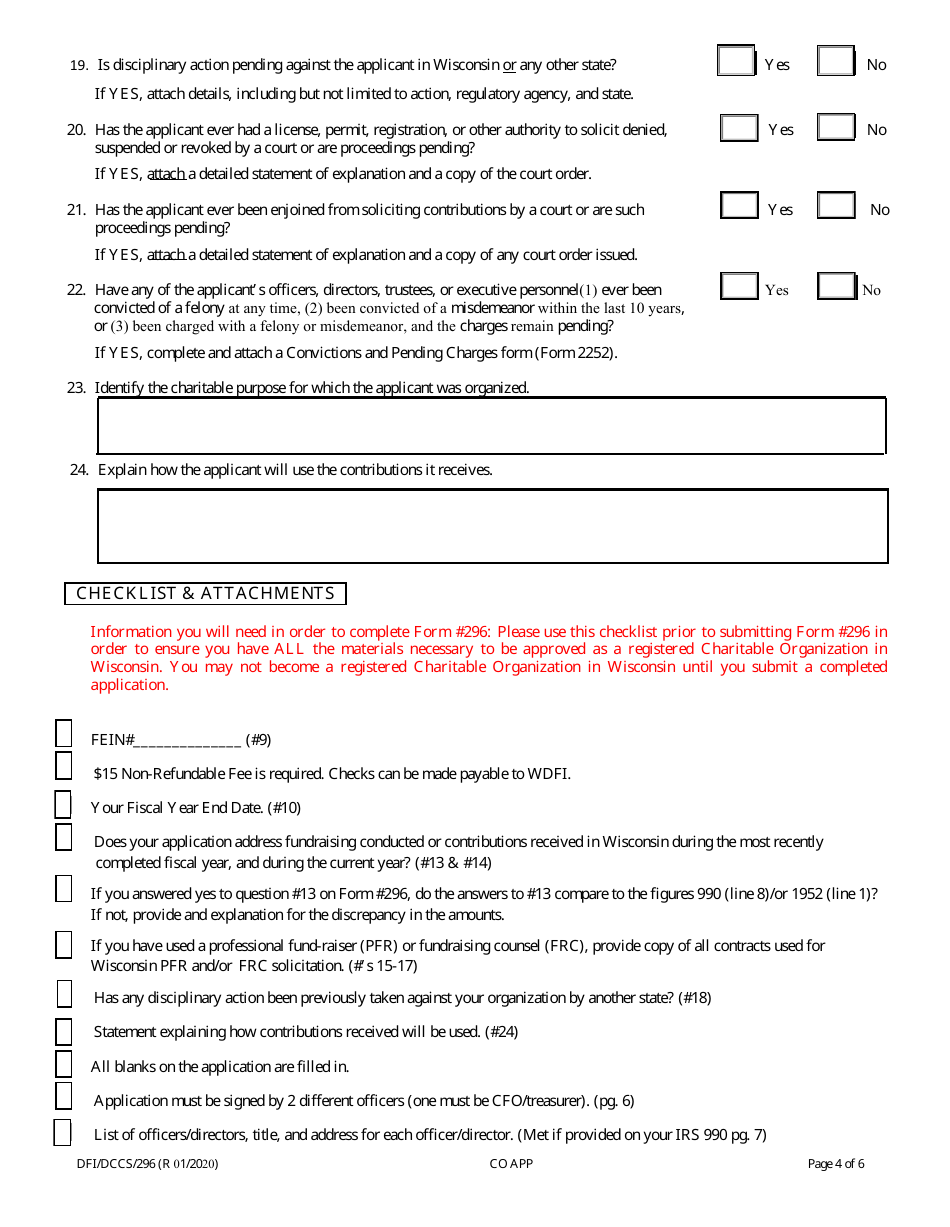

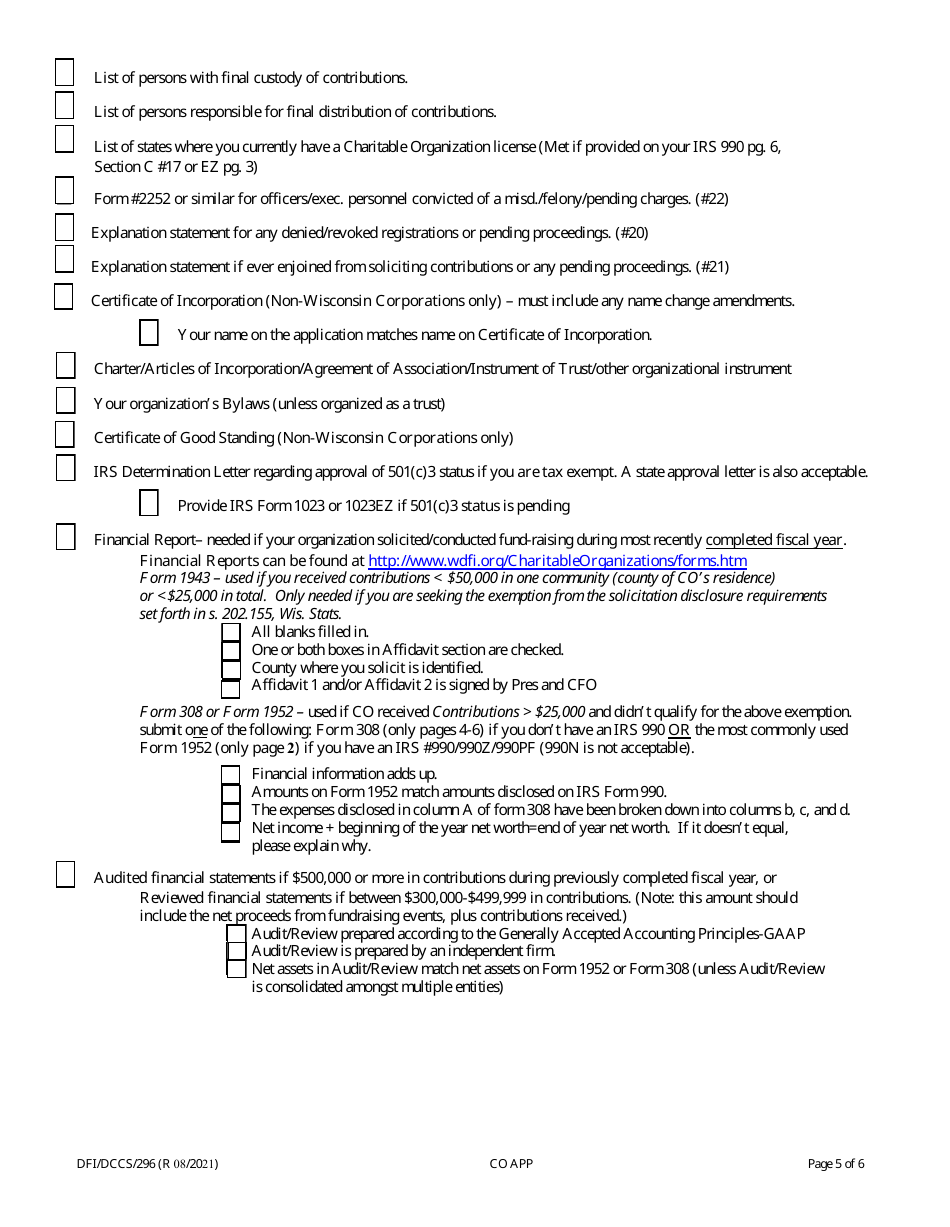

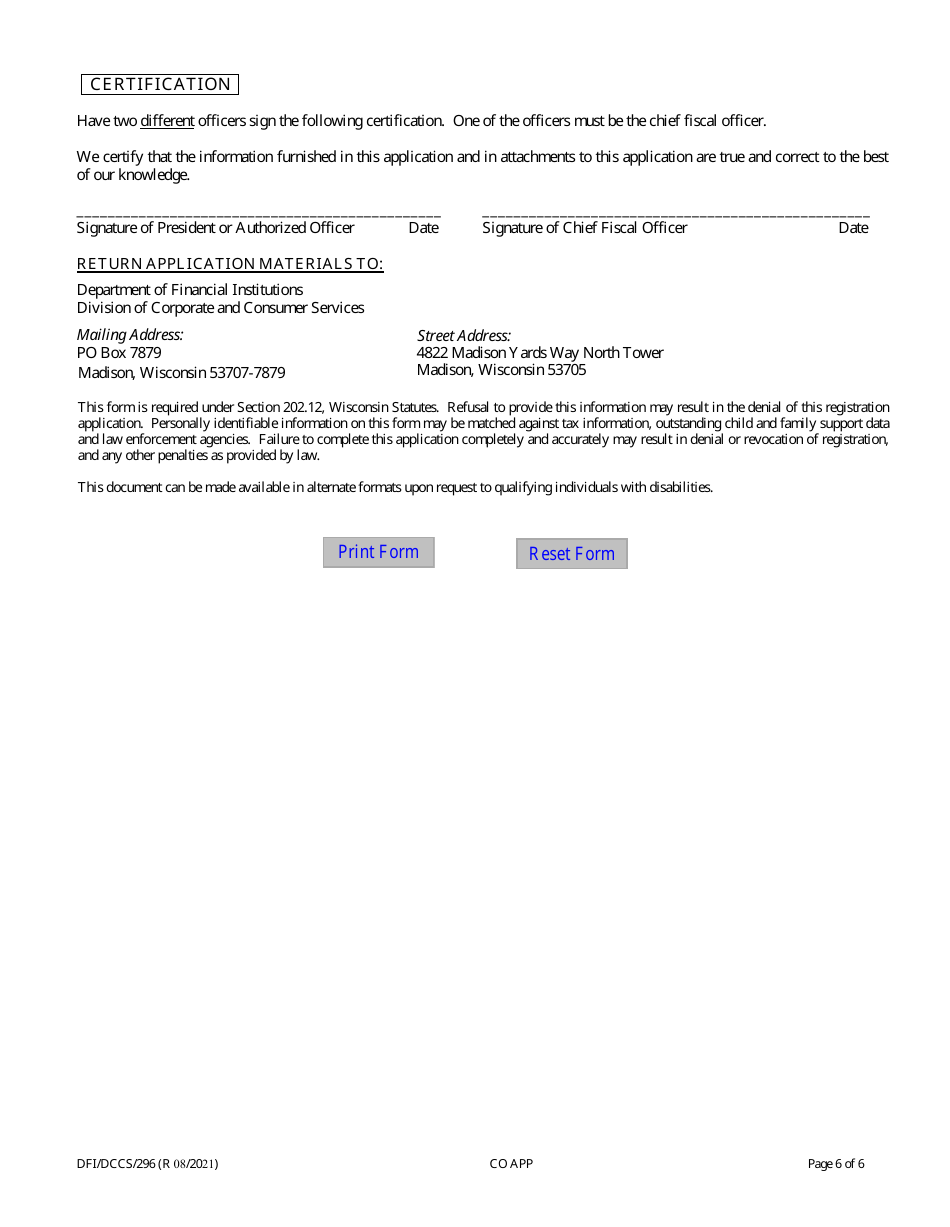

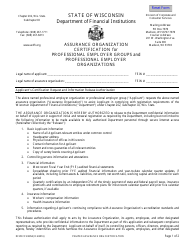

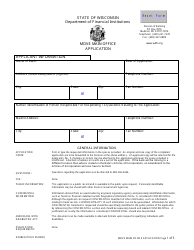

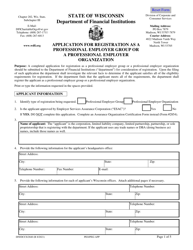

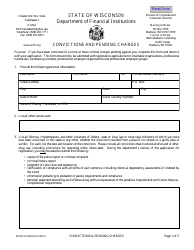

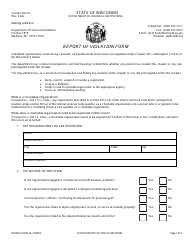

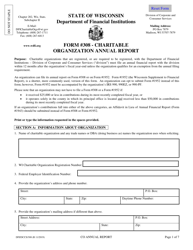

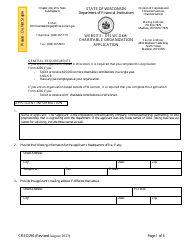

Form DFI / DCCS / 296 Charitable Organization Application - Wisconsin

What Is Form DFI/DCCS/296?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DFI/DCCS/296?

A: Form DFI/DCCS/296 is the application for charitable organizations in Wisconsin.

Q: What is a charitable organization?

A: A charitable organization is a nonprofit organization that aims to benefit the public or specific individuals in need.

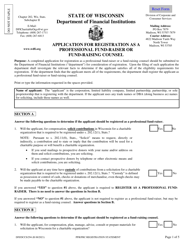

Q: Who needs to complete Form DFI/DCCS/296?

A: Charitable organizations operating in Wisconsin need to complete this form.

Q: What is the purpose of Form DFI/DCCS/296?

A: The purpose of this form is to gather information about the charitable organization's activities and financials.

Q: Are there any fees associated with filing Form DFI/DCCS/296?

A: Yes, there is a filing fee that needs to be paid along with the submission of the form.

Q: Is there a deadline for submitting Form DFI/DCCS/296?

A: Yes, charitable organizations in Wisconsin must submit this form annually by a specific deadline.

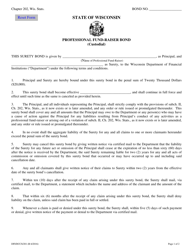

Q: What happens after I submit Form DFI/DCCS/296?

A: Once the form is submitted, it will be reviewed by the Wisconsin Department of Financial Institutions for compliance.

Q: Can I make changes to Form DFI/DCCS/296 after submission?

A: No, changes cannot be made to the form after it has been submitted. However, amendments can be filed if necessary.

Q: What happens if I don't submit Form DFI/DCCS/296?

A: Failure to submit this form or comply with the requirements may result in penalties or loss of charitable status for the organization.

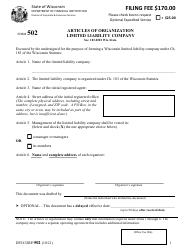

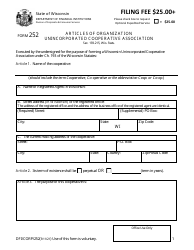

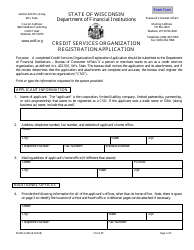

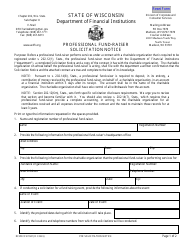

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFI/DCCS/296 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.