Instructions for IRS Form 8973 Certified Professional Employer Organization / Customer Reporting Agreement

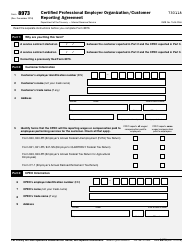

This document contains official instructions for IRS Form 8973 , Certified Professional Employer Organization/Customer Reporting Agreement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8973 is available for download through this link.

FAQ

Q: What is IRS Form 8973?

A: IRS Form 8973 is the Certified Professional Employer Organization/Customer Reporting Agreement.

Q: Who needs to fill out IRS Form 8973?

A: Certified Professional Employer Organizations (CPEOs) and their customers need to fill out IRS Form 8973.

Q: What is the purpose of IRS Form 8973?

A: IRS Form 8973 is used to establish the reporting responsibilities between the CPEO and its customers.

Q: Do I need to file IRS Form 8973 if I am not a CPEO?

A: No, IRS Form 8973 is only required for Certified Professional Employer Organizations and their customers.

Q: Are there any fees associated with filing IRS Form 8973?

A: No, there are no fees associated with filing IRS Form 8973.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.