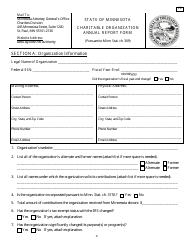

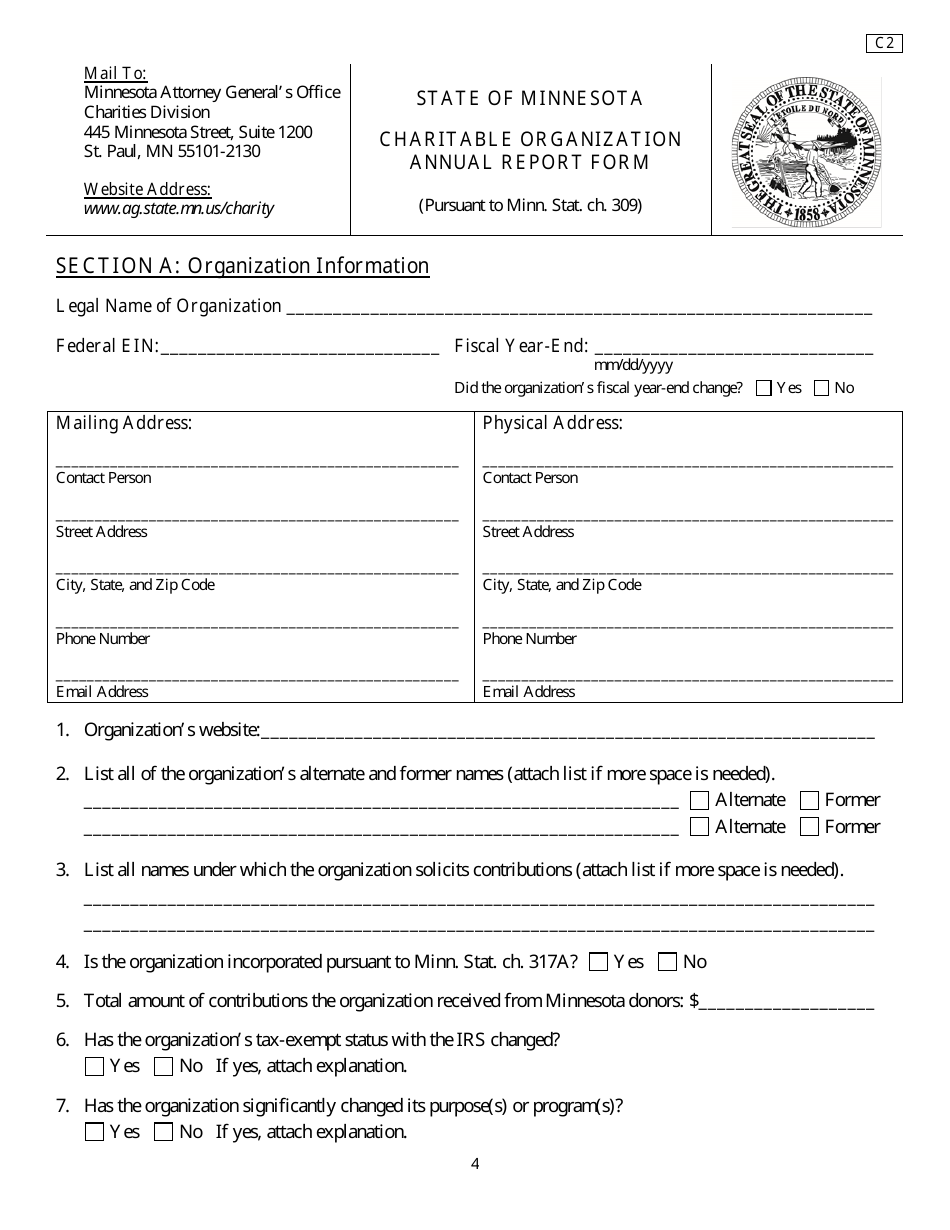

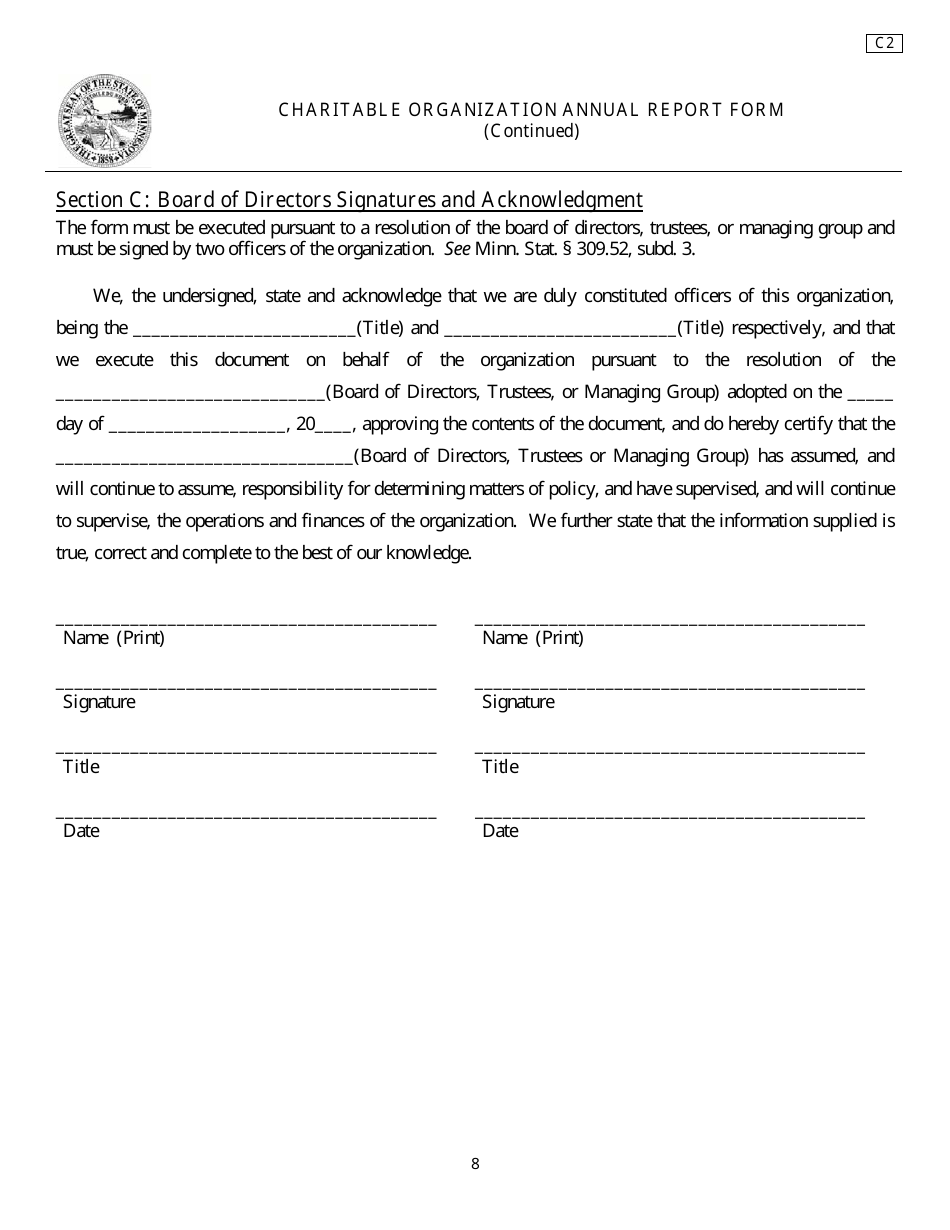

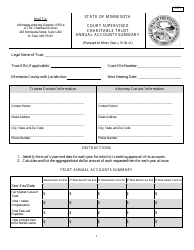

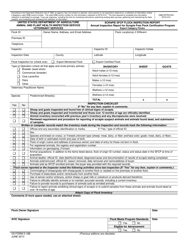

Form C2 Charitable Organization Annual Report Form - Minnesota

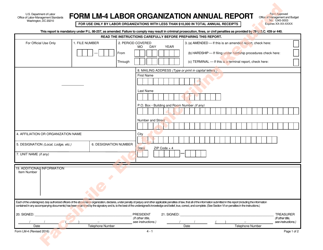

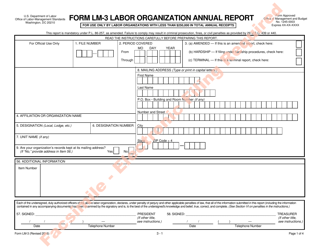

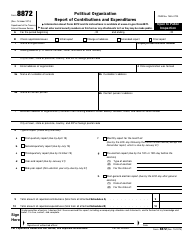

What Is Form C2?

This is a legal form that was released by the Office of the Minnesota Attorney General - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C2?

A: Form C2 is the Charitable Organization Annual Report Form.

Q: Who needs to fill out Form C2?

A: Charitable organizations in Minnesota need to fill out Form C2.

Q: What is the purpose of Form C2?

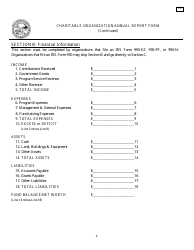

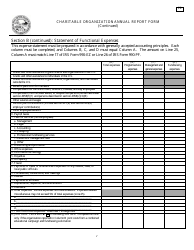

A: The purpose of Form C2 is to report financial information and activities of charitable organizations to the state of Minnesota.

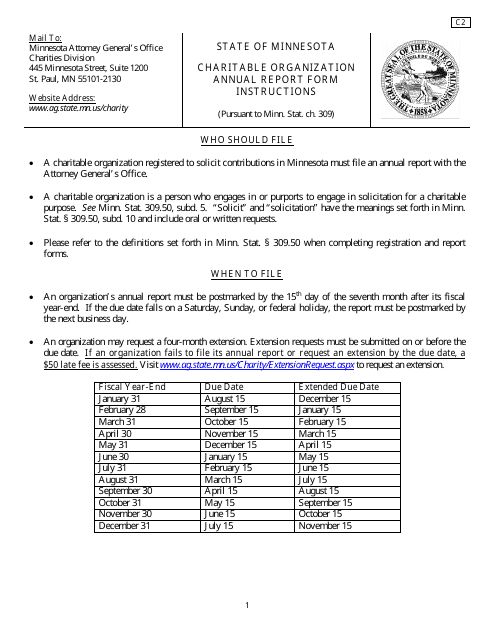

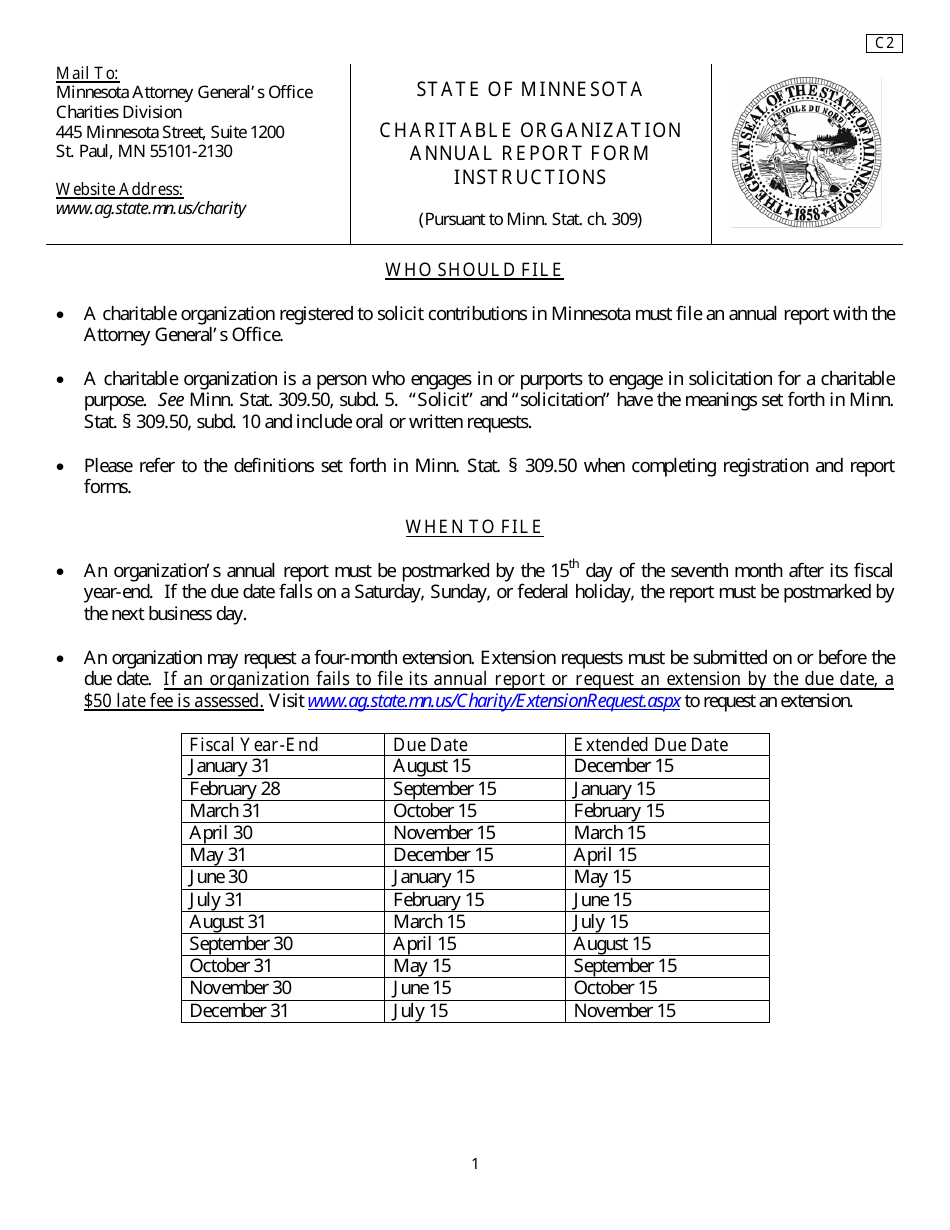

Q: When is Form C2 due?

A: Form C2 is due by the 15th day of the 5th month following the end of the fiscal year.

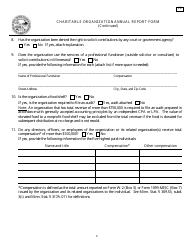

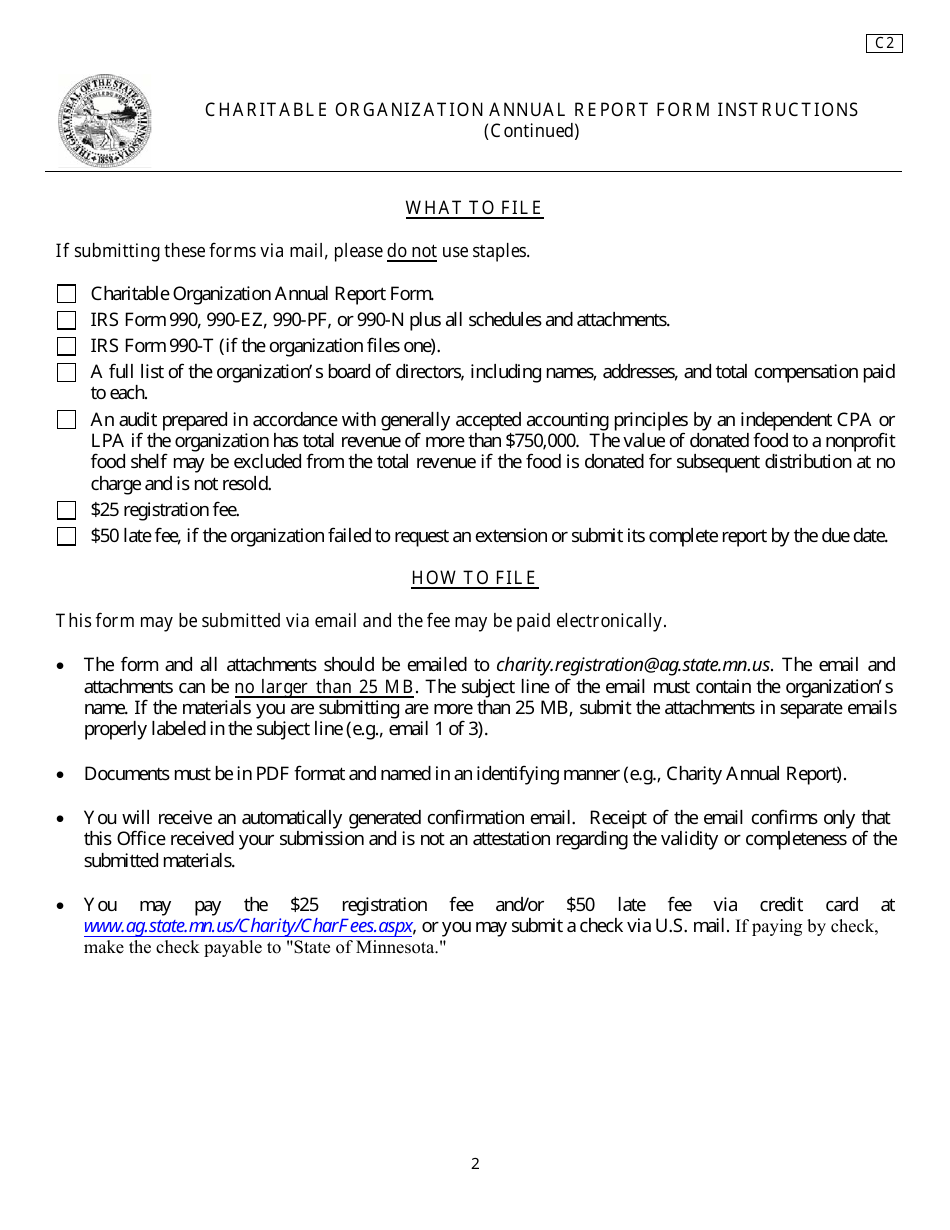

Q: Are there any fees associated with filing Form C2?

A: Yes, there is a filing fee of $50 for organizations that have gross contributions of $25,000 or more.

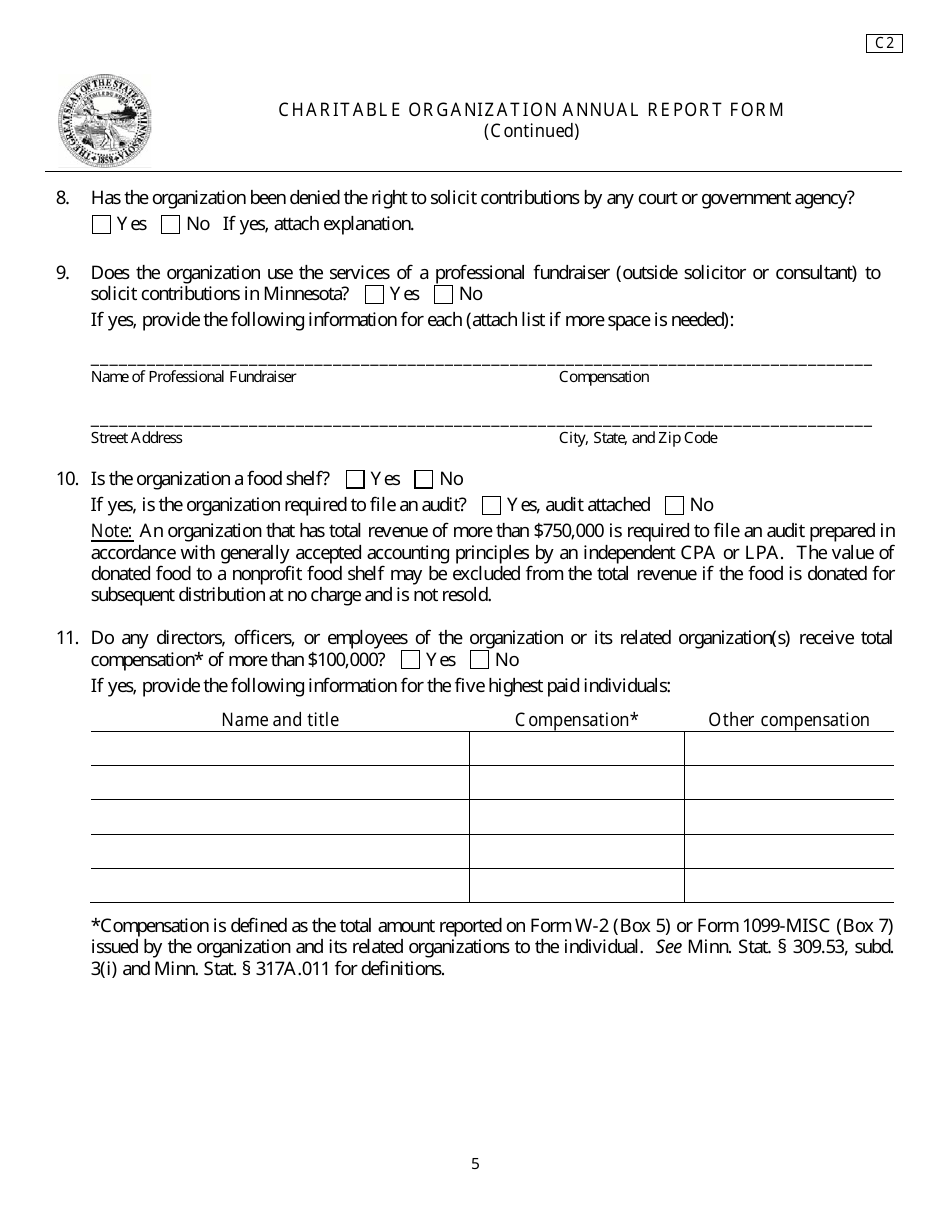

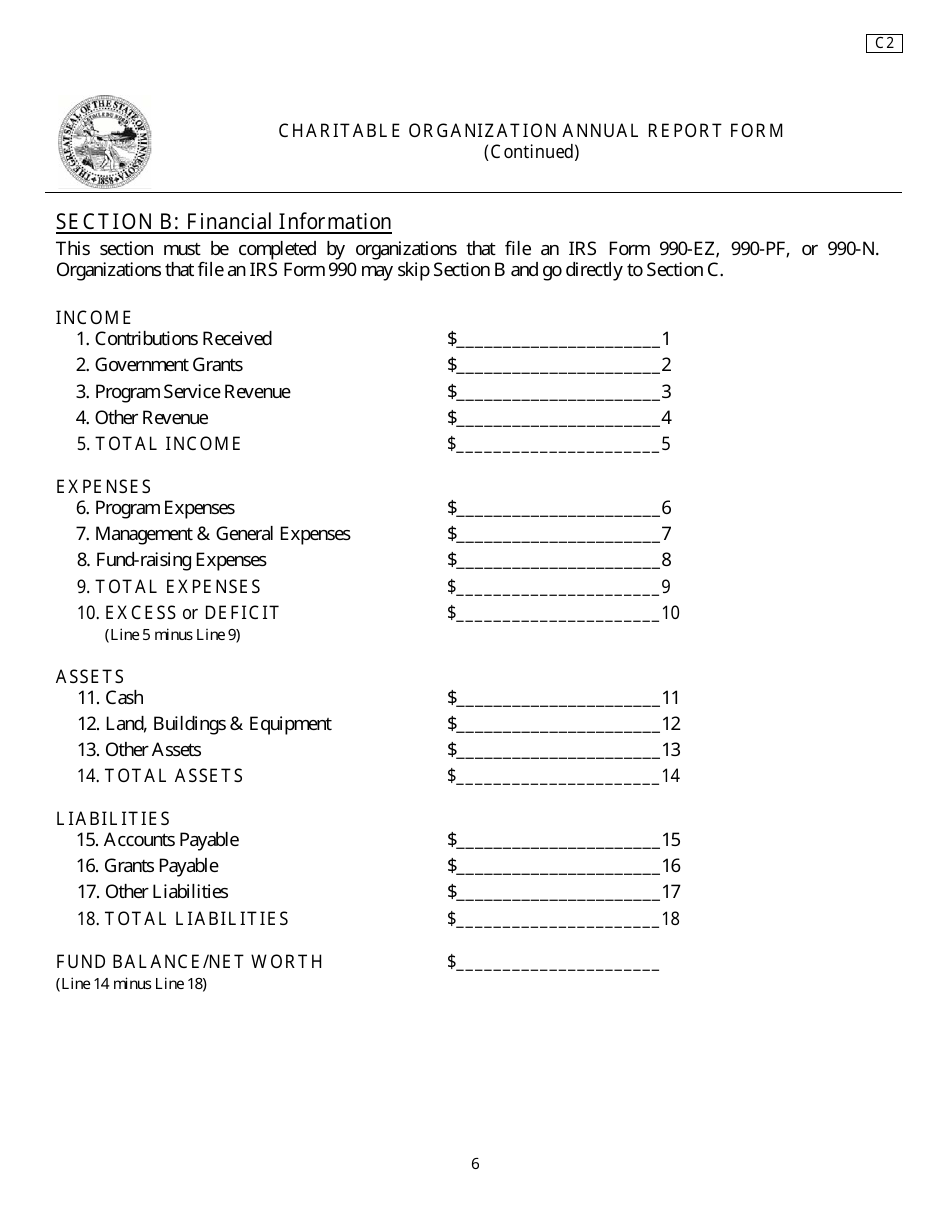

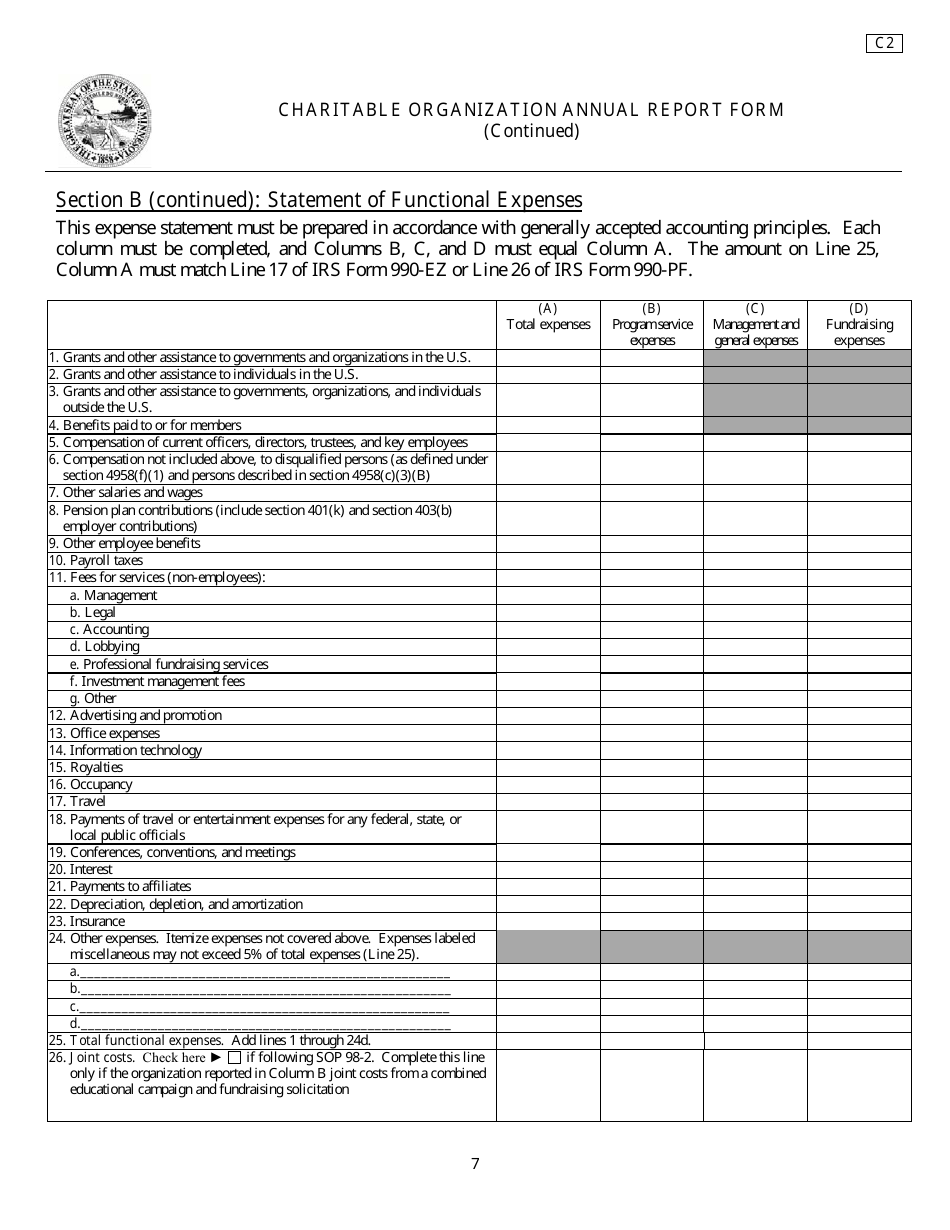

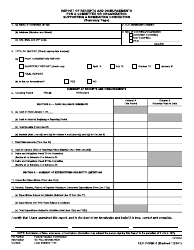

Q: What information is required to complete Form C2?

A: Form C2 requires information about the organization's financial activities, fundraising events, contributions received, and expenses.

Q: Is it mandatory to file Form C2 every year?

A: Yes, charitable organizations in Minnesota are required to file Form C2 annually.

Q: What are the consequences of not filing Form C2?

A: Failure to file Form C2 may result in penalties, loss of exemption, or legal action by the state.

Form Details:

- The latest edition provided by the Office of the Minnesota Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C2 by clicking the link below or browse more documents and templates provided by the Office of the Minnesota Attorney General.