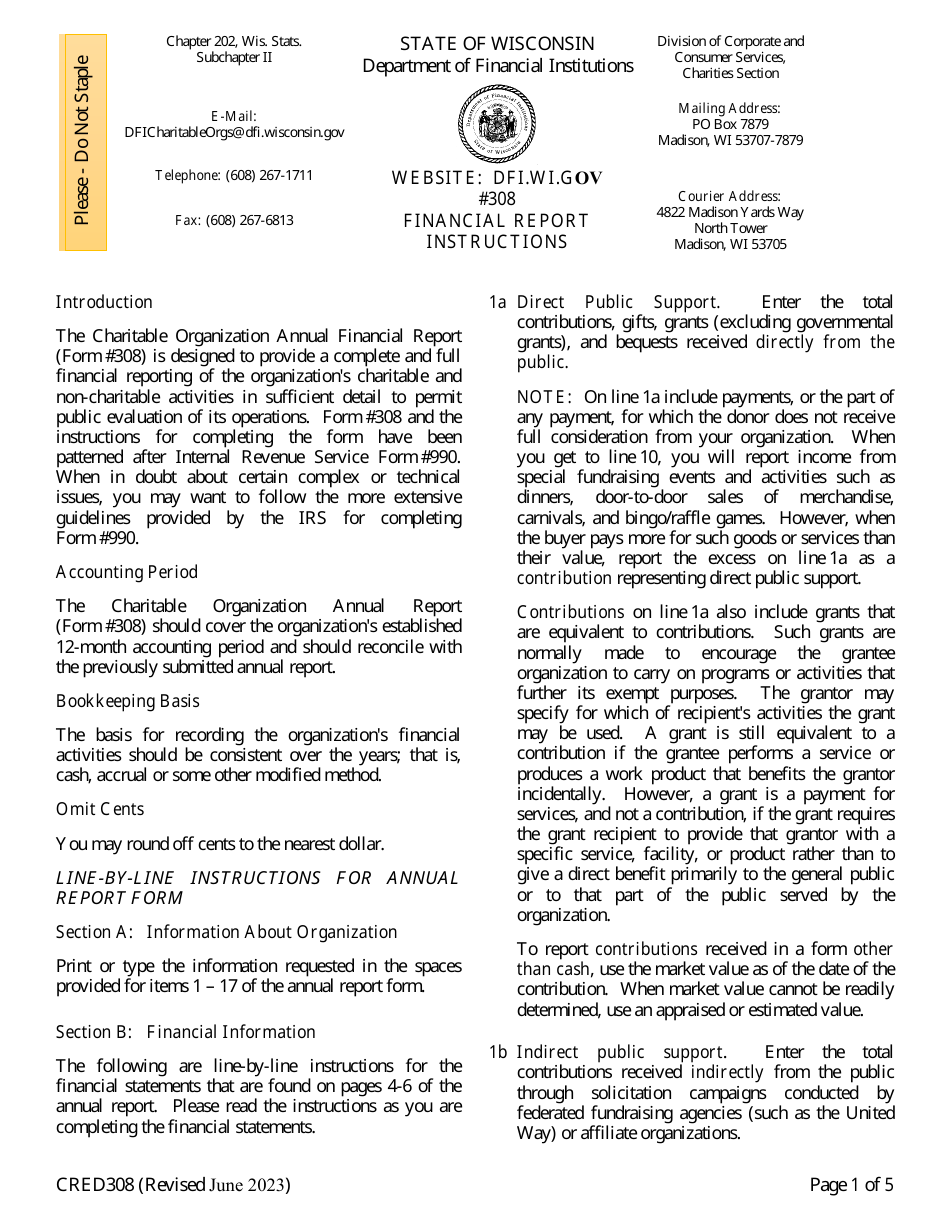

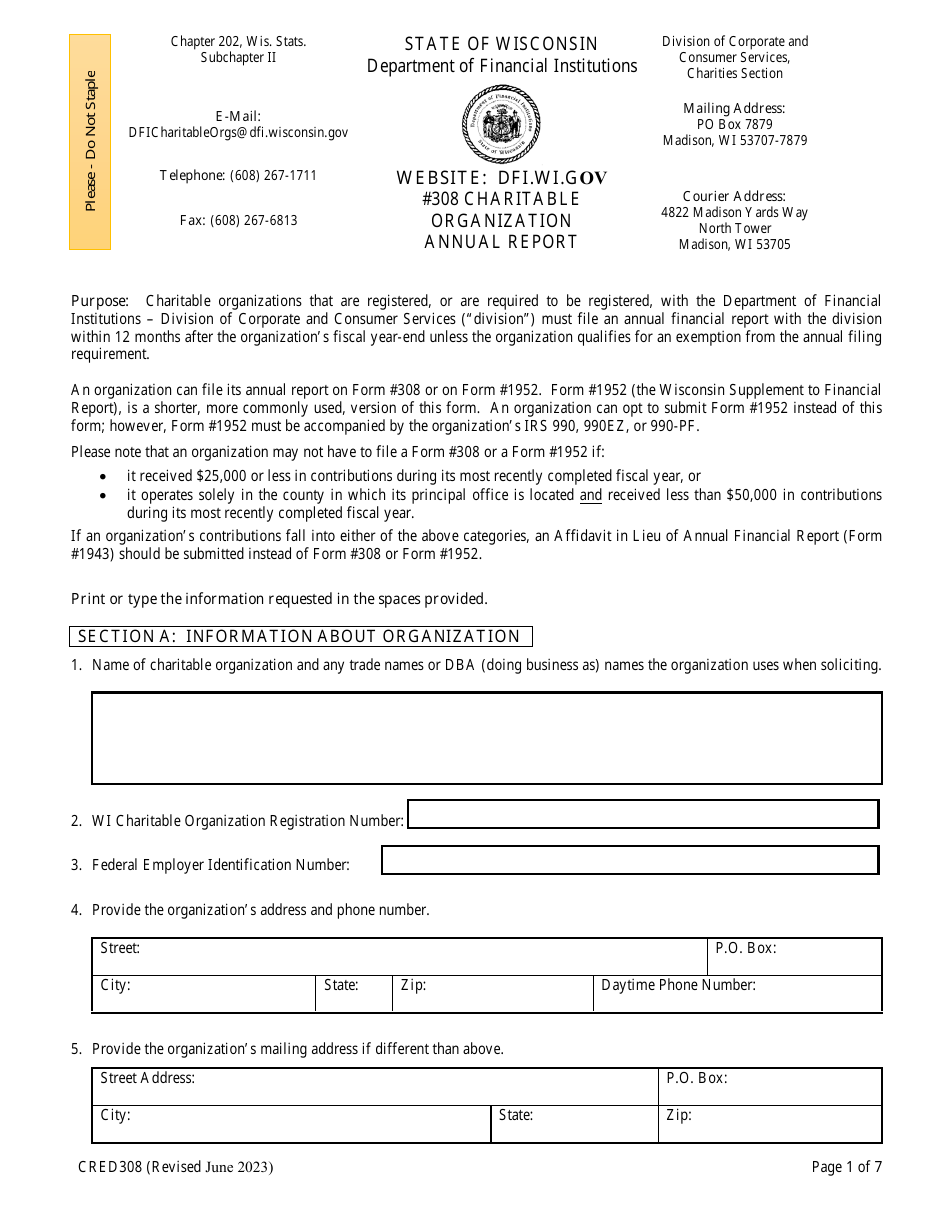

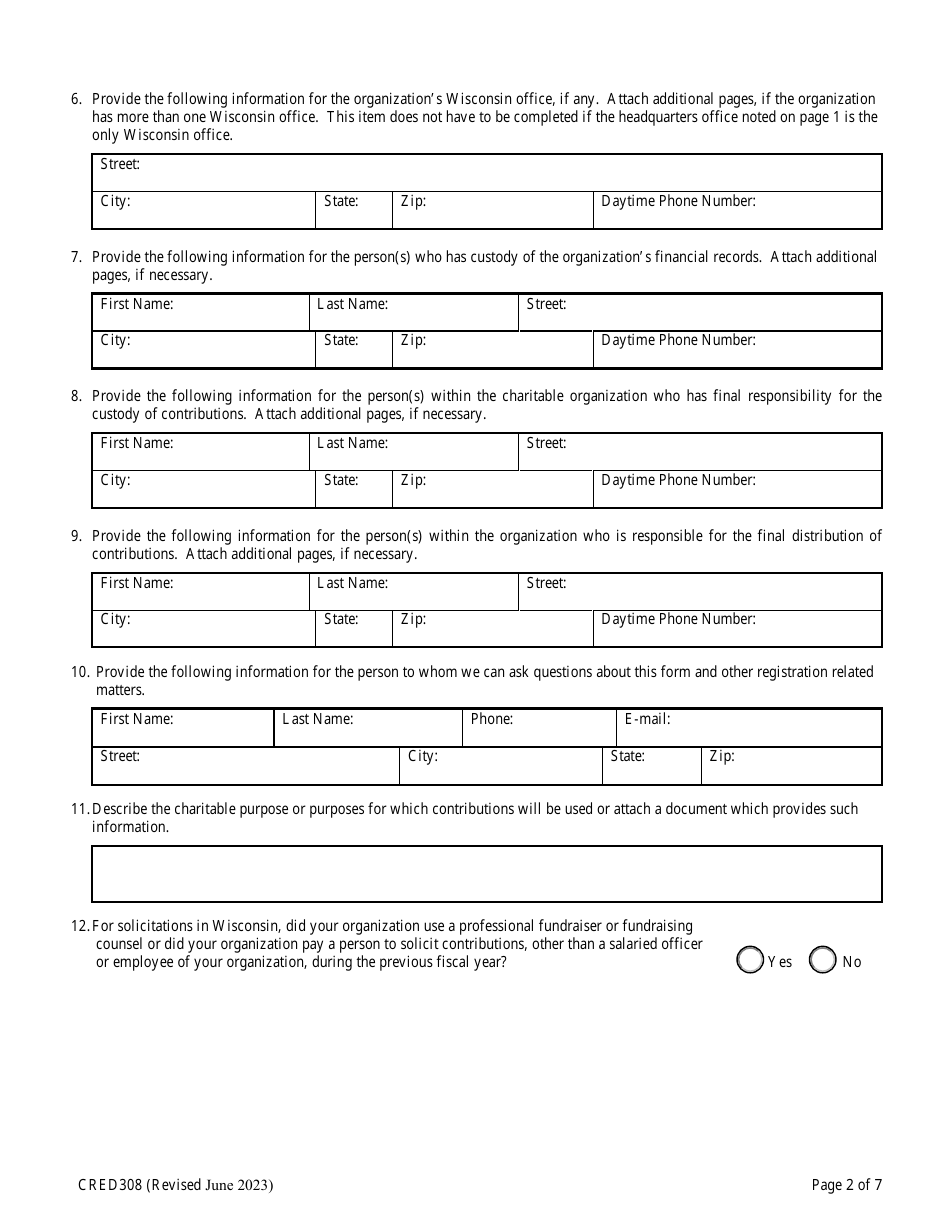

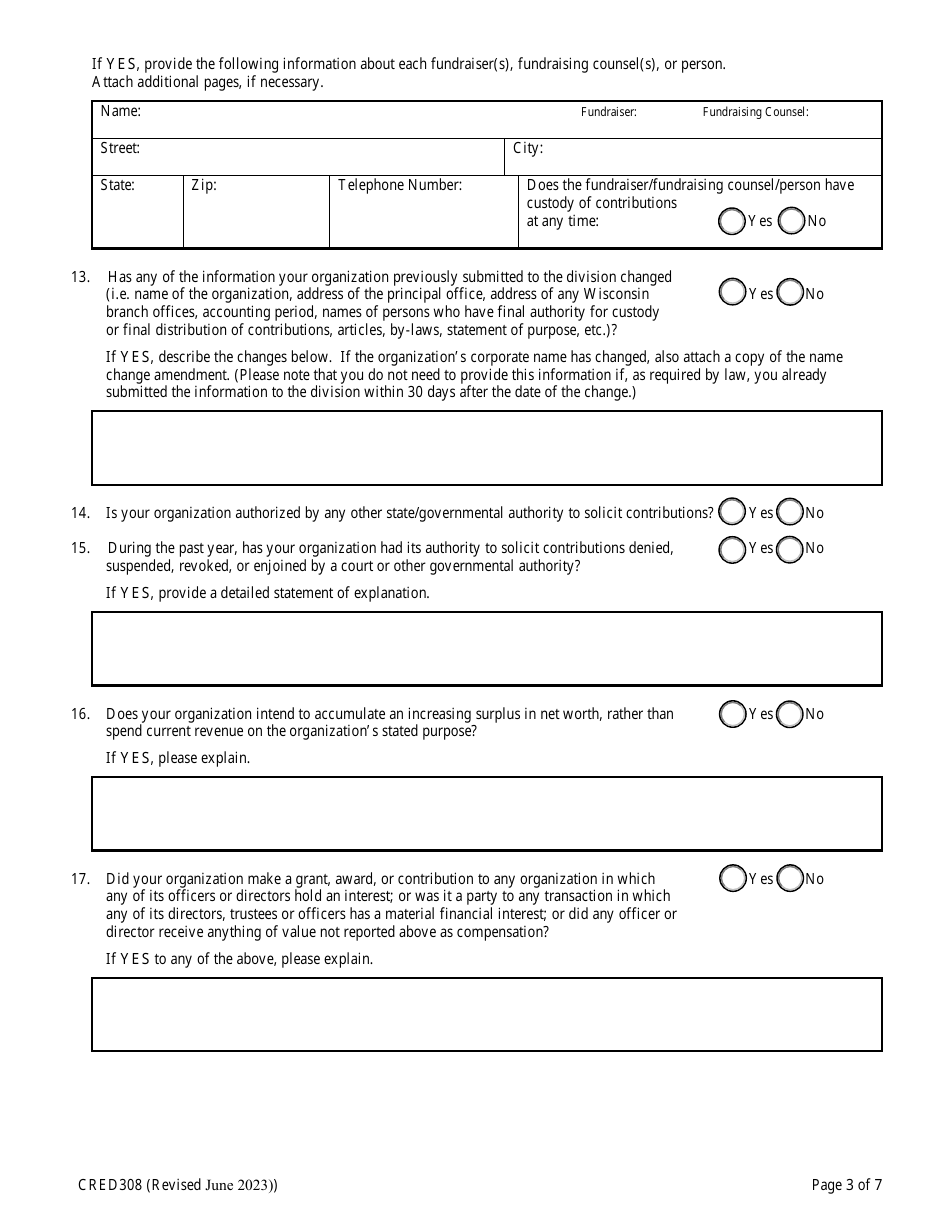

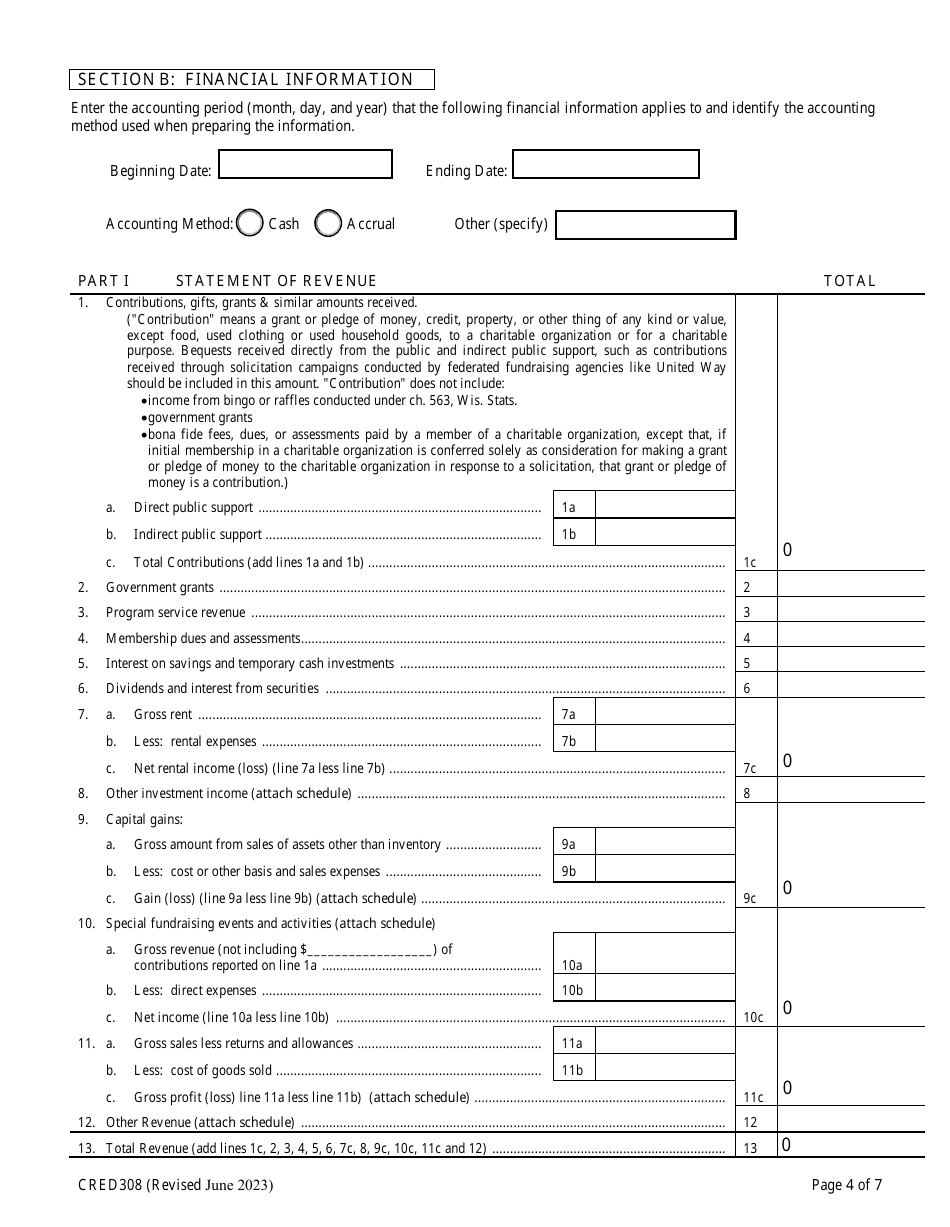

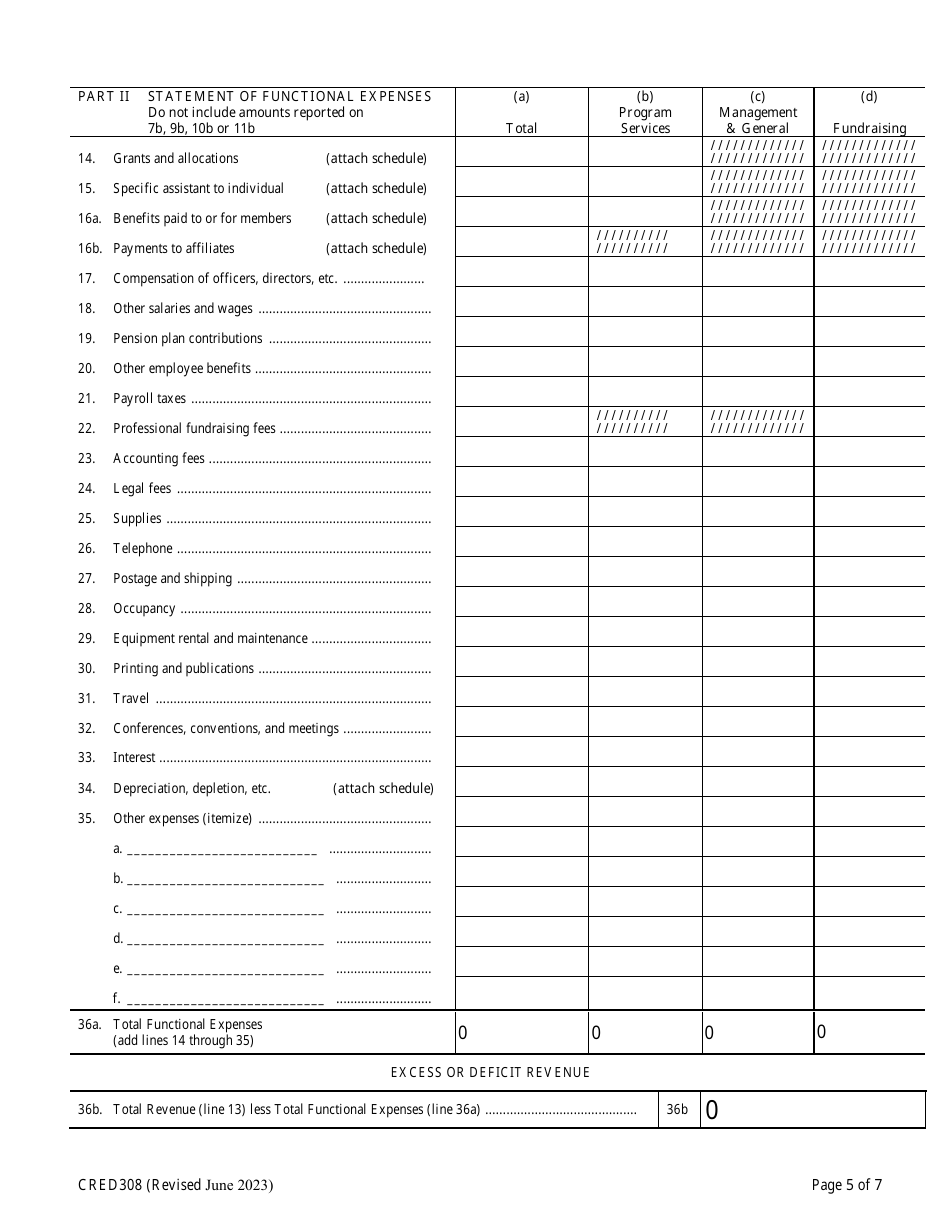

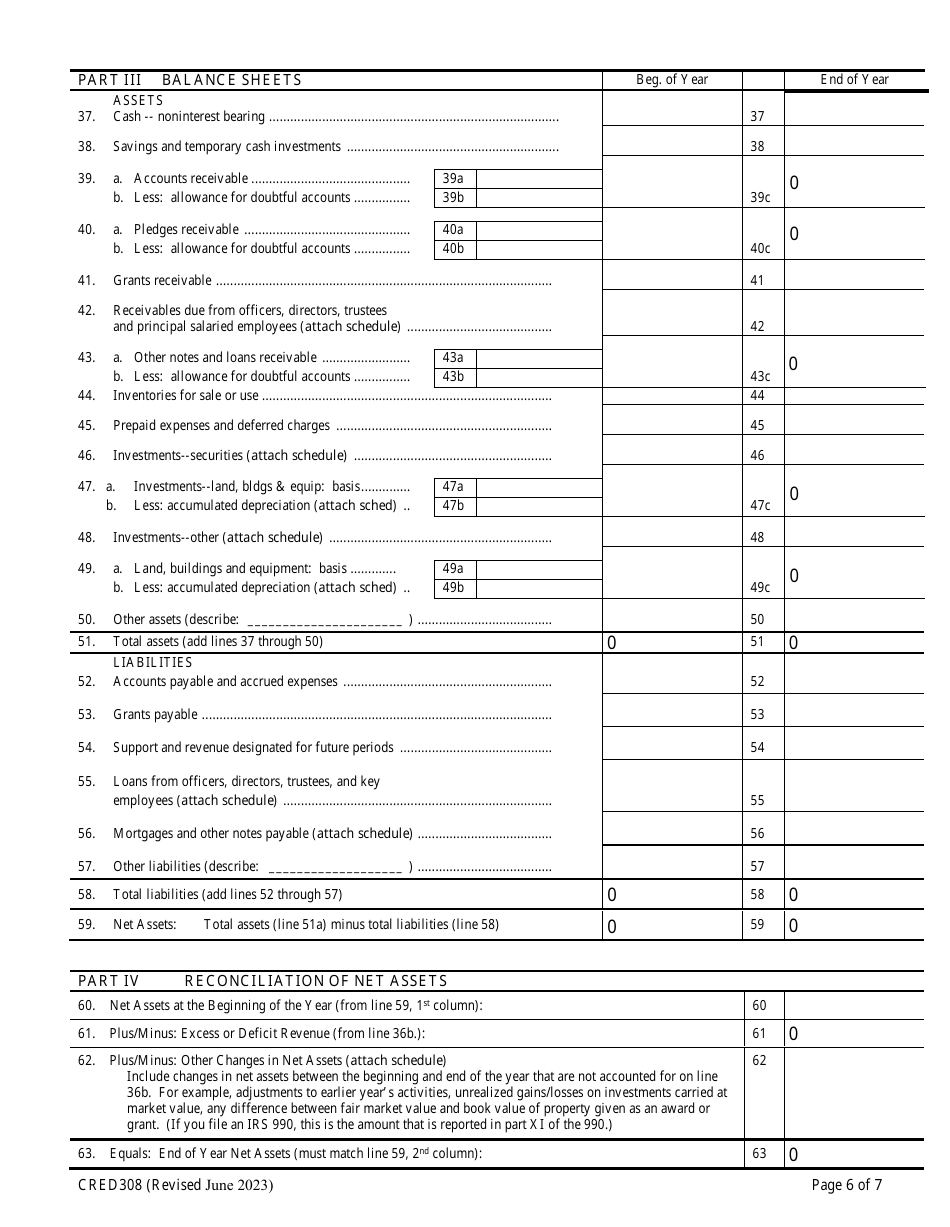

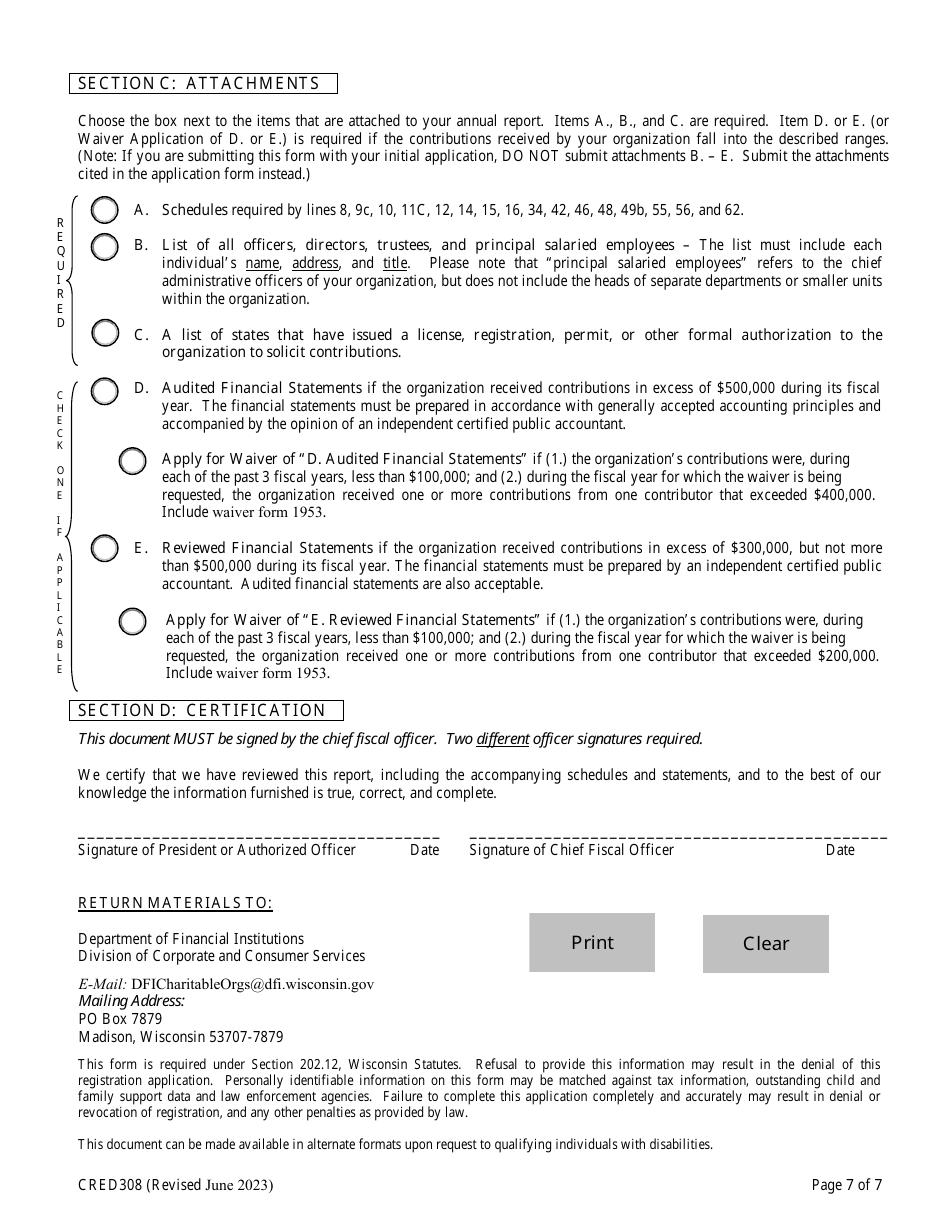

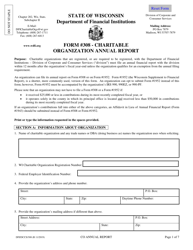

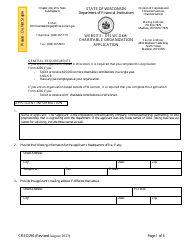

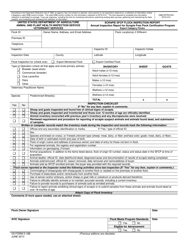

Form CRED308 Charitable Organization Annual Report - Wisconsin

What Is Form CRED308?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CRED308?

A: The Form CRED308 is the Charitable Organization Annual Report specific to Wisconsin.

Q: Who is required to file Form CRED308?

A: Charitable organizations operating in Wisconsin are required to file Form CRED308.

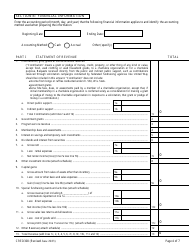

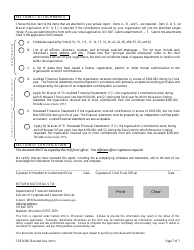

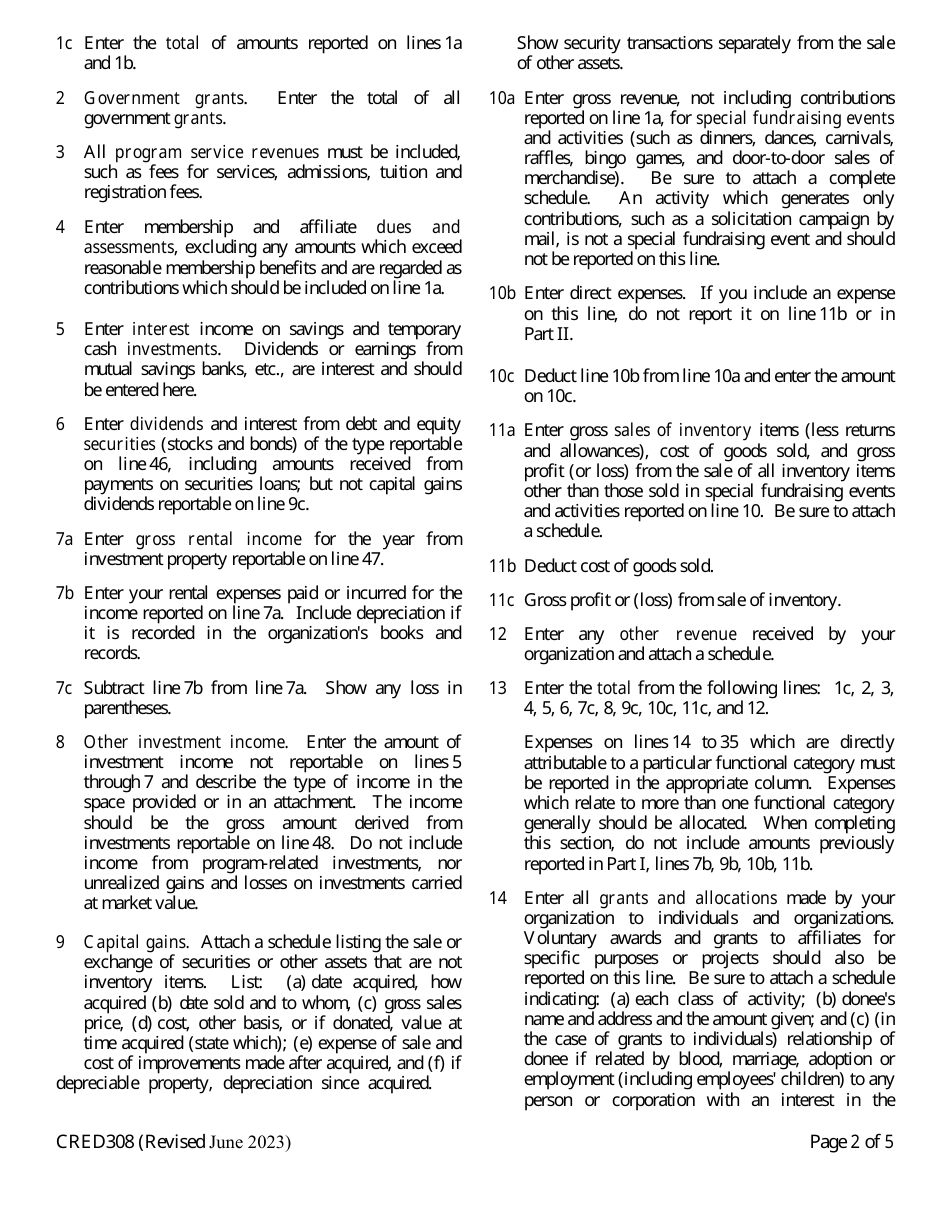

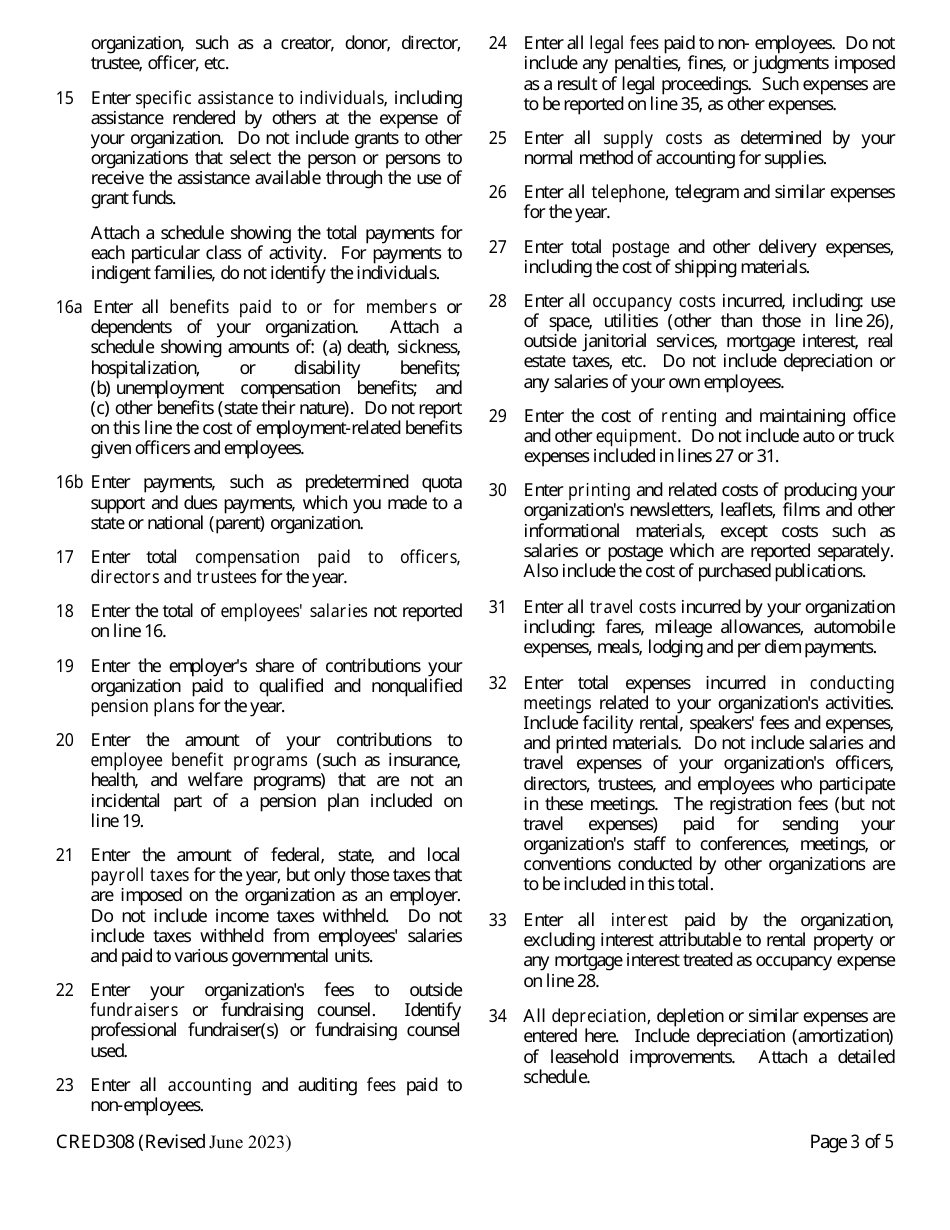

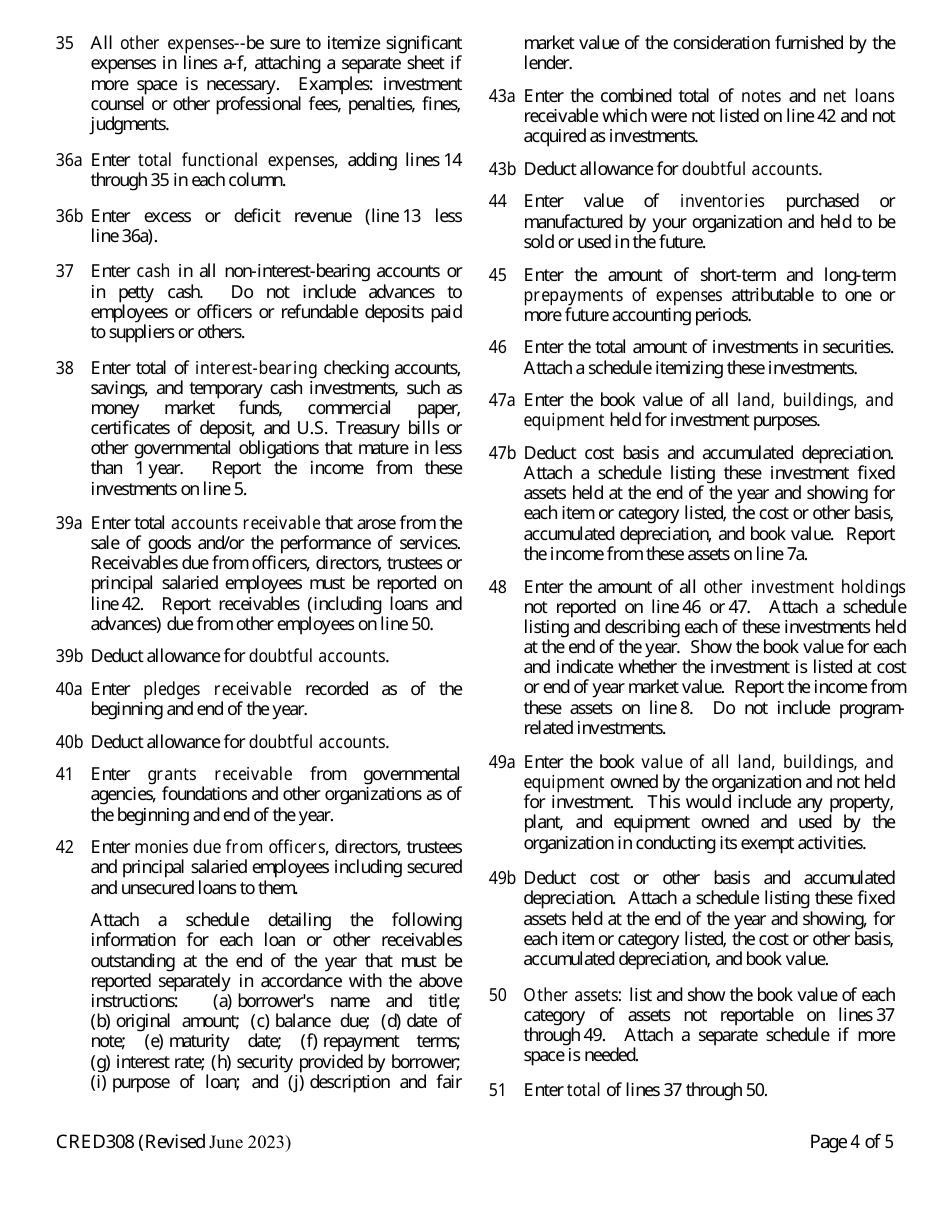

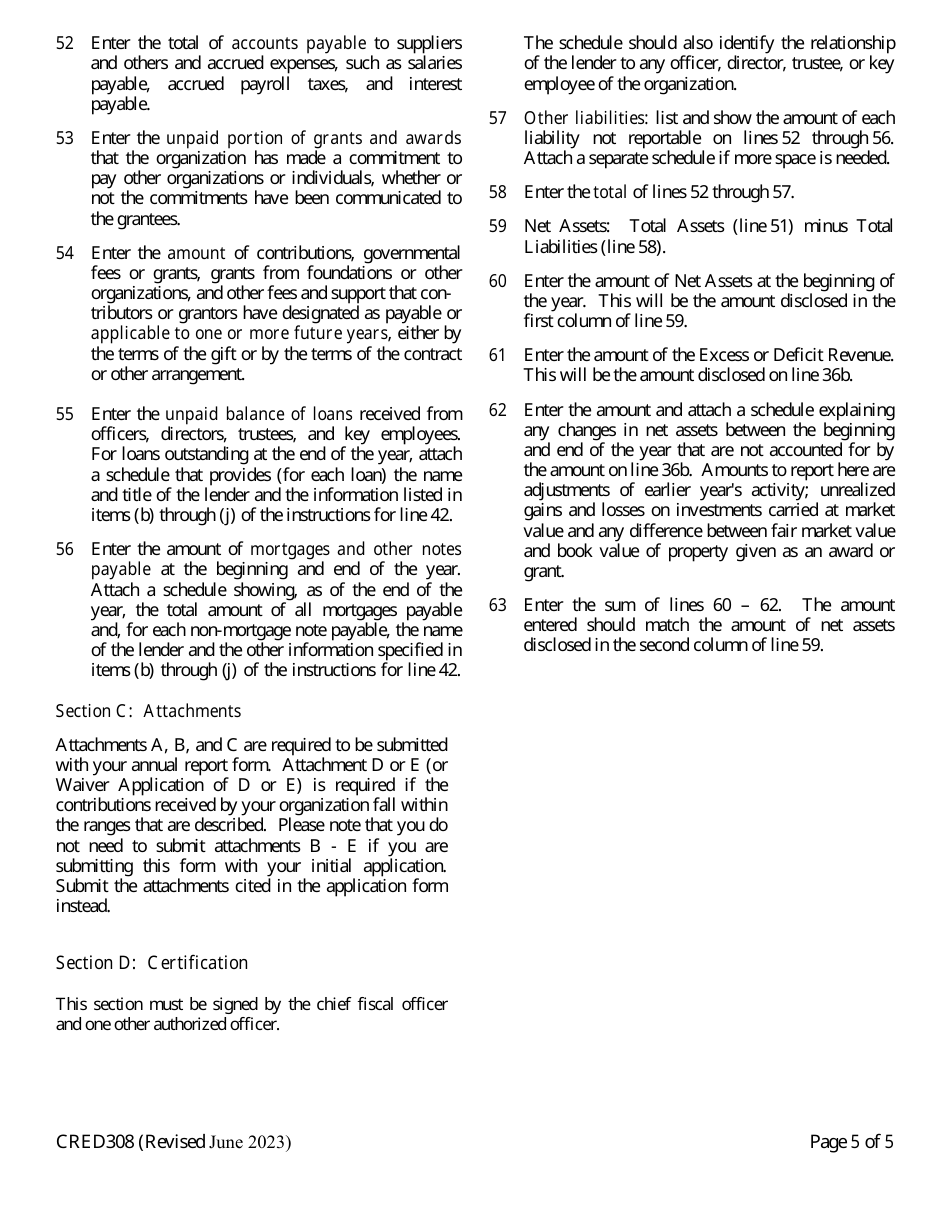

Q: What information is required on Form CRED308?

A: Form CRED308 requires information such as the organization's name, address, financial statements, and details of its charitable activities.

Q: When is Form CRED308 due?

A: Form CRED308 is due by the 15th day of the 5th month following the end of the organization's fiscal year.

Q: Is there a filing fee for Form CRED308?

A: Yes, there is a filing fee associated with Form CRED308. The fee amount varies depending on the organization's annual gross revenue.

Form Details:

- Released on June 1, 2023;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CRED308 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.