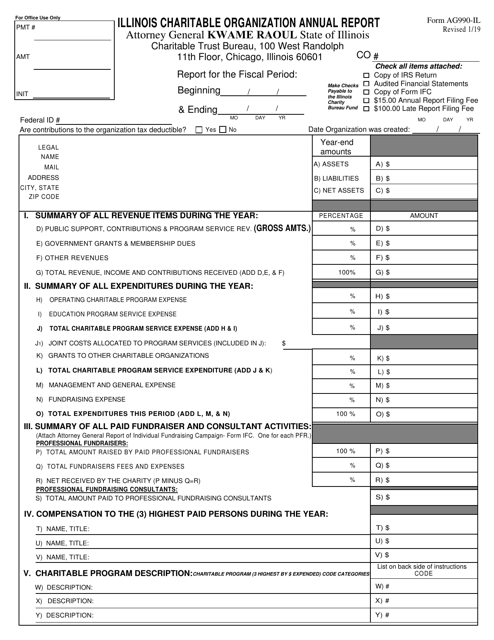

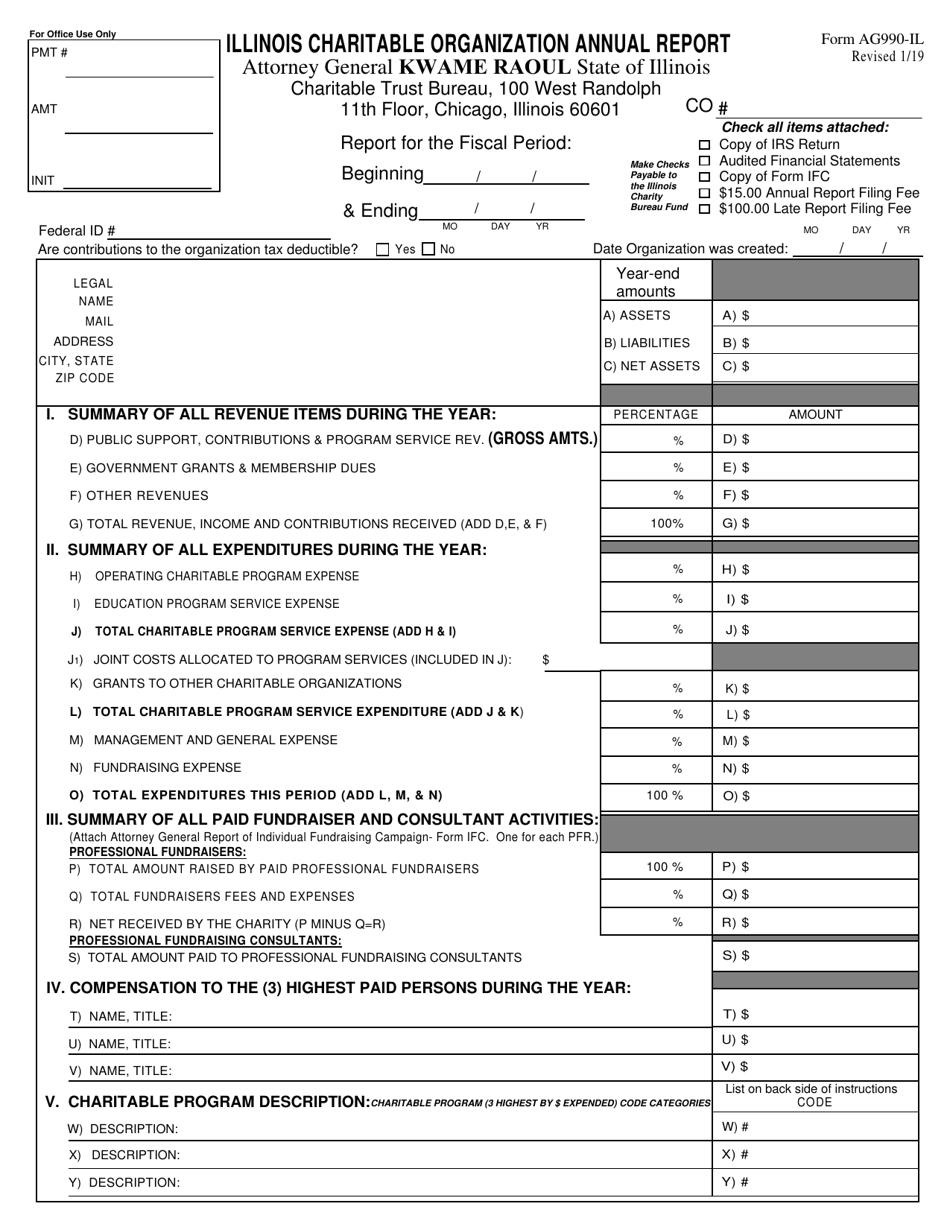

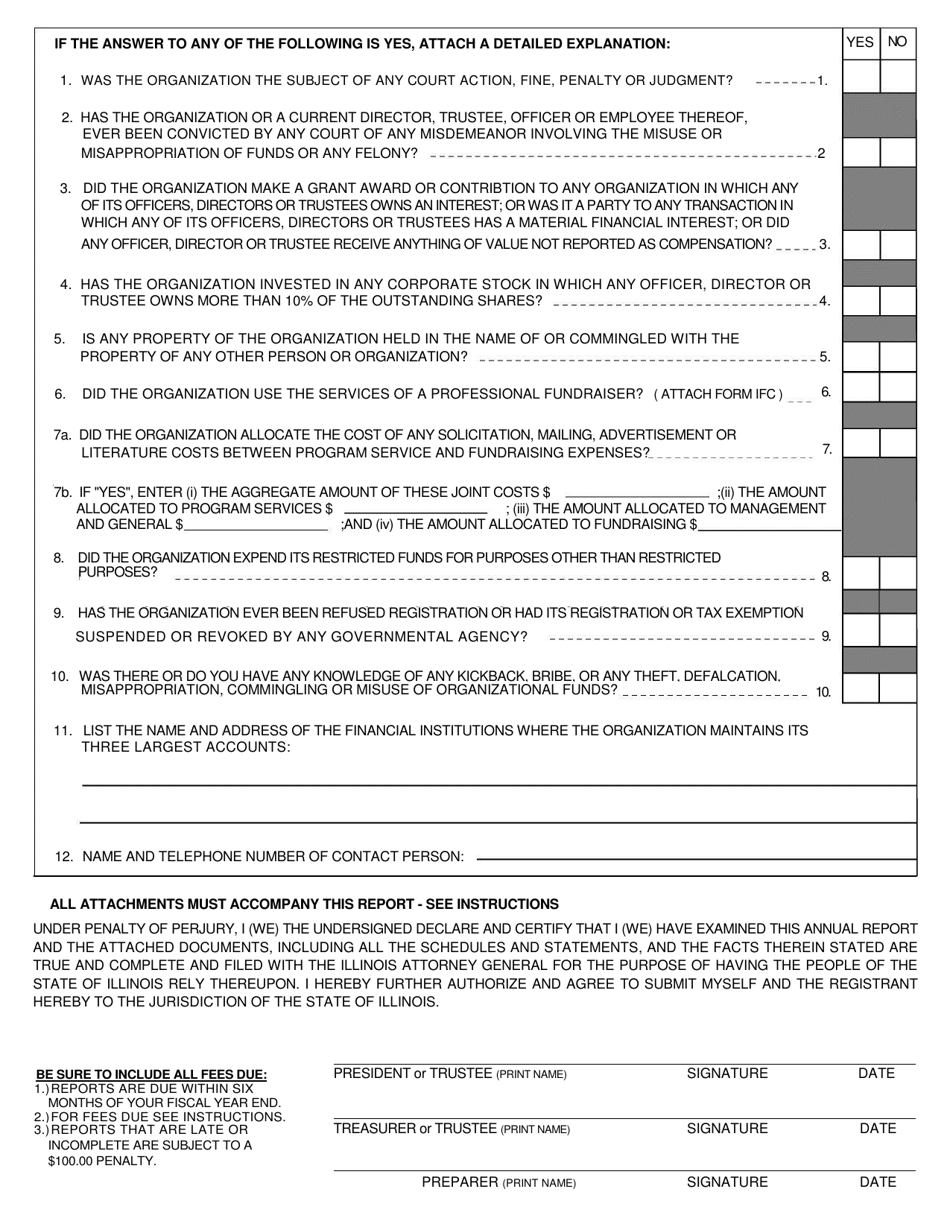

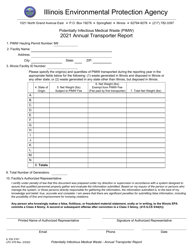

Form AG990-IL Illinois Charitable Organization Annual Report - Illinois

What Is Form AG990-IL?

This is a legal form that was released by the Illinois Attorney General - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AG990-IL?

A: Form AG990-IL is the Illinois Charitable Organization Annual Report.

Q: Who needs to file Form AG990-IL?

A: Charitable organizations operating in Illinois need to file Form AG990-IL.

Q: What is the purpose of Form AG990-IL?

A: The purpose of Form AG990-IL is to report financial information and activities of charitable organizations in Illinois.

Q: When is Form AG990-IL due?

A: Form AG990-IL is due every year on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any fees associated with filing Form AG990-IL?

A: Yes, there is a filing fee for Form AG990-IL. The amount depends on the organization's gross revenue.

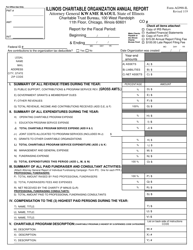

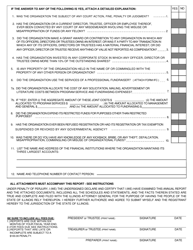

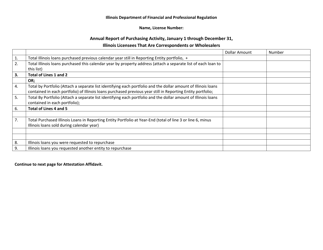

Q: What information is required to complete Form AG990-IL?

A: Some of the information required on Form AG990-IL includes financial statements, program activities, fundraising activities, and governance structure of the organization.

Q: Is there a penalty for late filing of Form AG990-IL?

A: Yes, there is a penalty for late filing of Form AG990-IL. The penalty amount depends on the organization's gross revenue.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Illinois Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AG990-IL by clicking the link below or browse more documents and templates provided by the Illinois Attorney General.