This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule I

for the current year.

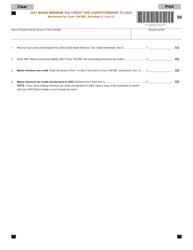

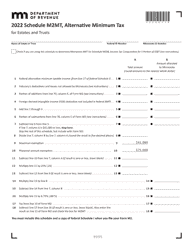

Instructions for IRS Form 1041 Schedule I Alternative Minimum Tax - Estates and Trusts

This document contains official instructions for IRS Form 1041 Schedule I, Alternative Minimum Tax - Estates and Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 1041?

A: Form 1041 is the U.S. Income Tax Return for Estates and Trusts.

Q: What is Schedule I?

A: Schedule I is used to calculate the Alternative Minimum Tax (AMT) for Estates and Trusts.

Q: Who should use Schedule I?

A: Estates and trusts that may be subject to the Alternative Minimum Tax (AMT) should use Schedule I.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a parallel tax system designed to prevent high-income taxpayers from avoiding taxes.

Q: What information is required on Schedule I?

A: Schedule I requires information on income items, deductions, exemptions, and other adjustments applicable to the Alternative Minimum Tax (AMT) calculation for estates and trusts.

Q: Is Schedule I required for all estates and trusts?

A: No, Schedule I is only required for estates and trusts that may be subject to the Alternative Minimum Tax (AMT).

Q: When is the deadline to file Form 1041?

A: The deadline to file Form 1041 is generally April 15th, unless an extension has been granted.

Q: What are the penalties for not filing Form 1041?

A: The penalties for not filing Form 1041 can include late filing penalties, interest charges, and accuracy-related penalties.

Q: Can I file Form 1041 electronically?

A: Yes, you can file Form 1041 electronically using tax software or through a tax professional.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.