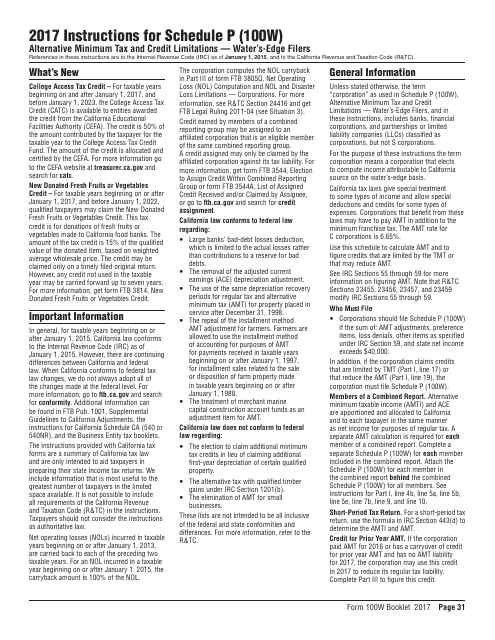

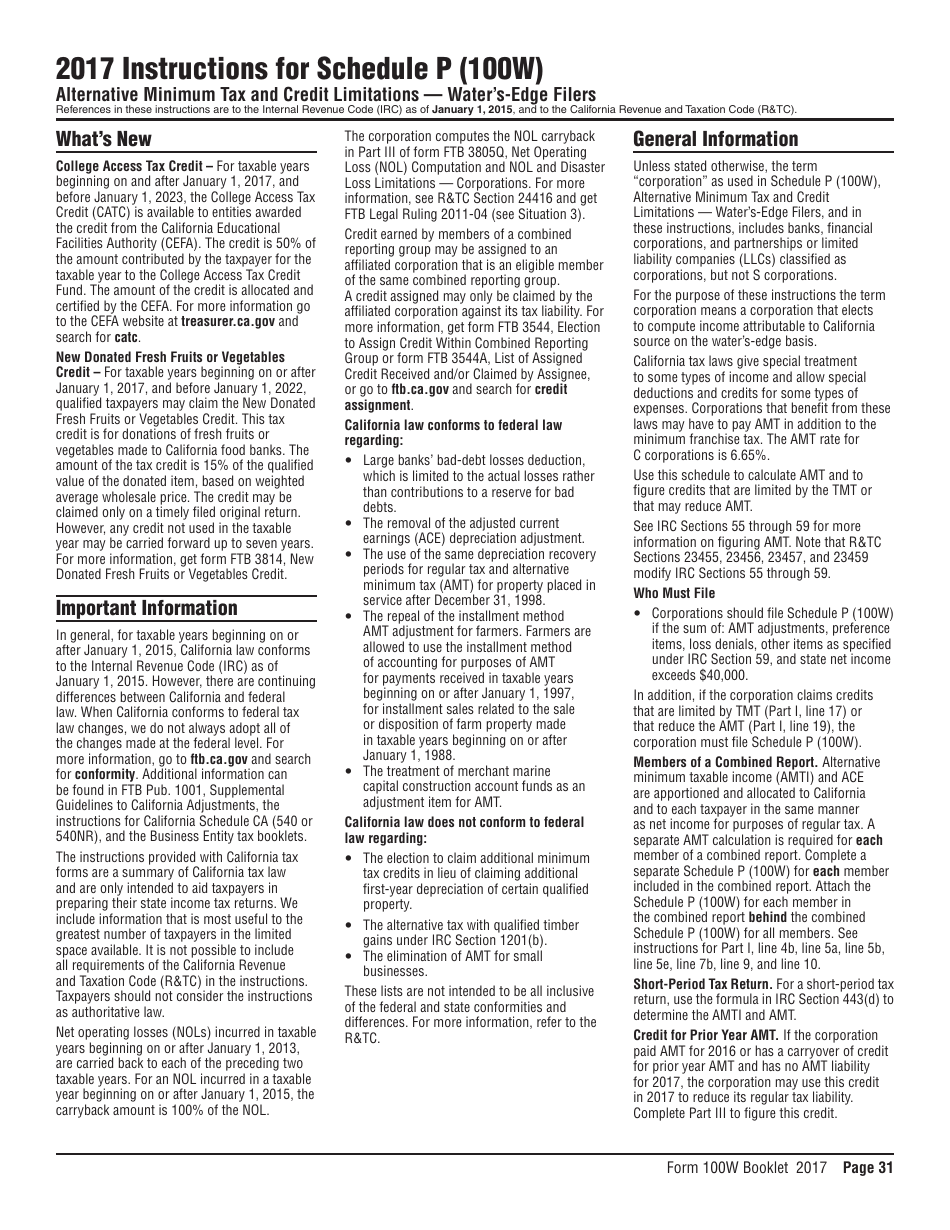

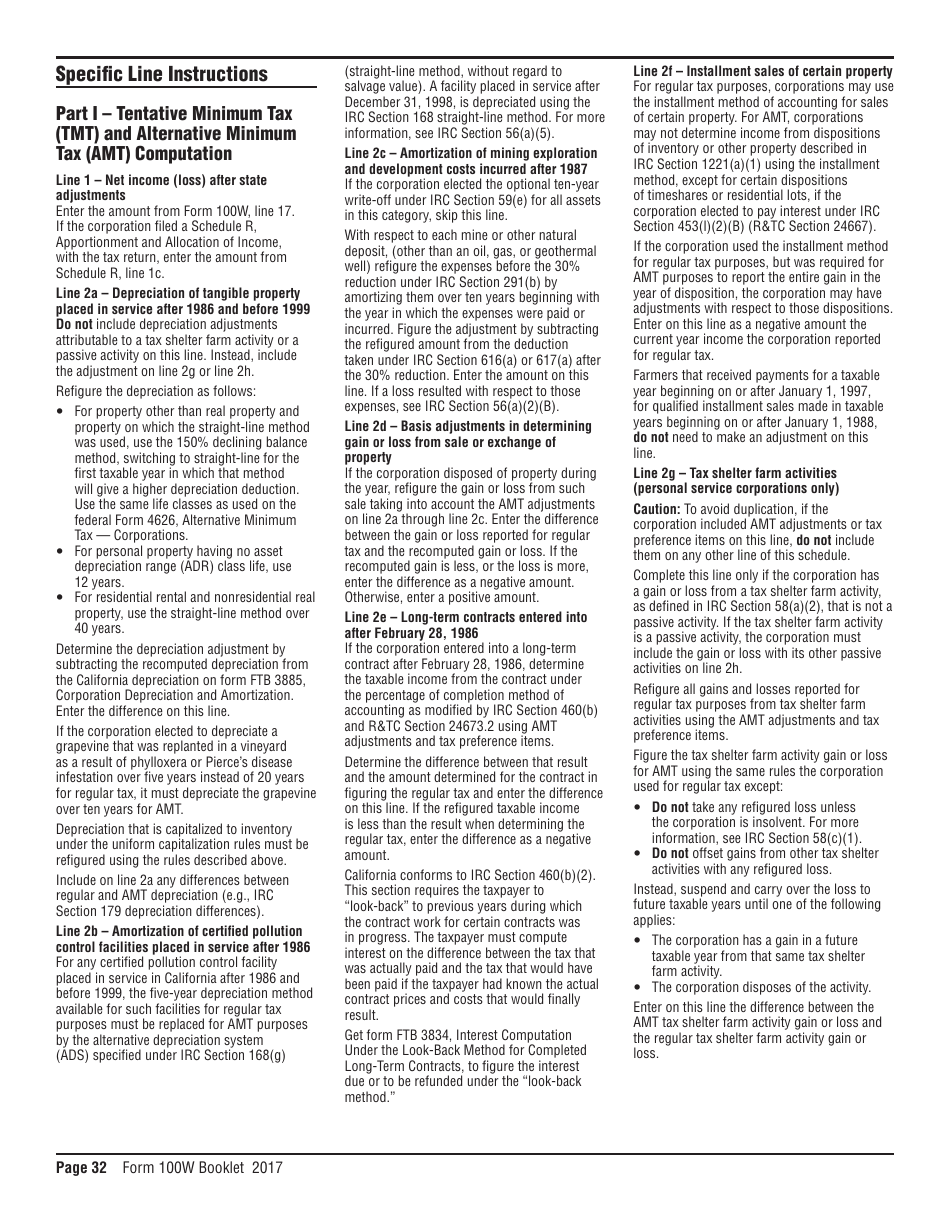

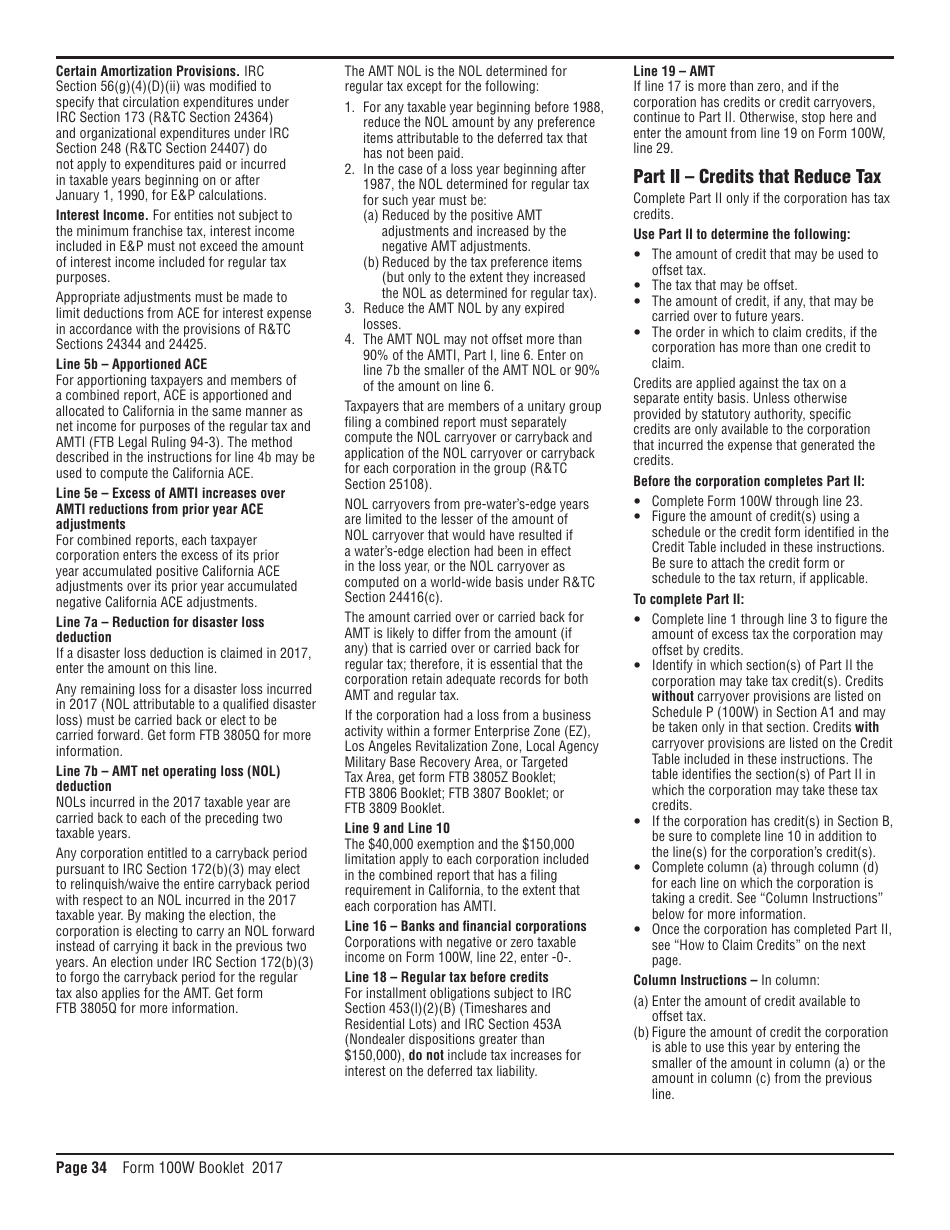

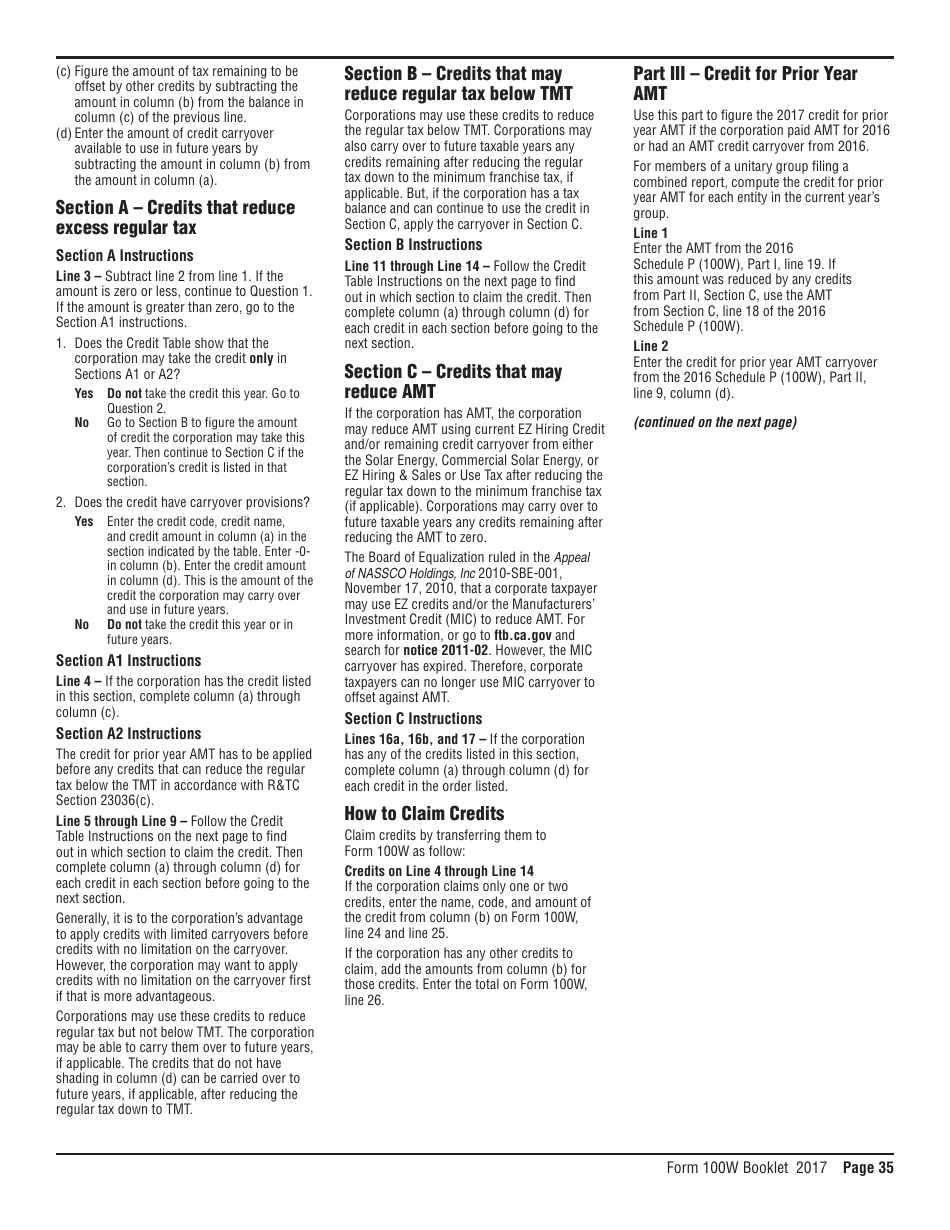

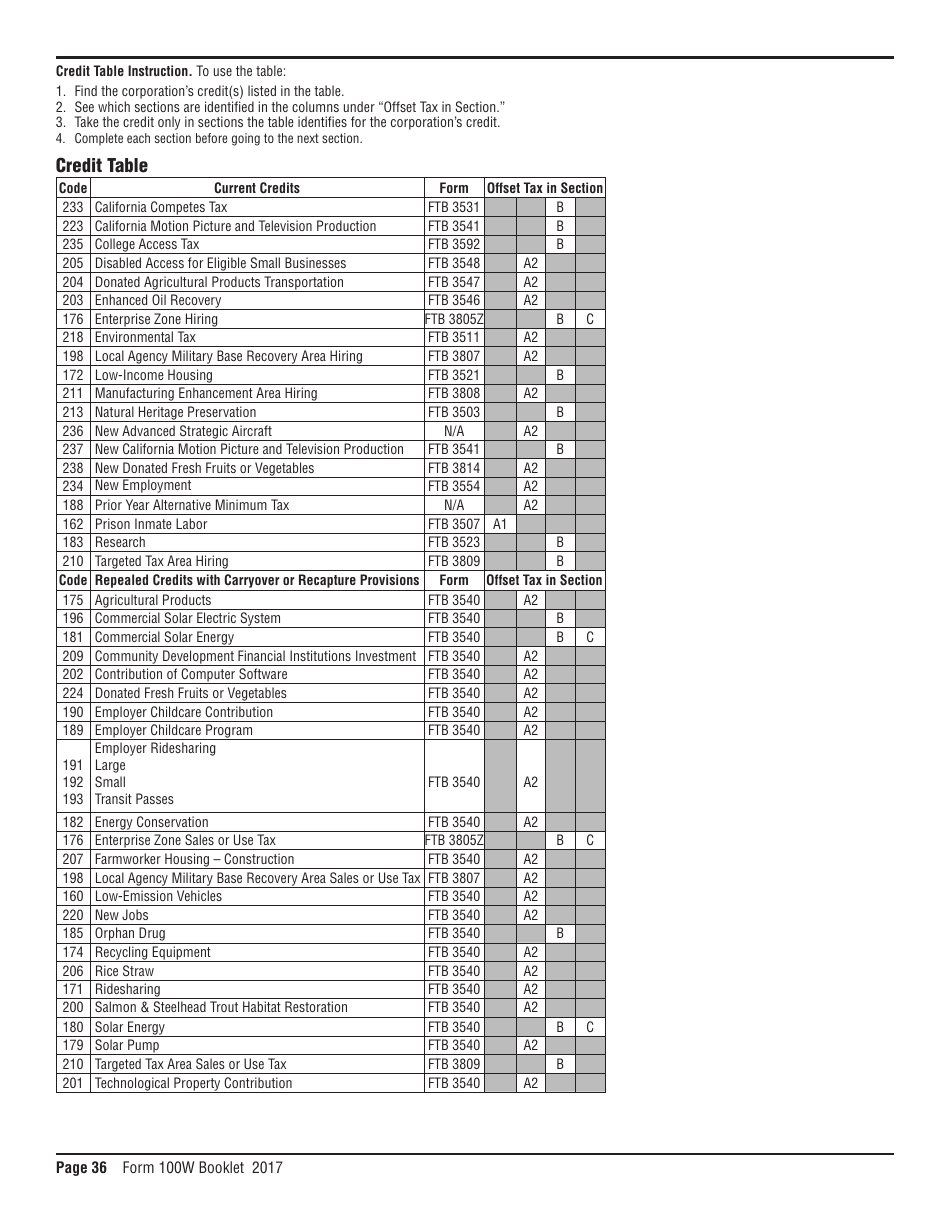

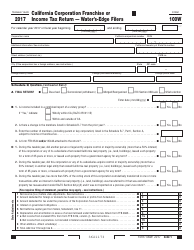

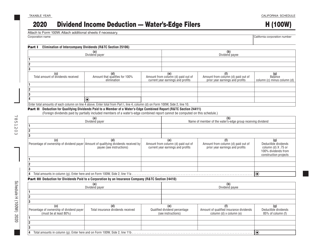

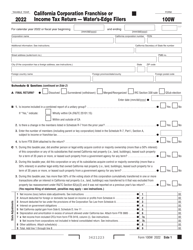

Instructions for Form 100W Schedule P Alternative Minimum Tax and Credit Limitations " Water's-Edge Filers - California

This document contains official instructions for Form 100W Schedule P, Alternative Credit Limitations '" Water's-Edge Filers - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 100W Schedule P?

A: Form 100W Schedule P is a tax form for water's-edge filers in California.

Q: Who needs to file Form 100W Schedule P?

A: Water's-edge filers in California need to file Form 100W Schedule P.

Q: What is the purpose of Form 100W Schedule P?

A: The purpose of Form 100W Schedule P is to calculate alternative minimum tax and credit limitations for water's-edge filers in California.

Q: What are alternative minimum tax and credit limitations?

A: Alternative minimum tax and credit limitations are additional tax calculations and restrictions imposed by the state of California for certain taxpayers.

Q: What are water's-edge filers?

A: Water's-edge filers are taxpayers with a water's-edge election for the state of California, which generally includes US corporations engaged in a water's-edge business and meets other requirements.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.