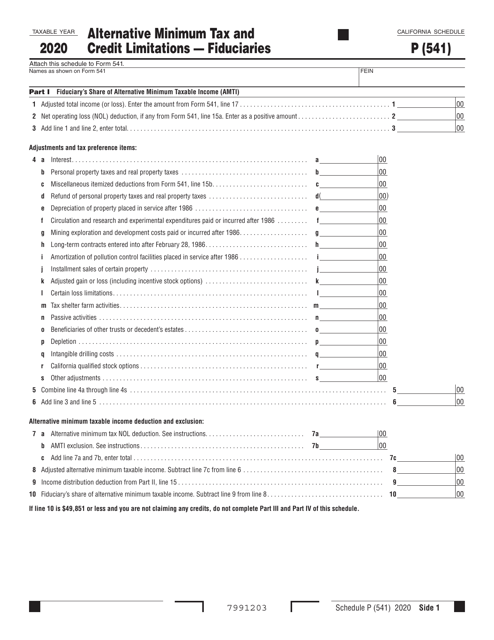

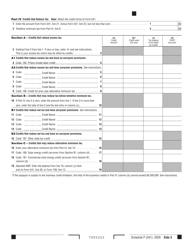

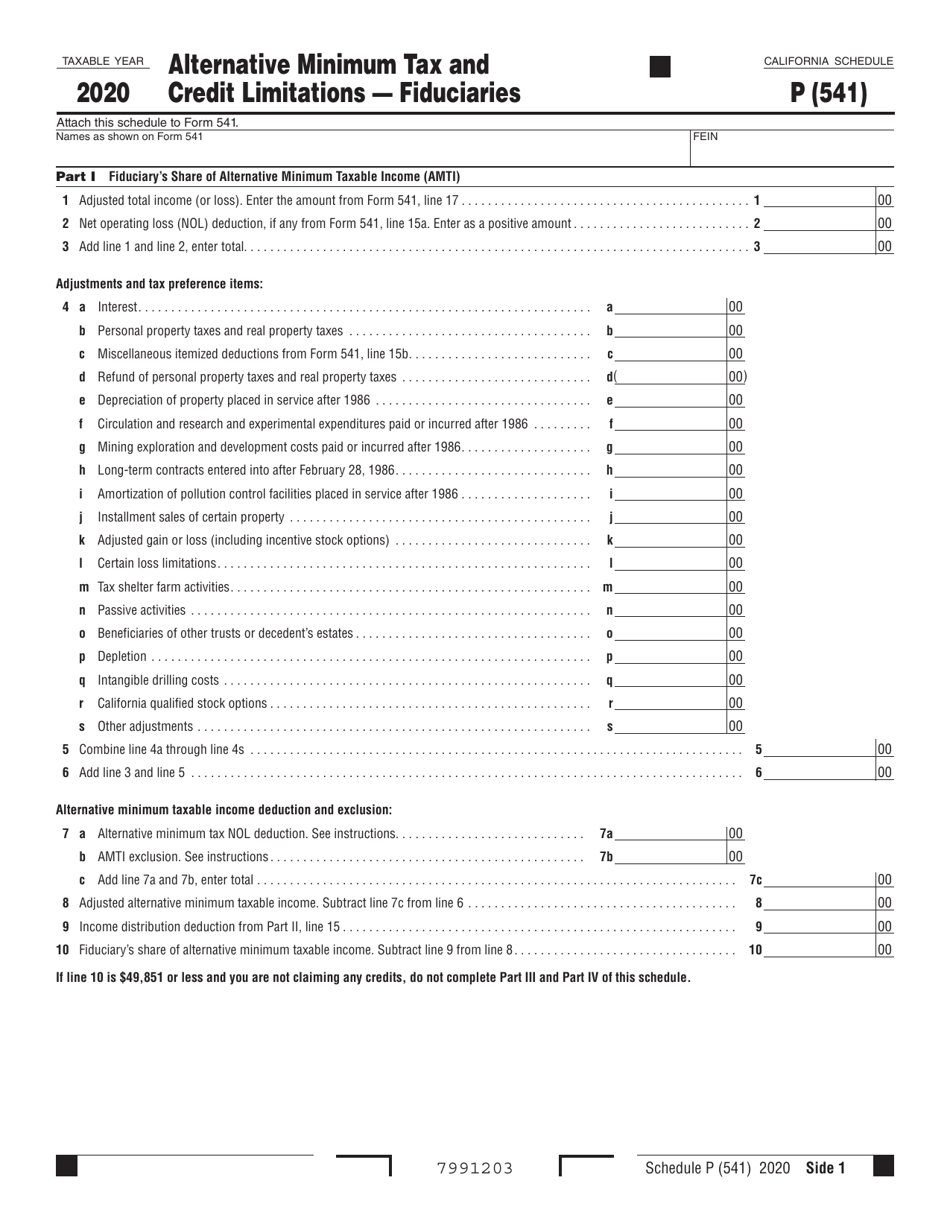

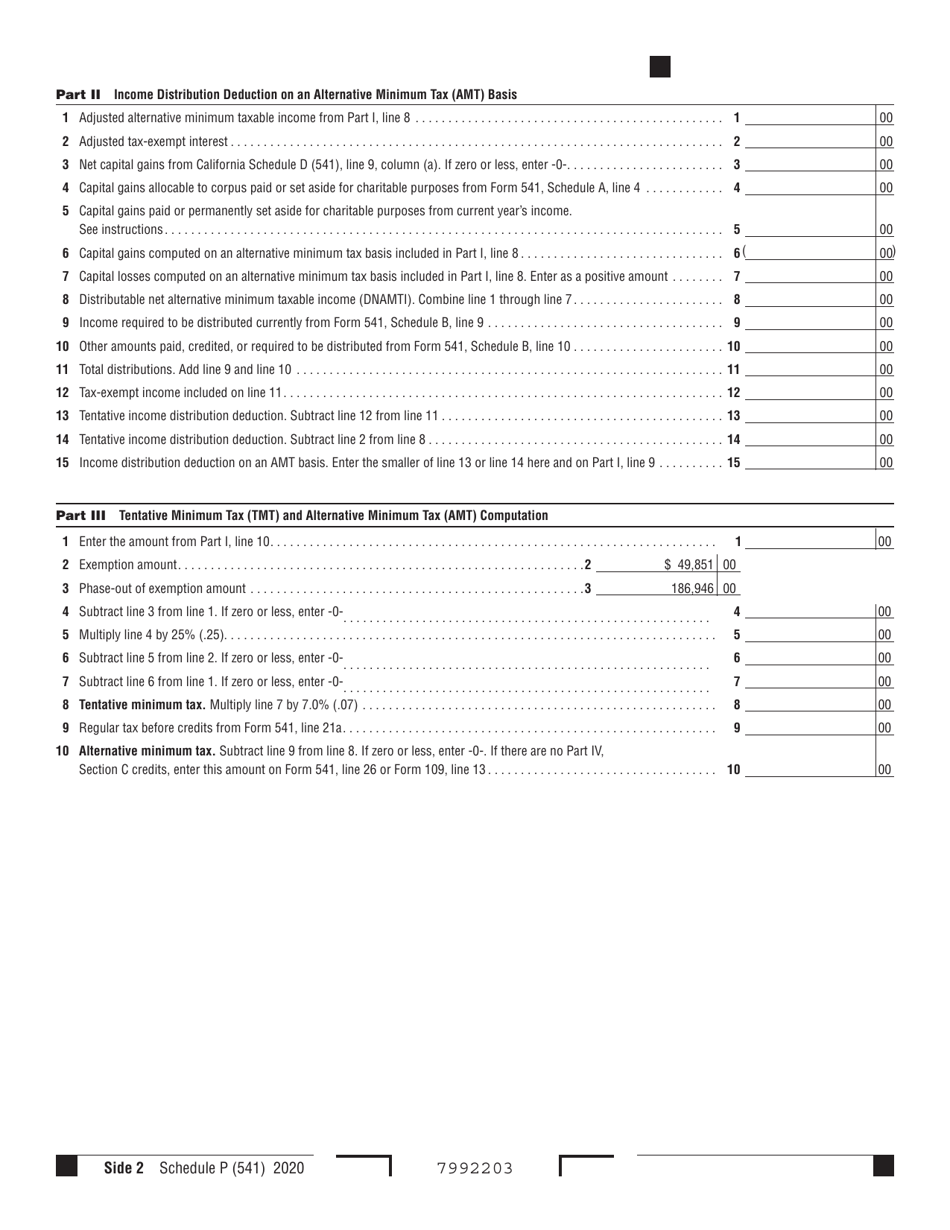

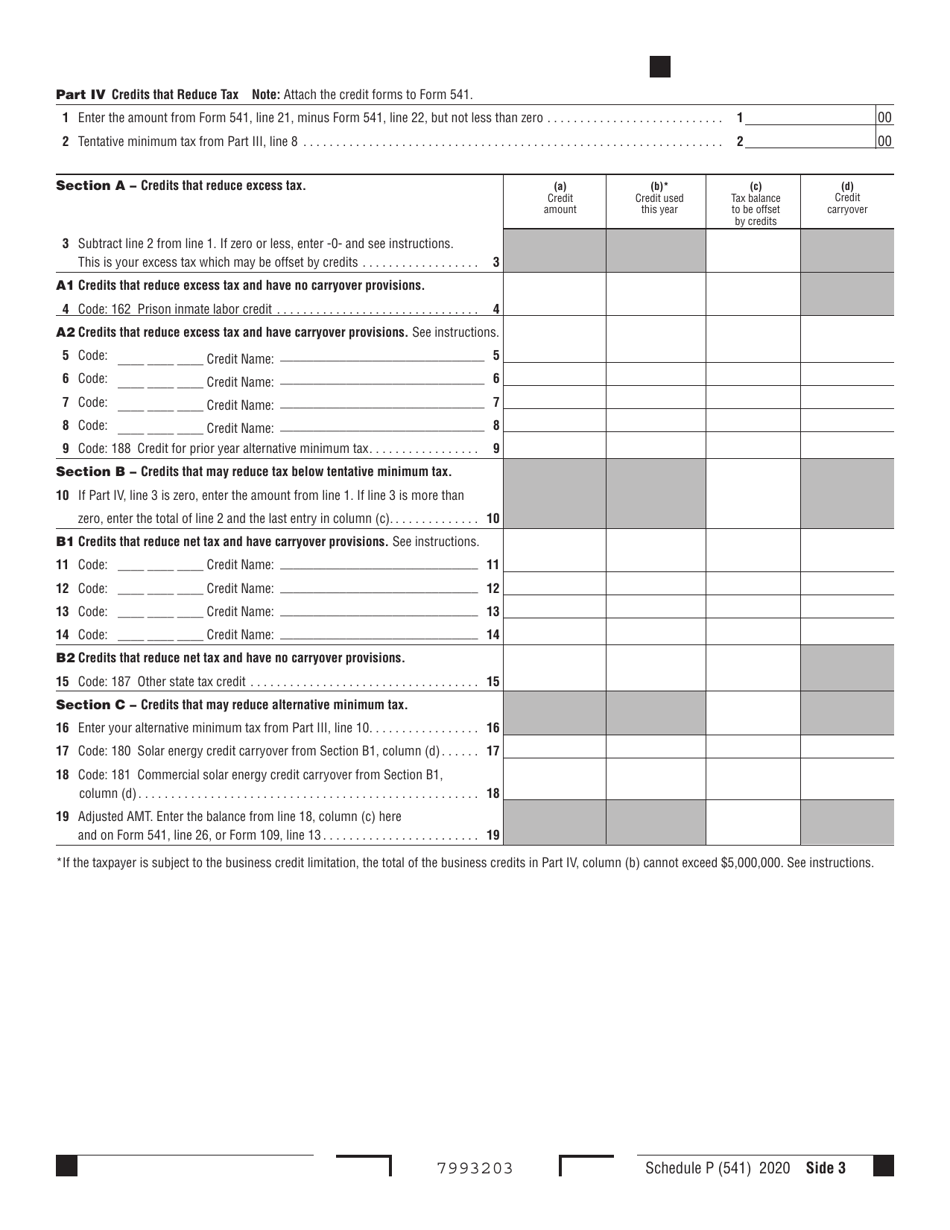

Form 541 Schedule P Alternative Minimum Tax and Credit Limitations - Fiduciaries - California

What Is Form 541 Schedule P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California.The document is a supplement to Form 541, Payment for Automatic Extension for Fiduciaries. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541 Schedule P?

A: Form 541 Schedule P is a tax form for fiduciaries in California to calculate the Alternative Minimum Tax (AMT) and Credit Limitations.

Q: Who needs to file Form 541 Schedule P?

A: Fiduciaries in California who are subject to the Alternative Minimum Tax (AMT) and Credit Limitations need to file Form 541 Schedule P.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate tax system that eliminates certain deductions and exemptions to ensure that high-income taxpayers pay a minimum amount of tax.

Q: What are the Credit Limitations?

A: The Credit Limitations are certain limitations on the amount of tax credits that can be claimed by a fiduciary in California.

Q: When is the deadline to file Form 541 Schedule P?

A: The deadline to file Form 541 Schedule P for fiduciaries in California is the same as the deadline for filing Form 541, which is the 15th day of the fourth month after the close of the taxable year.

Q: Are there any penalties for late filing of Form 541 Schedule P?

A: Yes, there may be penalties for late filing of Form 541 Schedule P, so it is important to file the form by the deadline to avoid any penalties or interest charges.

Q: Is Form 541 Schedule P required for all fiduciaries in California?

A: No, Form 541 Schedule P is only required for fiduciaries who are subject to the Alternative Minimum Tax (AMT) and Credit Limitations in California.

Q: What are some common mistakes to avoid when filing Form 541 Schedule P?

A: Some common mistakes to avoid when filing Form 541 Schedule P include miscalculating the Alternative Minimum Tax (AMT), not properly applying the Credit Limitations, and missing the deadline for filing the form.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 Schedule P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.