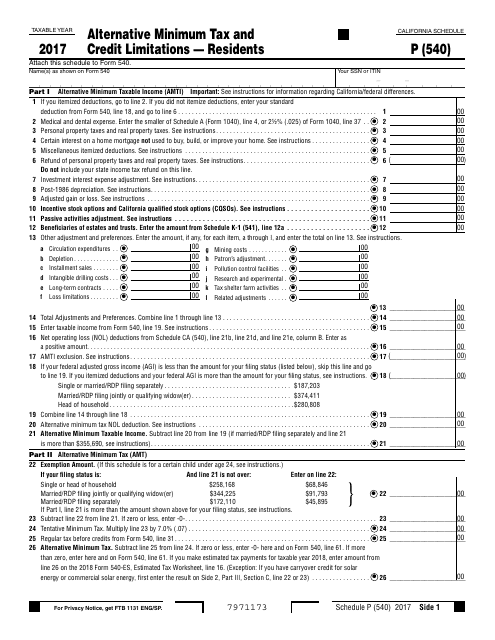

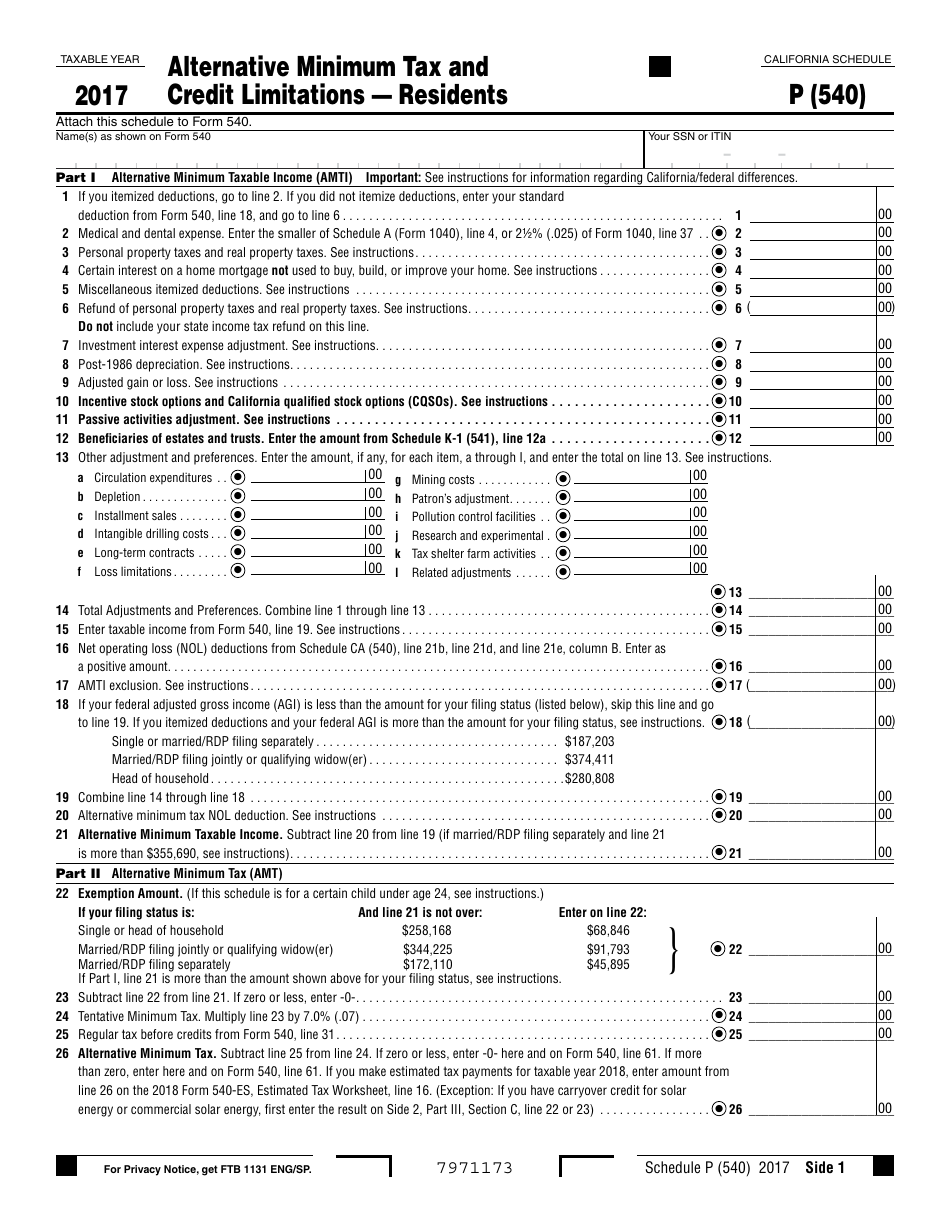

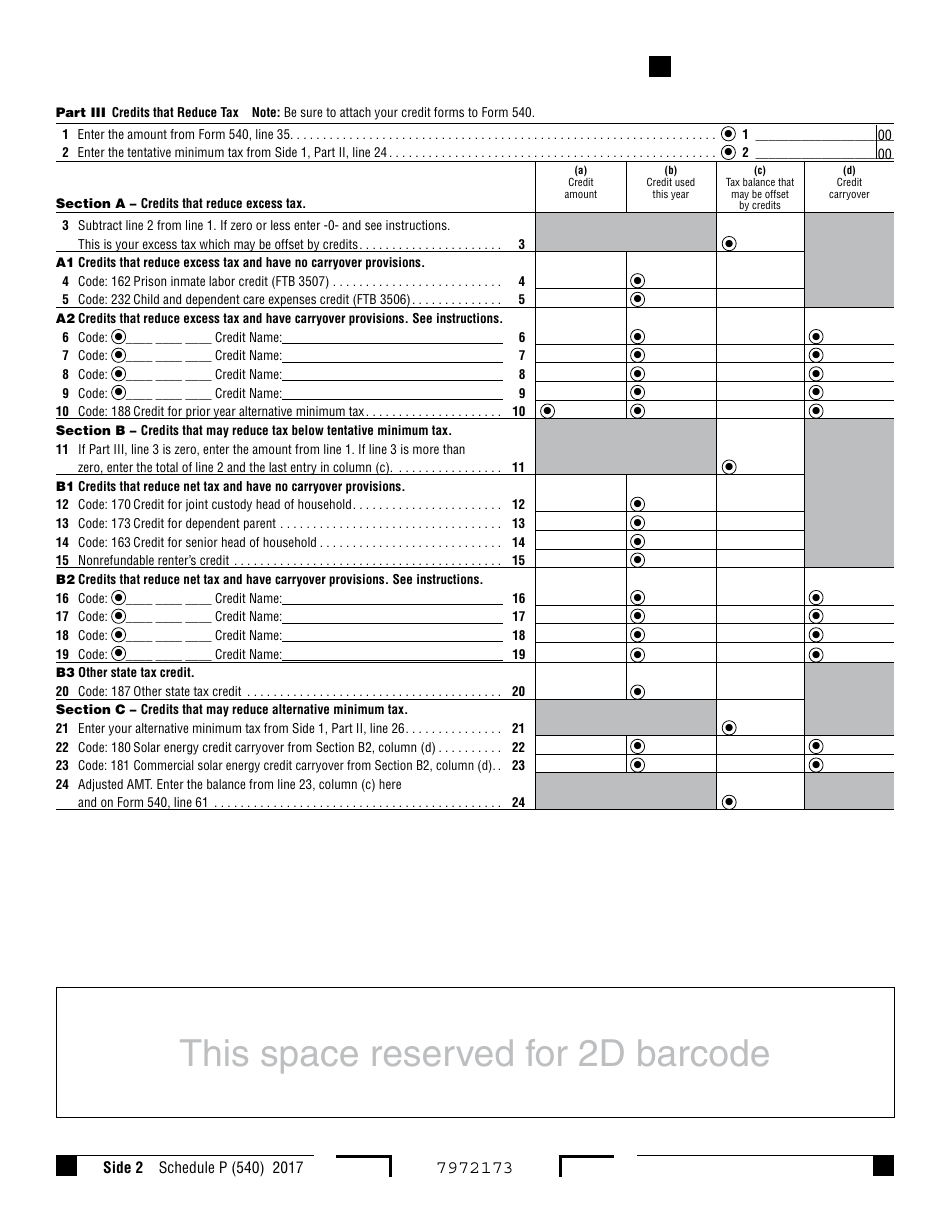

Form 540 Schedule P Alternative Minimum Tax and Credit Limitations - Residents - California

What Is Form 540 Schedule P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540 Schedule P?

A: Form 540 Schedule P is a tax form used by residents of California to calculate their Alternative Minimum Tax (AMT) and Credit Limitations.

Q: Who needs to file Form 540 Schedule P?

A: Residents of California who are subject to the Alternative Minimum Tax (AMT) are required to file Form 540 Schedule P.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate tax calculation that ensures that taxpayers who qualify for certain tax benefits still pay a minimum amount of tax.

Q: What are Credit Limitations?

A: Credit Limitations are restrictions that apply to certain tax credits, such as the California Earned Income Tax Credit (EITC) and the California Competes Tax Credit.

Q: How do I calculate the Alternative Minimum Tax (AMT)?

A: To calculate the Alternative Minimum Tax (AMT), you will need to complete Form 540 Schedule P and follow the instructions provided.

Q: What tax credits are subject to Credit Limitations?

A: Tax credits subject to Credit Limitations include the California Earned Income Tax Credit (EITC), California Competes Tax Credit, and other specified credits.

Q: When is the deadline to file Form 540 Schedule P?

A: The deadline to file Form 540 Schedule P is typically the same as your California state income tax return, which is usually April 15th or the following business day if the due date falls on a weekend or holiday.

Q: Do I need to file Form 540 Schedule P if I don't owe Alternative Minimum Tax (AMT)?

A: No, you do not need to file Form 540 Schedule P if you do not owe Alternative Minimum Tax (AMT).

Q: Can I e-file Form 540 Schedule P?

A: Yes, you can e-file Form 540 Schedule P if you are e-filing your California state income tax return.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540 Schedule P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.