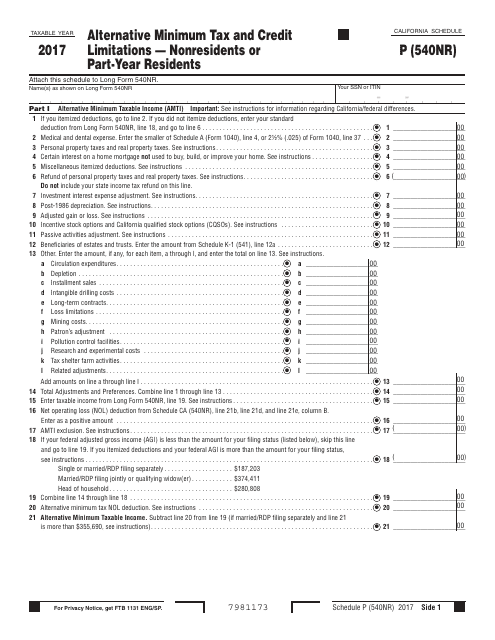

Form 540NR Schedule P Alternative Minimum Tax and Credit Limitations - Nonresidents or Part-Year Residents - California

What Is Form 540NR Schedule P?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 540NR Schedule P?

A: Form 540NR Schedule P is a tax form used by nonresidents or part-year residents of California to calculate their alternative minimum tax and credit limitations.

Q: Who needs to file Form 540NR Schedule P?

A: Nonresidents or part-year residents of California who are subject to the alternative minimum tax (AMT) or have certain tax credits may need to file Form 540NR Schedule P.

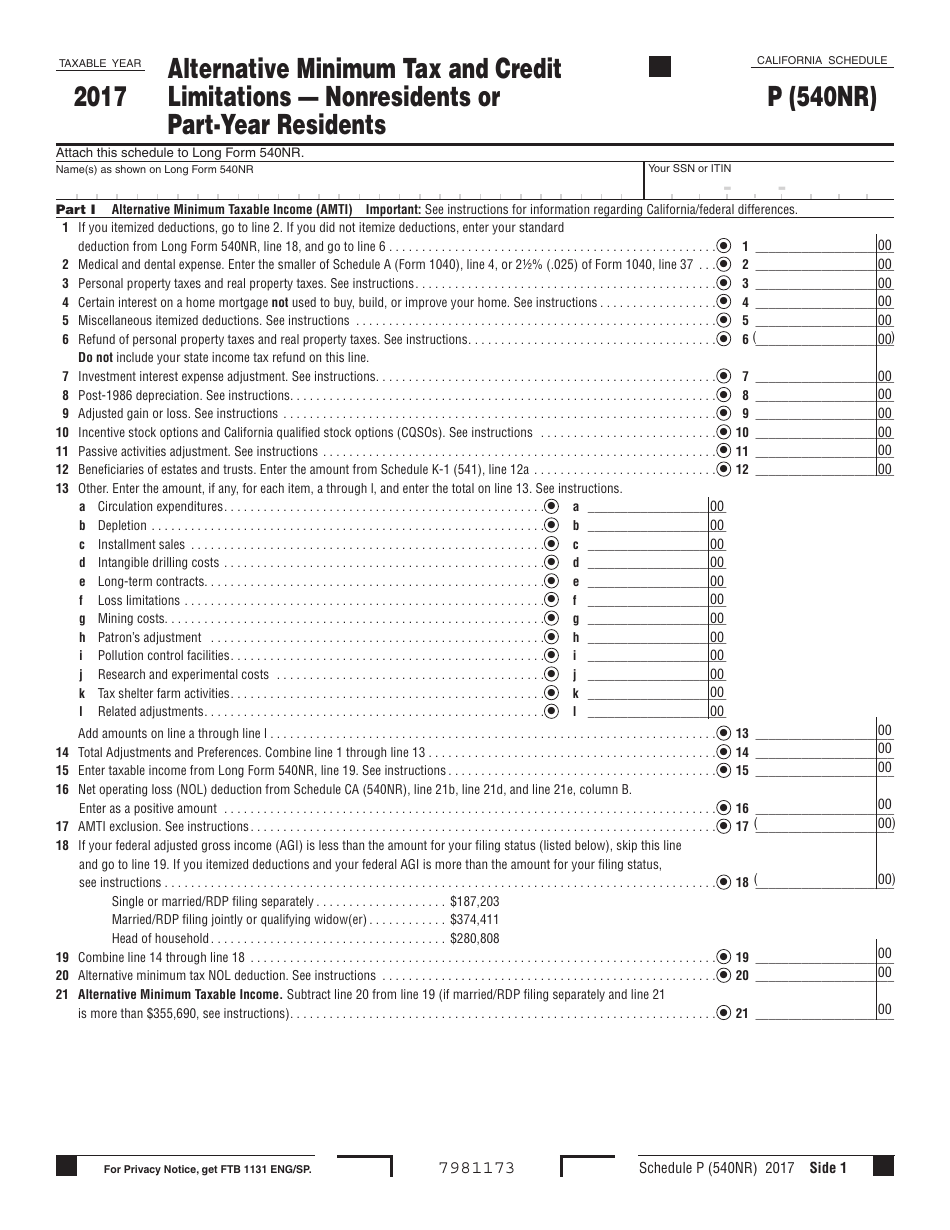

Q: What is the alternative minimum tax?

A: The alternative minimum tax (AMT) is an additional tax separate from the regular income tax. It is designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of deductions or credits.

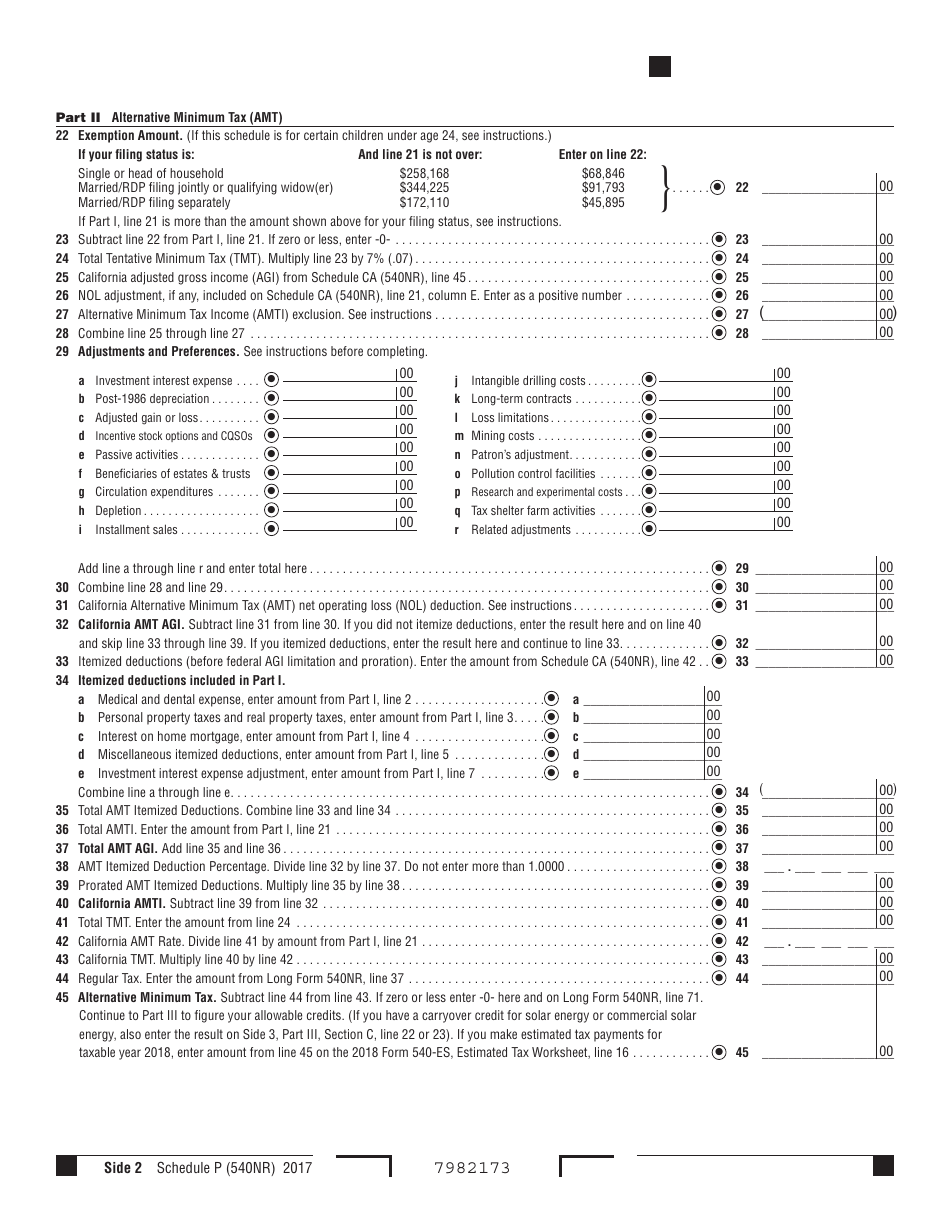

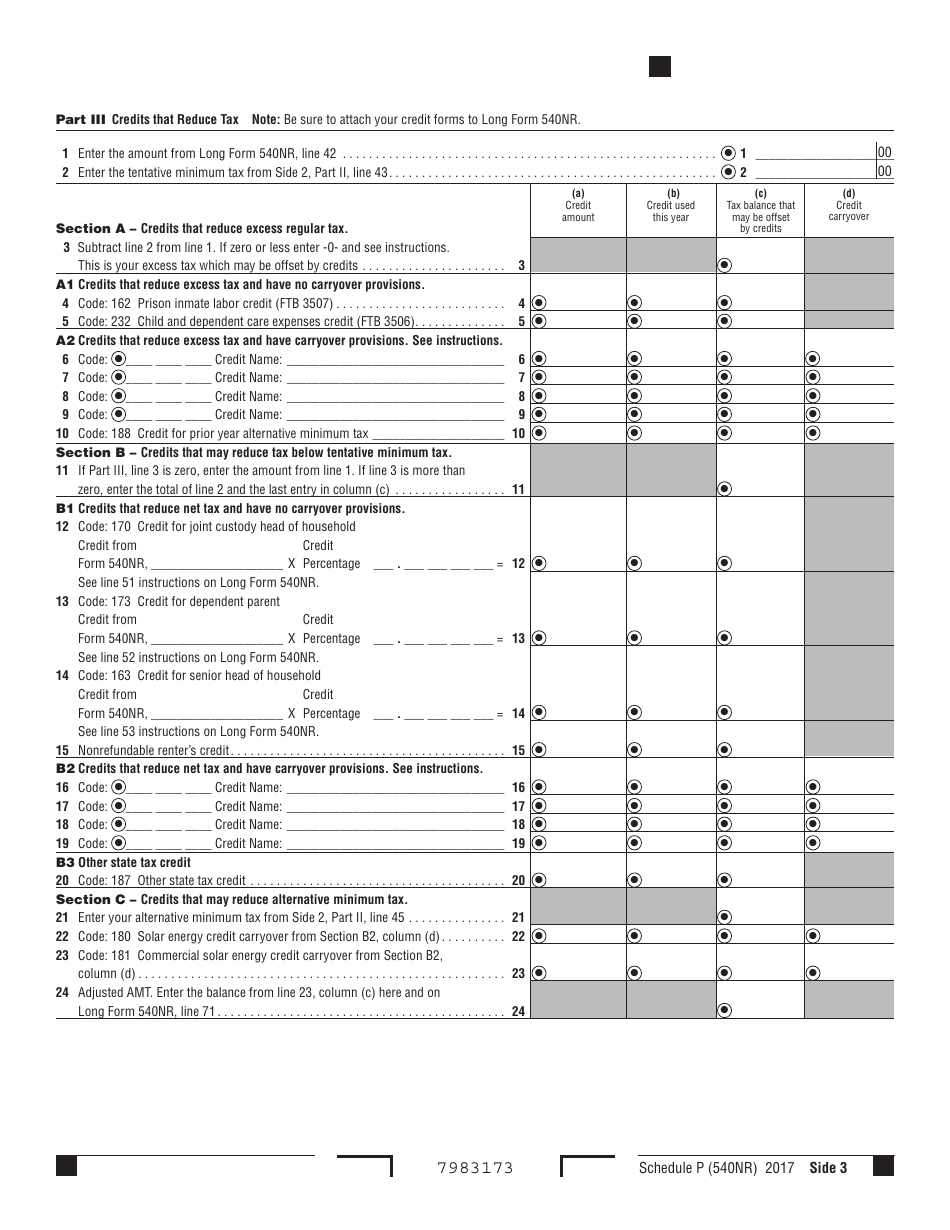

Q: What are credit limitations?

A: Credit limitations refer to restrictions on certain tax credits that can be claimed. These limitations are based on factors such as income level, filing status, and other specific criteria.

Q: Do I need to file Form 540NR Schedule P if I am not subject to the alternative minimum tax?

A: No, if you are not subject to the alternative minimum tax, you do not need to file Form 540NR Schedule P. However, you may still need to file other California tax forms depending on your residency status and income.

Q: What should I do if I need help filling out Form 540NR Schedule P?

A: If you need assistance filling out Form 540NR Schedule P or have questions about your specific tax situation, it is recommended to consult a tax professional or contact the California Franchise Tax Board (FTB) for guidance.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 540NR Schedule P by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.